Investing Update: Any Fuel Left In This Rally?

What I'm buying, selling & watching

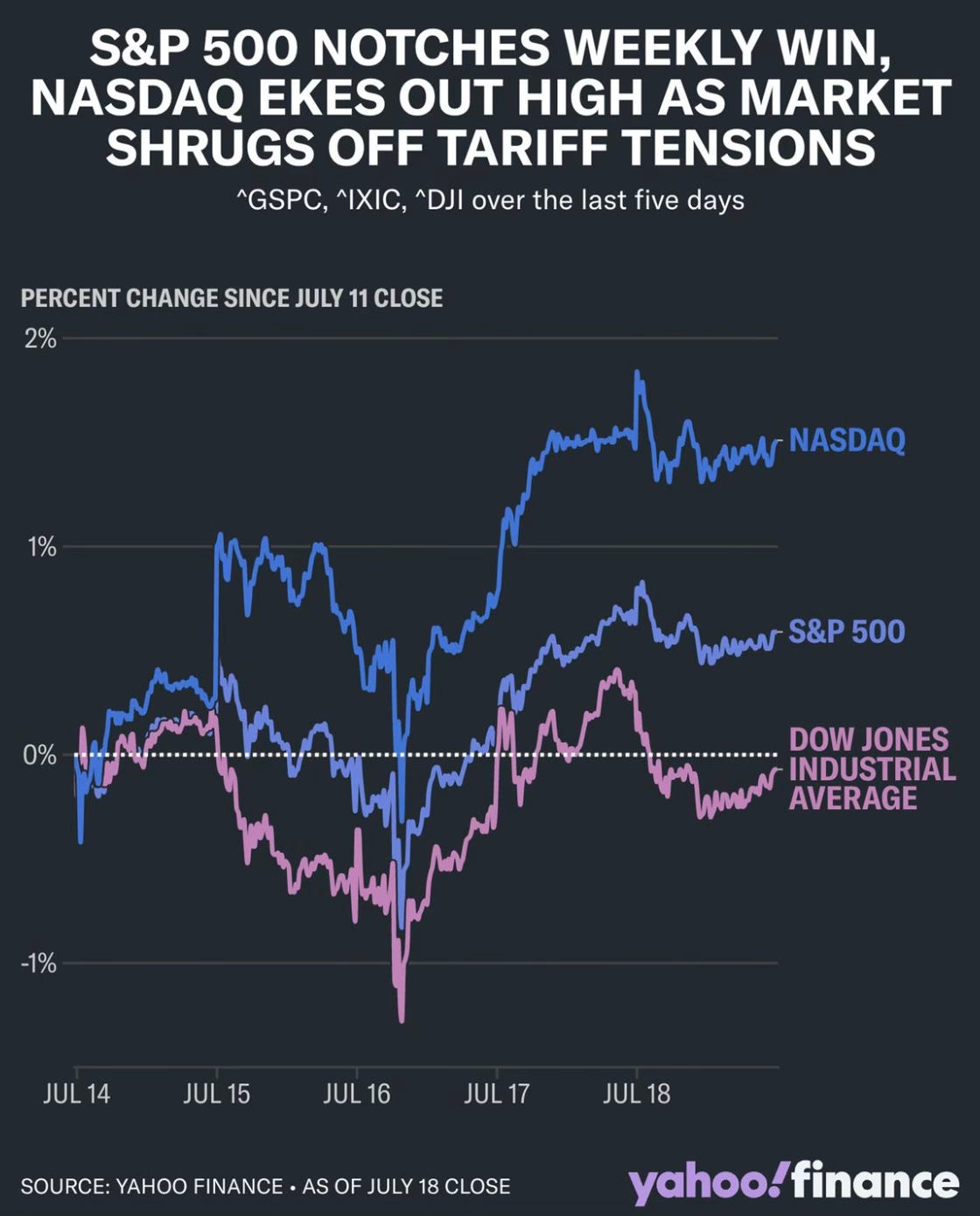

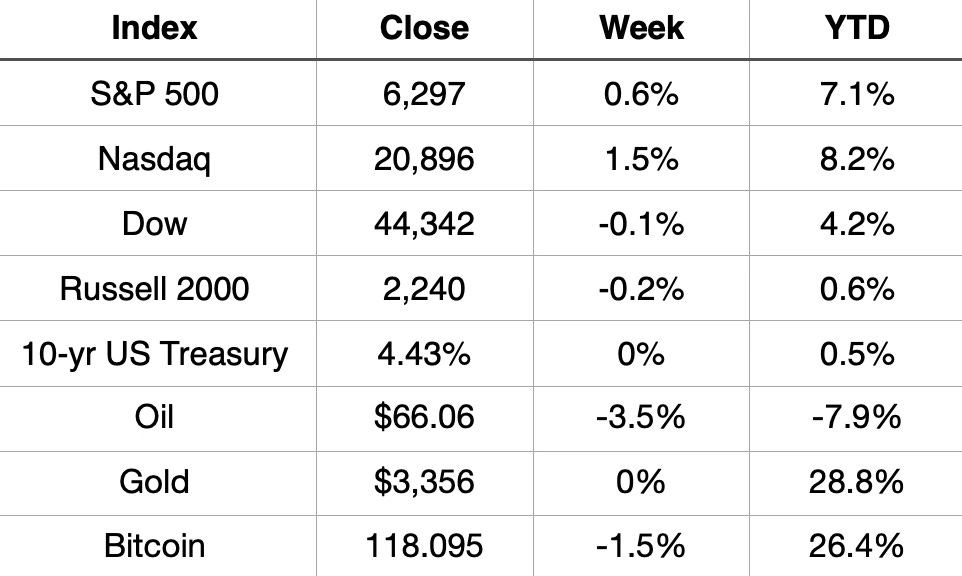

The market continued its steady climb higher with notching yet another green week. The S&P 500 hit its 9th all-time high of the year this week. It stands up 7.1% on the year. Since the April 8th low, the S&P 500 is now up 26%.

The Nasdaq is up 8.2% YTD and the Dow is up 4.2% YTD.

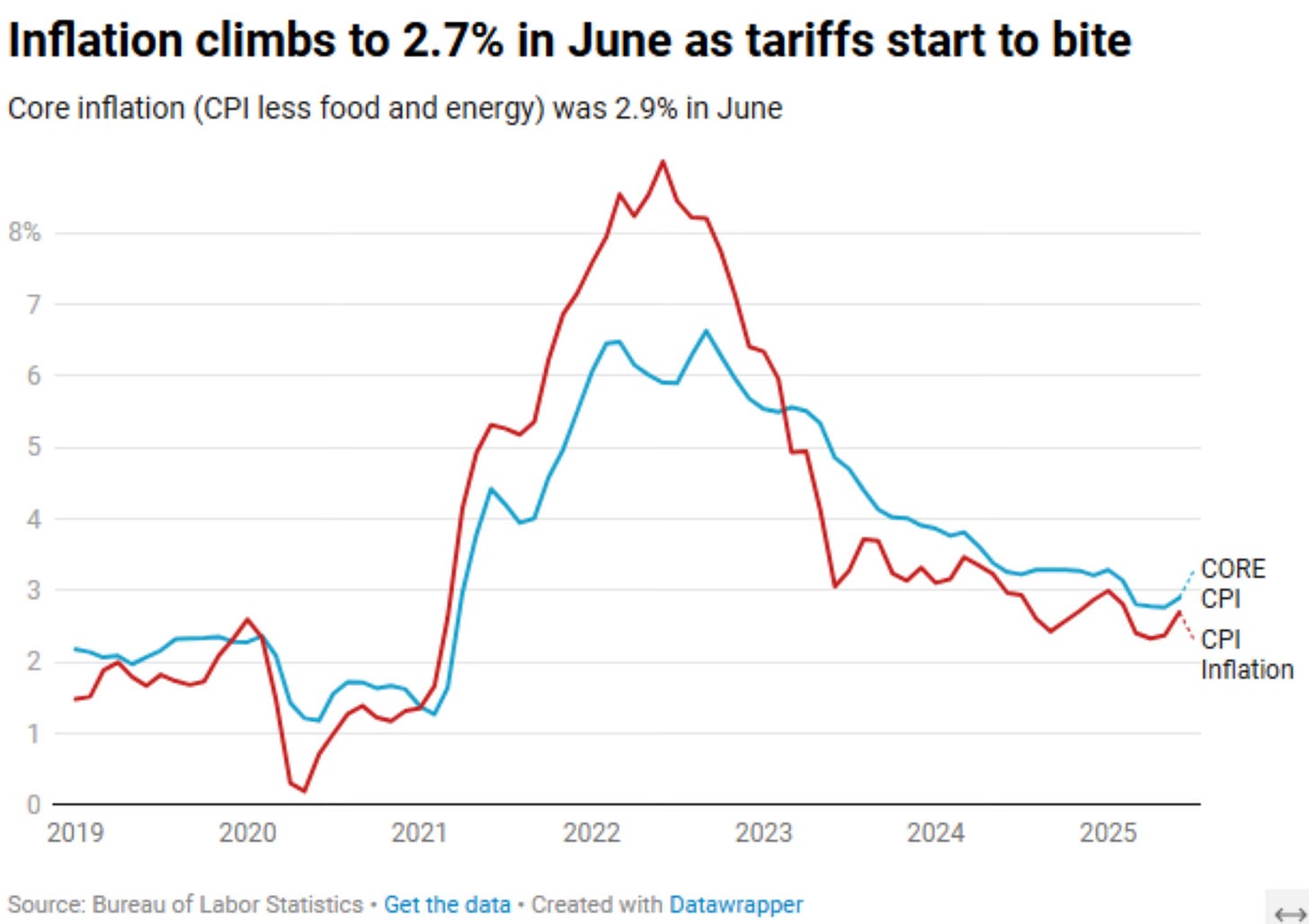

The week also saw inflation expectations come in line despite the tariffs kicking in. CPI came in at 2.7% in June and PPI came in at 2.9%.

Market Recap

Weekly Heat Map Of Stocks

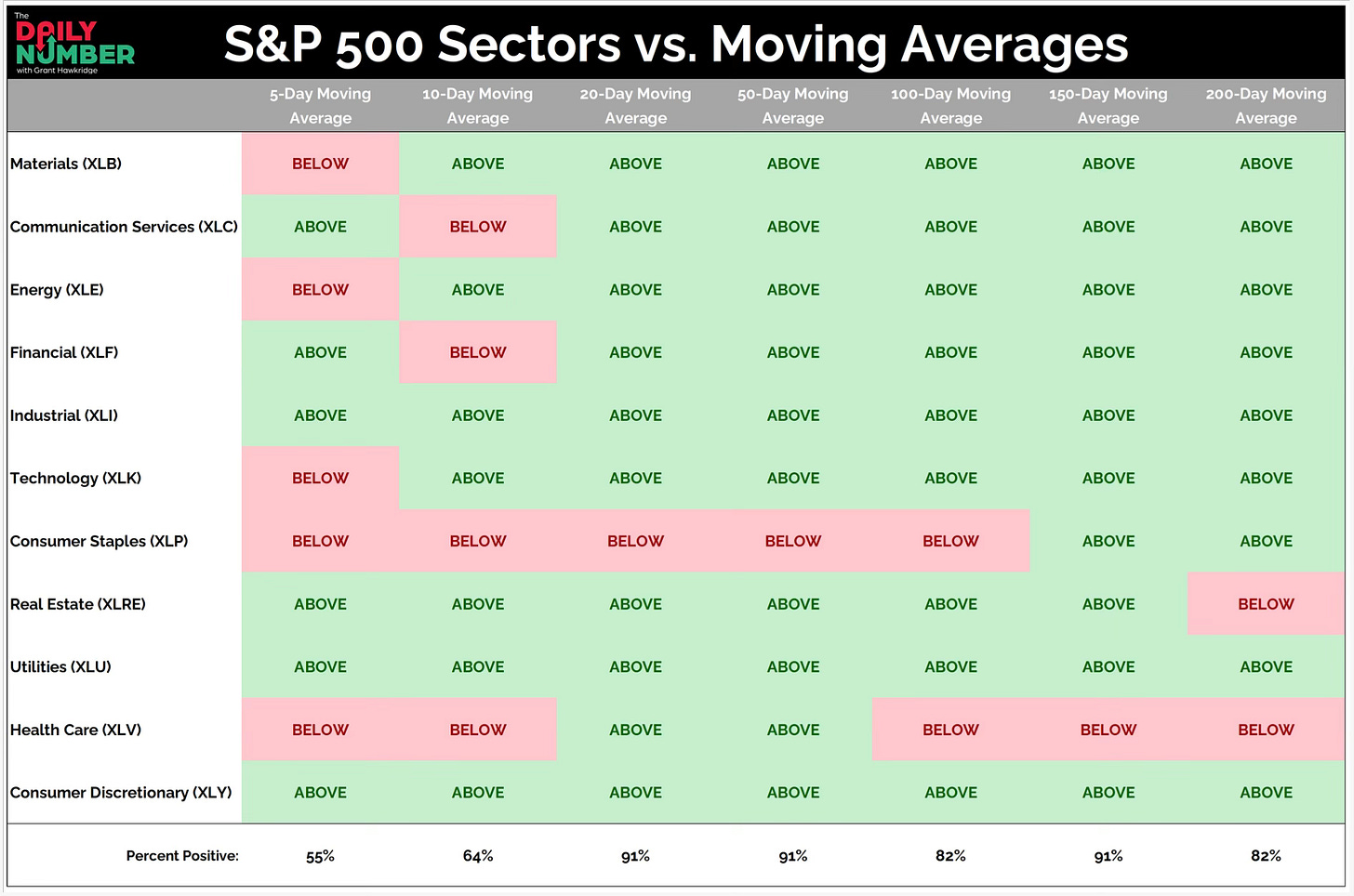

This market continues to see leadership from where you want to see it. What drives bull markets is leading. Where you want to see green, you see green.

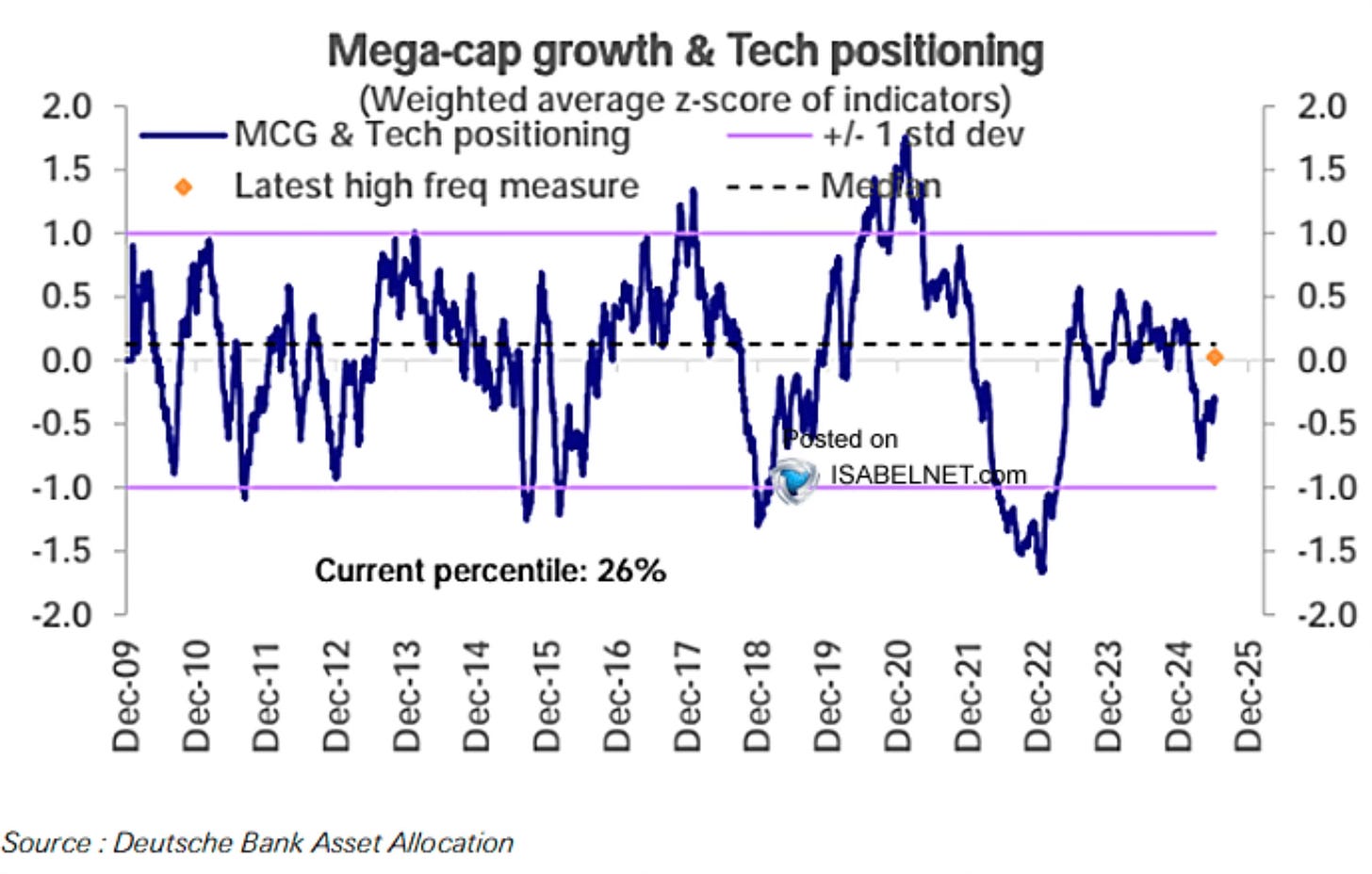

This comes even as positioning in mega-cap growth and tech stocks remains low.

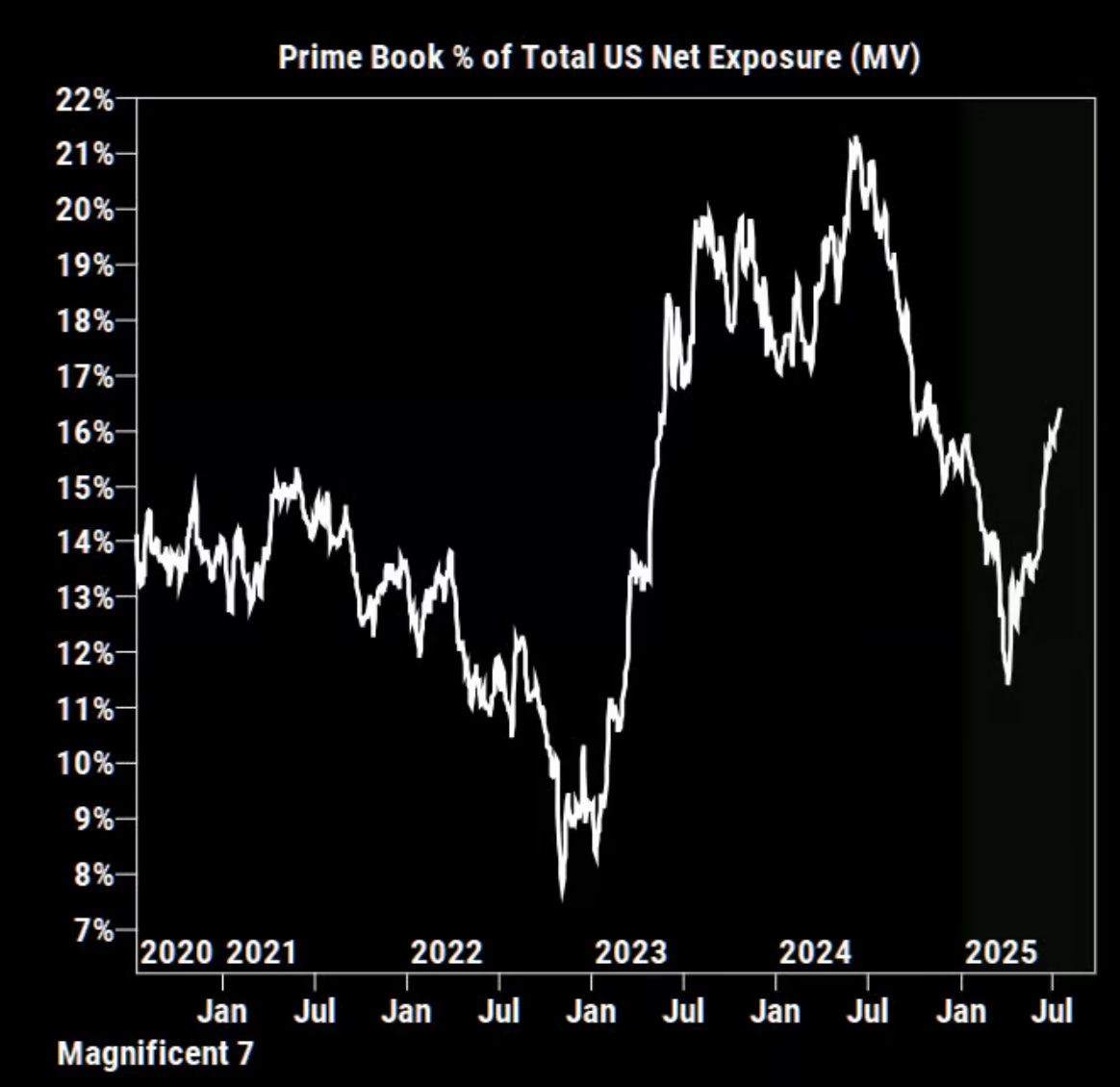

Now with hedge funds missing this rally, one area they may be looking to gain ground is in something else that has lagged, the Magnificent 7. They’re a long way from their highs and the positioning in them looks to be increasing fast.

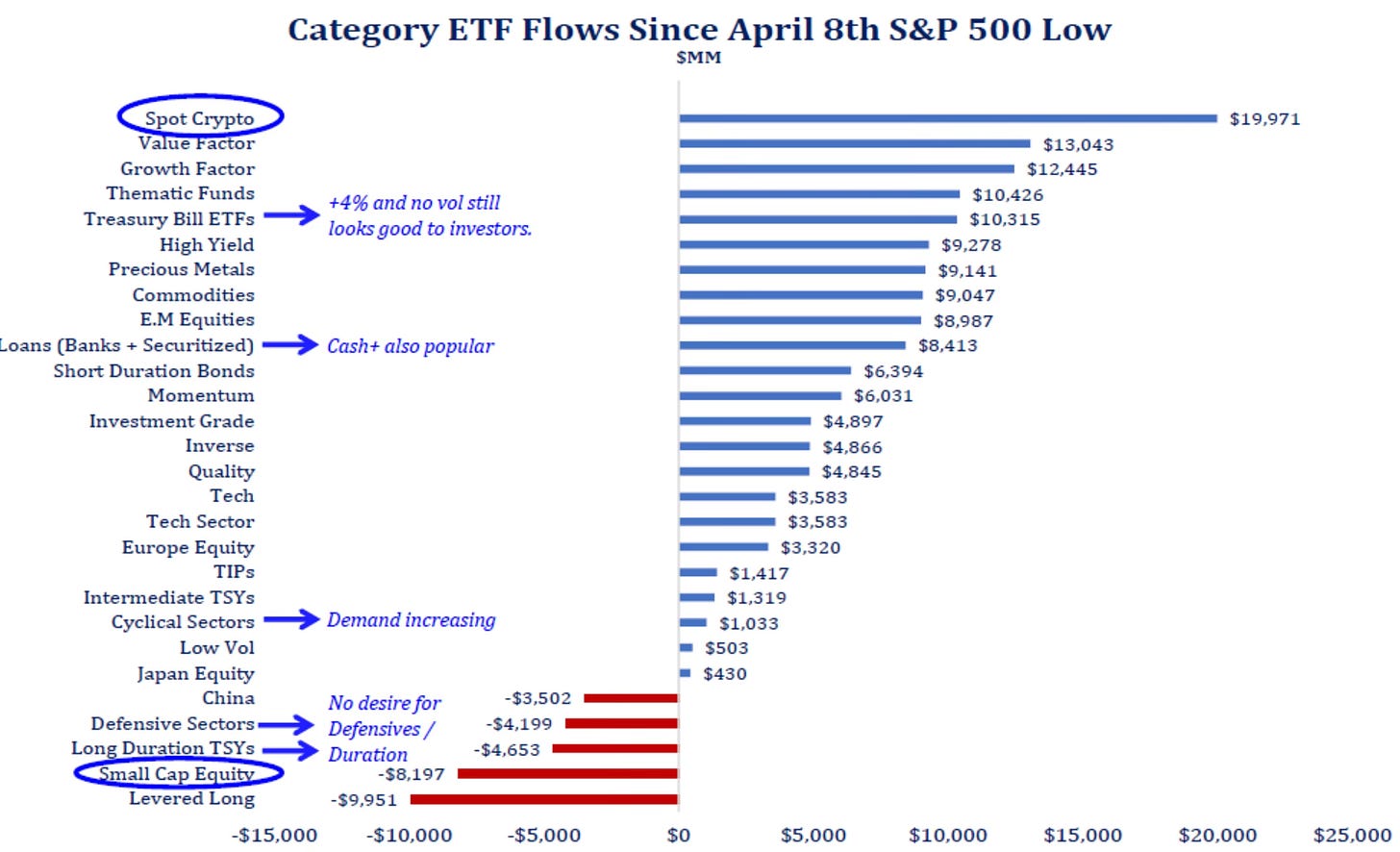

We also want to keep an eye on ETF flows. Here is what ETF flows have done since the April 8th lows. I can’t help but notice how spot crypto ETFs are just crushing everything else with inflows.

Any Fuel Left In This Rally?

There is no denying that the market has been on just a tear. That raises the question if there is any fuel left in this rally?