Investing Update: Are Tech Stocks Rested & Ready?

What I'm buying, selling & watching

Coming off the Martin Luther King Jr. Day holiday, Wall Street faced a news heavy stretch that resulted in the S&P 500’s first back to back weekly loss since last June.

Tariffs still matter, and Tuesday was a reminder of that. Stocks sold off after President Trump threatened to impose tariffs on European allies tied to his claims over Greenland.

The move marked the market’s largest selloff since October 10. That was the last major escalation on tariffs, when Trump threatened China with a 100% tariff over rare earth export controls.

Stocks rebounded after the President clarified he would not use force to acquire Greenland. The earlier selloff proved misguided, echoing a familiar pattern we have seen time and again. Geopolitical fear spikes, markets wobble, buyers step in. Different headline, same playbook.

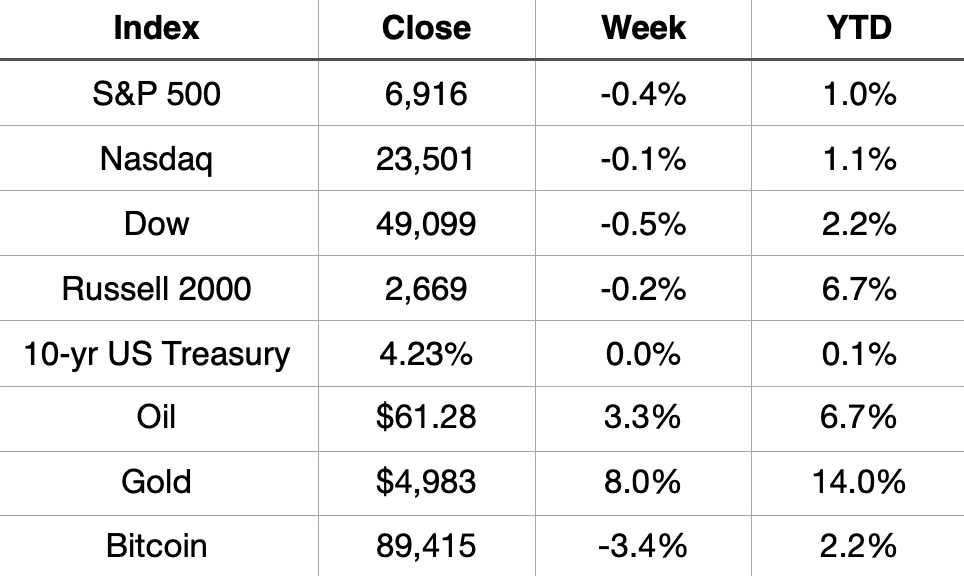

Market Recap

Weekly Heat Map Of Stocks

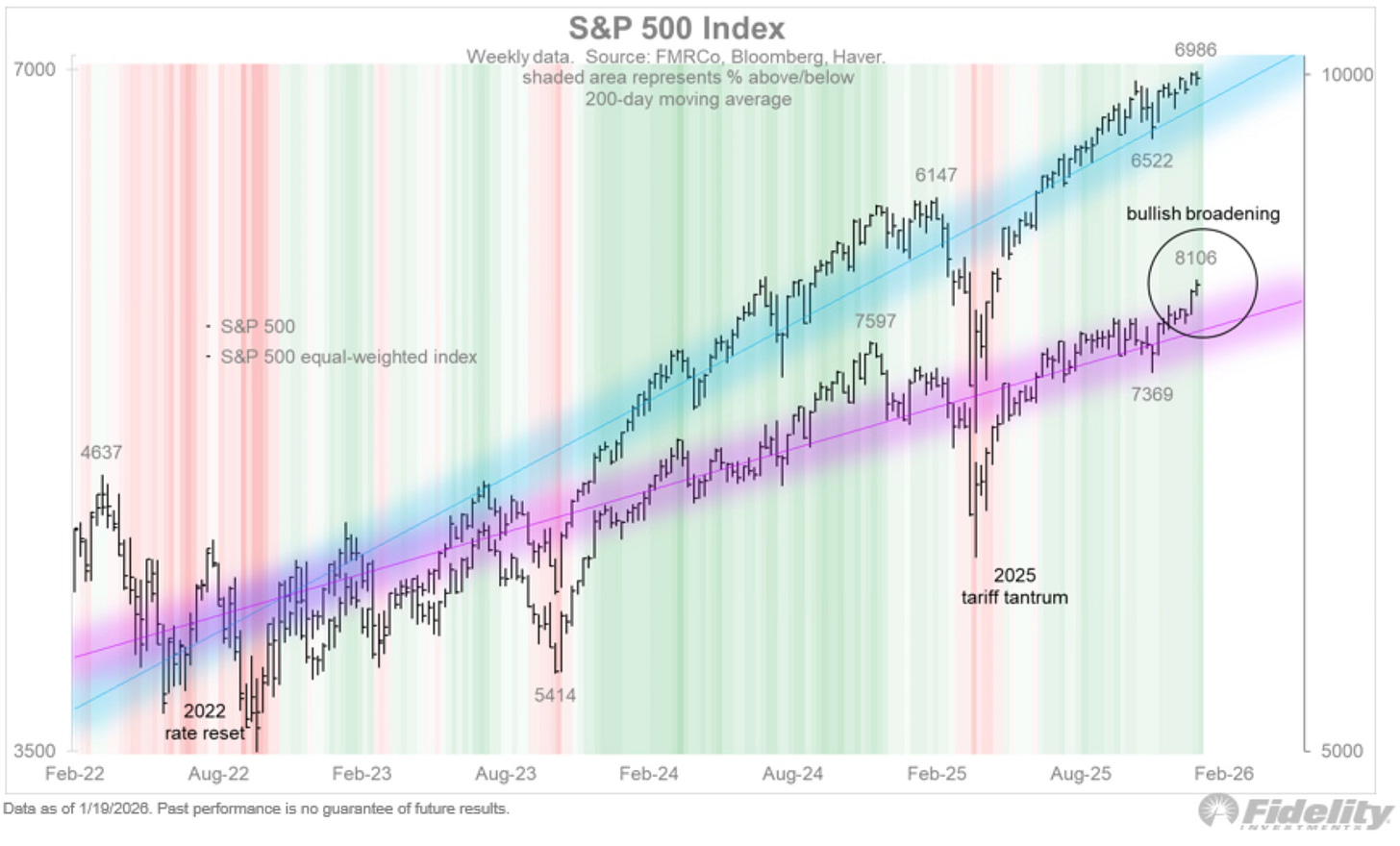

We continue to hear about a broadening rotation in the market.

This chart does a great job showing the rebalance that the S&P 500 has been experiencing.

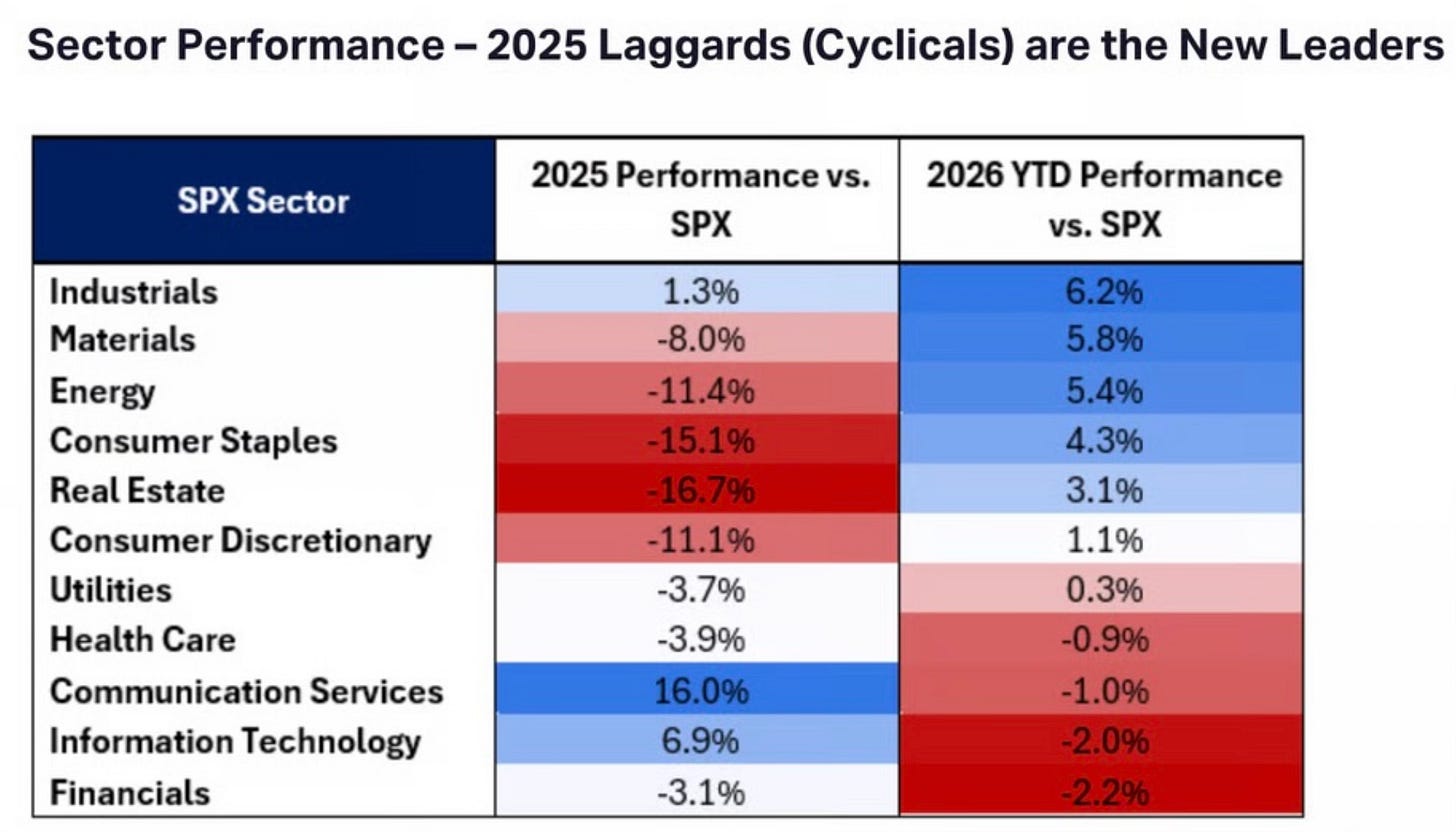

From a sector standpoint, you can see the change from the 2025 performance versus 2026. A clear shift to new leadership.

I think the bigger question is whether that shift in leadership continues, or if tech and the Magnificent Seven begin to reassert themselves after a brief breather.