Investing Update: Hedge Fund Buys & Holdings

What I'm buying, selling & watching

Markets ended the week on an upswing Friday, a welcome shift after several rough sessions that left all the major indices in the red.

Even Nvidia’s strong earnings on Wednesday, which made the Mag 7 a perfect seven-for-seven this earnings season, couldn’t stop the broader pullback. Investors kept selling through the week anyway.

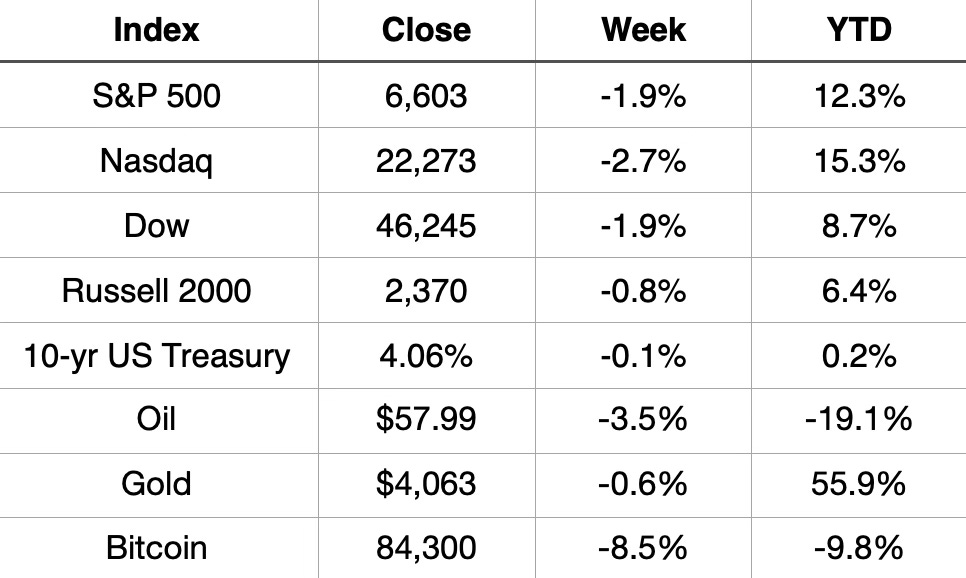

The week ended with the S&P 500 down 1.9%, the Dow slipped 1.9%, and the Nasdaq dropped 2.7%, marking the third straight weekly decline for the Nasdaq.

Market Recap

Weekly Heat Map Of Stocks

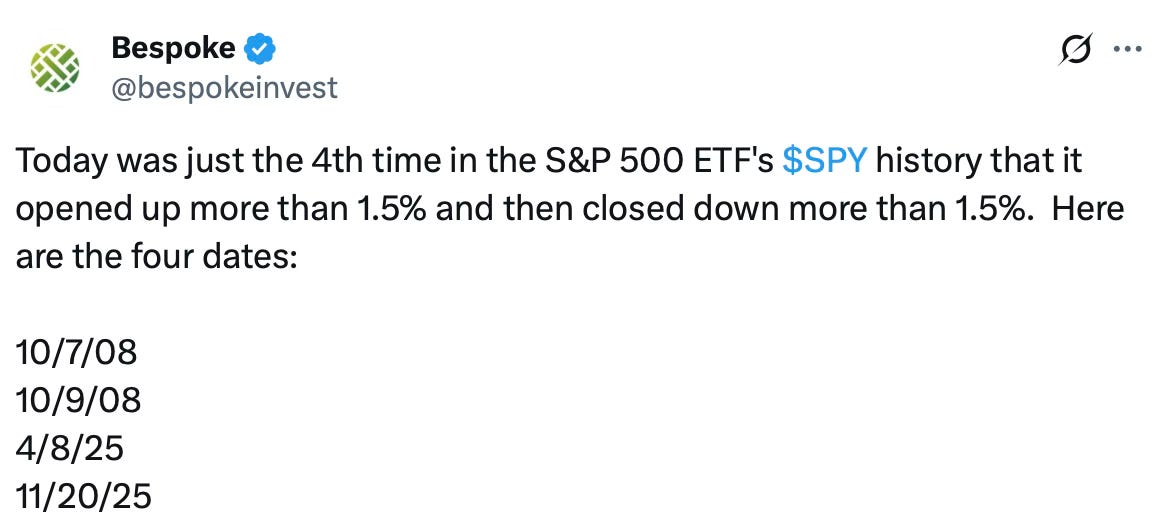

We also saw a bit of unwanted history on Thursday. It was only the 4th time ever that the S&P 500 experienced an intraday swing of that magnitude.

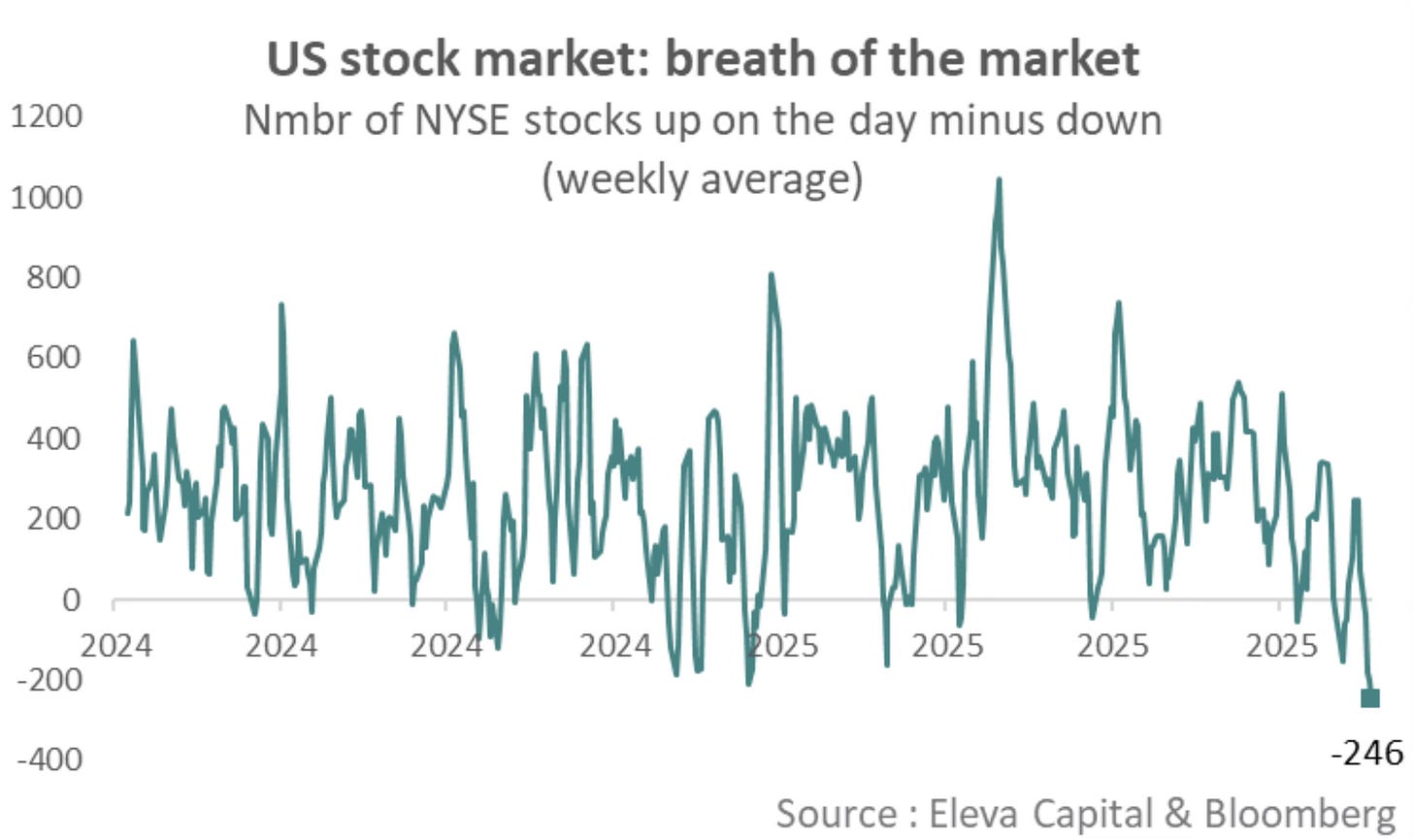

We also saw the market breadth go through the worst five day period in the past two years

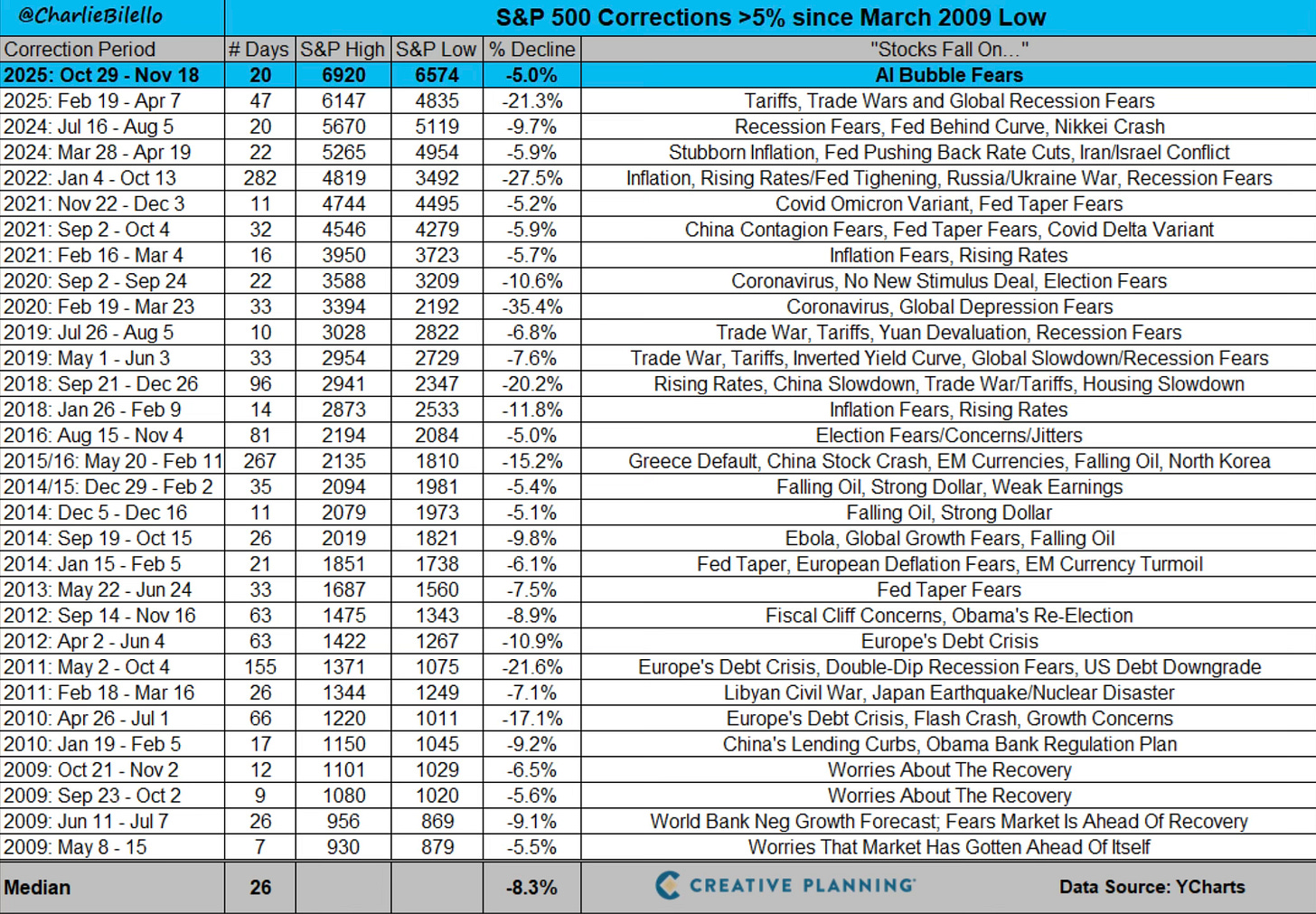

This week marked the second 5%+ correction of 2025. The S&P 500 is now down just over 4% from its peak on October 29th.

We are at a point where the technical data now shows that less that half of S&P 500 stocks are trading above their 200-day. That’s the worst reading since June.

This is something that bulls don’t want to see continue inching lower.

Take a look at how far off some of these popular names are from their record highs.

Oracle -44%

Palantir -30%

Meta -27%

AMD -27%

Tesla -22%

Netflix -22%

Nvidia -19%

Amazon -17%

Microsoft 16%

Broadcom -15%

We also saw the VIX touch 28. That’s the highest since April.

Where this leads from here is an interesting question.

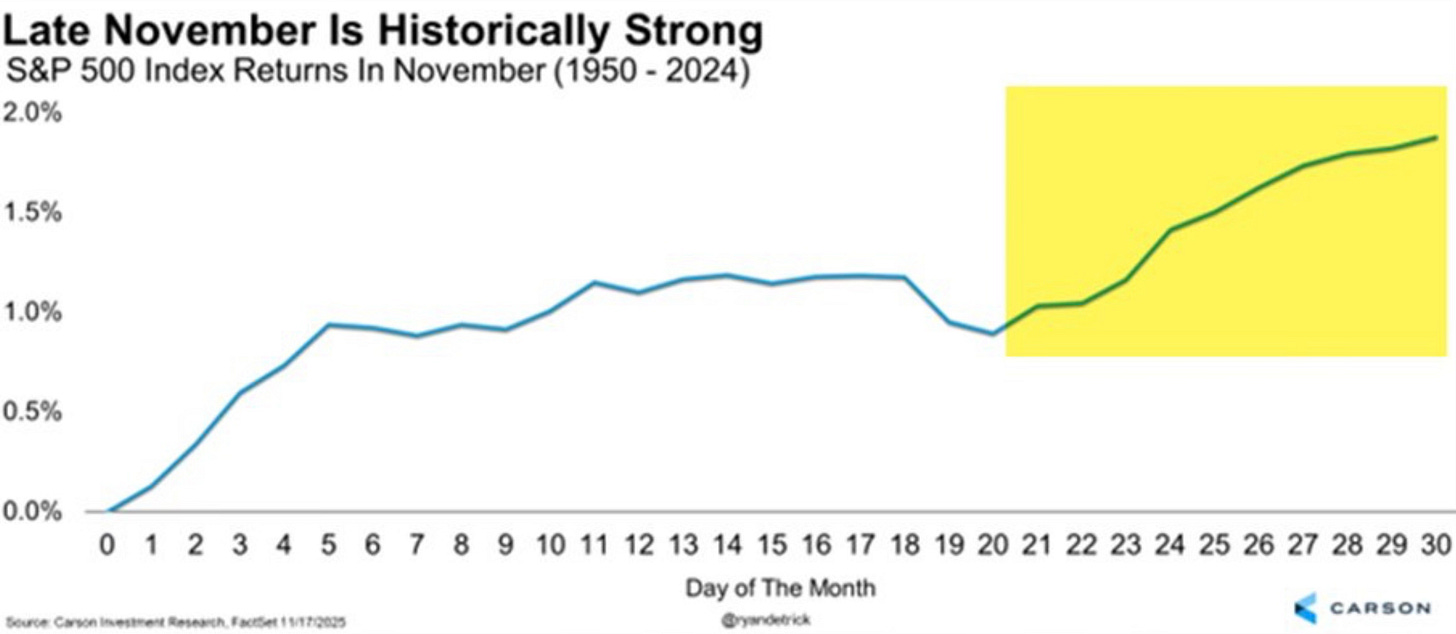

We are about to enter the historically strong part of November. Setting up a case for bullish seasonality.

We did see a bounce on Friday off the 6,525 level on the S&P 500 and 21,900 on the Nasdaq. Those now become two levels to watch. If they’re tested again, you want to see them hold.

This still looks like a sentiment driven pullback. Some froth is coming off the market, which is healthy. It’s also the first meaningful drop since April, and like it or not, that’s healthy and part of a normal cycle.

To gauge whether the short term bottom was set at 6,525 on the S&P 500, there are a handful of names worth watching. These should give an early read. The areas I’ll be tracking early next week include Nvidia, Meta, Microsoft, Robinhood, Palantir, small caps, cyclicals and Bitcoin. They’ll help signal where this market wants to head next.