Investing Update: Investor Cash Levels Rise

What I'm buying, selling & watching

This week showed some overall market strength. As the mega-cap tech stocks reported earnings, it was the overall market reaction to the earnings which was a big surprise to me. I think it’s starting to signal some positivity in the market outlook.

Tuesday after the bell Alphabet GOOGL 0.00%↑ and Microsoft MSFT 0.00%↑ announced earnings. Meta META 0.00%↑ announced Wednesday, followed by Amazon AMZN 0.00%↑ and Apple AAPL 0.00%↑ on Thursday. Not a one of these had a very good earnings report or outlook.

Here is what the stocks have done since they reported earnings.

Alphabet -7.9%

Microsoft -5.9%

Meta -23.4%

Amazon -6.8%

Apple +7.4%

With as big as these companies are and the weighting to the overall market, you’d think the market would have taken a nose dive. Well you’d be wrong. Here is what the indices have done since these companies reported.

DOW +3%

S&P 500 +1.6%

Nasdaq +1%

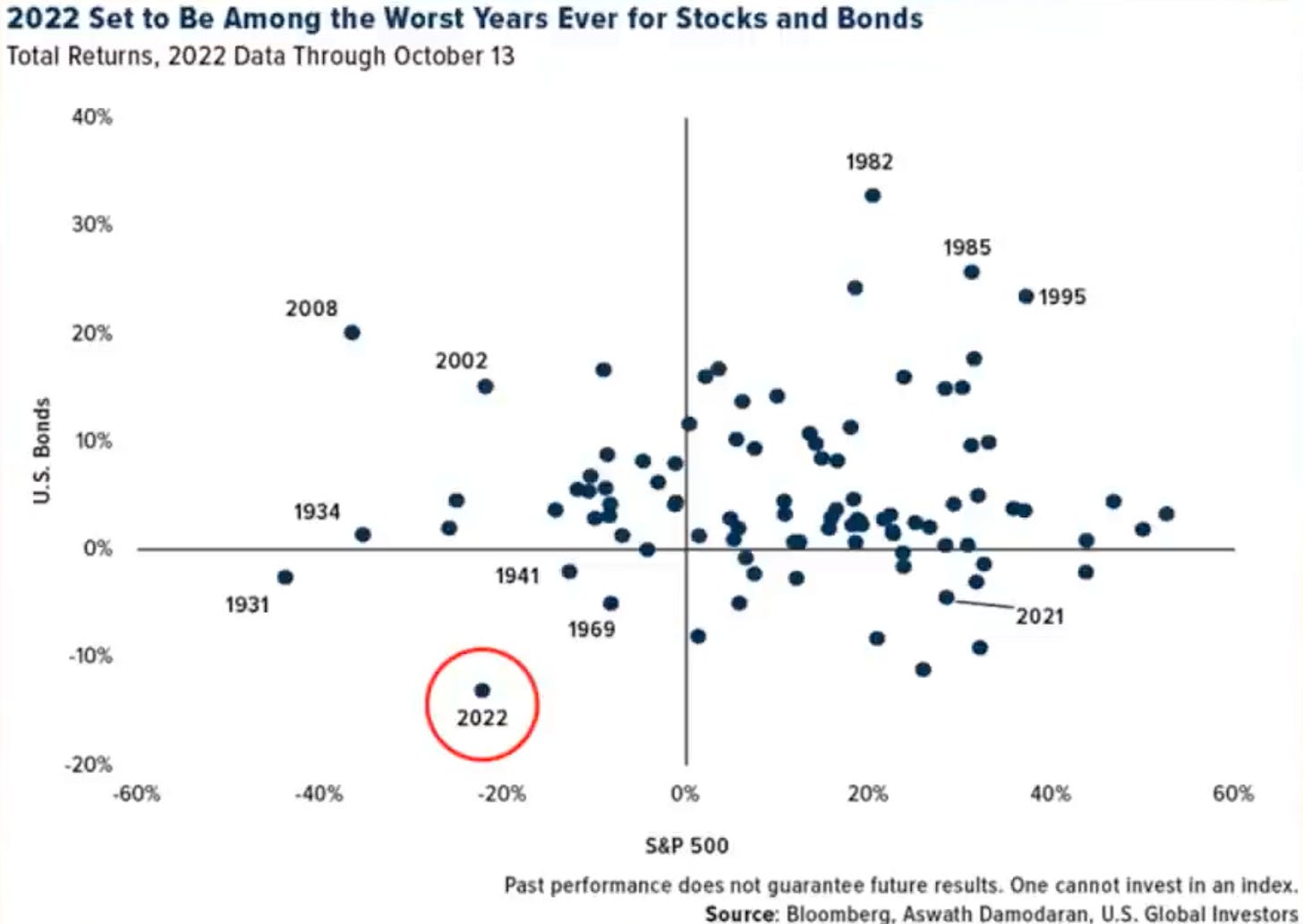

We’re already on pace to have the worst year ever for stocks and bonds as shown below. We’ve been through ten straight months of selling. So the risk attributed to buying now has been drastically reduced. It’s definitely not a time to sell if you haven’t already, but a time to buy with a long-term outlook. The markets reaction to the weak mega-cap tech earnings should provide more proof that a lot of bad news is already priced in.

Investor Cash Levels Rise

The bearish side of the boat is getting really crowded. The BofA Global Fund Manager Survey below shows that cash levels have risen in October to the highest levels since April 2001. The chart under that shows that both retail and individual investors are at their highest levels of cash this year by a significant margin and still growing. I still view this as a very bullish sign.

Stocks Bottoms Before the Economy

Michael Cembalest of JP Morgan did some excellent work in looking back at history of what the S&P 500, earnings, payrolls and GDP did during six down economic periods in history. As you can see below stocks bottom first before everything else does.

First the market falls, then earnings and then the economy. Look back at the headlines during the peak period of the pandemic. The stock market was rising while the economy was in shambles. People weren’t understanding how that could be. The market is always forward looking. Don’t be surprised when the headlines get worse and the market starts rising.

Stock Market’s Historical Best Months of the Year Are Here

The S&P 500 has just entered it’s best historical monthly performance stretch of the year. The best month historically is November. But as you can see from the chart below, these upcoming few months dating back to 1950 have provided some of the best monthly returns.

Sector Performance of the S&P 500

Under the surface it’s interesting to see what sectors are down more or less than the overall S&P 500. Energy is clearly the outlier with a very positive year to date return. While all the other sectors are negative for the year. The sectors that are down worse than the S&P 500 are communication services, consumer discretionary, information technology and real estate.

Moves I’ve Made

Tesla TSLA 0.00%↑ After Tesla reported earnings I did like what I heard on the conference call. Nothing in the call caused long-term concern for me. The Twitter overhang on this stock was very short-term and I feel that pulled it down recently. Once it hit $201.95 a share, I decided to add more shares to my position.

Alphabet GOOGL 0.00%↑ Alphabet's earnings were not very good and the stock did get pounded. On Wednesday after earnings, the stock fell over 9% and had it's biggest one day decline since March 2020. I thought that was a perfect time to add more shares to my position. I bought more at $95 per share.

What I’m Watching

On Wednesday I wrote a post Opportunities In the Stock Market: Where I’m looking for long-term stock market buys. In it I detailed everything that I’m watching. The indices, sector ETFs and individual stocks are all discussed in this piece. I also note my current holdings.

The Coffee Table ☕

I enjoyed reading Jared Dillian’s post Are You Lucky? It made me think and provided an interesting point of view on luck.

Nick Maggiulli had an informative post about retirement, pensions, lump sums and interest rates. Why You Might Want to Retire Soon If You Have a Pension

I finished the book The Artist’s Way by Julia Cameron. This classic book which has inspired many famous artists and coined the popular morning pages. It came recommended to me by multiple people. Part book and part workbook, this really helps turn on and grow your creativity.

Thank you for reading! If you enjoyed Spilled Coffee, please subscribe and/or give a gift subscription for others.

Spilled Coffee grows through word of mouth. Please consider sharing this post with someone who might appreciate it.

Disclaimer: This is not investment advice. You should not treat any opinion expressed as a specific inducement to make a particular purchase, investment or follow a particular strategy, but only as an expression of an opinion. Do your own research.