Investing Update: Are New All-Time Highs Next?

What I'm buying, selling & watching

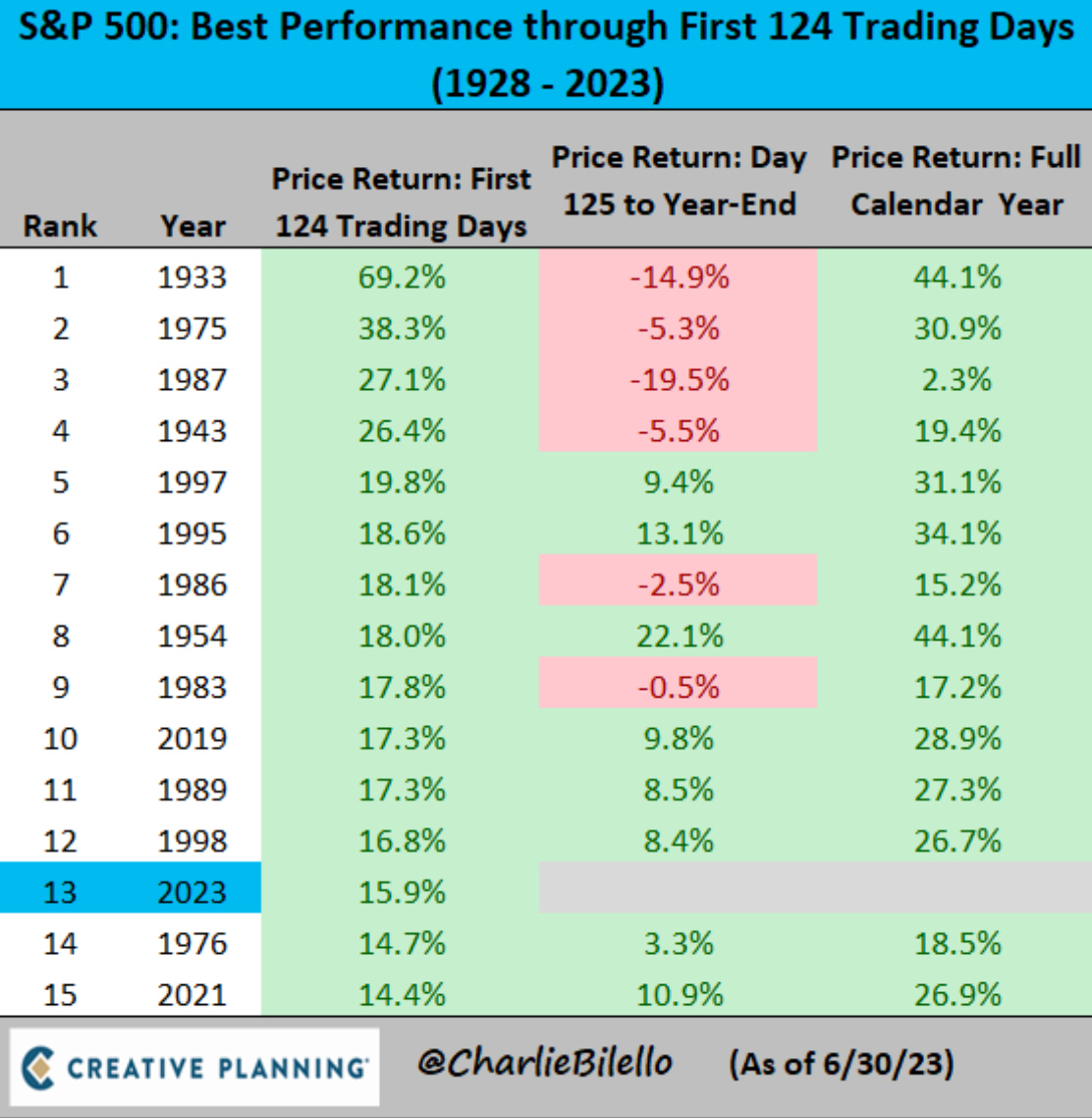

The S&P 500 finished a shortened week of trading down slightly to start the second half of the year. This comes after an end to the first half where it saw the S&P 500 have the best start to a year since 2019, up 16%.

The Nasdaq had the best first half to start a year since 1983 up 32%. While the Dow finished up just 3%.

After the sea of negativity following a down 2022 and seemingly almost everyone bearish to start 2023, the S&P 500 now only sits 8% from the record all-time high in January 2022.

With second-quarter earnings now approaching, a question that has to be asked is, are the January 2022 highs in play and is the next step higher for the market? With all that the stock market has endured in the first half, I think we do reach and even exceed those highs in the second half of the year.

📅 Wednesday 7/12 will be my mid-year recap piece on the predictions I made to start the year, along with a look ahead to the 2nd half of the year. Be sure to watch for it!

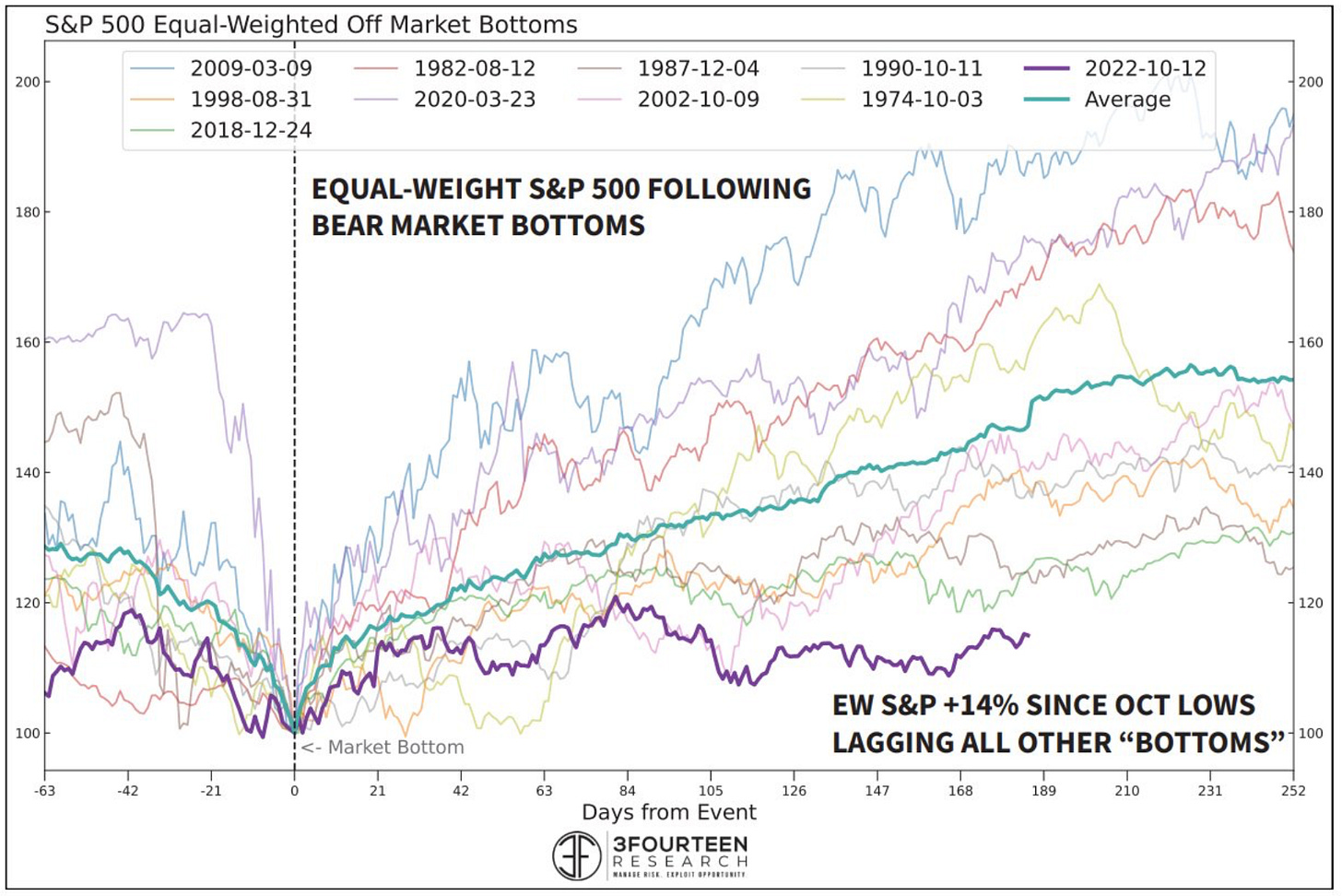

Weakest Rally From Bear Market Bottom

A lot of investors who are pointing to this current market rise as a bear market rally keep pointing to the lack of participation. We hear how the S&P 500 gain is mainly due in part to the mega-cap tech stocks or the new term, The Magnificent 7. One measure they refer to is the equal-weight S&P 500. That’s where each company in the S&P 500 has the same weighting. All the slices are the same regardless the size of the company. Some great chart work below from Warren Pies who points out the following;

Assuming October was THE low: On an equal-weighted basis, the S&P 500 is up only 14%...would be the weakest recovery on record.

If participation broadens, as I discuss later, another of the bear market rally camp reasons to not consider this a bull market will fade away.

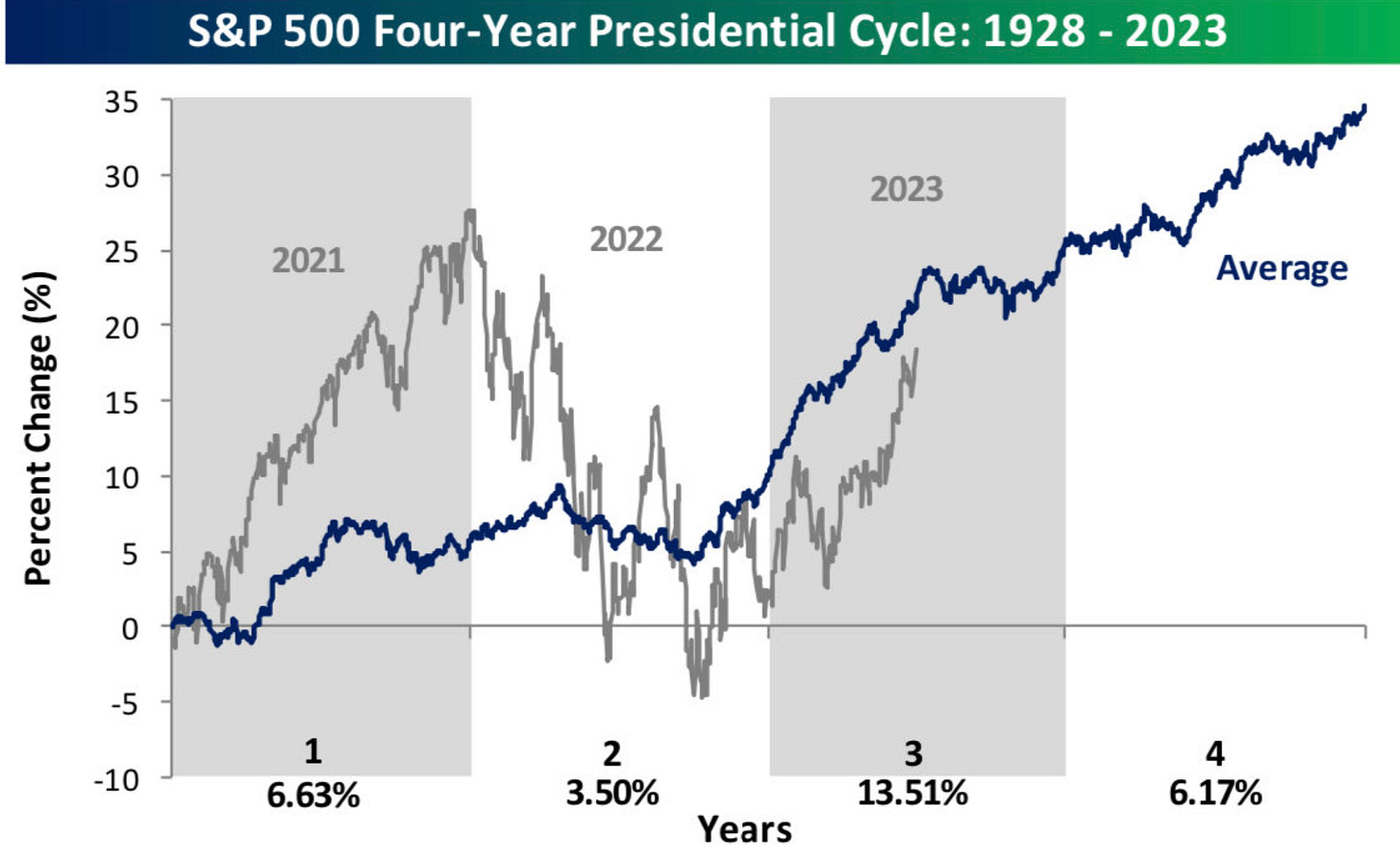

Presidential Cycle Update

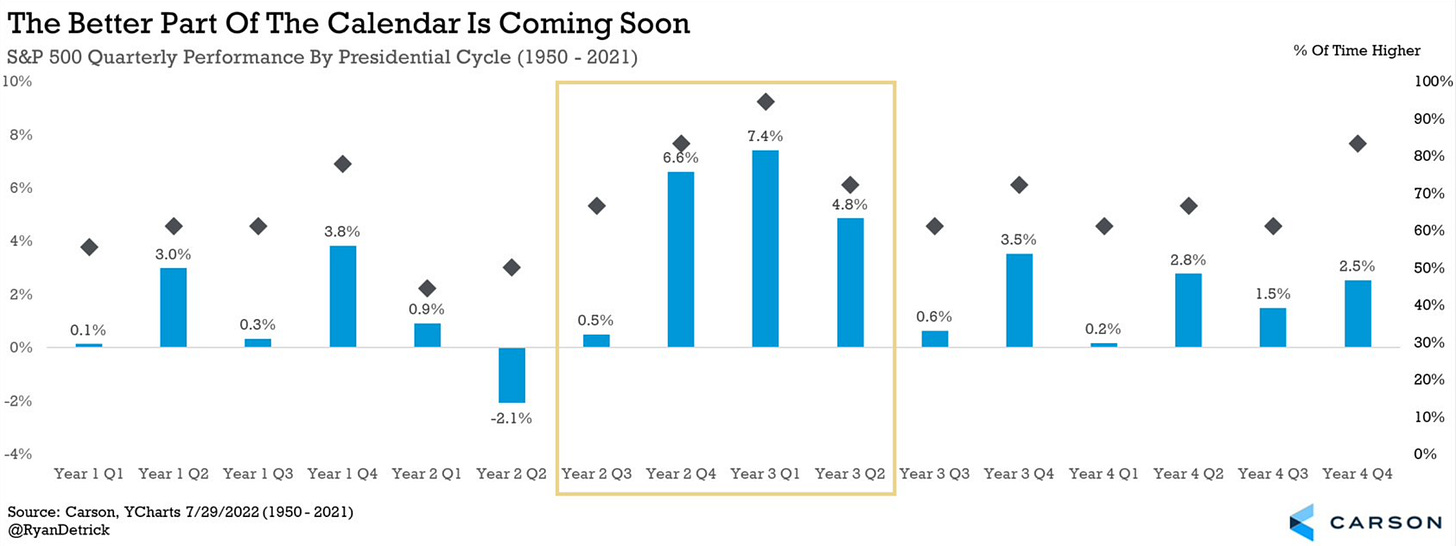

Readers of Spilled Coffee have heard me talk about the presidential cycle and how it matters to the stock market multiple times. I first covered this October 1, 2022, Investing Update: Are Midterms the Catalyst? Then again on February 4, 2023, Investing Update: A New Bull Market? If the trend continues within this cycle, there is a long runway of positive returns still from here. A runway to new all-time highs?

Ryan Detrick’s chart below points out just how good things have been and that even the upcoming quarters tend to be all be positive in the cycle dating back to 1950.

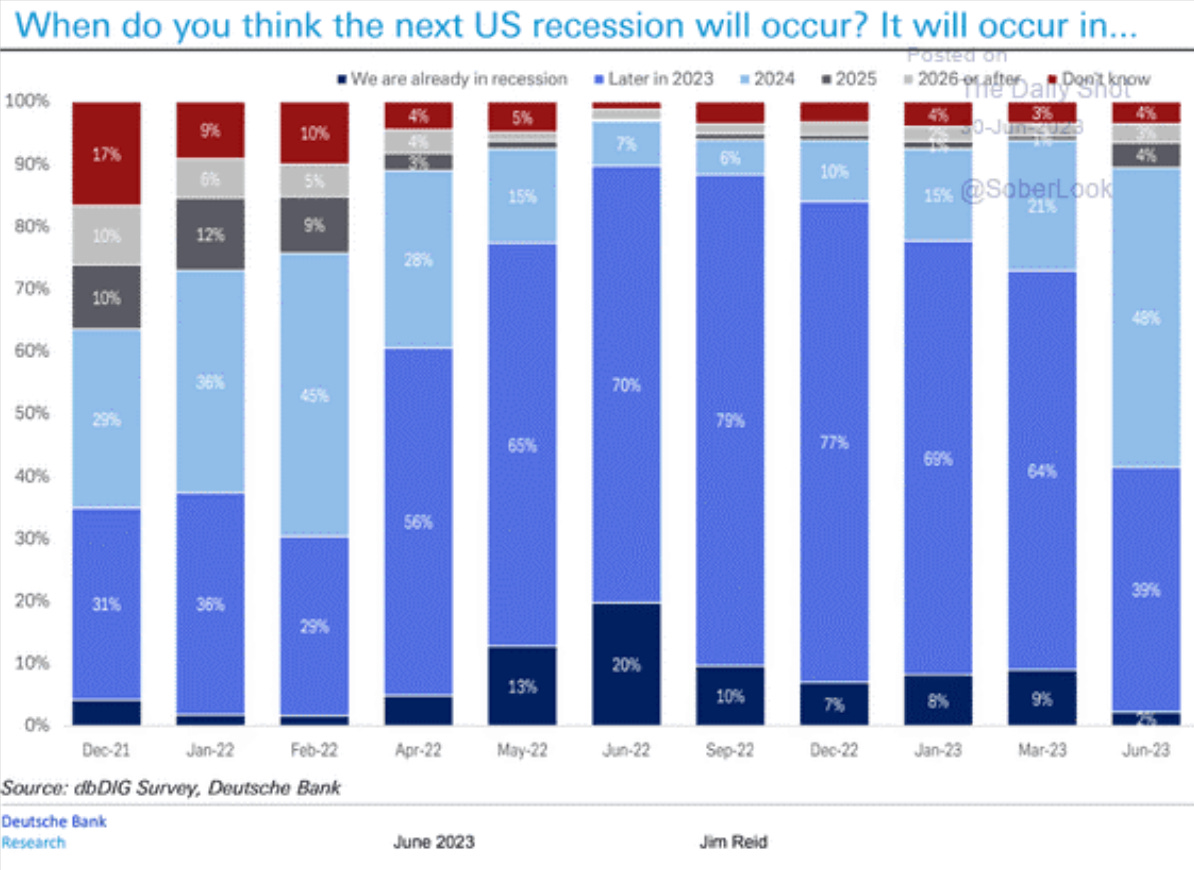

Recession Fears Subsiding

The use of the word recession has really dwindled of late. For the past year it was all we continued to hear. The recession fears keep getting kicked further and further down the road. A year ago saw the peak recession point. I now have my doubts that we even see a recession in the near term. There are a lot of positives in the economy right now. Like it or not and contrary to what the fear-mongers say, things are doing very well.

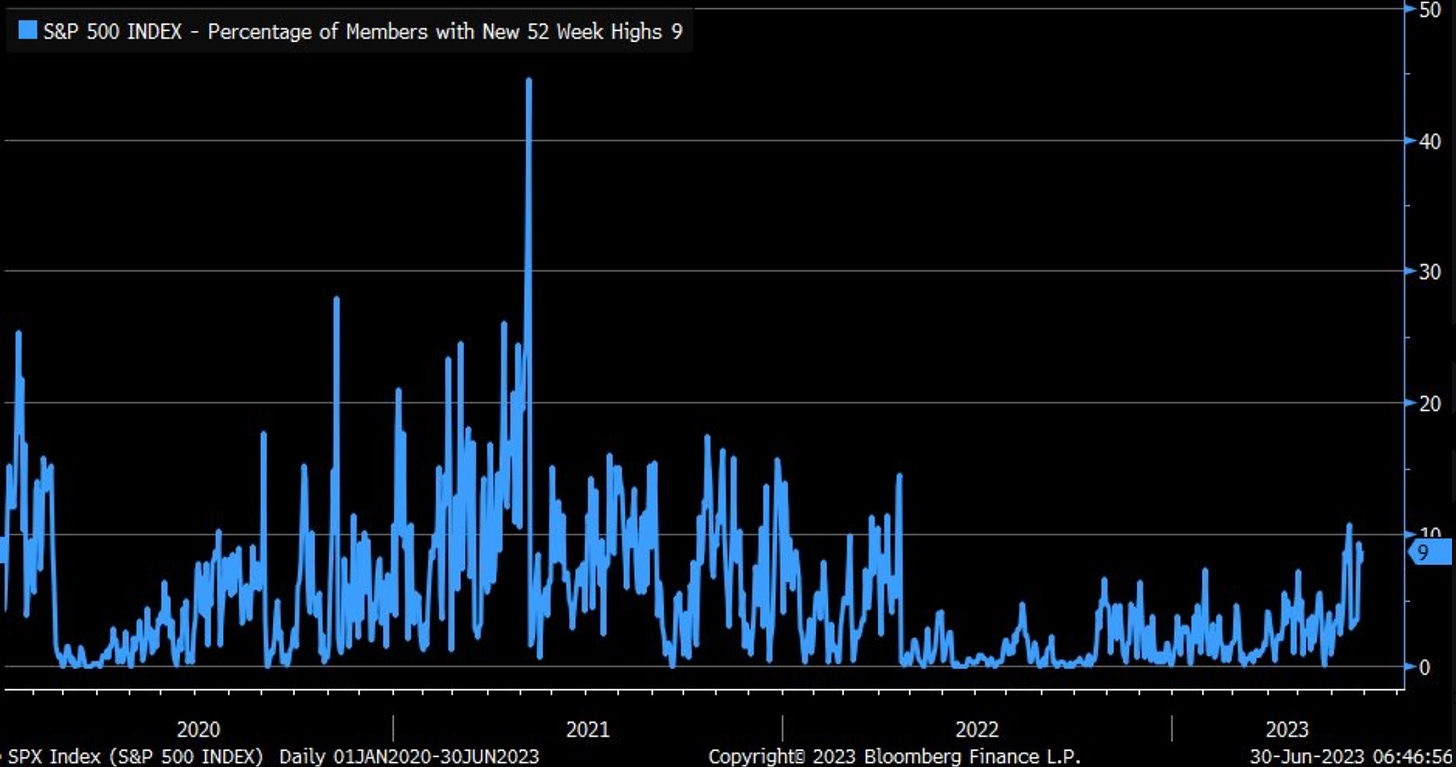

52-Week Highs List Expanding

The first part of the year we heard how this was just a mega-cap tech rally. It couldn’t last. But it’s not just tech stocks any longer. The rally has broadened and that’s evident in what we’re seeing for companies reaching new 52-week highs. The percentage of companies making new 52-week highs is rising.

Look at the diverse list of companies which hit new 52-week highs in the past few trading sessions. This is what we see during bull markets, not bear market rallies.

Apple AAPL 0.00%↑

Carnival CCL 0.00%↑

Chipotle Mexican Grill CMG 0.00%↑

Delta Air Lines DAL 0.00%↑

FedEx FDX 0.00%↑

General Electric GE 0.00%↑

JP Morgan JPM 0.00%↑

Lowe’s LOW 0.00%↑

Marriott International MAR 0.00%↑

Mastercard MA 0.00%↑

McDonald’s MCD 0.00%↑

Norwegian Cruise Line NCLH 0.00%↑

Visa V 0.00%↑

Walmart WMT 0.00%↑

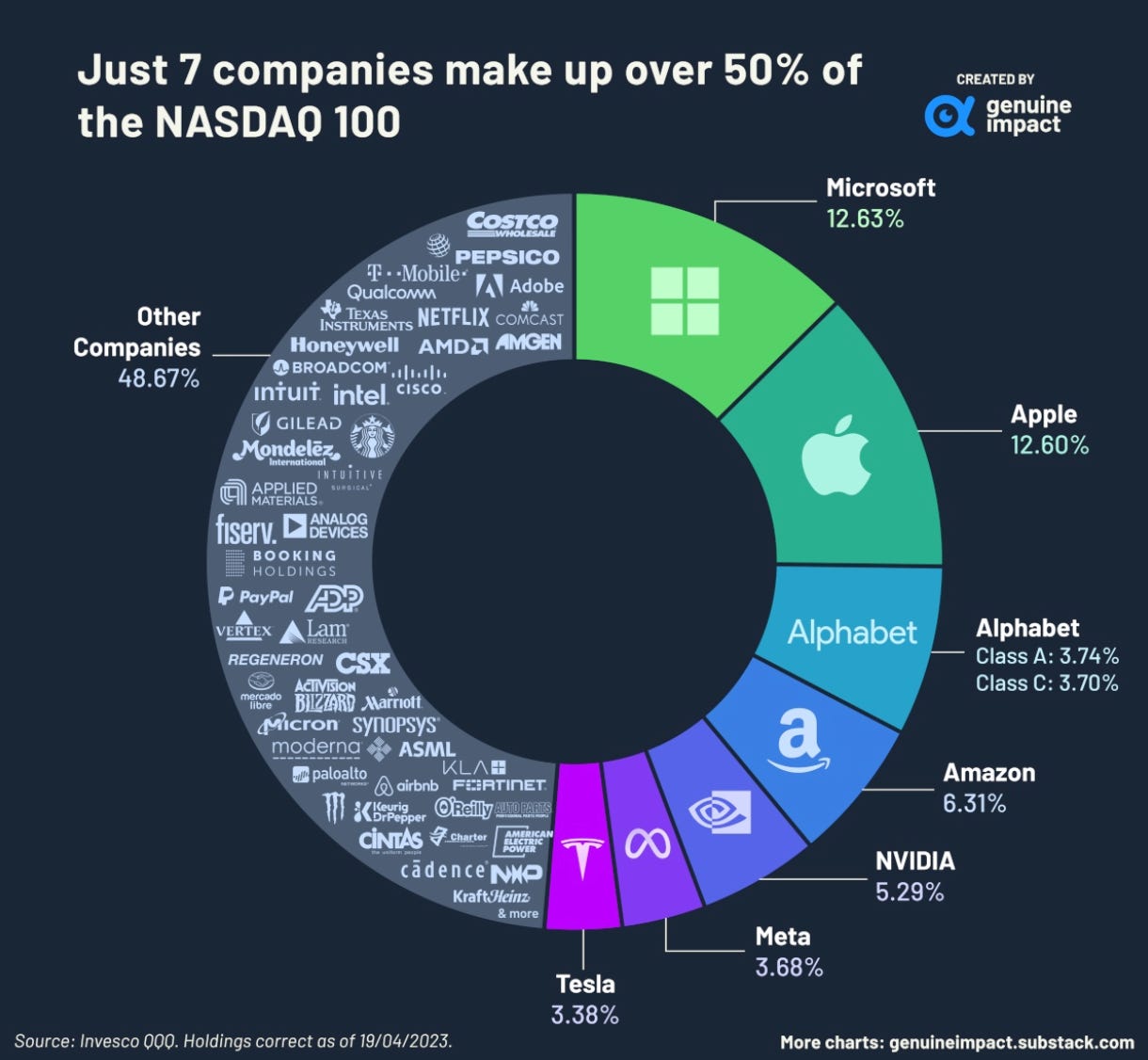

Nasdaq Visual

Genuine Impact put together a great visual of the Nasdaq 100. This shows just how large of a weighting the big seven companies are in the Nasdaq. Those seven make up over 50% of the entire Nasdaq. To see a closer visual of this you can check it out here.

Moves I’ve Made

S&P 500 Index On Thursday of this week I made a monthly contribution to my S&P 500 index holding in my retirement account.

Bank of America BAC 0.00%↑ I sold out of my position in Bank of America at $28.75. I had started my position at $28.50 on March 18th. I’ve looked at this holding a few times over the past few months. It’s really been a weak link in my portfolio. So I asked myself if I didn’t own it today, would I buy it. The answer was no.

I had bought this stock after the steep selloff following the SVB debacle and banking crisis. I discussed the reasons why I bought it in, Investing Update: Panic Creates Opportunity. I thought the selloff in BofA was overdone at the time and that it would bounce back. As you can see from the chart below it has just not bounced back. It got knocked down and has not recovered.

JP Morgan on the other-hand already has. Hitting a new 52-week high this past week.

From my post on March 18th Investing Update: Panic Creates Opportunity.

In addition to Bank of America I compared research on JP Morgan JPM -0.71%↓, Wells Fargo WFC -0.67%↓, Schwab SCHW -0.92%↓ and Morgan Stanley MS -2.57%↓. None of what was transpiring was going to affect the long-term outlook and businesses of any of these. At least I don't think so.

Sometimes you pick the right ones and sometimes you pick the wrong ones. You win some, you lose some. That’s investing.

The Coffee Table ☕

It was great to see my friends Sam Ro and Michael Antonelli share insight together on a piece in the TKer by Sam Ro called 11 ways cynics argue any news is bad news. If you aren’t a subscriber to Sam Ro’s TKer, I don’t know what you’re doing.

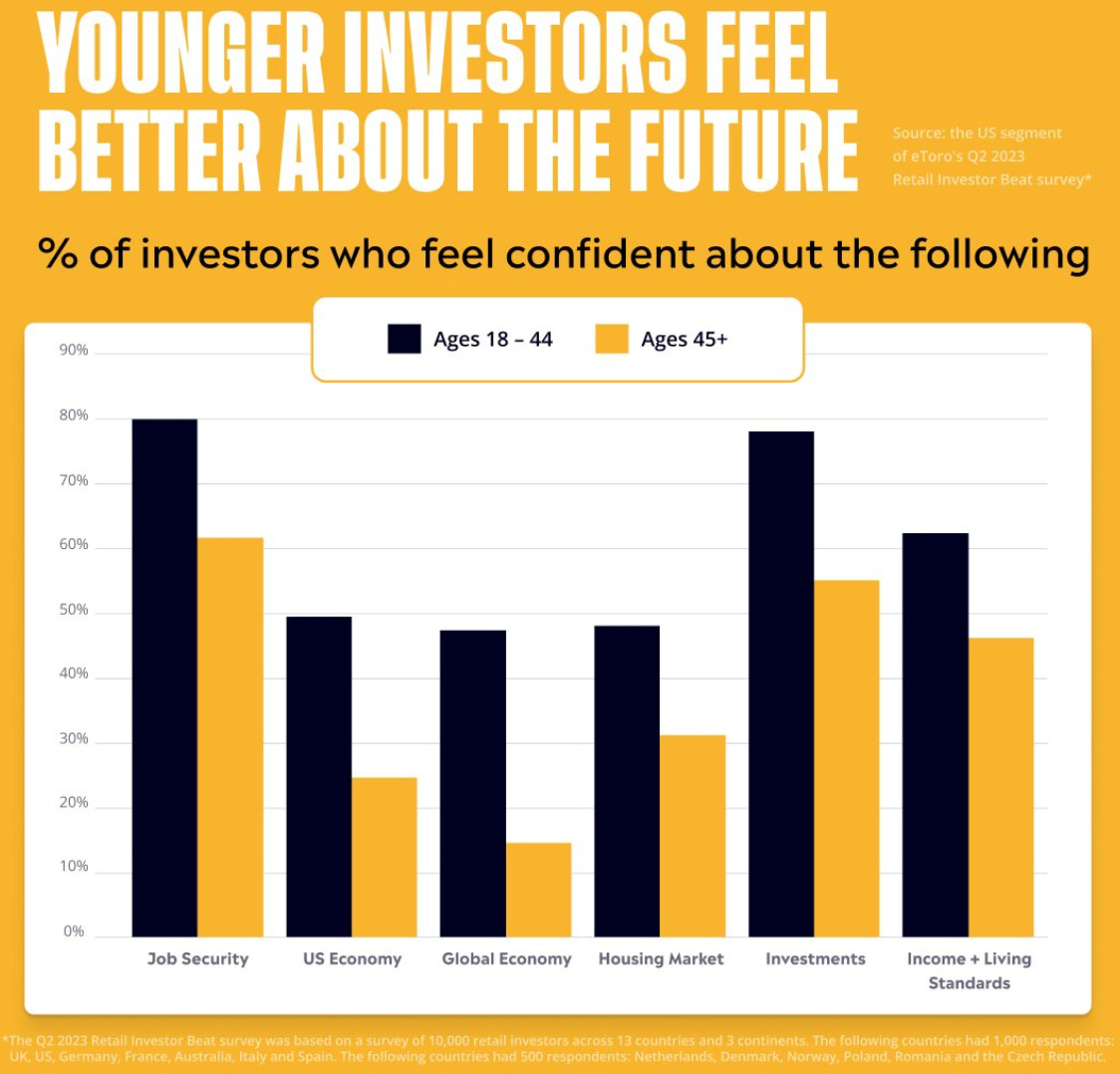

Callie Cox wrote about the improving consumer confidence in her piece Confidence makes a comeback. I particulary liked this chart she shared about how younger Americans are leading the comeback.

After seeing George Dickel Bottled in Bond in the highly allocated area multiple times, I decided it was time to give it a try. Two friends of mine have mentioned that they like it. This is aged for 13 years and has a lot of boldness to it. I got a lot of nutmeg and pecans. Almost kind of like gingerbread. The finish does hang with you for a bit. It was good but it’s not a favorite.

Thank you for reading! If you enjoyed Spilled Coffee, please subscribe.

Spilled Coffee grows through word of mouth. Please consider sharing this post with someone who might appreciate it.

Disclaimer: This is not investment advice. You should not treat any opinion expressed as a specific inducement to make a particular purchase, investment or follow a particular strategy, but only as an expression of an opinion. Do your own research.