Investing Update: Bubble Talk Returns

What I'm buying, selling & watching

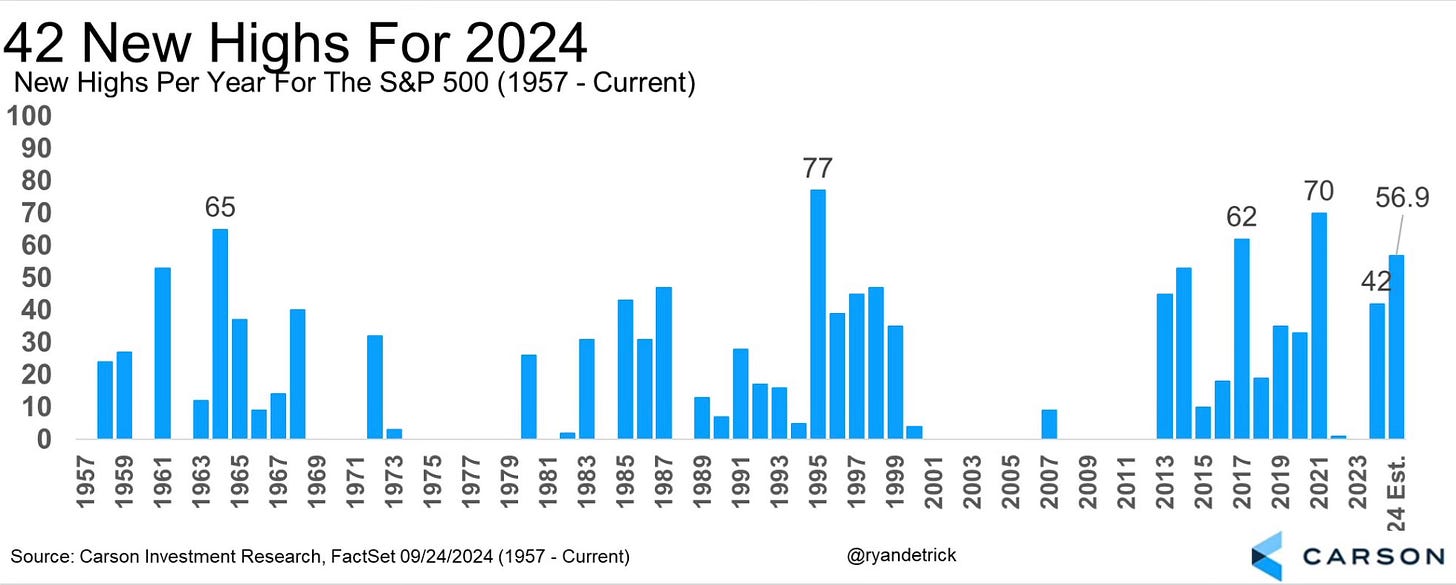

Another week, another 3 days of new all-time highs for the S&P 500. This week saw Monday, Tuesday and Thursday each set a new all-time high. That brings the total to 42 new highs for 2024.

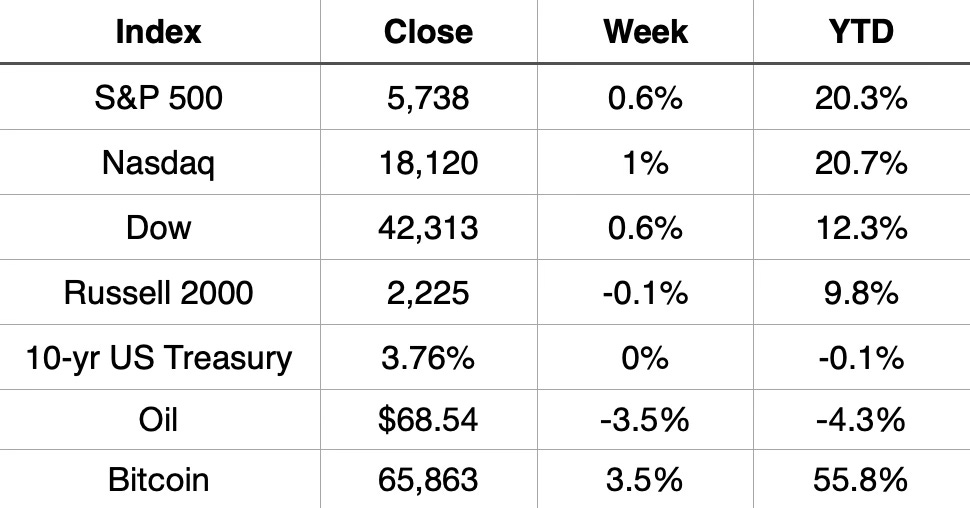

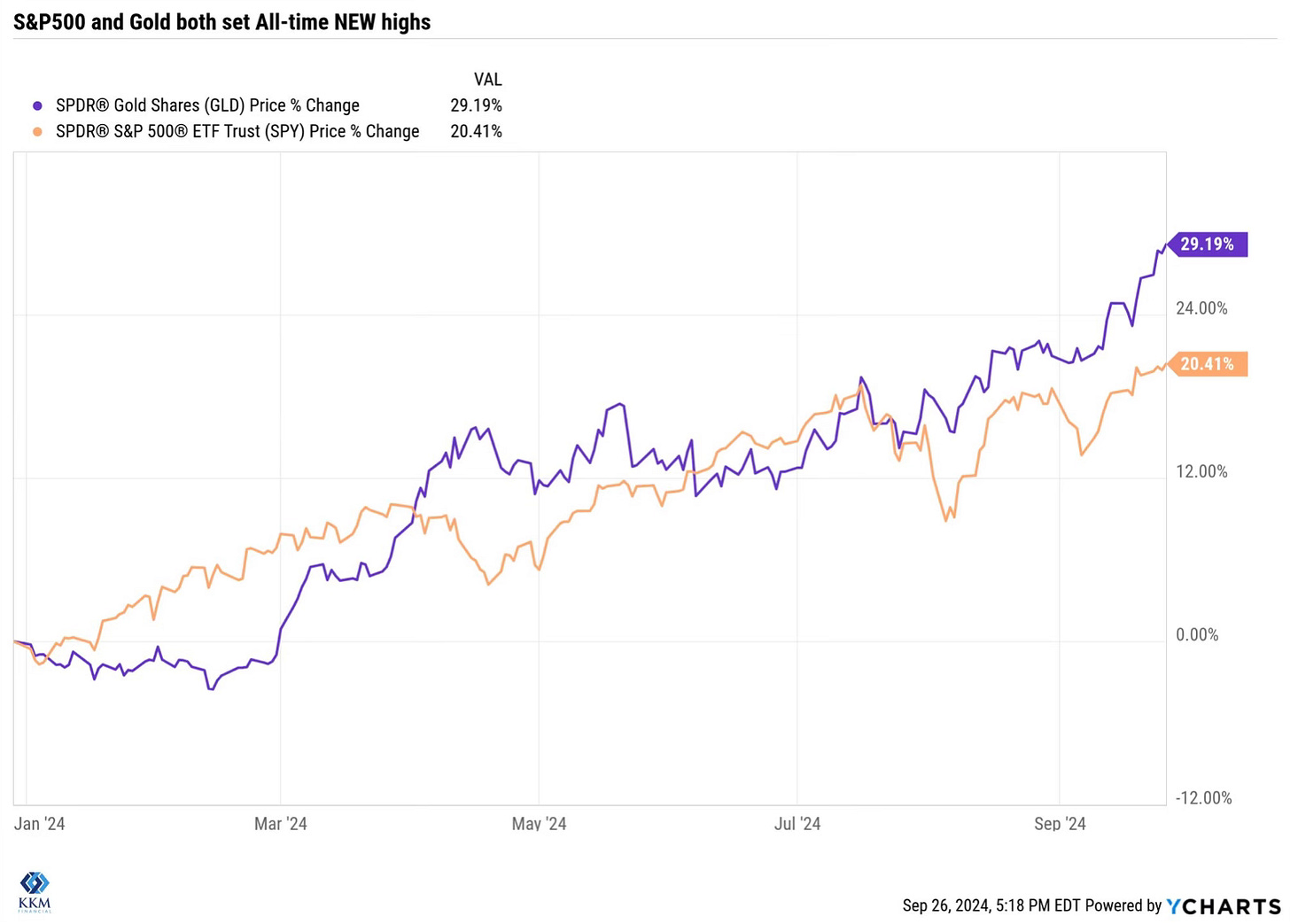

The S&P 500 and Nasdaq both now stand up over 20% so far this year. The Dow is now up over 12% YTD.

Market Recap

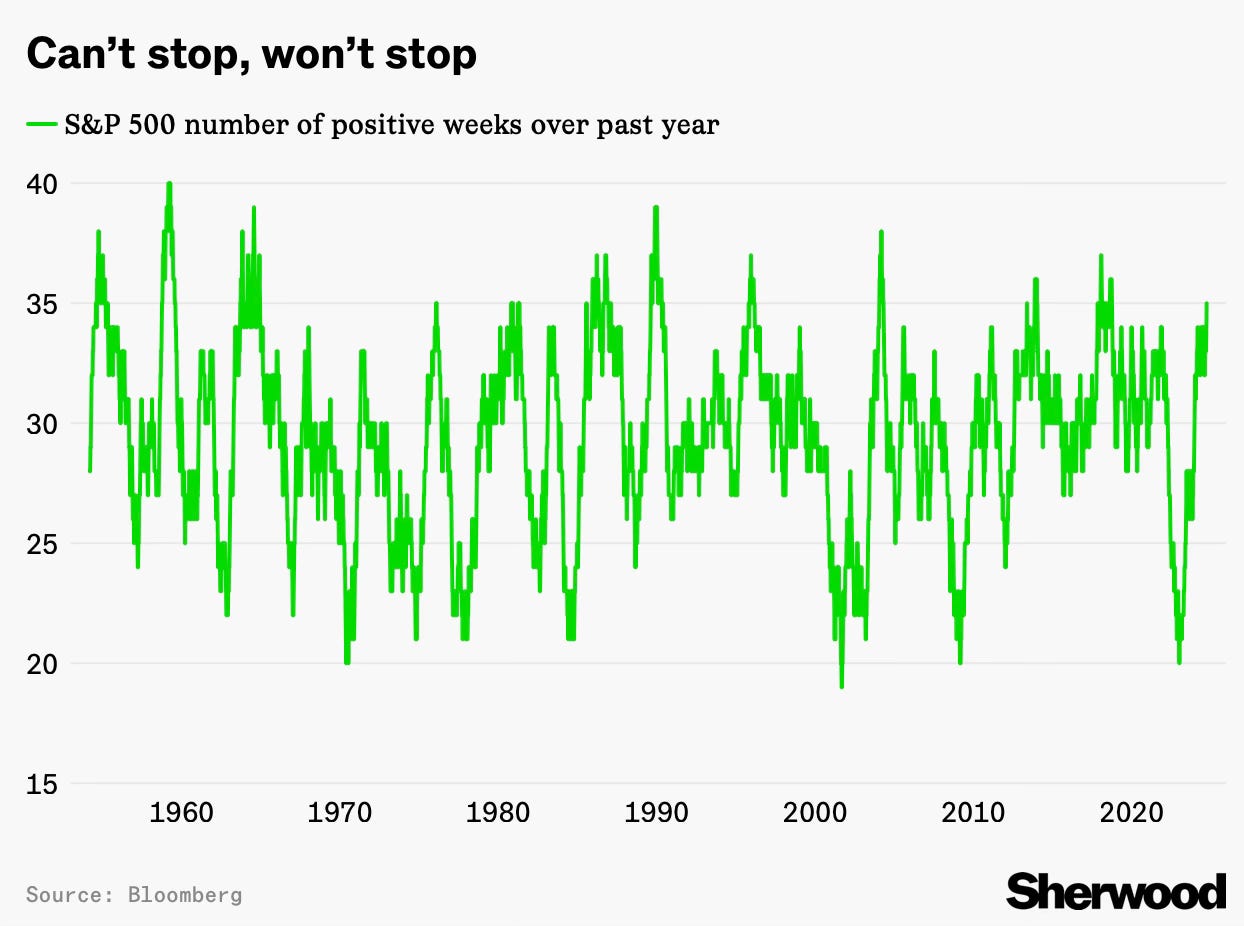

This week made the third consecutive week of gains.

In fact, over the last 52 weeks, 35 of those weeks have been positive. 67% of the weeks over the past year have been up weeks.

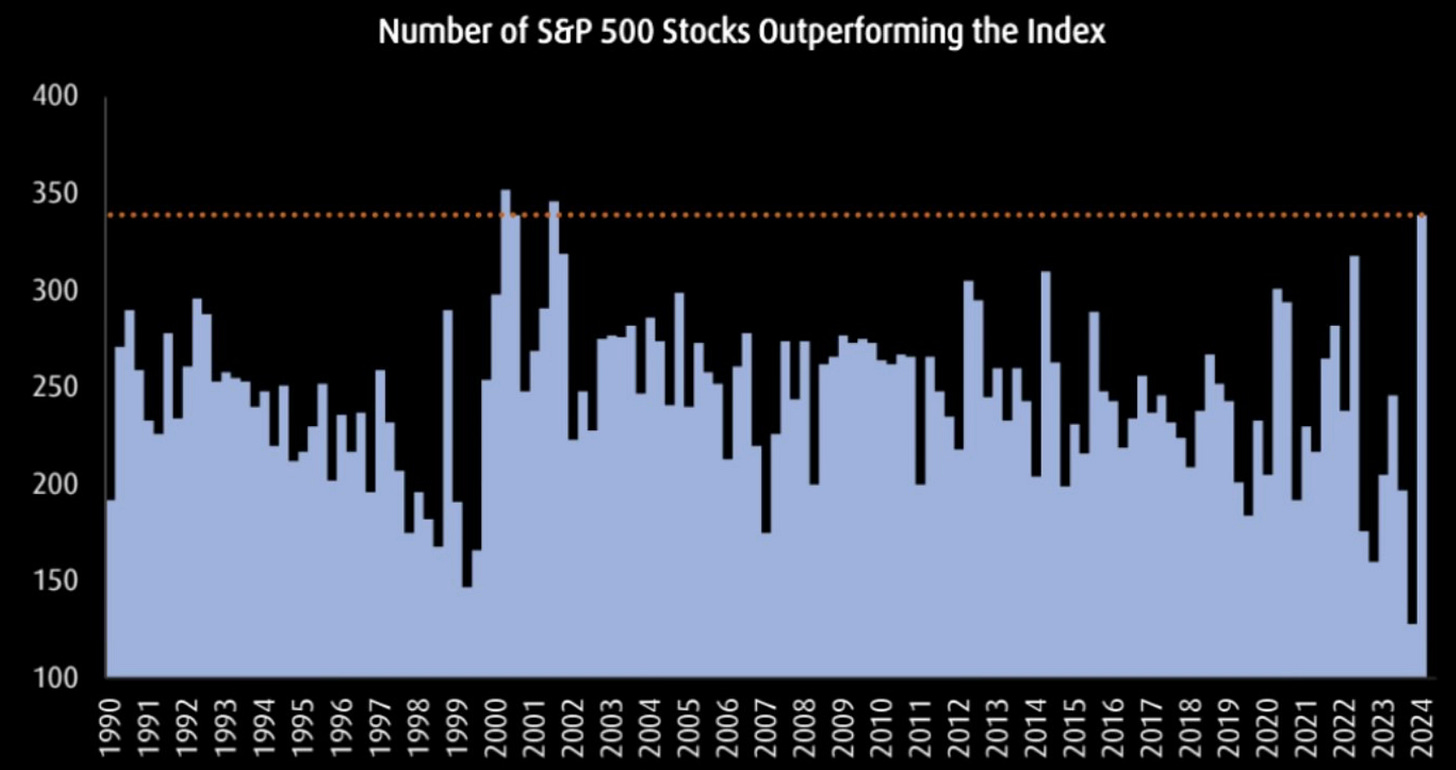

The number of S&P 500 stocks outperforming the index is now at the highest level since 2002.

This level of performance for a September isn’t common. Historically September is one of the worst performing months with the lowest frequency of all-time highs. We’re now experiencing one of the best September in history.

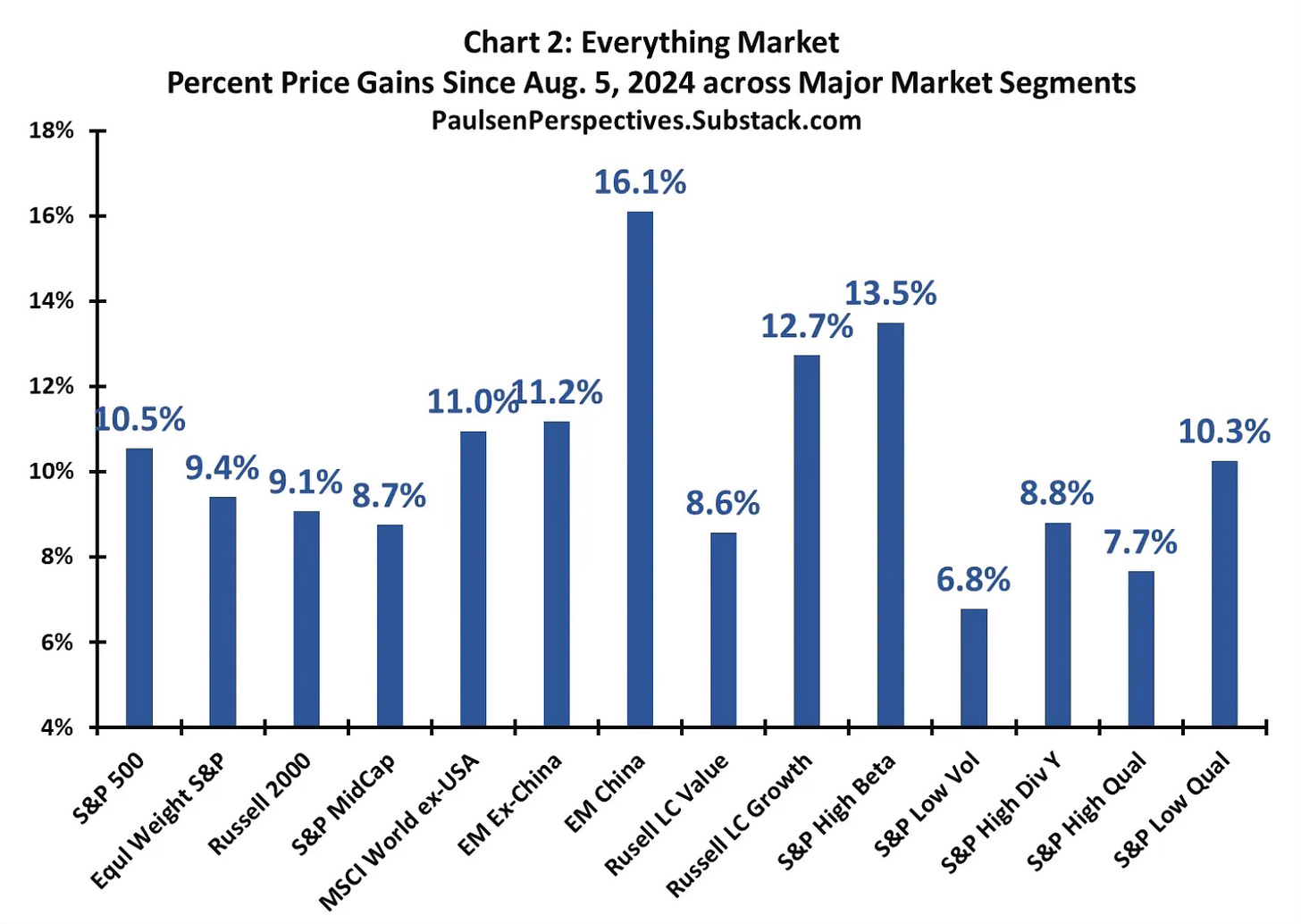

Everything Is Rallying

Right now it seems that literally everything is rallying. From high beta and low volatility to high dividend yields. Both high and low quality stocks are working.

To my surprise is you actually have both the S&P 500 and Gold at all-time highs at the same time. This might be the biggest surprise to me right now.

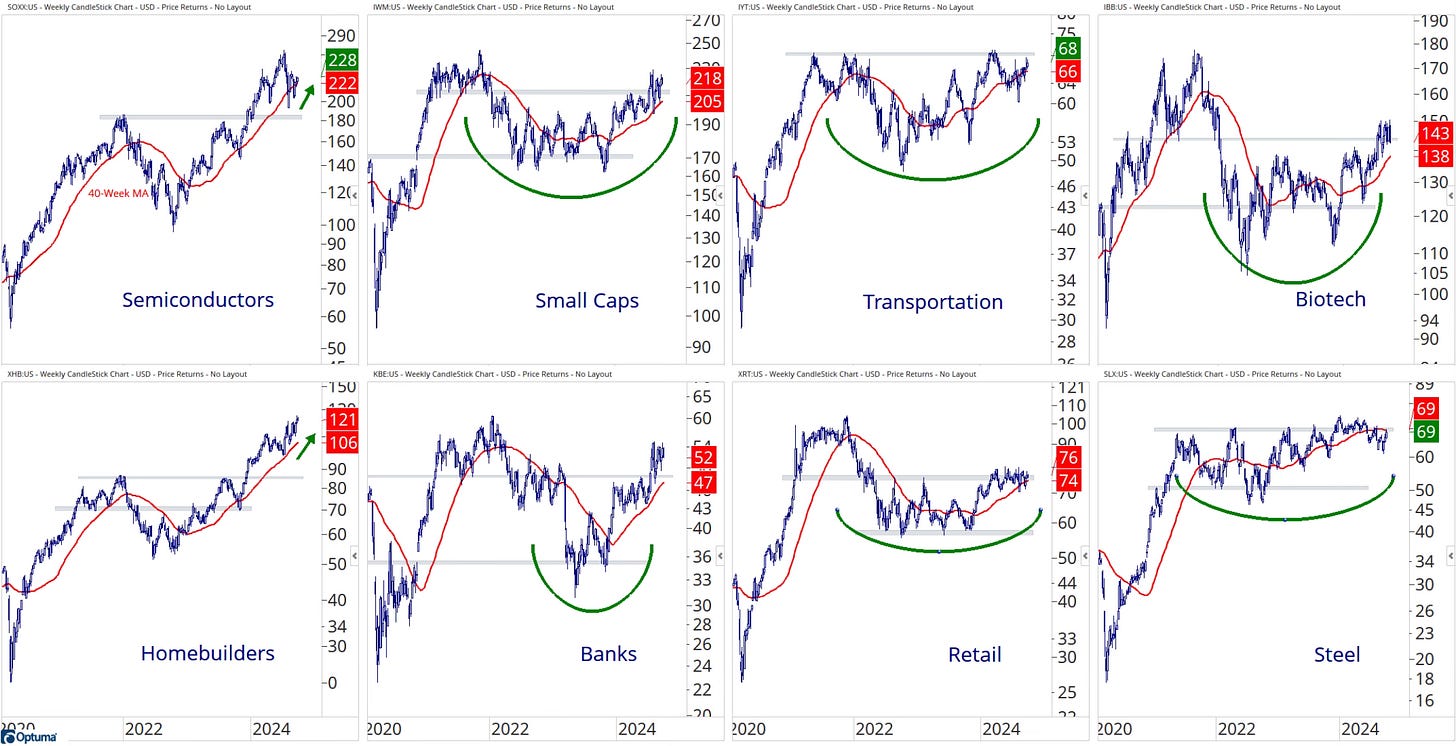

I like these areas that Grant Hawkridge points out.

My canaries in a coal mine are all looking constructive.

These all are things to watch for breakdown signals. Right now, that isn’t happening. Look at the strength that these are showing. There looks to be no slowing of this bull market.