Investing Update: Hedge Fund Buys & Holdings

What I'm buying, selling & watching

Going into Friday, the S&P 500 had been down 5 straight trading days and the Nasdaq had been down for 6 straight trading days. The longest losing streak for the Nasdaq since October 2022.

Markets soared on Friday as Fed chair Powell's dovish tone opened the door for a September rate cut. "The baseline outlook and the shifting balance of risks may warrant adjusting our policy."

That’s all the market needed to reverse course from what was looking to be the worst week in months. Friday was the biggest daily gain for the S&P 500 (+1.5%) since May. The Dow actually finished the week at a new all-time high. That’s the first new closing all-time high of 2025 for the Dow.

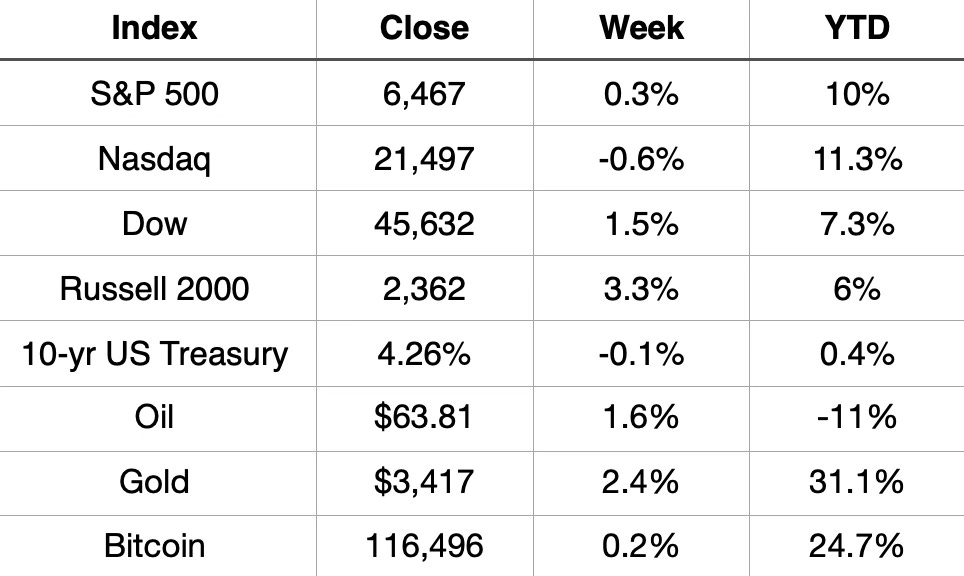

Market Recap

Weekly Heat Map Of Stocks

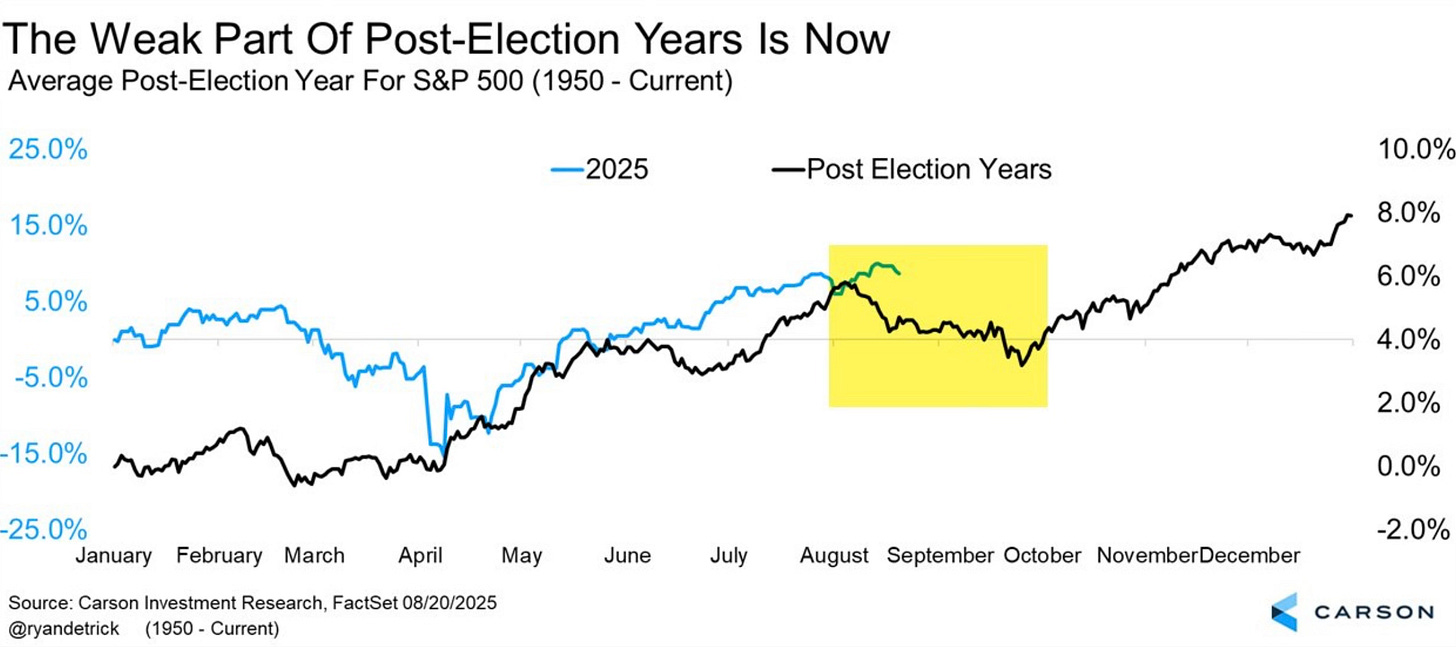

Remember not to be surprised if we continue to see some volatility. Seasonally this is the time of year where we usually get it.

The surprising part though, is the sizable amount of investors that are still so bearish.

The latest AAII shows 45% bears and 31% bulls. That now makes three weeks in a row of bearish sentiment far outweighing bullish. This has occurred all while the Dow, S&P 500 and Nasdaq are all eclipsing new all-time highs. Isn’t that odd?

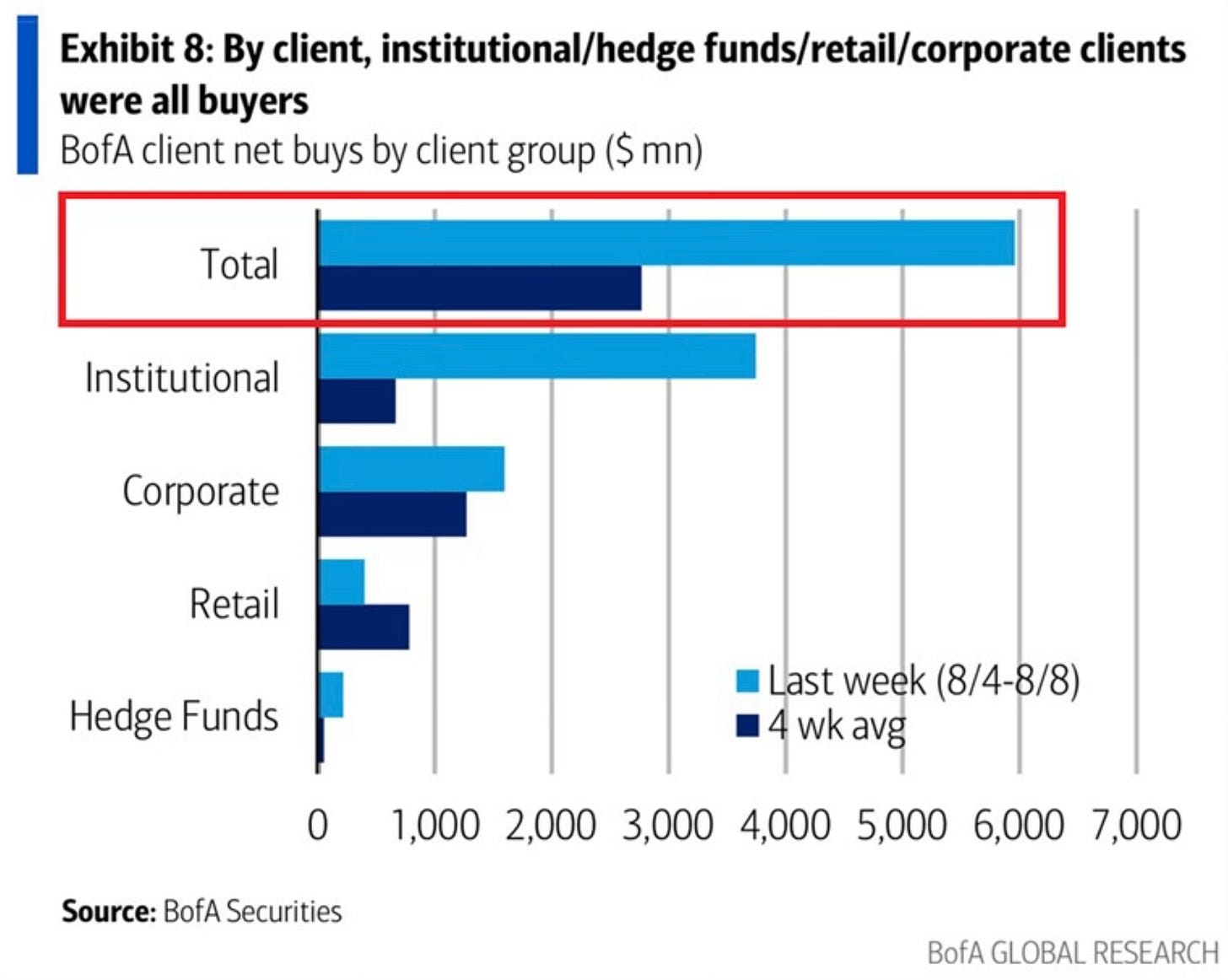

Institutional Money Has Shifted

Earlier this year all the talk was how offsides the institutional money was. They’ve changed course. Institutions just had their 10th largest weekly buying in 17 years.

Their allocation has now shifted to the highest level since November 2007. The catch up trade that I had called for has happened. They were late to the party but they’ve finally arrived.

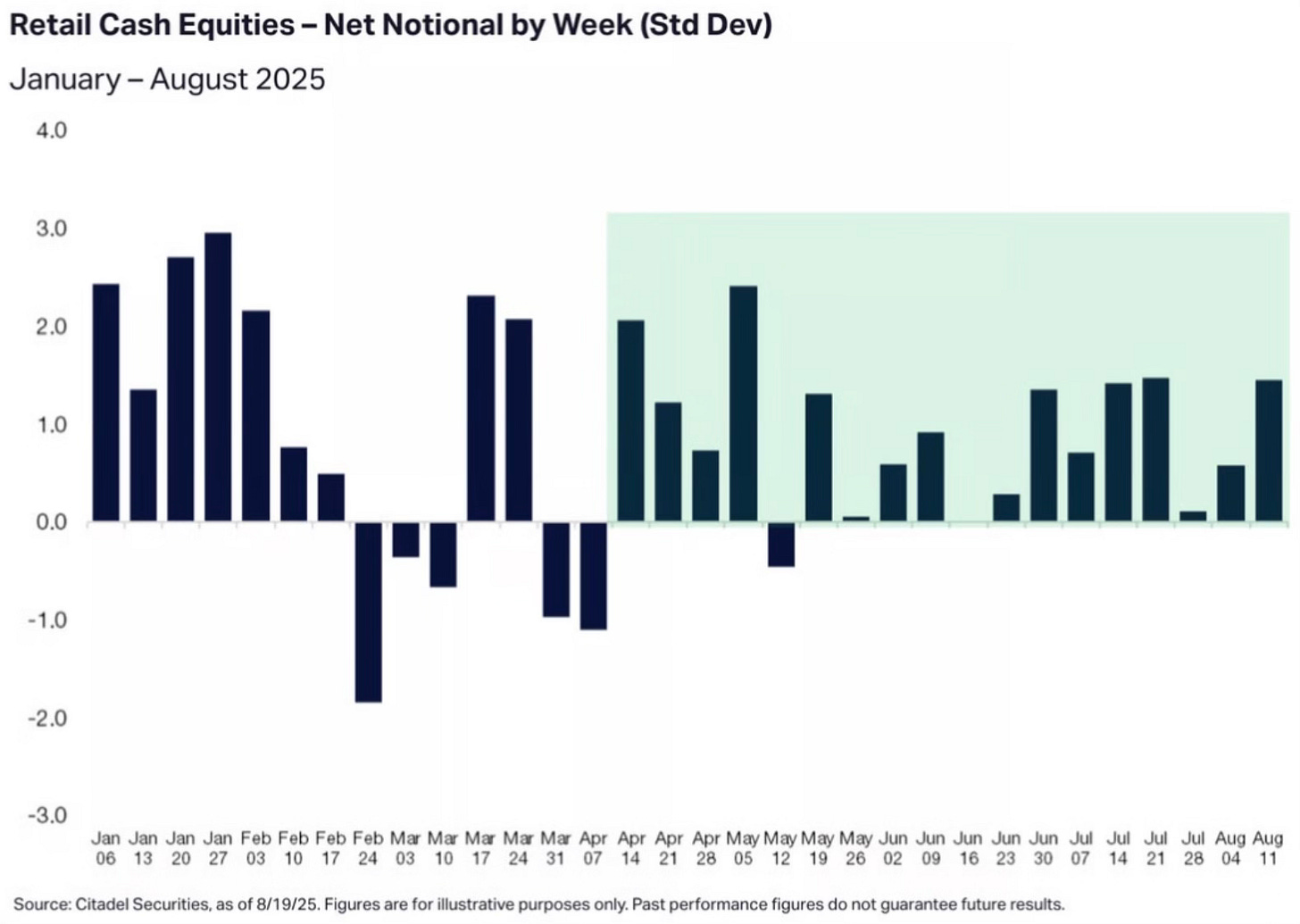

Retail Investors Stay The Course

Retail continues to buy. They’ve been net buyers of U.S. equities in 16 of the last 18 weeks.

Why do I continue to watch retail activity so much? It’s because retail investors have been the actual smart money.

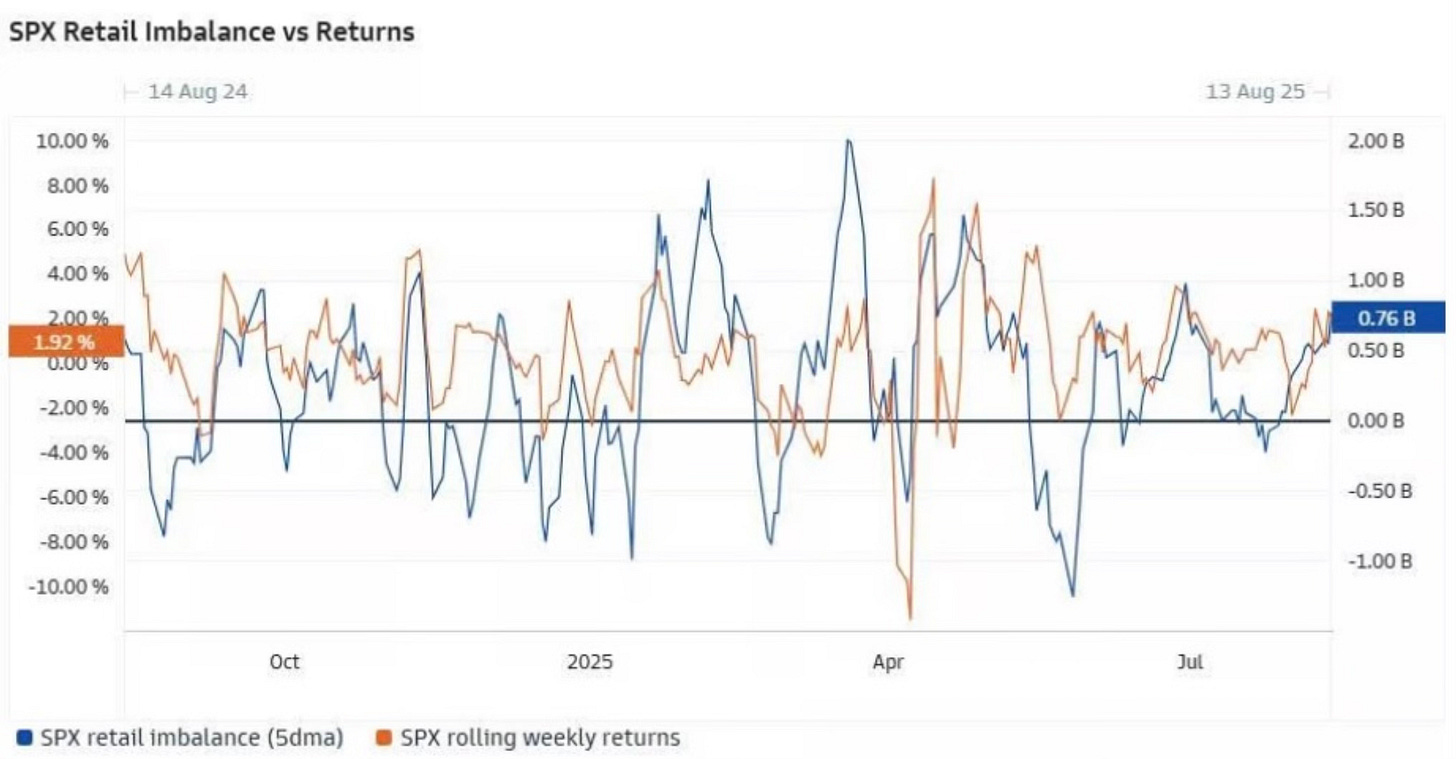

Take a look at how strongly correlated retail imbalance has been with the S&P 500 price action. Retail investors have been on a heater for a while now.

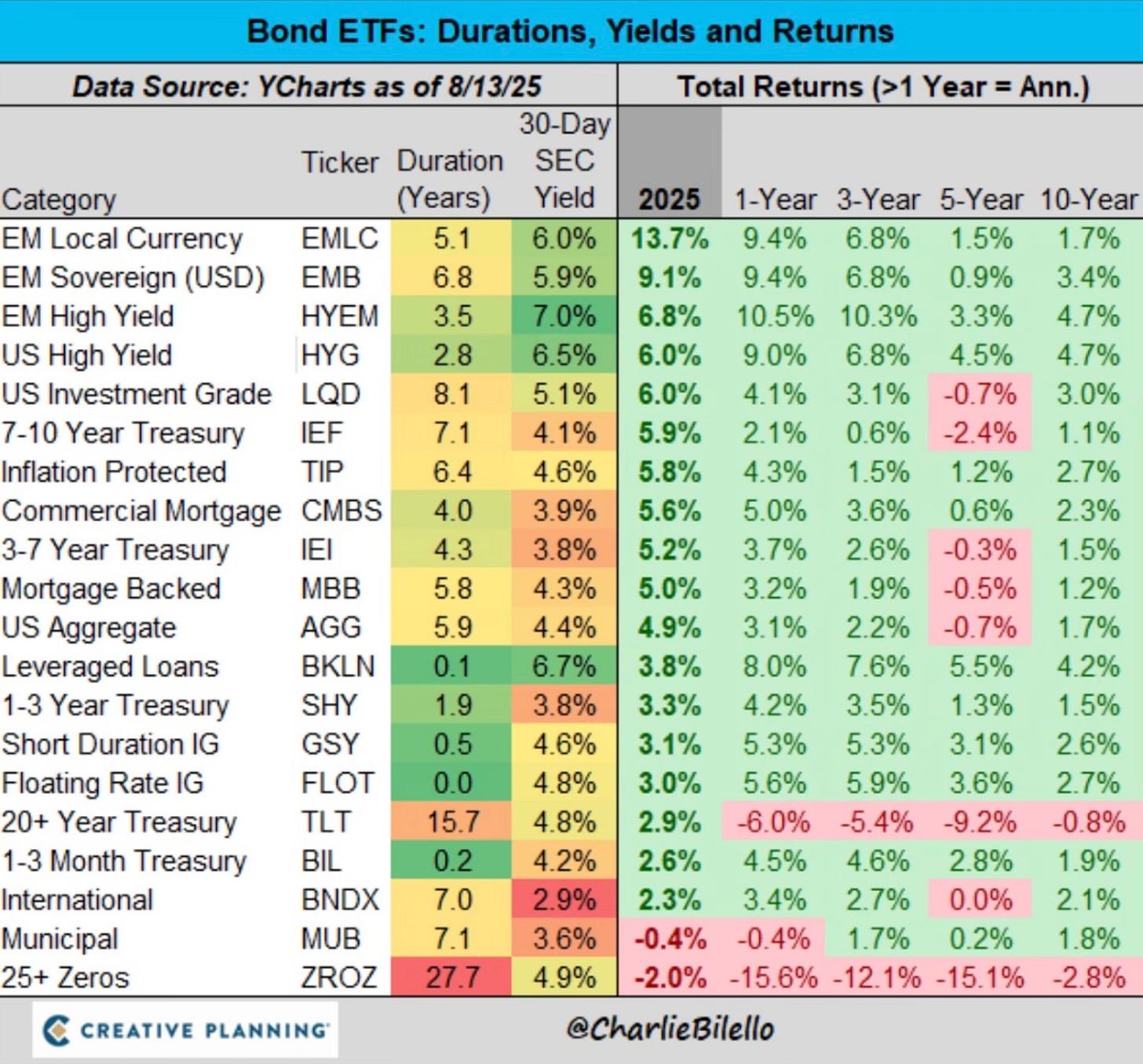

A Look At Bonds

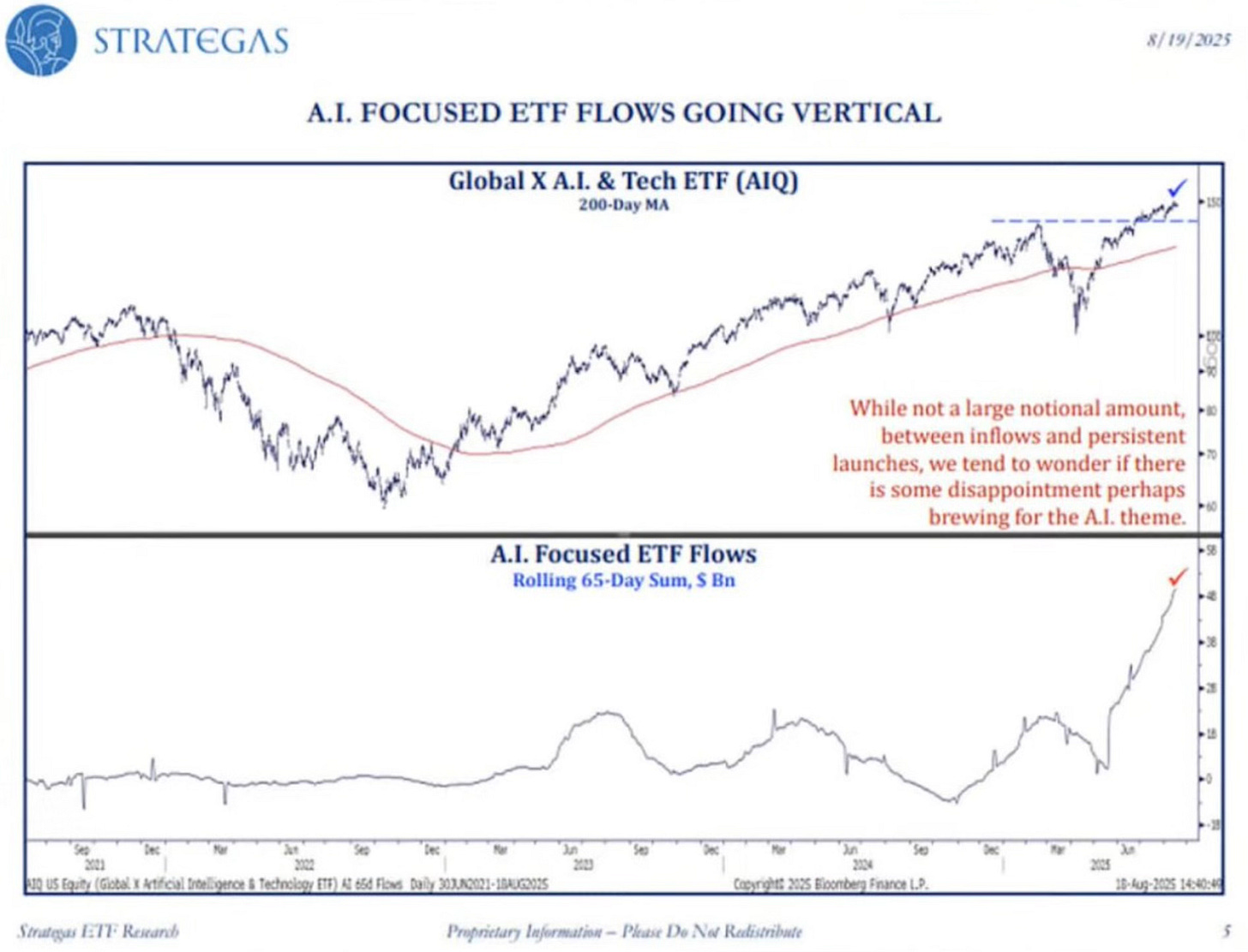

AI Focused ETFs

The AI focused ETFs are some of the most popular ETFs in the market right now.

Just how popular? Take a look at the flows.