Investing Update: Is It Time To Buy?

What I'm buying, selling & watching

This week saw the Dow briefly turn negative for the year and the S&P 500 flirted with 4,200 before rallying Friday to end the week.

On Friday, the market reacted negatively and then turned positive on the jobs report that came in better than expected with over 330,000 jobs added. That was better than the estimate of 170,000. This keeps the recession word off the table. No recession is going to happen when employment remains this strong.

The employed consumer has been and still is the key. Don’t forget that!

The Dow still is hanging on to a slight gain up 0.8% YTD. The S&P 500 is still up 12.2% and the Nasdaq up 28.3%.

But it’s hard not to notice what this increase in yields has done. Friday saw the 3-year treasury yield hit 5.63%. That’s the highest level since January 2001.

Stocks now face completion for investors’ money. When was the last time that was the case? Investors can now take on much less risk to still obtain solid returns instead of the exposure of risk that equities bring.

Take a look at what has happened to utilities (XLU- Utilities Select Sector SPDR ETF) and real estate (VNQ- Vanguard Real Estate Index Fund) recently. These lows coincide with the jump in yields.

Money that usually finds a home in these sectors because of their big yields have now seen steep selloffs. Instead of having the risk that comes with owning stocks, investors can take that money and buy treasuries which carry much less risk. These high yields are now pulling money out of stocks.

Student Loan Repayments May Not Hurt The Economy

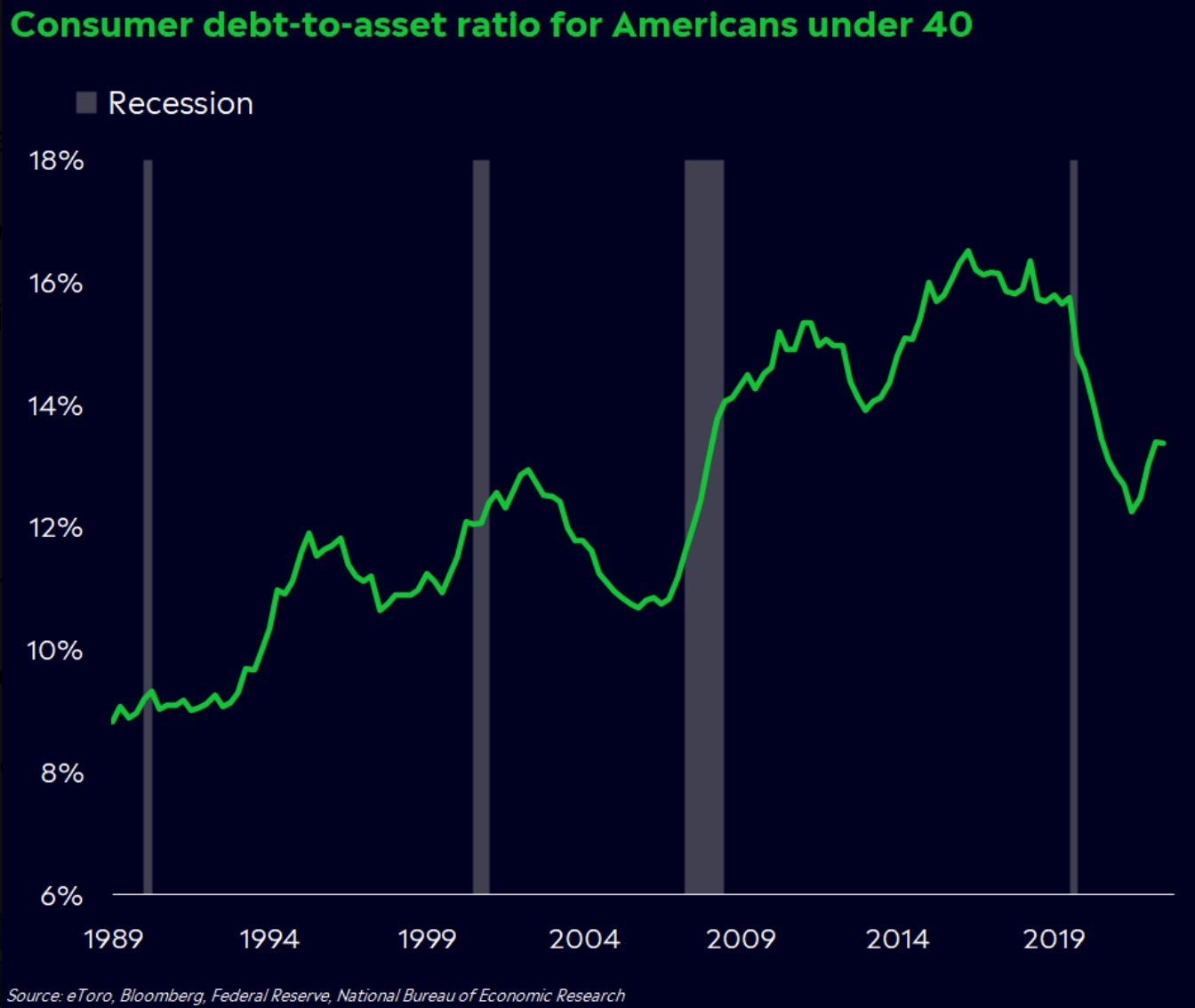

This month student loan repayments resume. We’ve heard over and over the potential impact this could have on the economy. The below chart from Callie Cox shows that this just might not be the case. Americans under 40 are actually in the best position in over a decade to repay their debt. Their debt-to-asset ratio remains in very good shape.

Q3 Recap

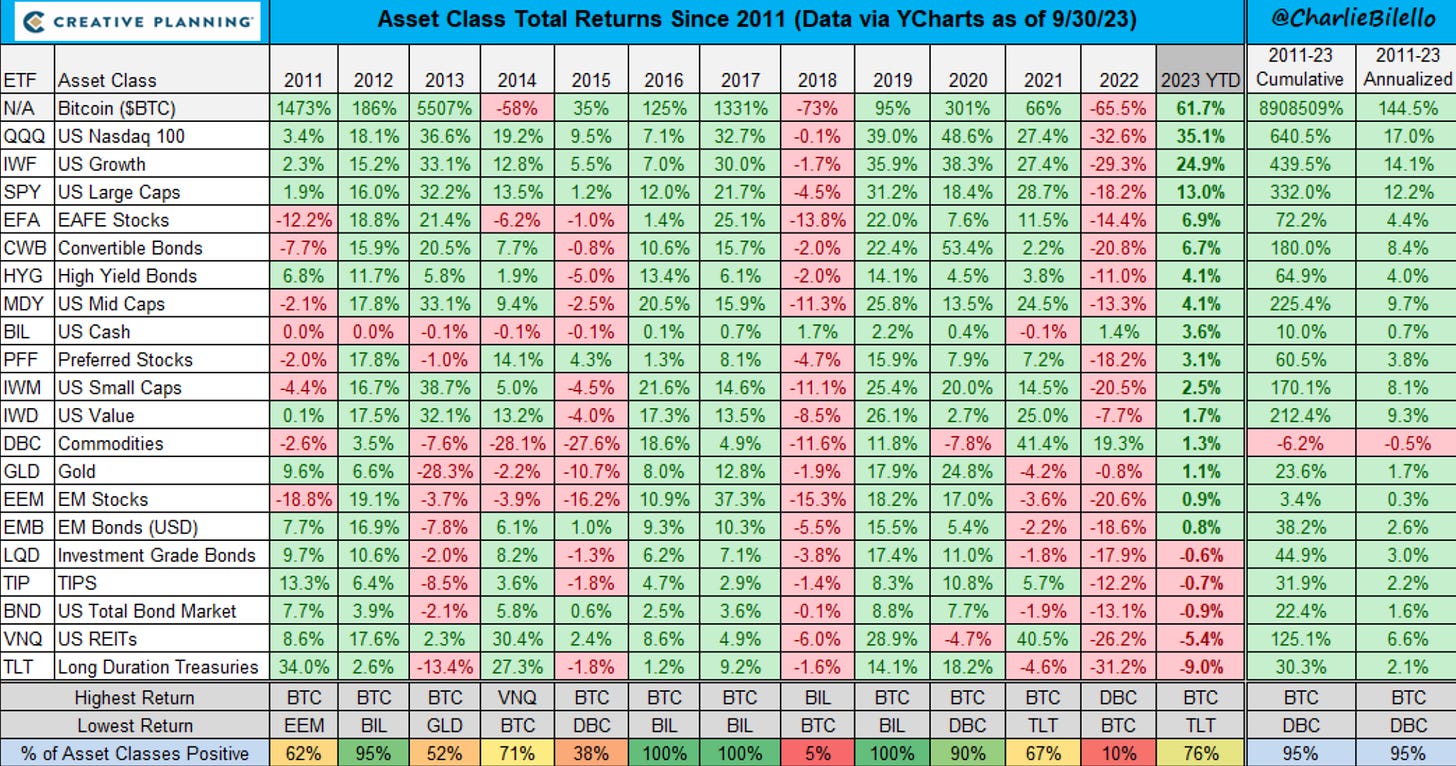

As the 3rd quarter concludes, I wanted to look at where my portfolio is at as well as my three stock picks for 2023 versus the major indices. This is all through Q3.

Dow: +1.12%

S&P 500: +12.13%

Nasdaq: +27.27%

My Portfolio (Actively Managed): 55.2%

My 3 Stocks For 2023

Nvidia: +203.87%

Amazon: +48.12%

Deere: -11.06%

Here are links to my 2023 stock picks article and my quarterly updates for this year.

Investing Update: 3 Stocks For 2023

1st Half Recap & 2nd Half Outlook

Not a Market For Small-Caps

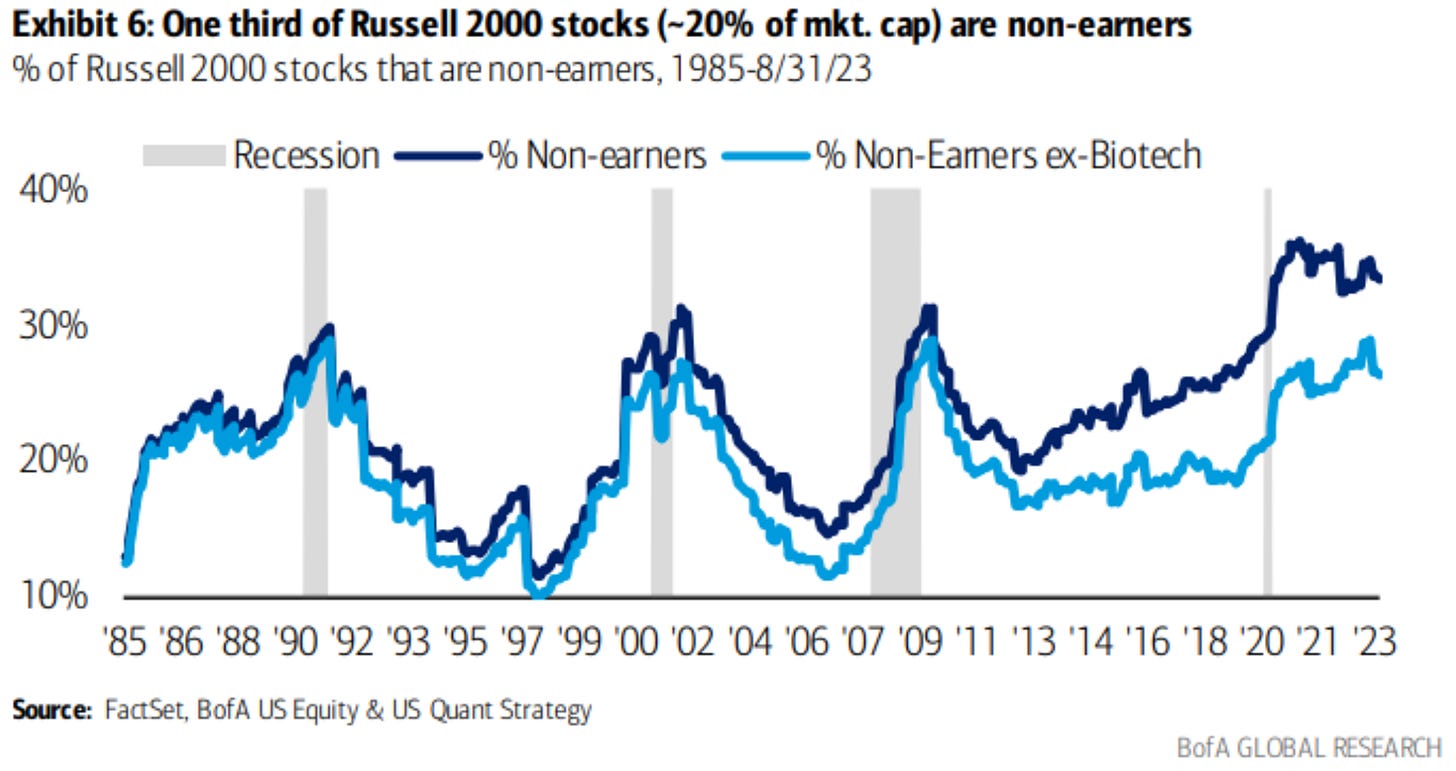

High interest rates don’t mix well with small cap stocks. Smaller companies rely on capital to continue their high growth and are many times unprofitable. When the cost of that capital increases it really puts pressure on them.

One third of small cap stocks are losing money which is the most in history. That even surpasses the 1987 crash, the Dotcom bubble, and the Global Financial Crisis.

How do they compare against large caps? US small caps have hit a 22-year low relative to large cap stocks. That’s just how bad 2023 has been for small caps.

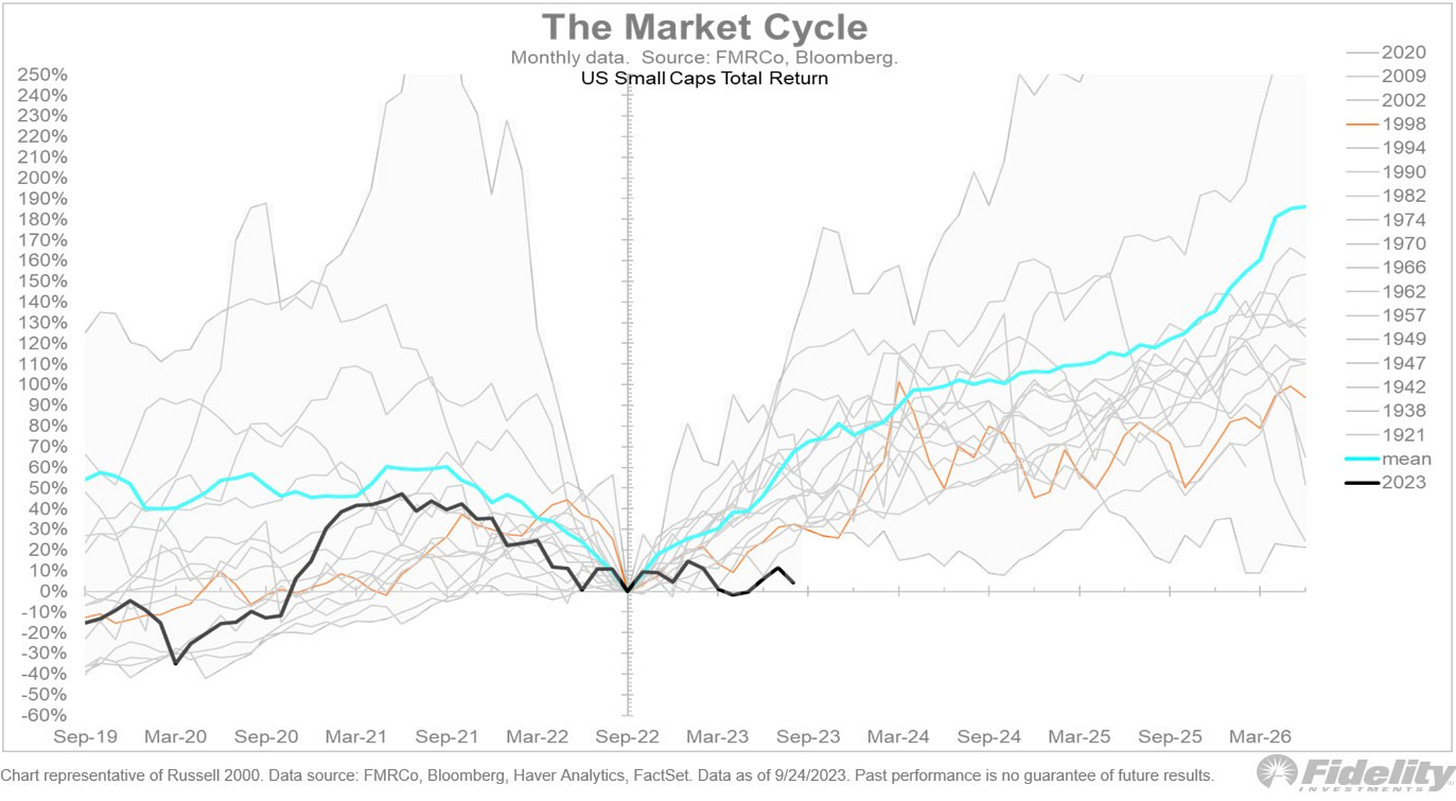

Then there was this which I found very interesting from Jurrien Timmer.

If stocks entered a new bull market last October, you'd never know it by looking at the small caps: In fact, this would be the weakest small-cap start ever for a new bull, which is not good, considering small caps normally outperform on the way up.

Is It Time To Buy?

Drawdowns and not every pull back is the next crash. So many are wired to start spreading the words crash and collapse at the first sign of a down stock market.

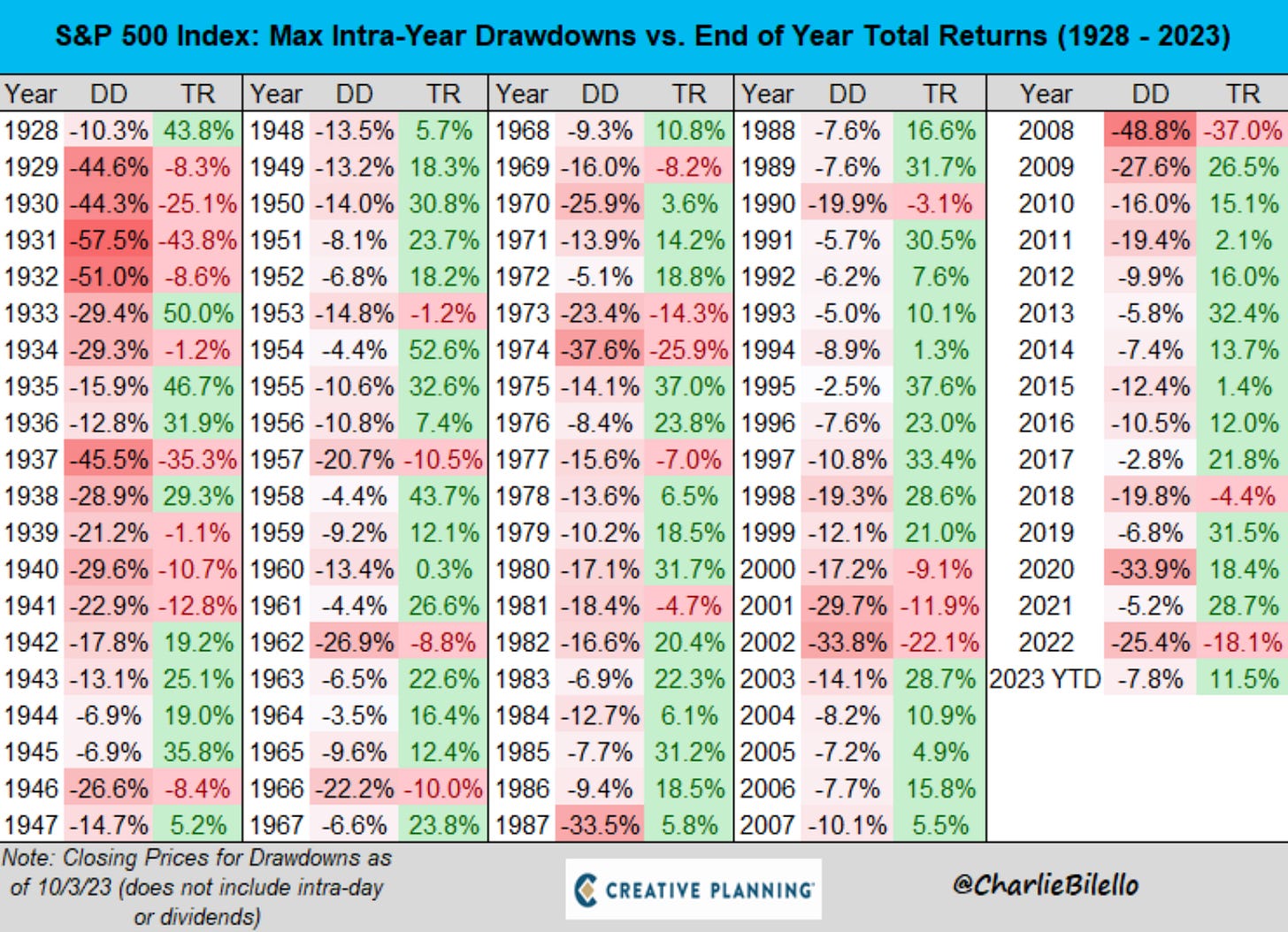

We have to remember that going back to 1928 the average intra-year drawdown for the S&P 500 is 16%. So far this year the worst has been -7.8%.

Right now a lot of stocks are down and down big. How bad is some of the selling? This from Barchart.

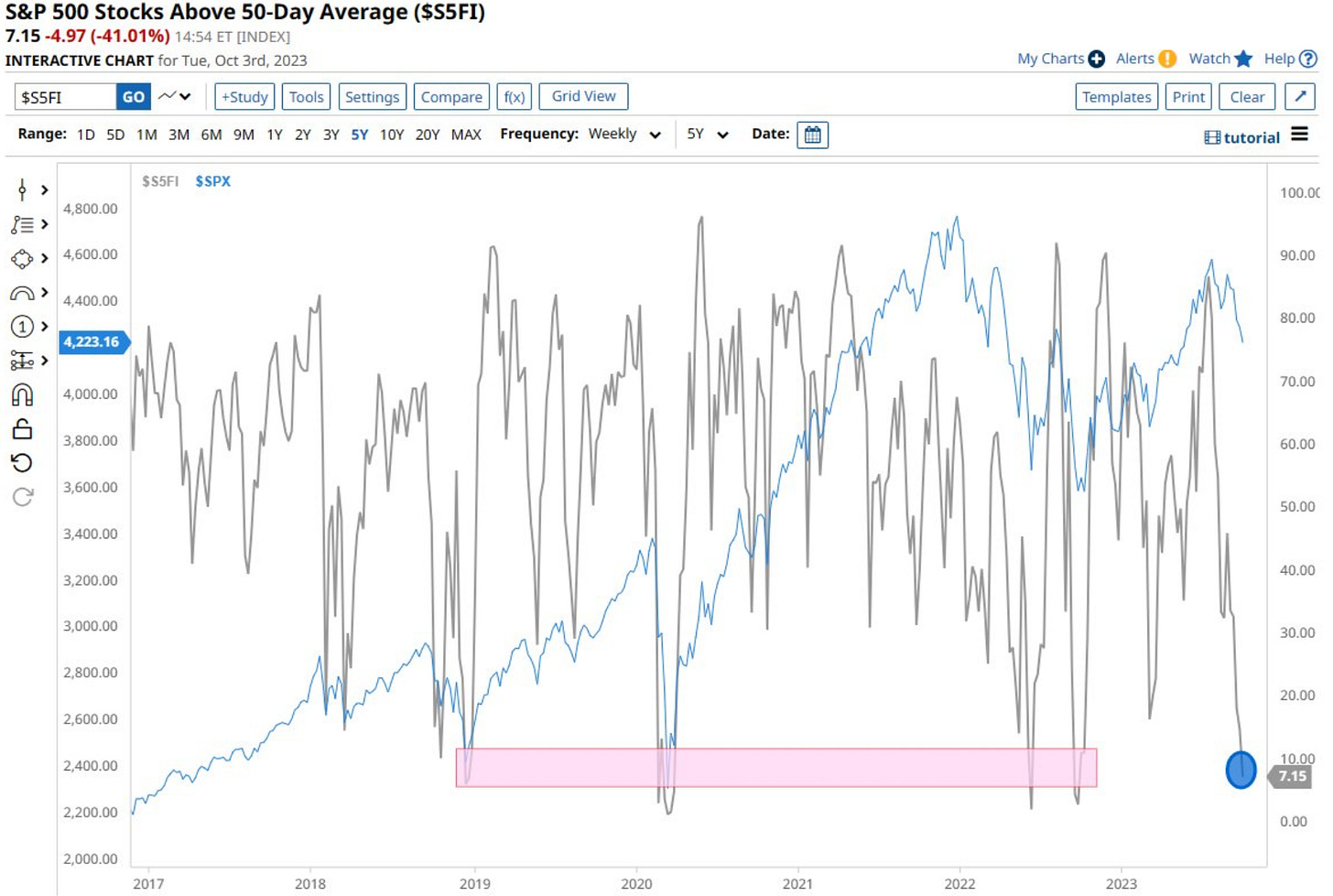

93% of S&P 500 stocks are now trading below their 50-Day moving average which is one of the highest levels of the last 6 years and has typically coincided with the $SPX forming a bottom and heading higher.

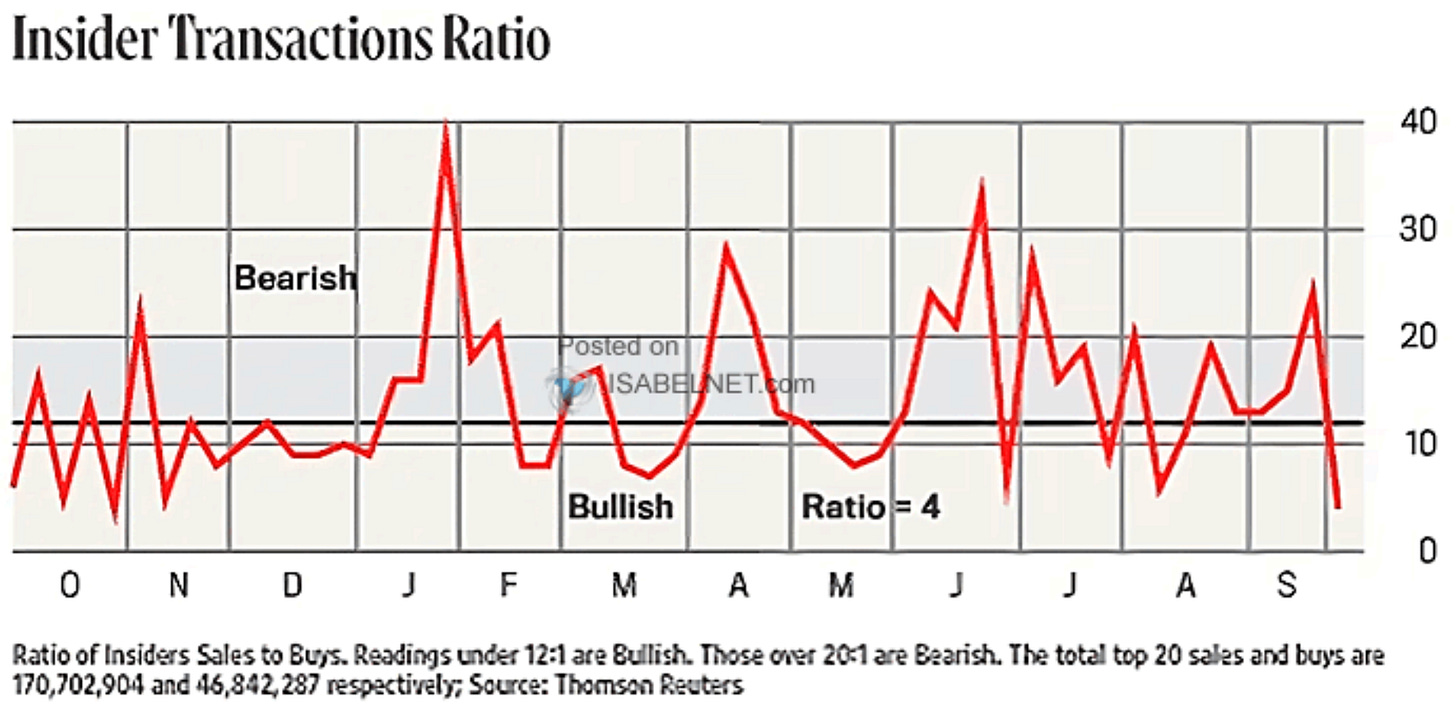

Another thing to monitor during these periods is the insider transactions ratio, which has now returned to the bullish zone. That indicates a positive sentiment among corporate insiders and potentially signaling a positive outlook for the market. It’s at levels last seen in fall of 2022.

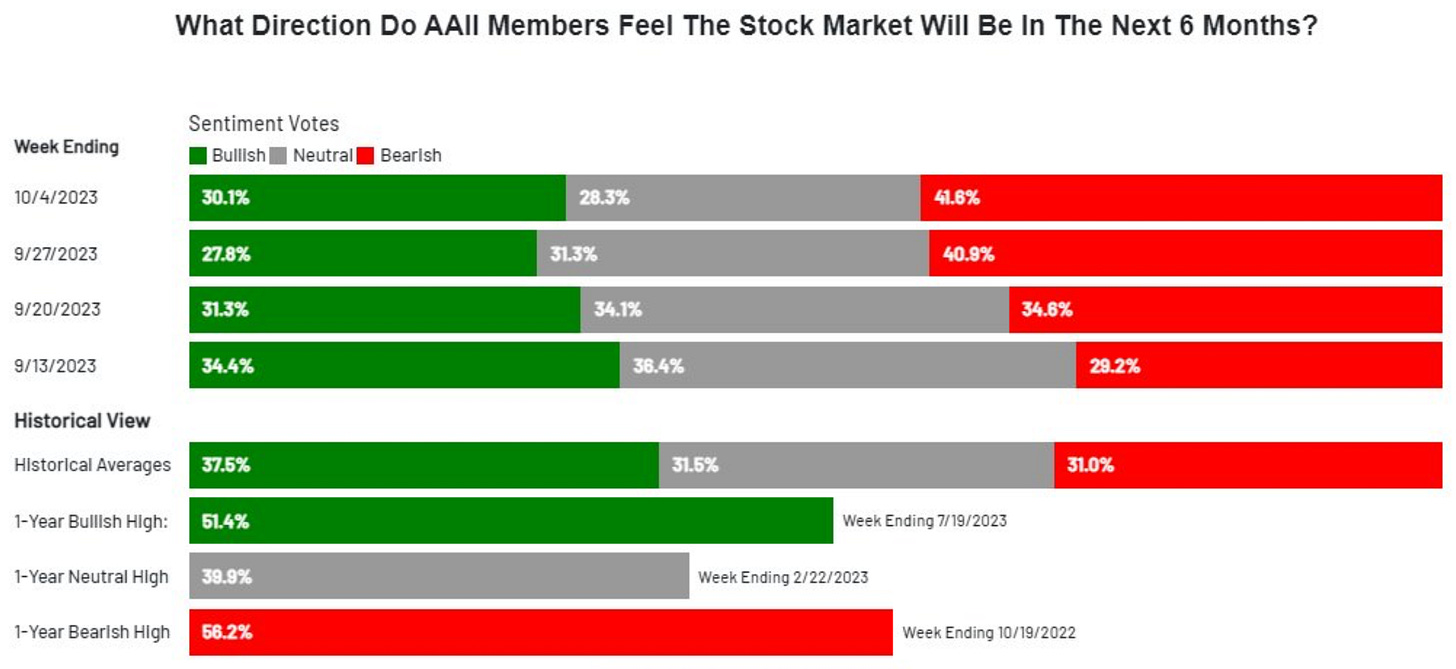

Then retail investor sentiment has seen the first increase in bullish sentiment in four weeks. Bearish levels are at a five-month high. When the bullish reading gets under 30%, that usually tells me it’s a good time to buy something.

There are also only 37% of S&P 500 members above their 200-day moving average. That’s the lowest of 2023.

To me, this all plays into my reason for buying on this pullback. After seeing what was being sold off and some price action that I liked, I did do some buying as you’ll see below.

In my last update on September 23rd, Investing Update: Reasons For Concern? I said the following.

I was already expecting this to occur as we hit the back-end of September. It’s why I’m not a bit surprised by this current drop we’re experiencing. This has me actively looking for opportunity as I still think we rally into year-end.

I found some opportunity. I’m still sticking with my feeling that we get a year-end rally, which will be fueled by a Q4 catch-up trade. I expect that many money managers will chase right into the annual Santa Claus rally to end the year.

Moves I’ve Made

Deere I added to my position in Deere at $375. Still one of the most undervalued companies in my opinion. I’ve finished building out my position to where I want it now. You can read about the last time I added to the position from September 9th in Investing Update: Is a Recession Still Coming? and read about my original thesis on why I started the position back in January in Investing Update: 3 Stocks For 2023.

Home Depot I also added to my position in Home Depot at $291. This stock has been just hammered recently. It was doing great until interest rates started to spike. This is a short-term drawdown and with it being a long-term holding, I took this selloff to add more. You can read about why I started this position back in May here, Investing Update: Buy in May and Stay?.

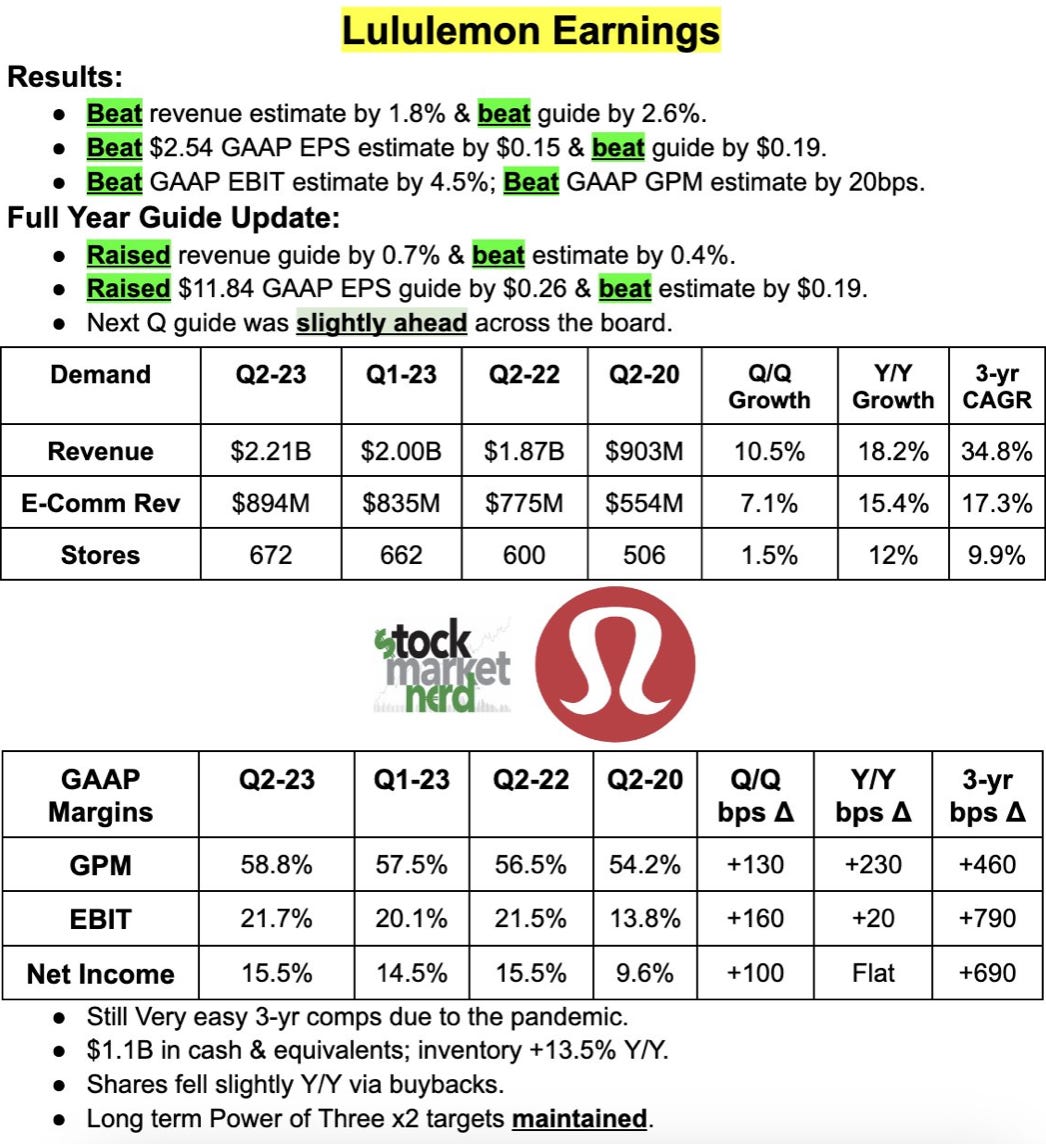

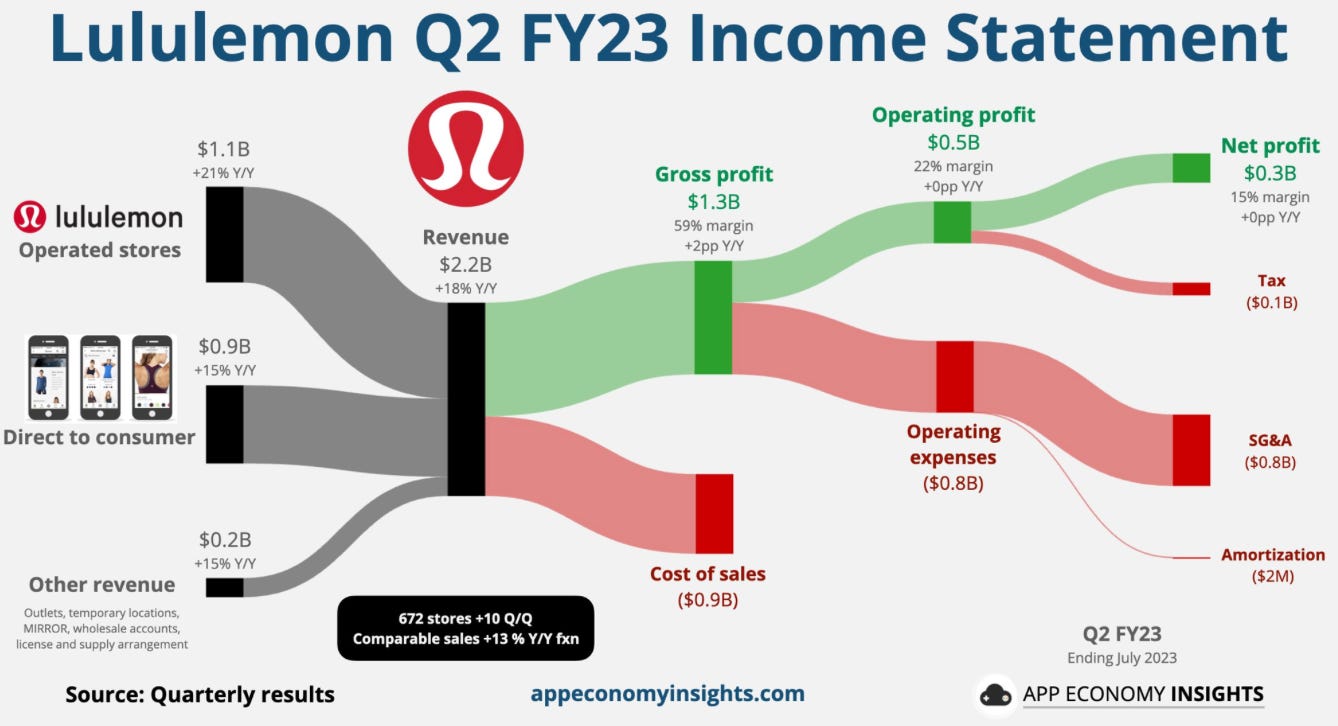

Lululemon I finally bought Lululemon! As readers know, I’ve long had my eye on it. I wanted it under $370 and bought it $368. I know not all great products and companies are great stocks. But all LULU and Calvin McDonald the CEO do is continually beat earnings.

They recently announced a partnership with Peloton, which I’m a big fan of. Two of my favorite brands! I think that this does help both of them long-term and it connects two great companies for even more possibilities in the future.

Outside of shoes, my wife and I pretty much buy all our clothes from here. They have a market for men where they buy all their leisure/workout clothes as well as their business-casual/work clothes. The clothes are like teflon. I’ve yet to have an issue with anything I own from them.

LULU is really creating their own category. To me there really isn’t competition in what they’re doing. Nike who has long been viewed as its main competitor, is doing things totally differently. LULU has built one of the best lifestyle brands on their high quality and I think they have a lot of opportunity for growth.

The Coffee Table ☕

As Spilled Coffee readers know, I rely on Sam Ro’s TKer by Sam Ro to keep me caught up on the macro environment. His post from last weekend provided that but he also made a great point on, Two recent instances when uncertainty seemed low and confidence was high.

My fellow Wisconsinite pal Michael Antonelli wrote a great post on life, a mid-life crisis and our future road ahead. Today is Never Too Late to be Brand New I think everyone can relate to this post in one way or another. My favorite line Michael wrote was, “Tomorrow is promised to no one, mid-life crisis or not I need to embrace the Michael that will get me to the final stages of my life.”

Conor Mac wrote a good piece on why people pick stocks. I can attest to a lot of what he wrote. Very informative and interesting on why people like picking stocks over the known easier road. Why don't you just sell all your stocks and buy ETFs, you'll probably have better performance?

I’ve always wondered what happens to a bottle of bourbon if it’s opened and sits for along time. Does the taste change? Does it go bad? I found this post interesting and it answers what I’ve long wondered. Will an Open Bottle of Fine Bourbon Ever Go Bad?

Thank you for reading! If you enjoyed Spilled Coffee, please subscribe.

Spilled Coffee grows through word of mouth. Please consider sharing this post with someone who might appreciate it.