Investing Update: Is the Bear Market Dead?

What I'm buying, selling & watching

This week saw the S&P 500 crawl out of bear market territory into the technical start of a new bull market. It was up 20% from the October low. That ended the longest bear market since 1948. A streak of 248 trading days. The average length of a bear market prior to this one was 142 trading days.

It’s technically considered a new bull market once stocks are more than 20% off their bear market lows. When stocks are down 20% they’re in a bear market.

Can we go back down 20% from here and another bear market emerge? Sure. Could we go up another 20% from here? Sure. But there doesn’t always have to be the extremes. It doesn’t have to be labeled a bear market or bull market. That label is used mainly for news headlines and investor psychology.

The S&P 500 closed the week at just under 4,300. That’s the highest level since August 2022. It’s now up 12.41% YTD. The story to the year continues to be the Nasdaq, which is up 27.65%. This has been the Nasdaq’s best start to a year since 1999. Look at the gap to the second best year.

I’ve talked about the amount of money being on the sidelines due to investors being overbearish and all on one side of the boat. If the market did turn upward, money would be forced to come in and chase. I started talking about this on January 7th in Investing Update: 2022 Recap & 2023 Outlook.

Also on February 4th in Investing Update: A New Bull Market?

As we’re in a clear uptrend you now have to wonder when the large amounts of money not in equities starts to come back in. If the market stays hot, many managers are going to be forced to put money to work. They can’t afford to sit in cash while the market is going up. They’re not paid to sit in cash. They need to generate returns that are better than the overall market for clients.

You have an oversold market with people being too bearish and negative. I’ve continued to say that if things turn bullish, a lot of people are going to be caught offsides. That side of the boat has been very crowded. Groupthink sometimes isn't the best way to think.

Then again on February 18th in Investing Update: What Recession?

The bottom line is both the news and price action is showing that we’re in a bull market. Agree or disagree but that’s what I’m seeing. Investors are still offsides and a lot of money is on the sidelines. The longer this market runs higher, the more investors may need to chase and it could set up for a massive rally.

We just may be getting to this point.

Thursday and Friday Are Up Days

I had to share this chart that Ryan Detrick did. Really respect the work in finding out that there have been certain days of the week that have performed remarkably better than other days of the week in 2023. It seemed like this was the case and many talked about it but Ryan actually did the work and shows that what people thought, is in fact true.

Orange Juice Leads the Way

Were you aware that orange juice has been the best performer so far in 2023? I had no idea! A year ago all anyone talked about was natural gas and oil costs. That was where the money was being made. Well where are those this year? Bright red on the bottom.

Case Against a Recession in One Chart

We’ve heard the recession talk. It dominated the headlines and narrative for a long time. If there is one chart that crushes the thought of a recession in the near term, it’s this. The real construction spending on manufacturing has gone full on hockey stick.

If you forgot, the pandemic caused the push for onshoring and the need for things to be made here on U.S. soil. The CHIPS act (Creating Helpful Incentives to Produce Semiconductors) and IRA act (Inflation Reduction Act) were passed and now this is being put into action. Economic activity for U.S. companies and consumers (jobs) will follow as this chart reflects.

The Bottom Line

Sam Ro, CFA wrote The simplest explanation for why stocks are up in TKer by Sam Ro. This was one of my favorite things I’ve read over the past few weeks. It really is the bottom line and it is truly just that simple. It’s earnings. It always has been earnings and it will always be earnings that move stock prices.

The bottom line is the bottom line 💵

We can’t reiterate enough that earnings are the most important driver of stock prices.

As long as earnings are expected to go up, you should expect stock prices to go up.

“That's all there is to it,” Peter Lynch once said of this relationship.

And, as FactSet data shows, it just happens to be the case that earnings are expected to grow in 2023 and 2024

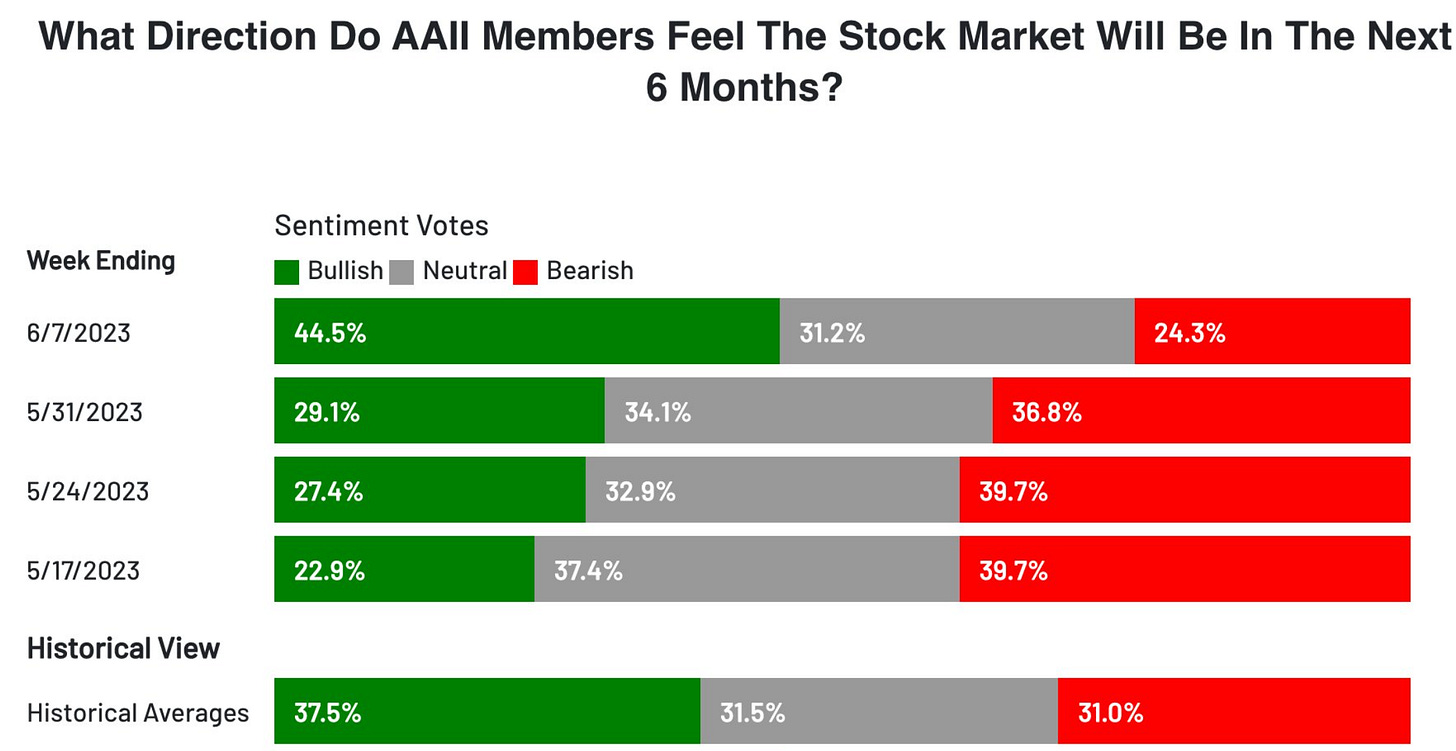

Sentiment Shifts

This week saw a drastic change in market sentiment. Bullish outlook shot up. The last time it was this high bullish and low bearish was November 2021.

This change in sentiment has changed some positioning as May was the biggest monthly inflow into tech stocks since February 2021.

Weekly equity fund inflows also paint the same picture as it too saw a spike.

Is the Bear Market Dead?

If you were a bear and negative about the stock market, you were first tied to the “all but certain recession" that was coming. As that view faded it then became that the market is only being driven by a handful of mega-cap tech stocks and that wasn’t sustainable. Those both have been debunked for the time being. So what’s next for the bears?

Let’s look at this chart which shows where this current bear market is at versus the other bear markets in history.

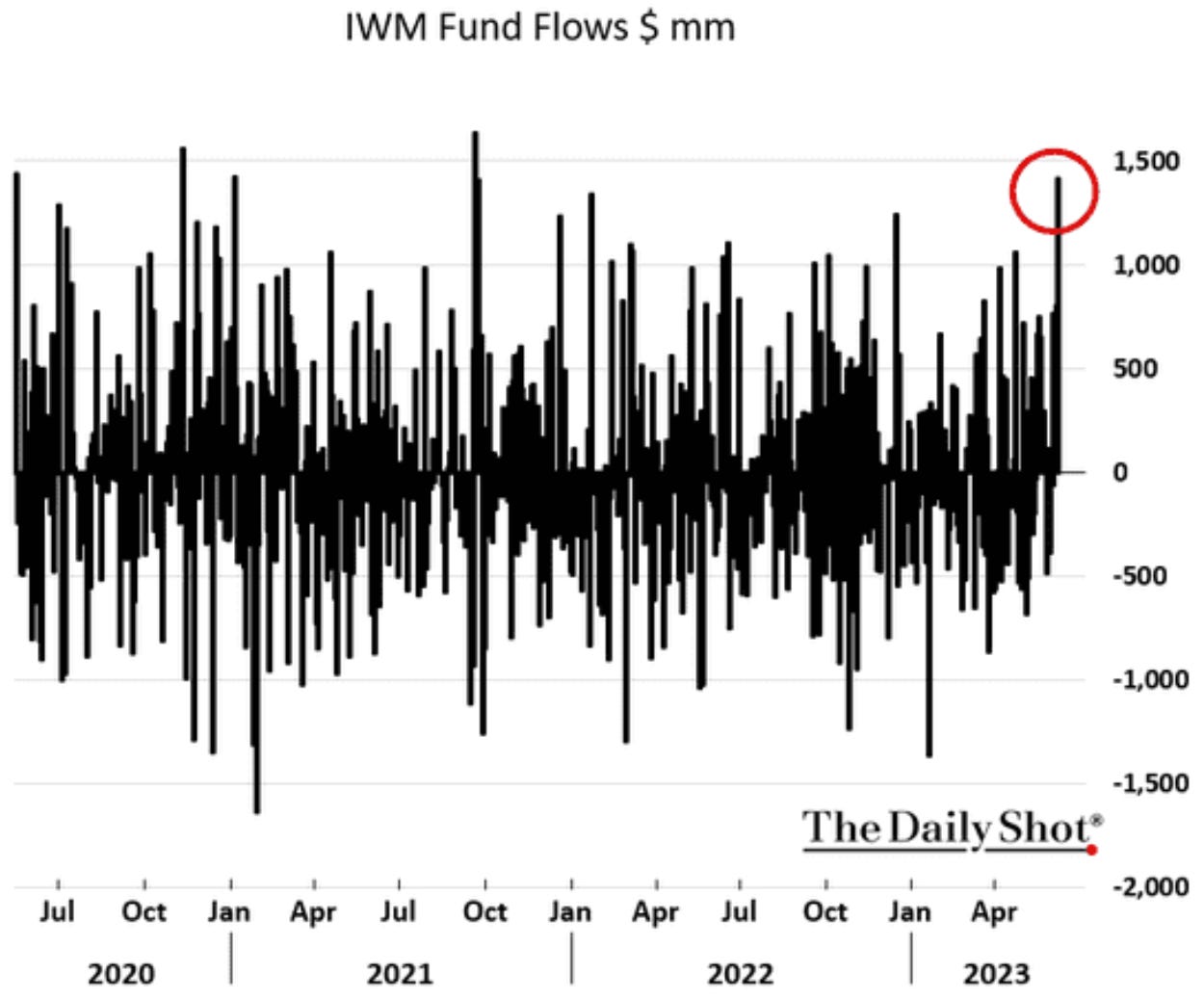

If you think the bear market is over and we’re about to enter a bull market then you should be buying small caps. The early cycle bull markets as Jurrien Timmer says are led by small caps.

Small caps have started to participate in the rally this week but only 5% of the Russell 2,000 have made new 52-week highs. For as well as the overall market has done, especially the Nasdaq and technology that number is very low. Small caps have been a laggard to date offering big upside possibility. A way to buy the small caps is the iShares Russell 2,000 ETF IWM 0.00%↑.

Inflows into small-caps are starting. This is an important piece to the overall market sentiment and towards recapturing new all-time highs. From Daily Chartbook.

As broader participation continues to come from small caps, industrials, financials, REITs and if no major black swan type events occur to steer things off course, the run to new all-time highs are more likely than falling back into another bear market from here. The winds of momentum are now squarely with the bulls.

Moves I’ve Made

S&P 500 Index This week I made a monthly contribution to my S&P 500 index holding in my retirement account.

I haven’t made any stock moves in my actively managed portfolio as I’m fully invested and the recent buys I’ve made were at lower prices as I’ve detailed in past updates. It has been a while since I’ve been able to watch stocks I own rise day after day. 2022 felt like the opposite where each day stocks I owned were in the red and falling daily. So I’m taking a moment and enjoying it while it lasts.

What I’m Watching

That doesn’t mean I’m not on the watch for good buying opportunities. Certain things we learn over time is that great companies can have a bad stretch which provide buying opportunities when they’ve been beaten down. That could be company specific news or in a bear market where all stocks are down.

The worst stocks and sectors in one year could be among the leaders the following year. Case in point is to just look at the reverse in sector performance of 2022 vs 2023. What worked in 2022 isn’t working in 2023. What didn’t work in 2022 is working in 2023. It would be too easy if everything went up all the time. That’s not reality. But we are able to learn from one year to the next which may be set for a bounce back.

Here are the best performing stocks so far this year in the S&P 500. If you looked up 2022 performance these were among some of the worst performers. There are some great companies on this list. If you bought these last year you’re very happy in 2023.

On the flip side the laggards in the S&P 500 this year may provide some big returns moving forward. A few names that peak my interest a bit and I’m doing work on from this list are; Charles Schwab SCHW 0.00%↑, Moderna MRNA 0.00%↑ and U.S. Bancorp USB 0.00%↑.

The Coffee Table ☕

Ed Zitron who writes Ed Zitron's Where's Your Ed At had a very good piece called Abandoment Issues. It’s about social media and the affects on children and how it’s doing the teaching of children today. Do we really want Instagram, Twitter, TikTok, Facebook, Google, YouTube etc. teaching our kids? Good info in it to consider and very thought provolking.

Ben Carlson had a stats and information filled post called Is This a New Bull Market? It has a good look at the bear and bull market filled headlines and if they even really matter. Ben cranks out posts almost every other day it seems. He’s one of the best writers on what’s currently happening regarding finance and the stock market.

This week I bought a bottle of Buffalo Trace. This is one of the consistently good bourbons. It’s inexpensive when you consider the quality of it. But now it’s allocated here in WI so it’s not as easy to get. To me it’s smooth drinking with hints of vanilla, mint, brown sugar and spice.

Thank you for reading! If you enjoyed Spilled Coffee, please subscribe.

Spilled Coffee grows through word of mouth. Please consider sharing this post with someone who might appreciate it.

Disclaimer: This is not investment advice. You should not treat any opinion expressed as a specific inducement to make a particular purchase, investment or follow a particular strategy, but only as an expression of an opinion. Do your own research.