Investing Update: Hedge Fund Buys & Holdings

What I'm buying, selling & watching

The stock market has been on a string of runs. Last week we saw the S&P 500 rise for 5 straight sessions.

This week it went the other way. The S&P 500 ended the week on a 4 day losing streak. It was the biggest weekly decline since the week of April 4th.

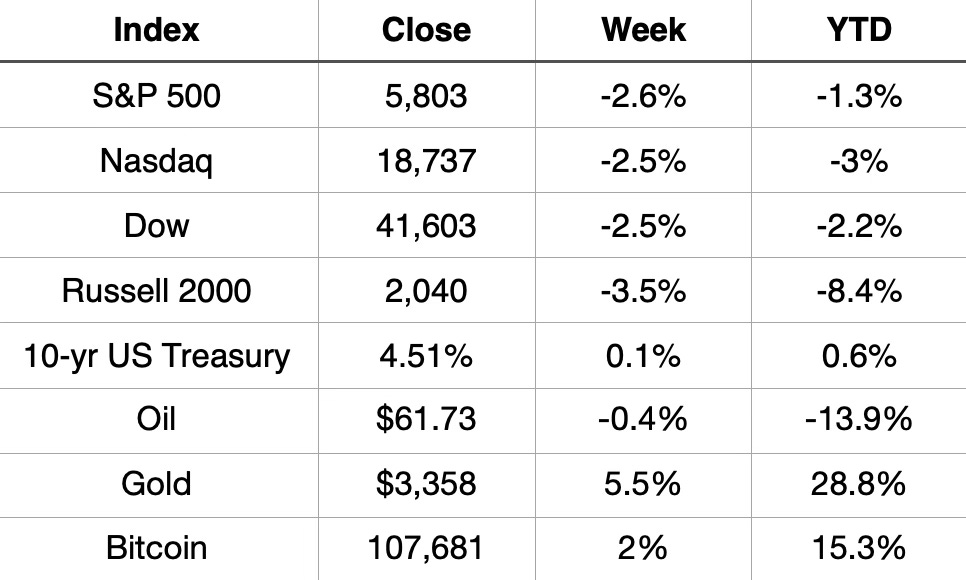

All the major indices were down 2.5% or more this week.

Market Recap

Weekly Heat Map Of Stocks

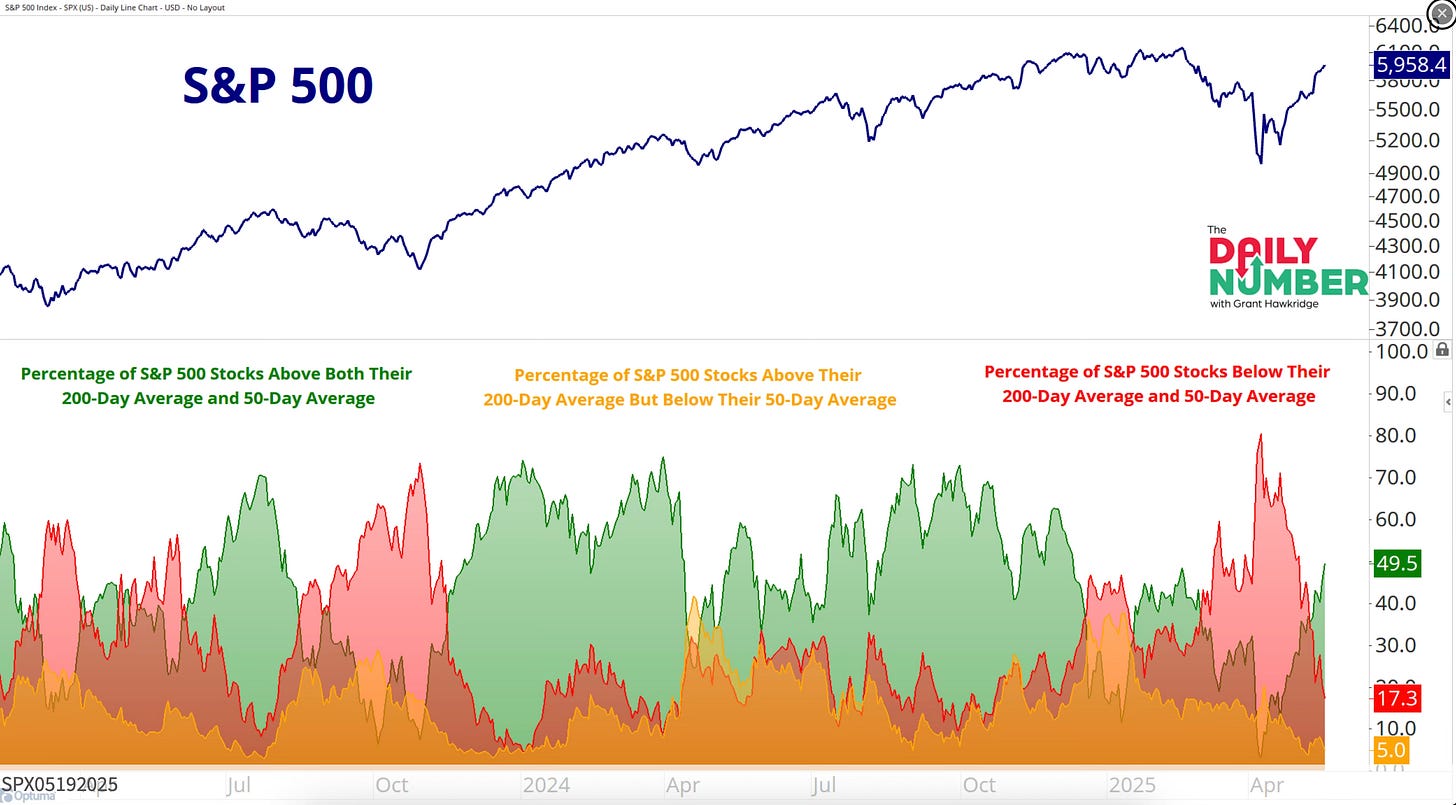

Even with a rough week, the S&P 500 still maintained its 200-day moving average.

My favorite chart from Grant Hawkridge still shows an increase in the green. I love seeing green as that means the percentage of S&P 500 stocks above both their 200-day and 50-day is rising. Right now that number stands at 50%.

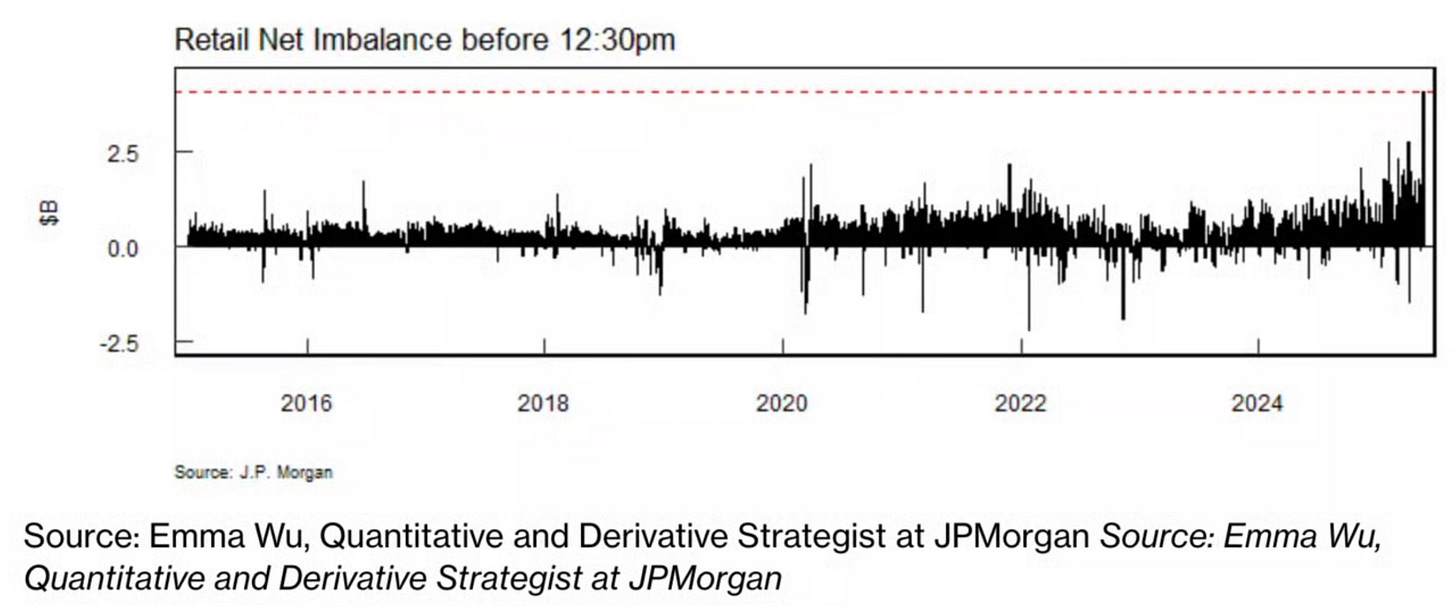

Monday also saw this record buying spree by individual investors happen per Alexandra Semenova.

Retail traders went on a record dip buying spree Monday ... Individual investors purchased a net $4.1 billion in US stocks through 12:30 p.m. in New York, the largest level ever for that time of day — and broke the $4 billion threshold by noon for the first time ever.

It was the 2nd best week of the year for gold. Unfortunately it seems like when stocks fall, gold rallies.

Rising bond yields together with fresh tariff threats to Apple and the EU are tapping the brakes on a stock market that looked poised to surge higher.

Yesterday when we saw the tariff tiff return, we all heard the “not again” reaction. Go ahead and admit it. You said it just like I did.

The longer this back and forth game continues, the more likely it is we revisit the lows. It seems as if the Trump administration wants to continue to have volatility.

This week is important to see if the bullish momentum that was there to start the week returns.

All eyes are going to be fixed on Nvidia’s earnings report after the bell on Wednesday. What’s said and the reaction to that earnings call will be an important catalyst in where things lead in the short term. Unless there are more tariff tiffs as that seems to dominate the news and ultimately determines what the market is doing day to day right now.

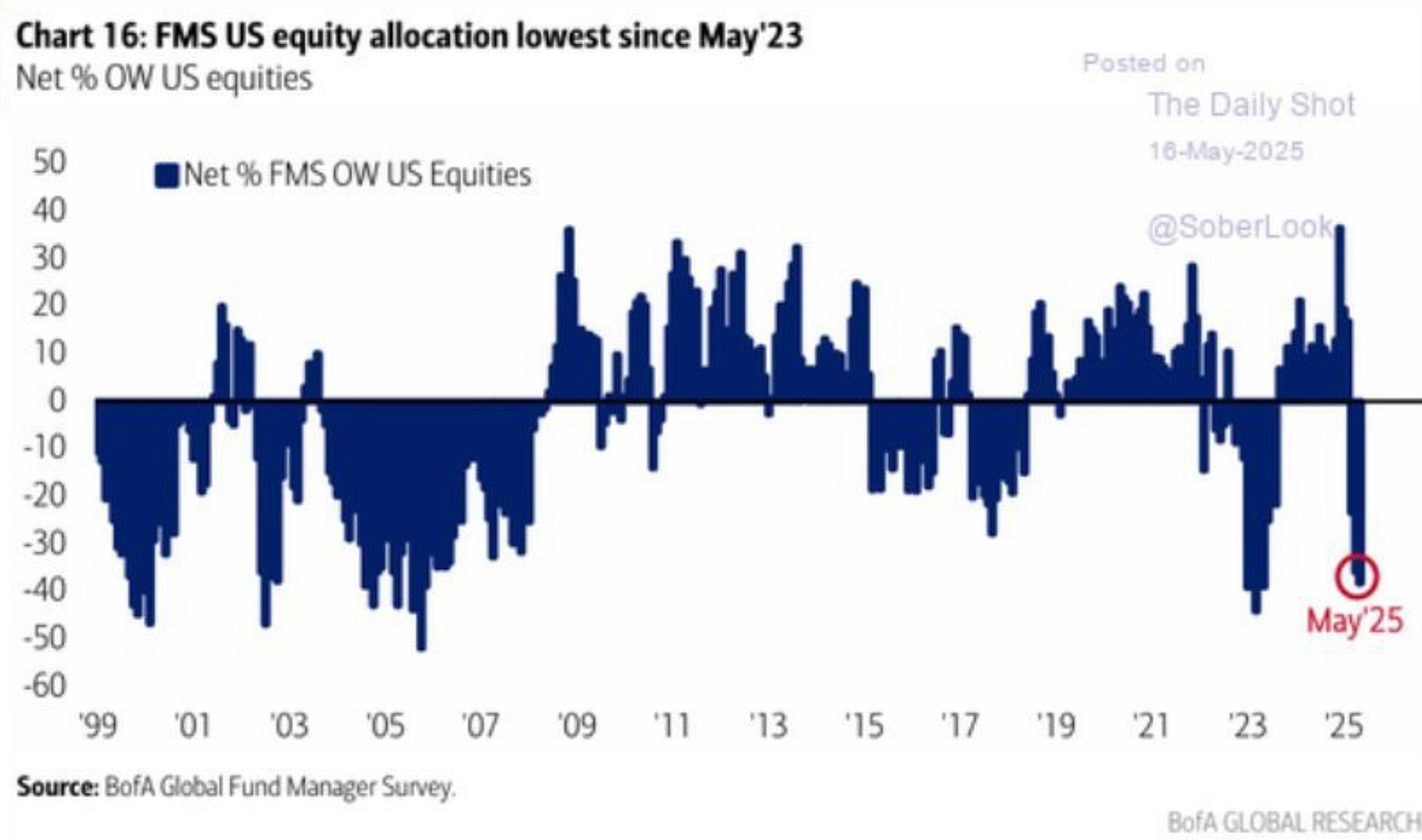

Underweight Equity Exposure

Fund managers are the most underweight equities since May 2023. Even after the recent run, their allocations have not budged.

What does this mean? They seemed wrong as the market rallied higher but now after this week one has to wonder. They seem to have conviction for being this underweight.

Or is this just more evidence to keep this in mind during the next market dip. Maybe it’s still a time to buy and there is a big chase that could be coming with a rally that has staying power. A rally with staying power will force money to chase.