Investing Update: Don't Forget This Chart

What I'm buying, watching & selling

Another week equals more new all-time highs for the stock market. Make that 45 new highs so far in 2024 for the S&P 500.

This was the 5th straight week of gains for the S&P 500. 8 of the 9 past weeks have been positive.

The S&P 500, Nasdaq and Dow all finished up over 1% on the week. The S&P 500 and Dow set new all-time closing highs. The Nasdaq is less than 2% below a new all-time high.

Market Recap

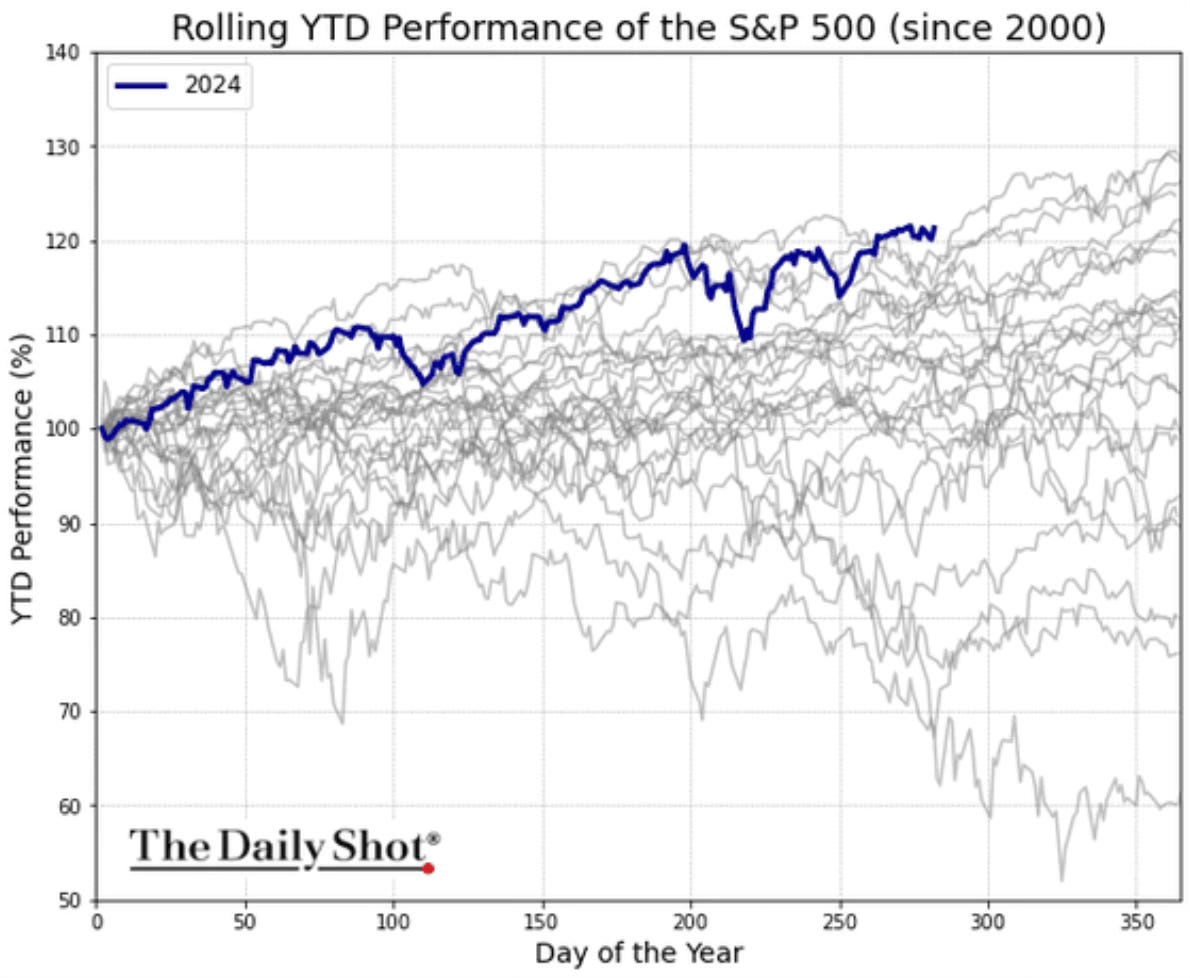

YTD the S&P 500 is experiencing the best performance since 2000. This is the best year into early October in 24 years.

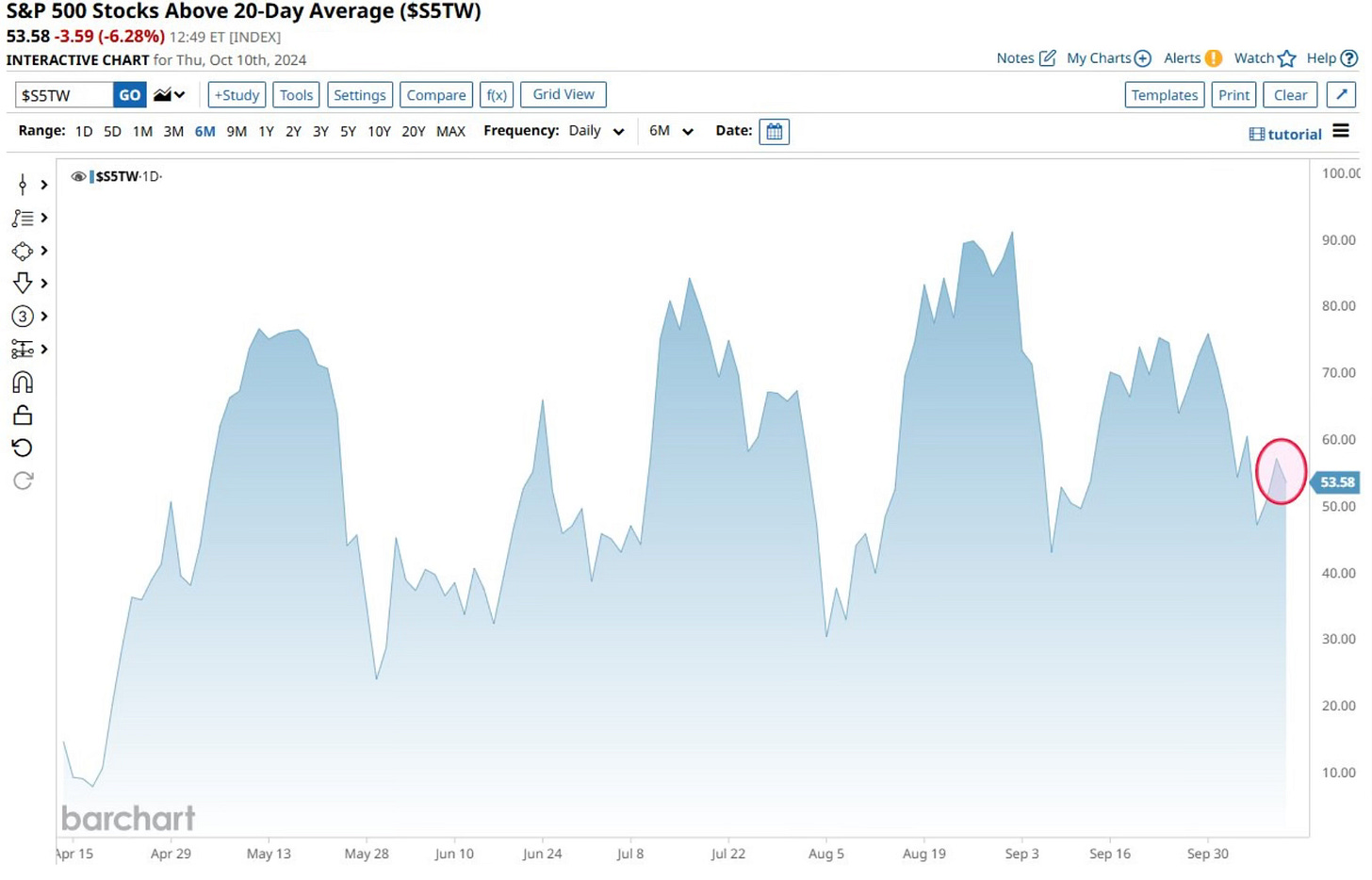

If there was one data point this week that surprised me in the midst of this rip-roaring bull market, it’s this chart.

With the S&P 500 continuing to set new at all-time highs, only 54% of S&P 500 stocks are trading above their 20-day moving average. That seems quite low to me. I don’t believe it signals anything yet, or that the bull is running out of steam. But it will be something that I’m watching.

Will The Fed Still Lower Rates?

Thursday saw initial jobless claims higher than expected and CPI came in hotter than expected.

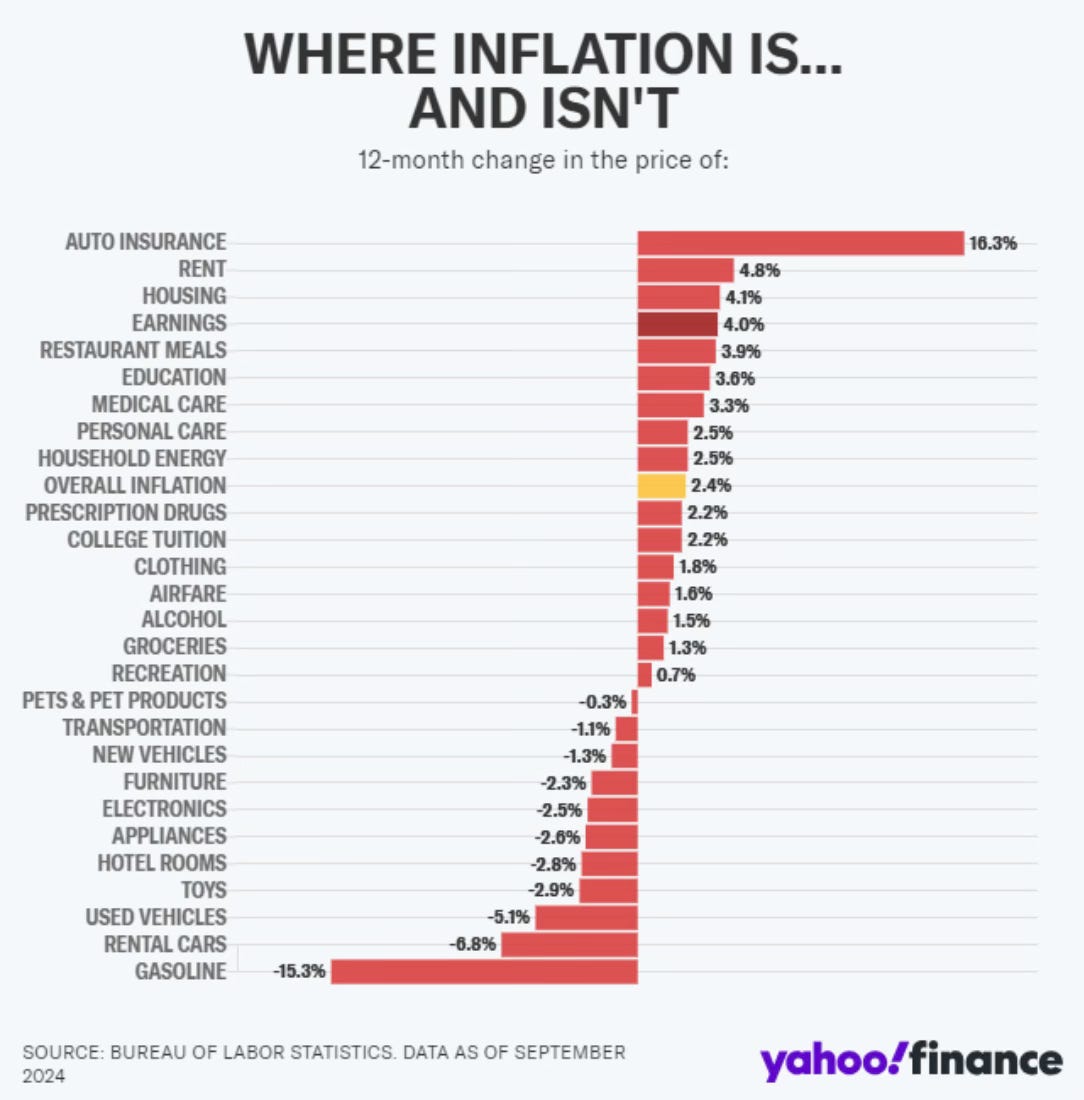

CPI actually ticked down to 2.44% YoY in September, but the forecast was for 2.3%. That’s still the lowest inflation reading since February 2021.

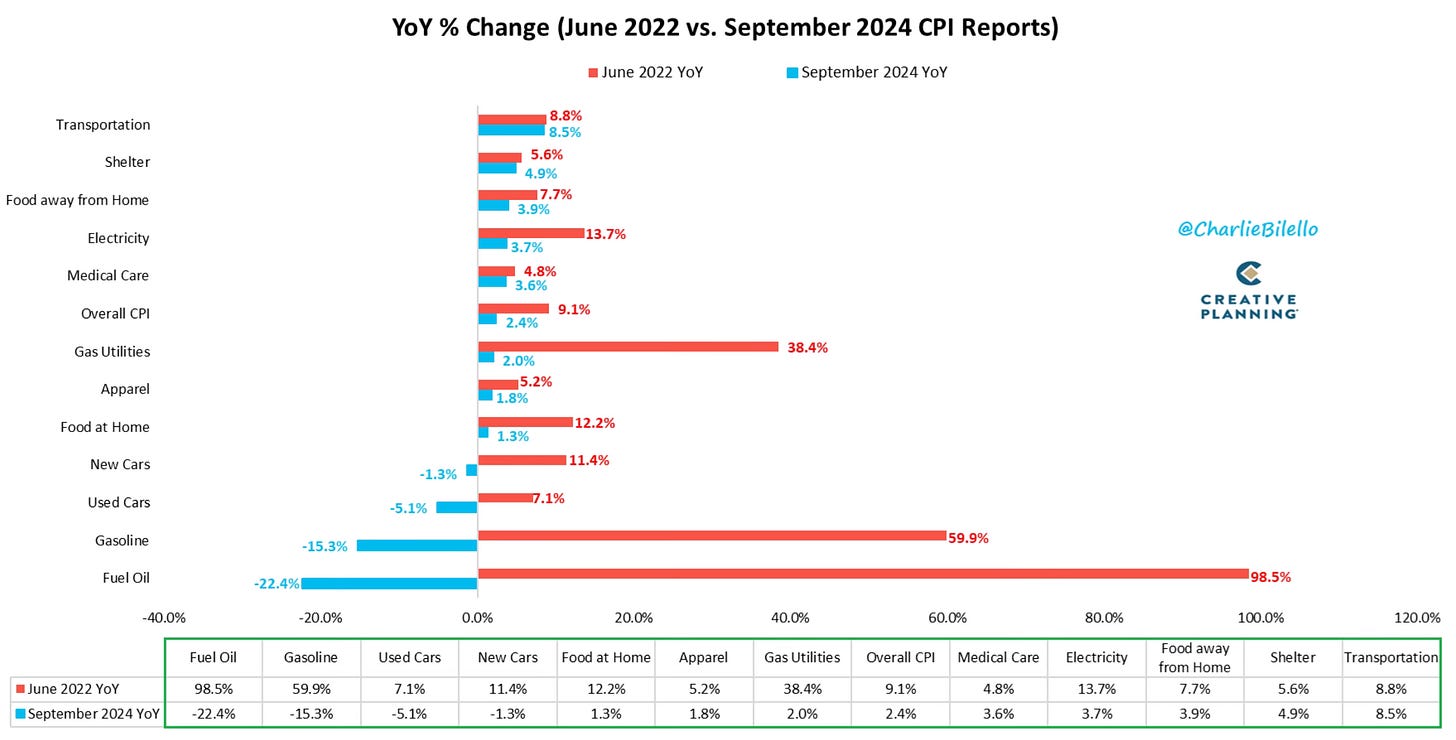

This is a good comparison of where things have come from during the 9.1% inflation peak in June 2022, until today at 2.4%. A lot of progress.

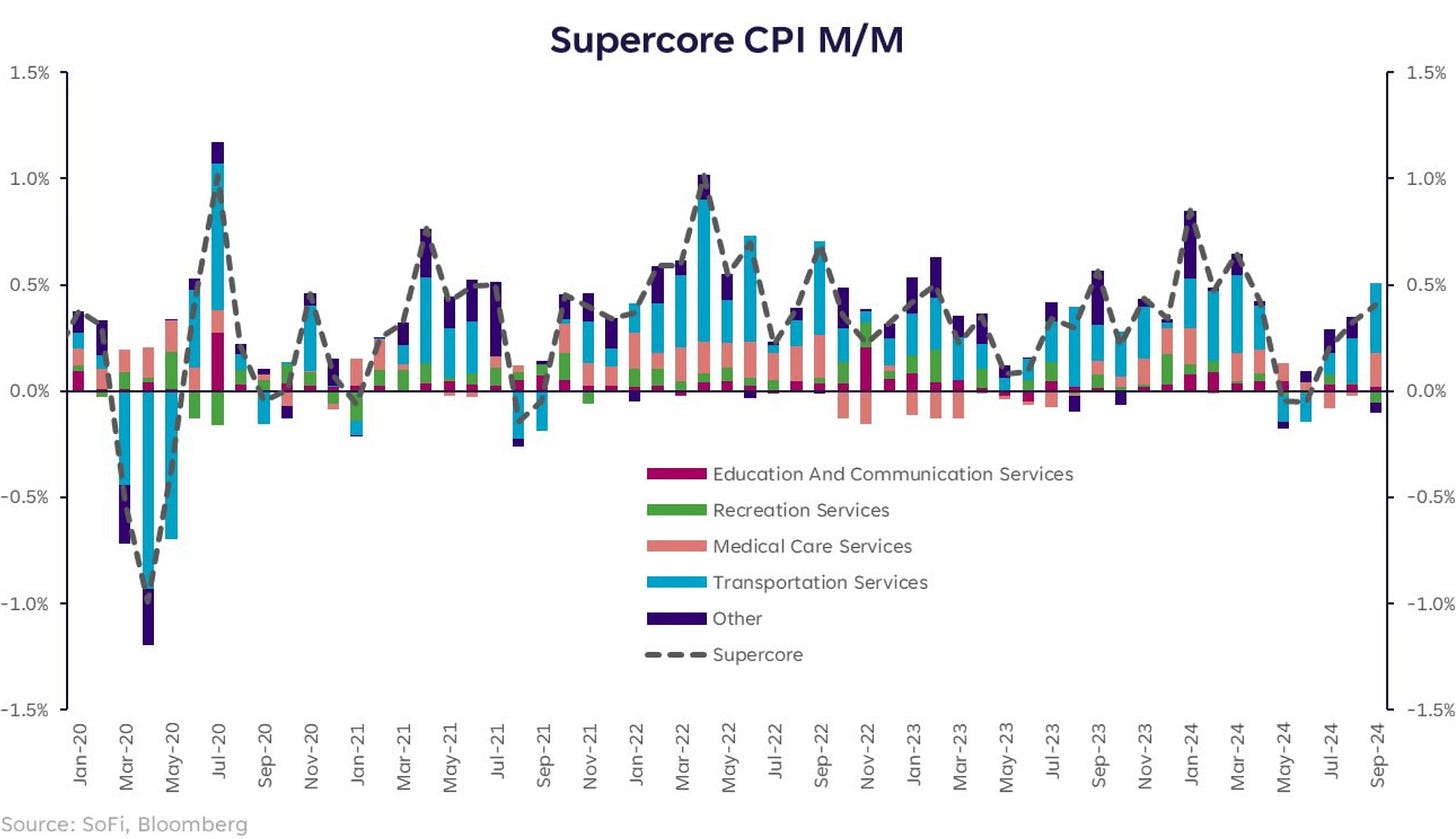

US Core CPI (excluding food/energy) came in above expectations at 3.26% YoY. This was the hottest supercore has been since April. That might seem a bit worrisome but I’m not worried until a trend develops. I’ll be watching the next reading. We can’t ignore inflation quite yet.

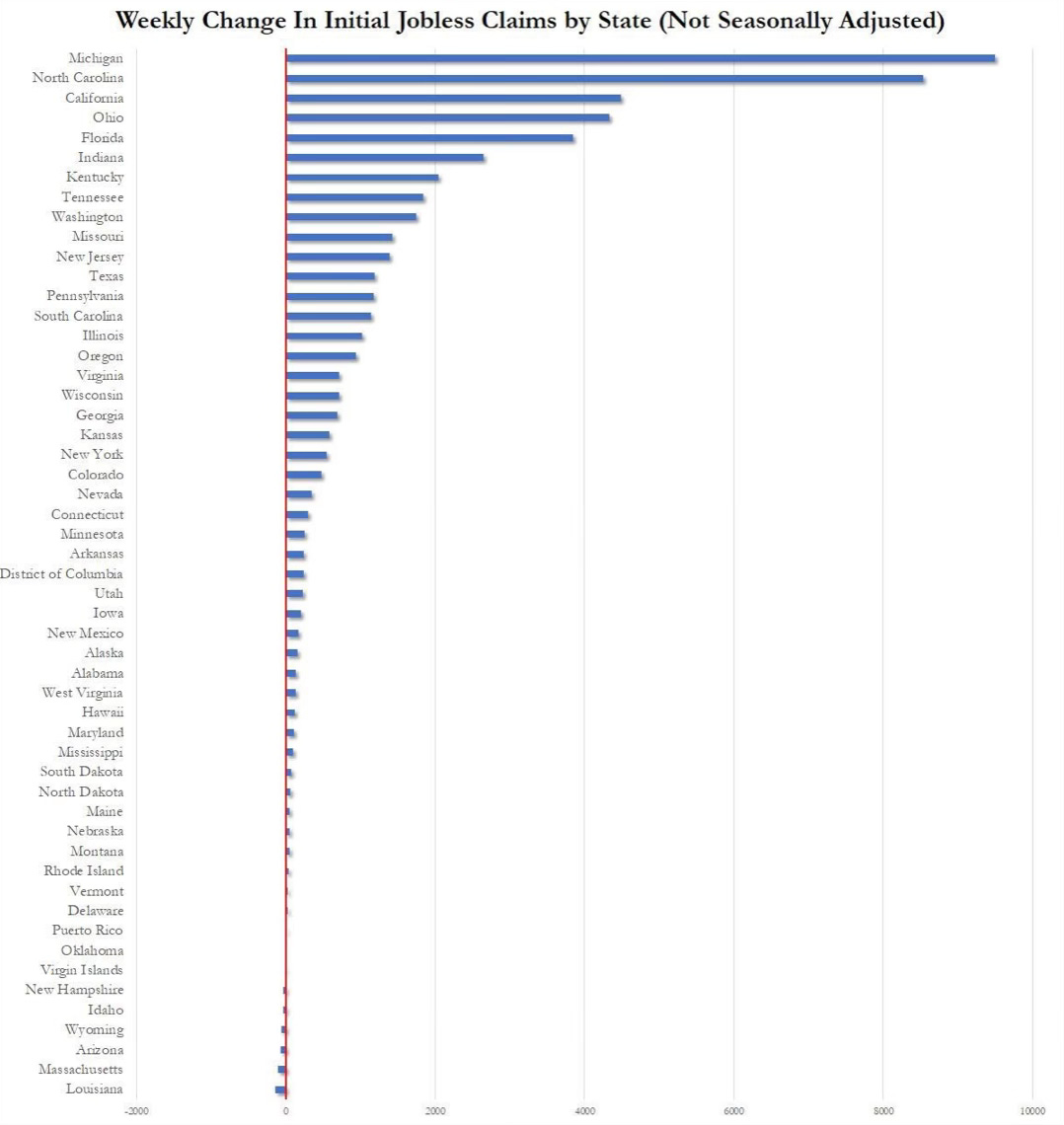

The labor market also flashed a warning on Thursday with initial jobless claims coming in with the biggest jump in 3 years. The forecast was for 230,000 but came in at 258,000. It was previously 225,000. It’s the highest initial jobless claims since June 2023.

My initial guess was that this was due to the hurricanes. But that doesn’t look to totally be the case. Michigan, California and Ohio also saw big jumps.

If you combine these two readings, it does make the Fed’s decision in November a bit more interesting. It’s given fuel to the voices who said that the Fed shouldn’t have moved 50 bps last month.

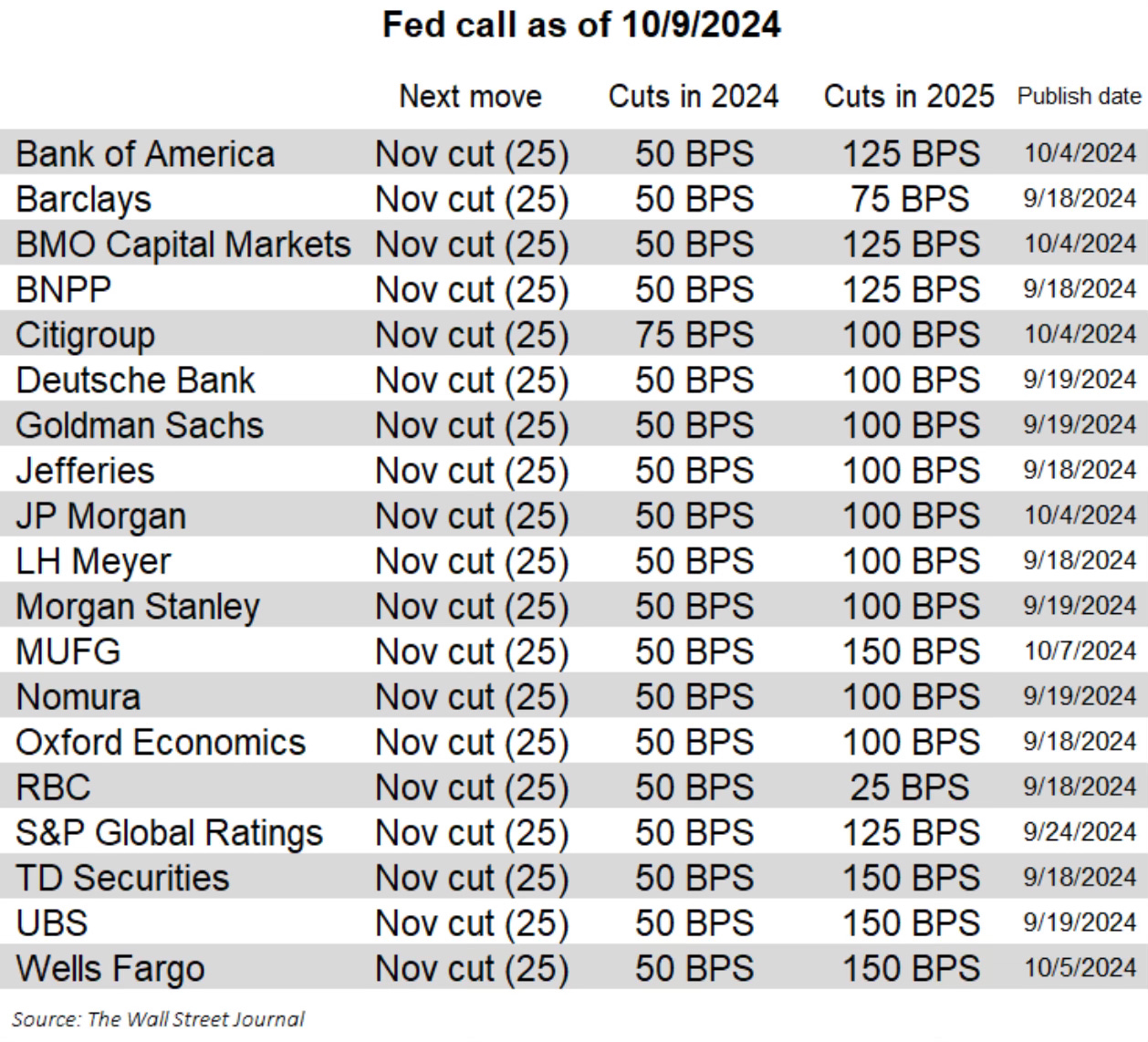

I still think they will move again in November regardless what this week’s data showed. I would expect another 25 bps cut.

It looks like that’s still the consensus among economists and strategists as well.