Investing Update: I Went On a Buying Spree

What I'm buying, selling & watching

This was one of the wilder weeks in recent memory. The week was already going to be important as the midterm elections were happening on Tuesday. Then on Wednesday the crypto crisis of FTX occurred. That rippled through to Bitcoin and all the cryptocurrencies. It also looked to spill over into the stock market as well on Wednesday.

Not to be outdone, Thursday brought with it the monthly inflation reading. The number came in at a surprising 7.7%. That was lower than the expected number of 7.9%. Below is a glance at certain sectors and where inflation is over the past 12 months.

The lower than expected inflation number sent the stock market skyrocketing higher. Thursday saw the DOW go up 3.7%, S&P 500 up 5.5% and the Nasdaq up 7.3%. Those are in one day! The S&P 500 experienced the 15th biggest one day gain since 1950. The best day since April of 2020.

Thursday’s everything rally was a great example of why you should stay invested and why timing the market is so hard. Missing out on single days jumps like Thursday can really affect your long term returns. I try to stay disciplined and just stay the course.

The Farther It Falls, the Bigger It Returns

This is a good chart from Compounding Quality illustrating that the father the stock market falls, the larger the upcoming 5-year return becomes.

As the market falls everyone becomes fearful and wants too sell. Too many people sell at the bottom. They essentially panic sell. By not selling and even buying you’ll see the results over the long-term. This chart really shows the long-term positive in doing so.

Bullish Period of the Presidential Election Cycle

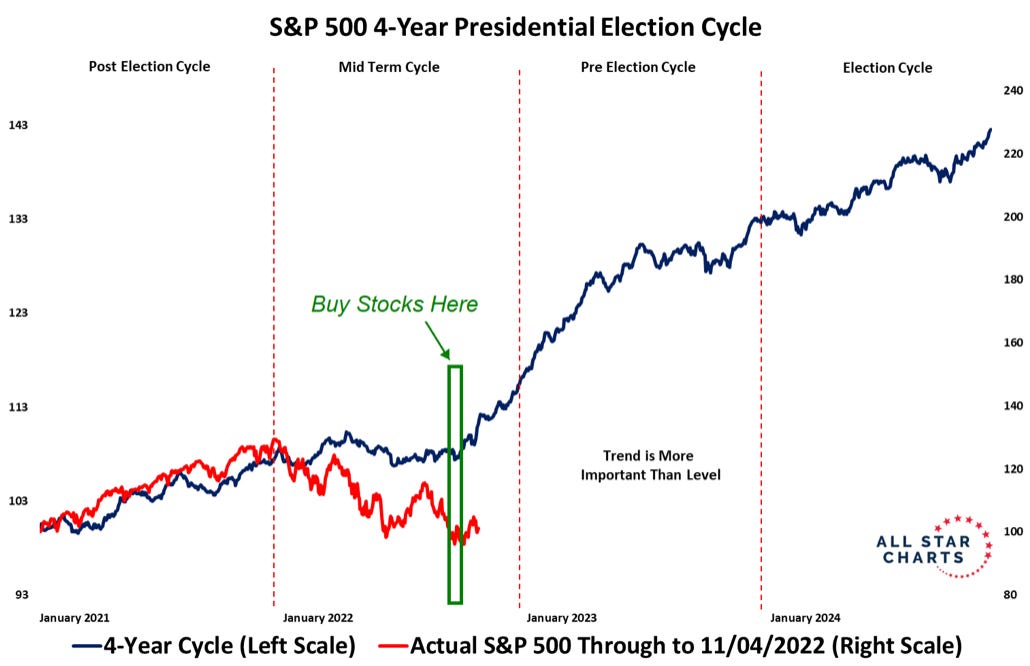

I covered the midterms and what the presidential cycles showed us last month in my Investing Update: Are Midterms the Catalyst? I highlighted the work that Joe Terranova and J.C. Parets did on the election cycles. (Congratulations by the way on the birth of your twin boys J.C.)

Below is a follow up chart that shows right where we’re at and this is the point to buy stocks within this cycle. A few days in and with the help of a lower inflation number history may repeat itself again.

Moves I’ve Made

As I was watching the prices of Amazon and Alphabet just get slammed day after day I knew I was going to have to buy more. The selling just wouldn’t let up. Then I came across the following.

Now Apple is my largest position. It has been a gigantic winner for me. Still the best company in the world in my opinion. But when I saw that the value of Amazon, Alphabet and Meta combined equaled the value of Apple, I knew I had to buy more Amazon and Alphabet. I’m not a fan of Meta.

To see Apple worth as much as Amazon and Alphabet combined, told me these two are undervalued. If a company is to challenge or knock Apple off the pedestal as the best company in the world, it’ll be one of these two. I decided to add shares in both at what turned to to be right near their 52-week lows.

Alphabet GOOGL 0.00%↑ Added shares at $83.93. Alphabet has a Price to Earnings ratio of 19x. The S&P 500 is 20x.

Amazon AMZN 0.00%↑ Added shares at $89. Amazon has a Price to Sales ratio of 2.1x. The S&P 500 is at 2.3x.

Tesla TSLA 0.00%↑ I added to my position in Tesla at $189 a share. It has fallen hard the past few weeks. I think this Twitter overhang on the stock will eventually pass. It does worry me as I think it does most Tesla investors but I trust Elon and that's why I'm long-term bullish Tesla.

CrowdStrike CRWD 0.00%↑ One of my favorite high growth names CrowdStrike, fell to $123, at the time setting a new 52- week low. I decided to add more at that price. As the market comes back I expect this to be one of the biggest gainers when we head higher. Cybersecurity has a big runway for growth and I feel this is the leader.

S&P 500 Index As the market fell hard Wednesday the day after the mid-terms and what I feel was in reaction to the FDX and crypto crisis, I decided to buy more of the S&P 500 index. I had reiterated multiple times in my Investing Update that my plan which I stated on October 1st in my Investing Update: Are Midterms the Catalyst?

The midterms in the United States are on November 8th. I plan to be positioned for a midterms stock market spike, followed by the annual Santa Clause rally into year-end.

I had that same view Wednesday when I added to all the above positions and still have this same view even after the large rally on Thursday. I feel we go higher from here into the Santa Clause rally and right into year-end. I wouldn’t be surprised to see the DOW get to a point where it may even go positive before the end of the year.

The Coffee Table ☕

ESI Money had a good post on buying time called Millionaire Thoughts on Buying Time. There were some very good points and examples that were hit on. They even reference our Spilled Coffee post Return On Hassle.

For you bourbon fans. I did finally get a bottle of E.H. Taylor Small Batch and it’s still my second favorite bourbon. The only one I have found better is Blanton’s. In my next Investing Update, I will tell you what my third favorite is so far.

Thank you for reading! If you enjoyed Spilled Coffee, please subscribe and/or give a gift subscription for others.

Spilled Coffee grows through word of mouth. Please consider sharing this post with someone who might appreciate it.

Disclaimer: This is not investment advice. You should not treat any opinion expressed as a specific inducement to make a particular purchase, investment or follow a particular strategy, but only as an expression of an opinion. Do your own research.