The S&P 500 finished August right at the cusp of new all-time highs. The Dow finished at an all-time high.

Through August, the S&P 500 is up 18.4%, the Nasdaq is up 18% and the Dow is up 10.3%.

Market Recap

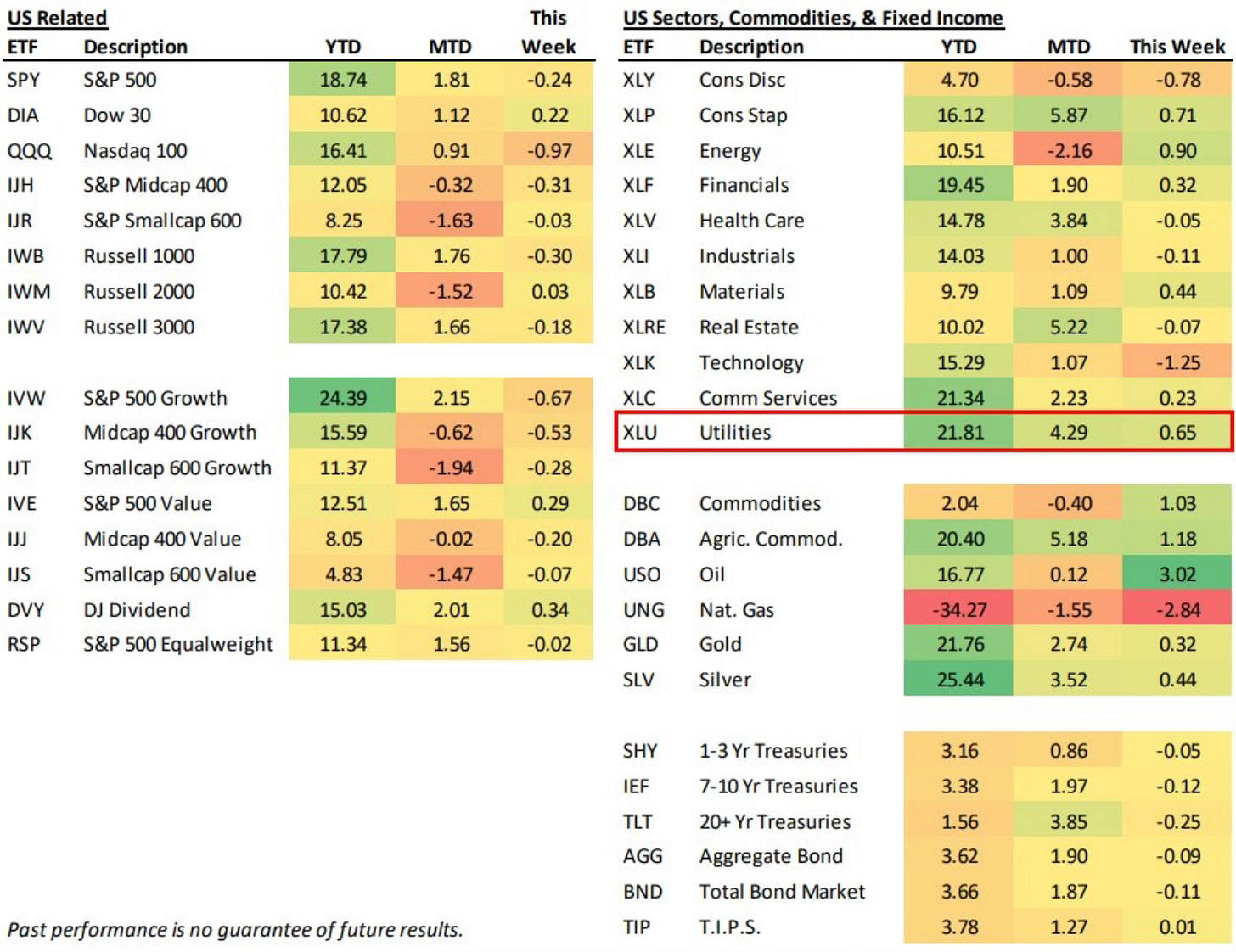

We saw further market broadening confirmation with the following sectors all hitting new all-time highs this week.

Utilities (XLU)

Financials (XLF)

Health Care (XLV)

Industrials (XLI)

Materials (XLB)

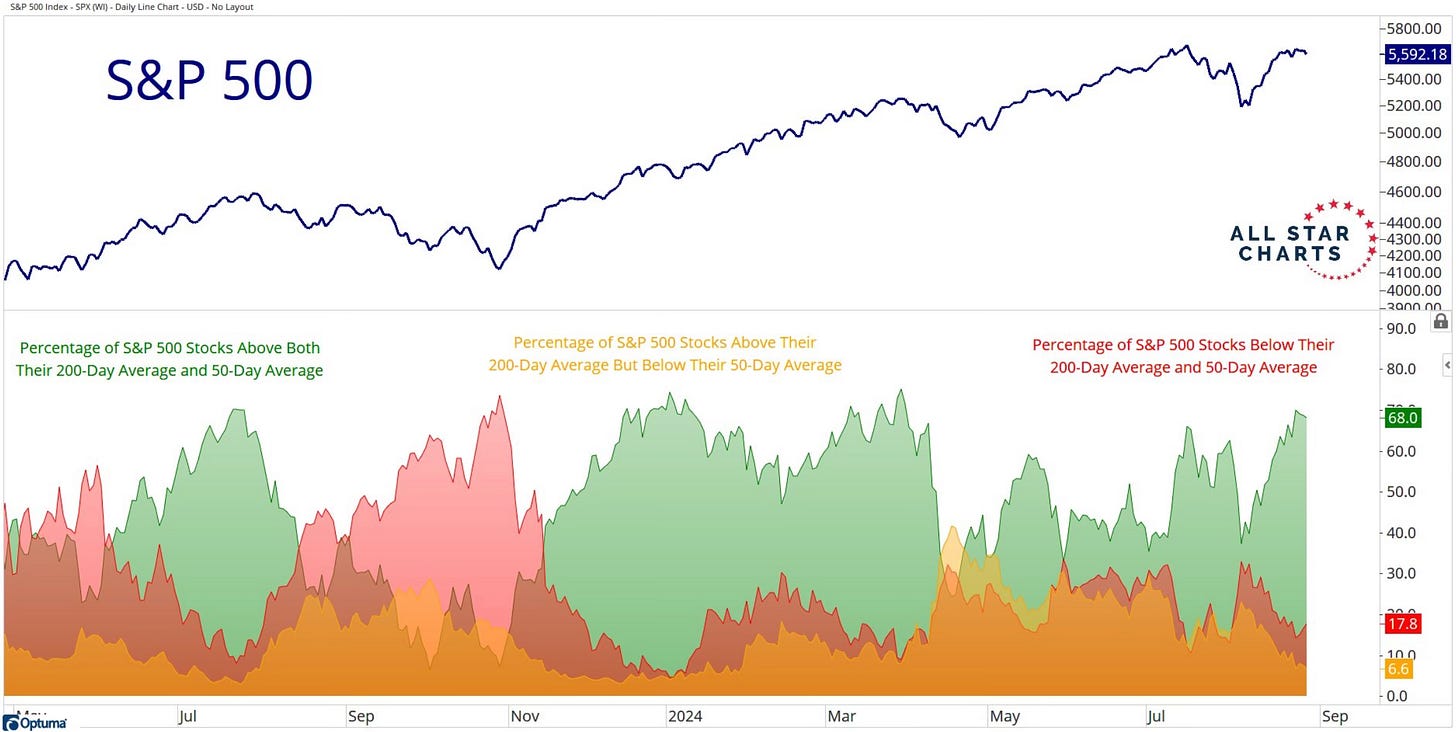

This chart from Grant Hawkridge which is one of my favorite to get a good look under the surface is showing a lot of green. 68% of S&P 500 stocks are above both their 50-day and 200-day averages.

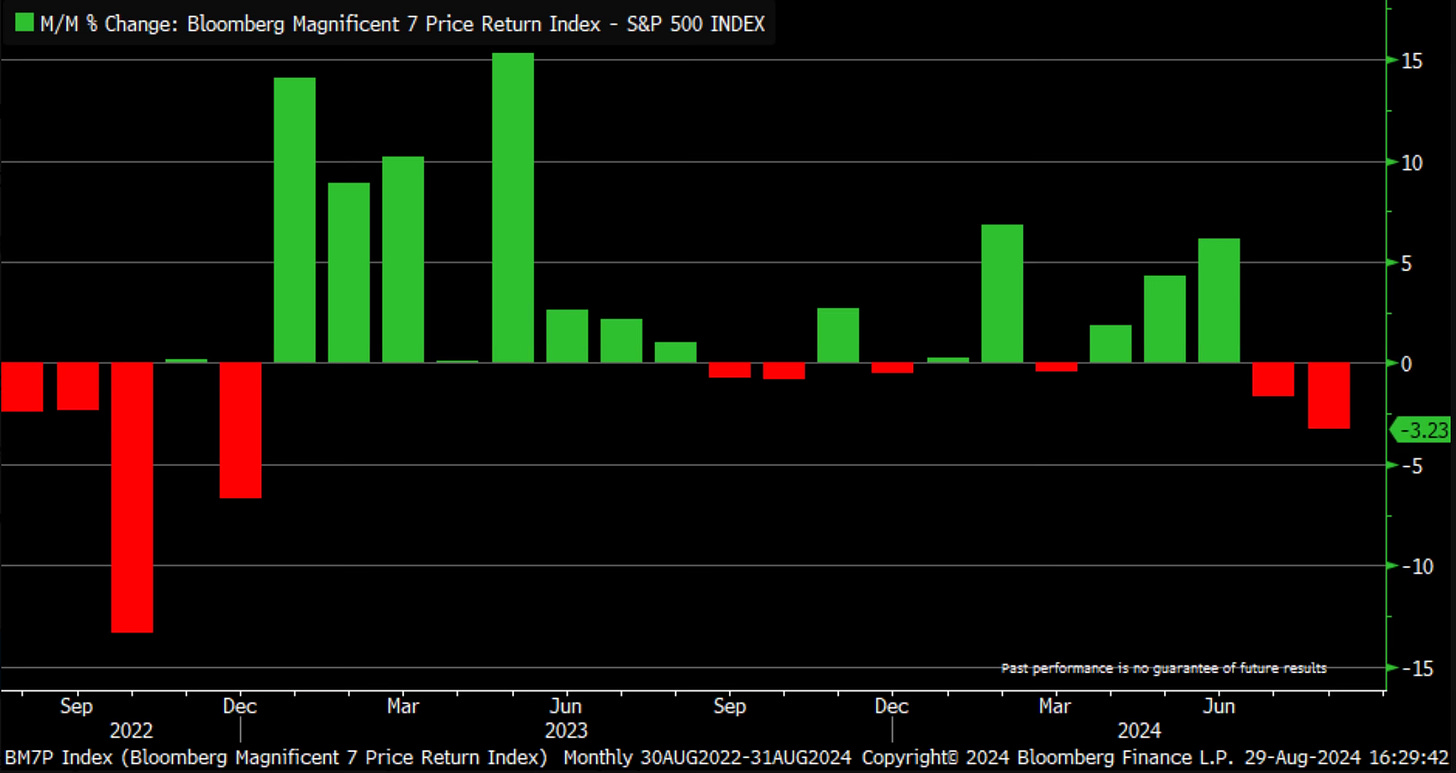

The most bullish part of all. This all has happened despite the Magnificent 7 having their worst month relative to the S&P 500 since December 2022.

A September Swoon?

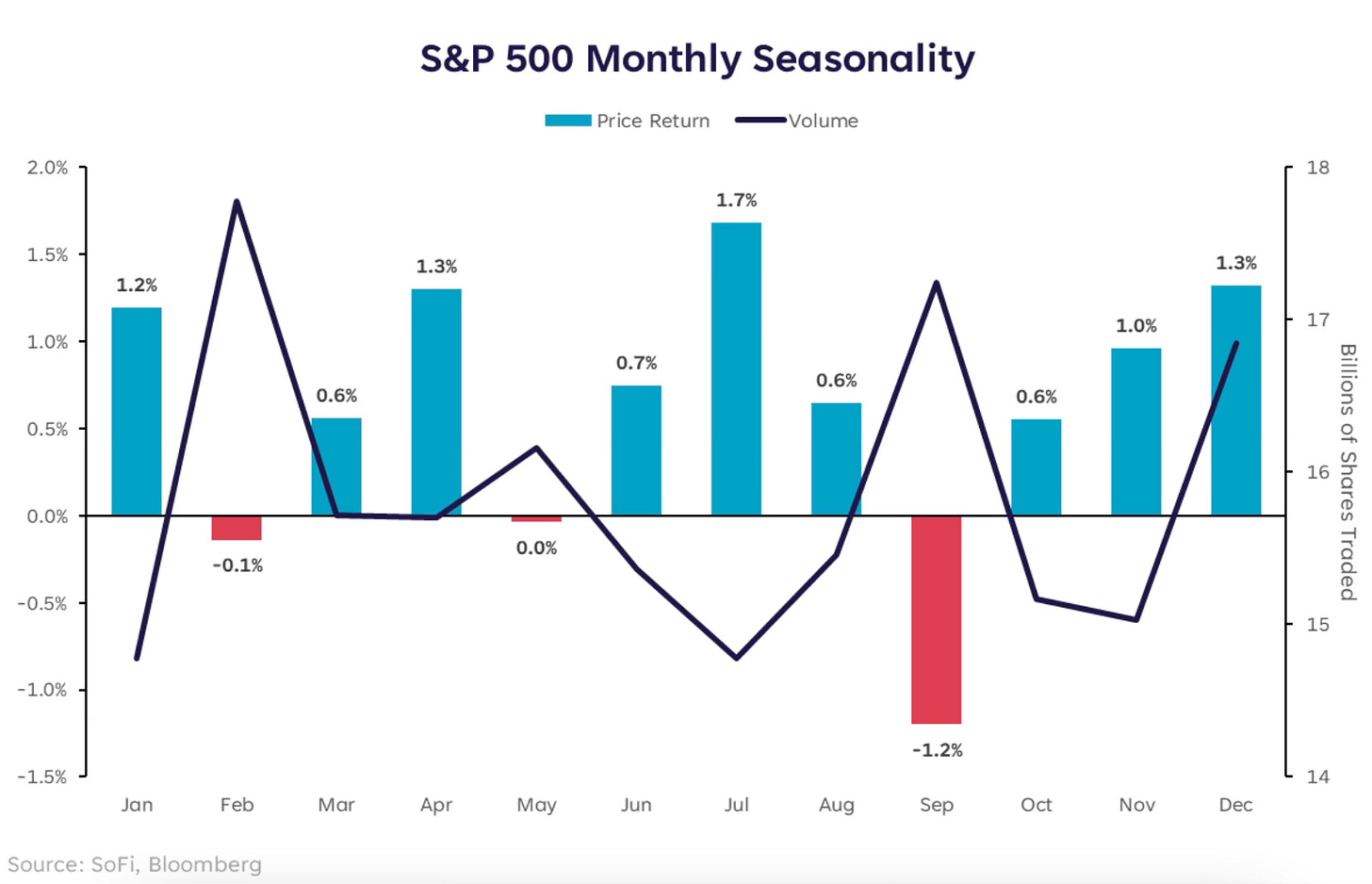

September is on average the worst month for stocks. It’s not only the worst, it’s also a very active month. That brings with it volatility. This is why we usually will hear that the September Swoon is coming.

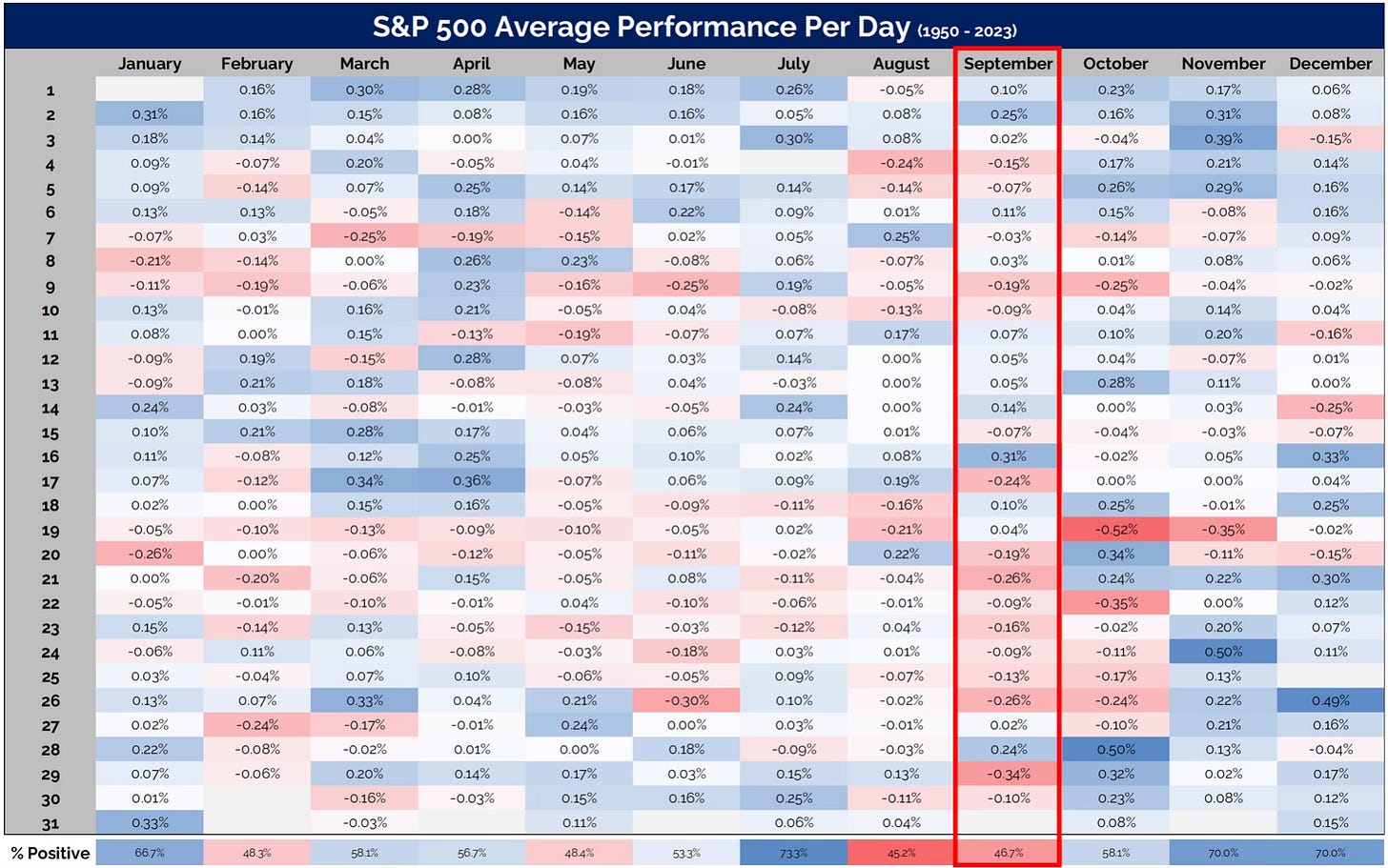

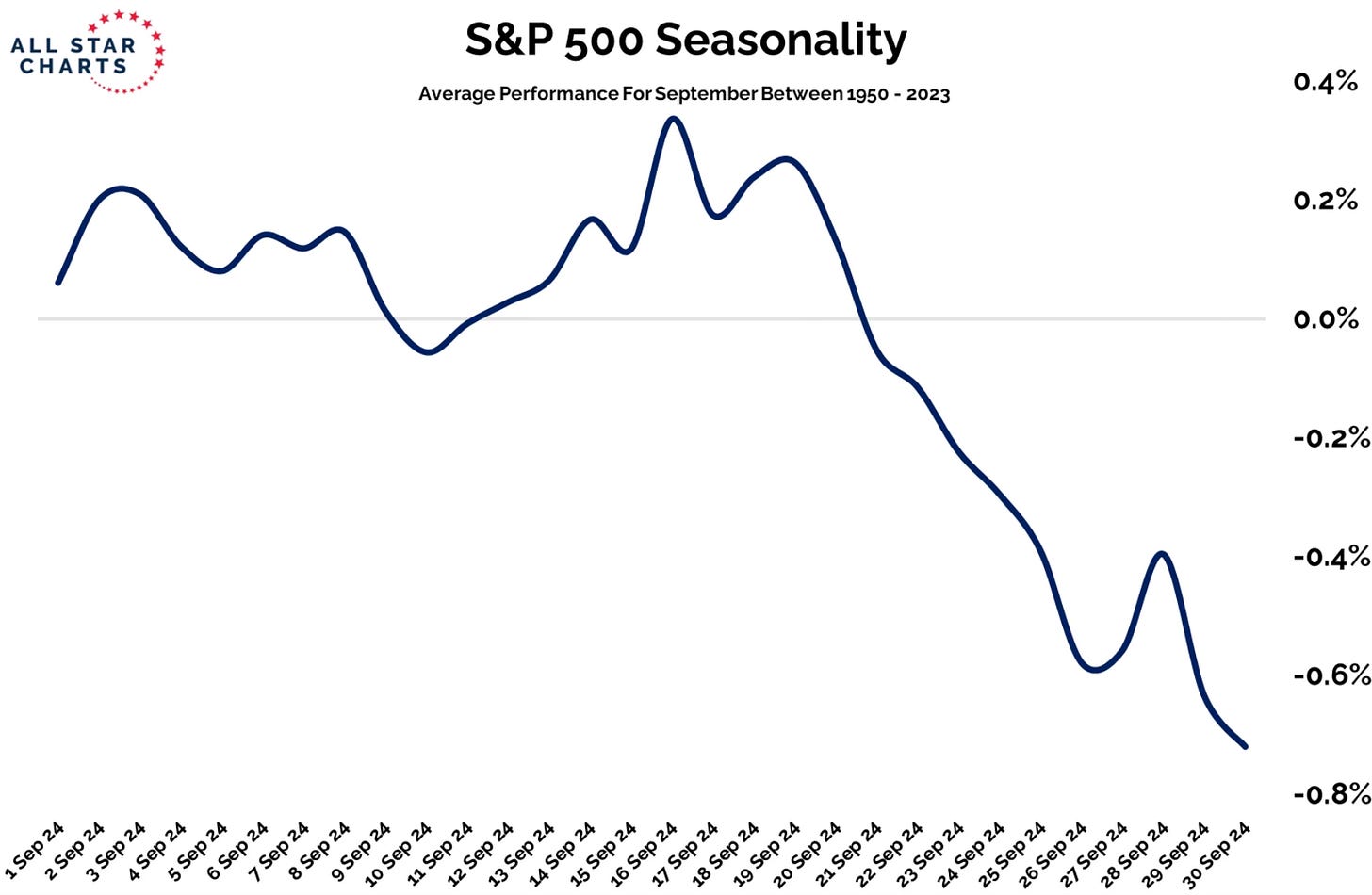

The back part of the month is historically the weakest with a lot of red.

This chart shows just how quickly September stumbles midway going back to 1950.

The economy and profits continue to look good and this bull market firmly remains intact. Seasonality in September and the upcoming elections will naturally bring volatility. Don’t let it scare or surprise you. Be prepared for it. Have a plan and be prepared to buy the dip. Take advantage of opportunities. That’s my September plan.

The Overlooked Story Of This Cycle

I think an area of this bull market cycle that has been overlooked is illustrated in this great chart from

. Check out what the construction employment in factory and infrastructure has done. This all coincides with the passage of the Bipartisan Infrastructure Law and Inflation Reduction & CHIPS Acts.

CapEx Spend Of Magnificent 7

This is an interesting chart that shows where the Mag 7 CapEx spending has been. I was surprised to see the amount that Amazon has spent in the past and continues to spend relative to the others. Microsoft has been increasing their spend of late.

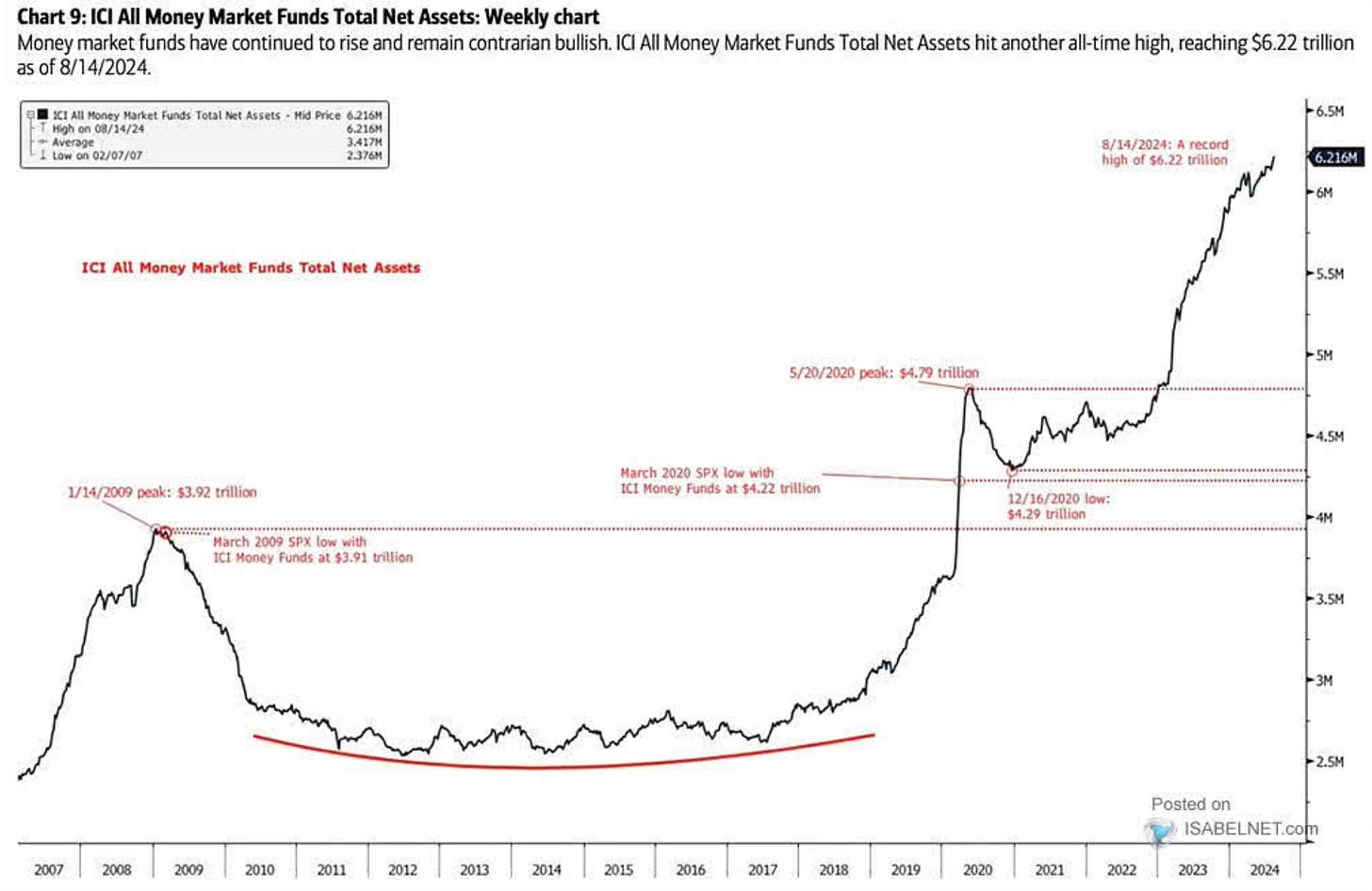

Money-Market Funds Remain Hot

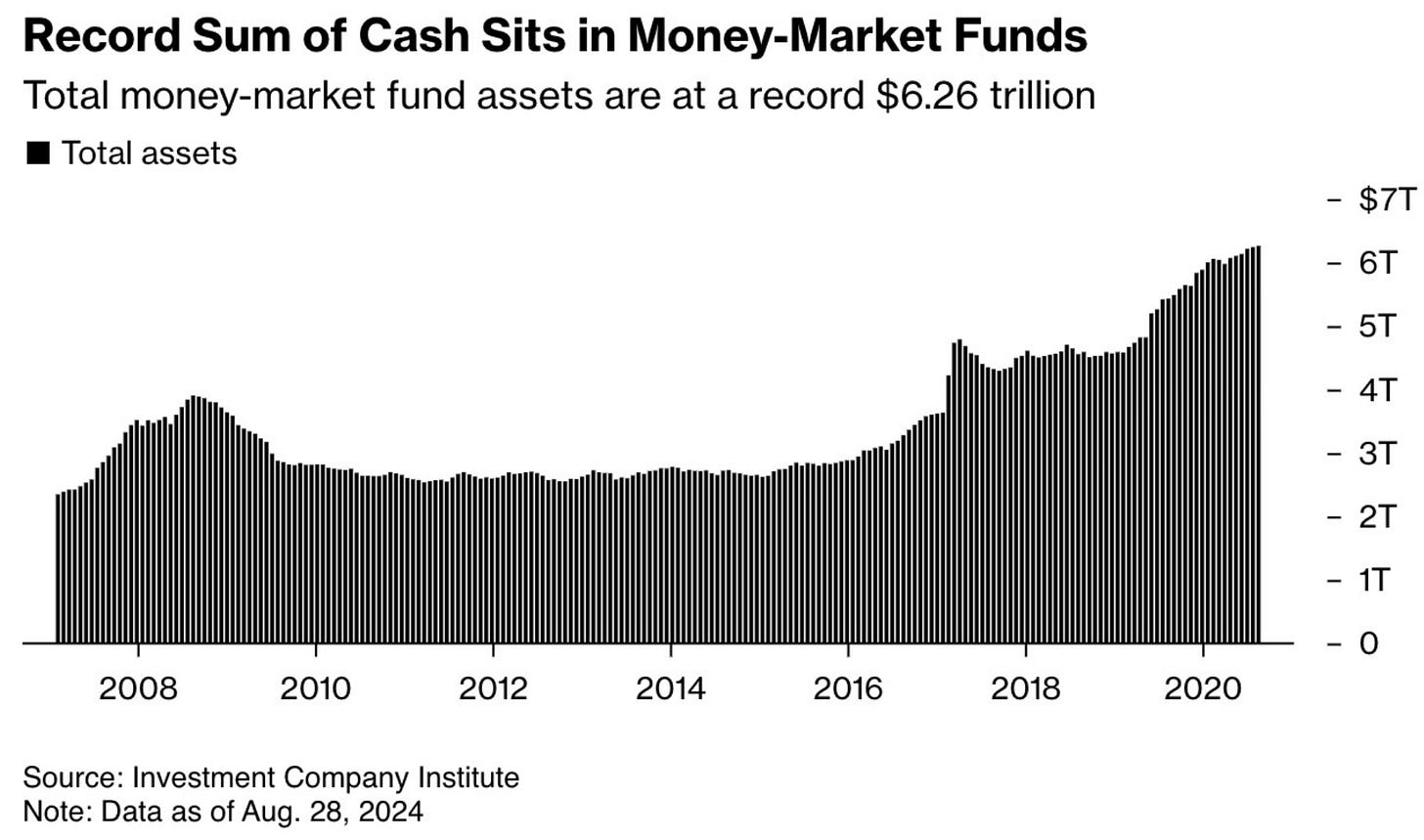

Arguable the hottest investment in 2024 has been money-market funds. Last week saw U.S. money market funds bring in $24.9 billion. For the month, August saw $127 billion come in, making it the biggest month of inflows this year. That brings the amount of cash in money-markets to a record $6.26 trillion.

You can see by this chart how the popularity of money-market funds has taken off since the pandemic. Then they took another leg higher when interest rates started to rise. Even with the likelihood of the Fed lower interest rates in September, which will lower the rate on money-market funds, it hasn’t stopped money from pouring in.

I found this to be the most fascinating chart regarding cash on the sidelines in money-market funds. This looks at cash as a % of the S&P 500 market cap from Kevin Gordon.

There might be a lot of "cash on the sidelines" in terms of total money market fund assets, but relative to the size of the equity market, the firepower just isn't what it used to be ... and in fact, cash as a % of S&P 500 market cap has been trending lower for the past year

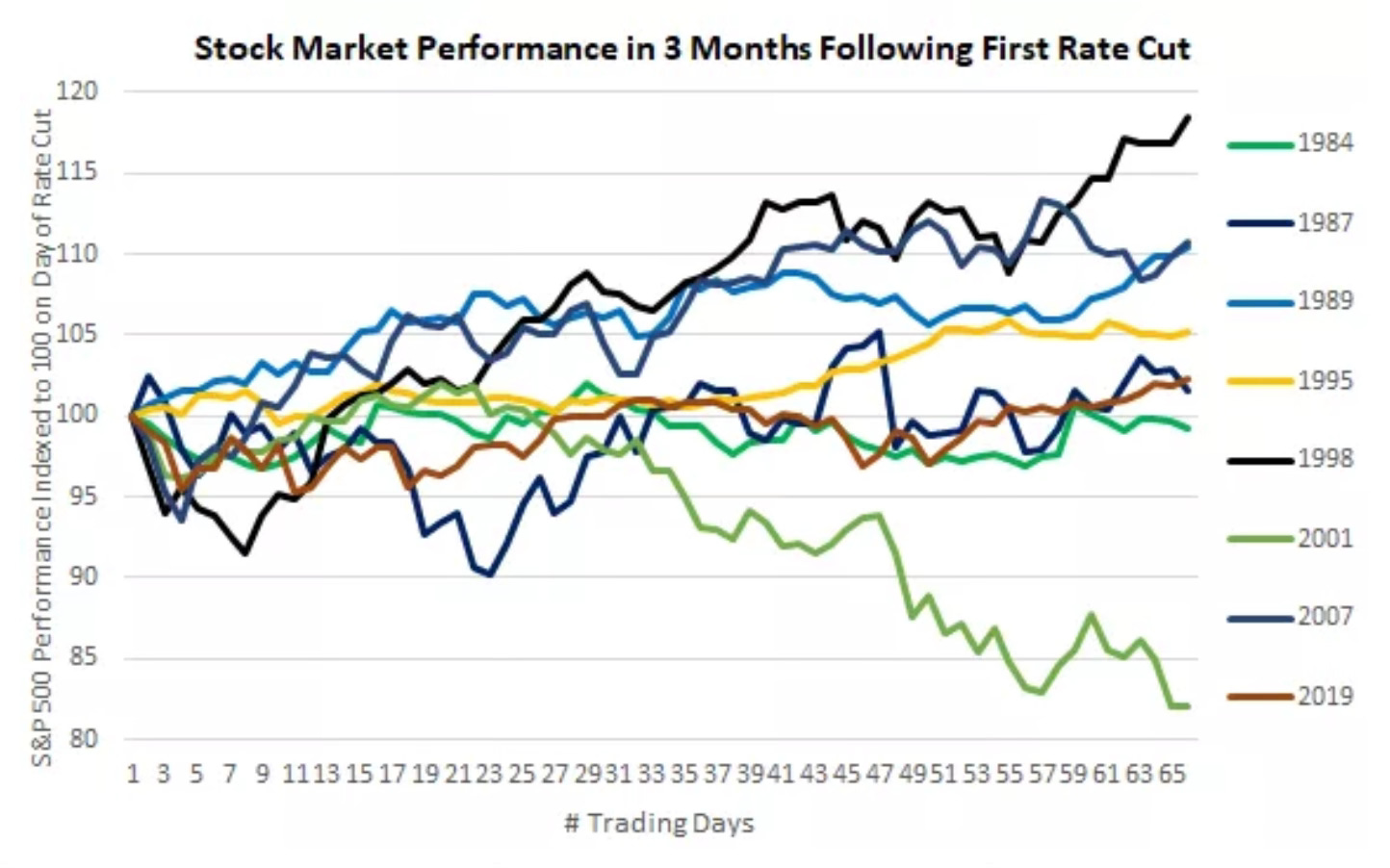

What To Expect After Rate Cuts

With rate cuts on the way and the only unknown is whether the Fed will do a cut of 25 bps or 50 bps. We continue to look at what that means for the stock market and certain areas of the market. As you will see it still doesn’t spell doom or any reason to panic.

After the first cut, you can see that 3 months later the performance of the market has been a mixed bag.

If we zoom out a bit father you can see that changes.

This was a good chart from the team at Ritholtz Wealth. You can see that 1 year later the S&P 500 is higher 18 out of 22 times. That’s 82%!

Average gain without a recession is 11%. Even with a recession the gain is 8%.

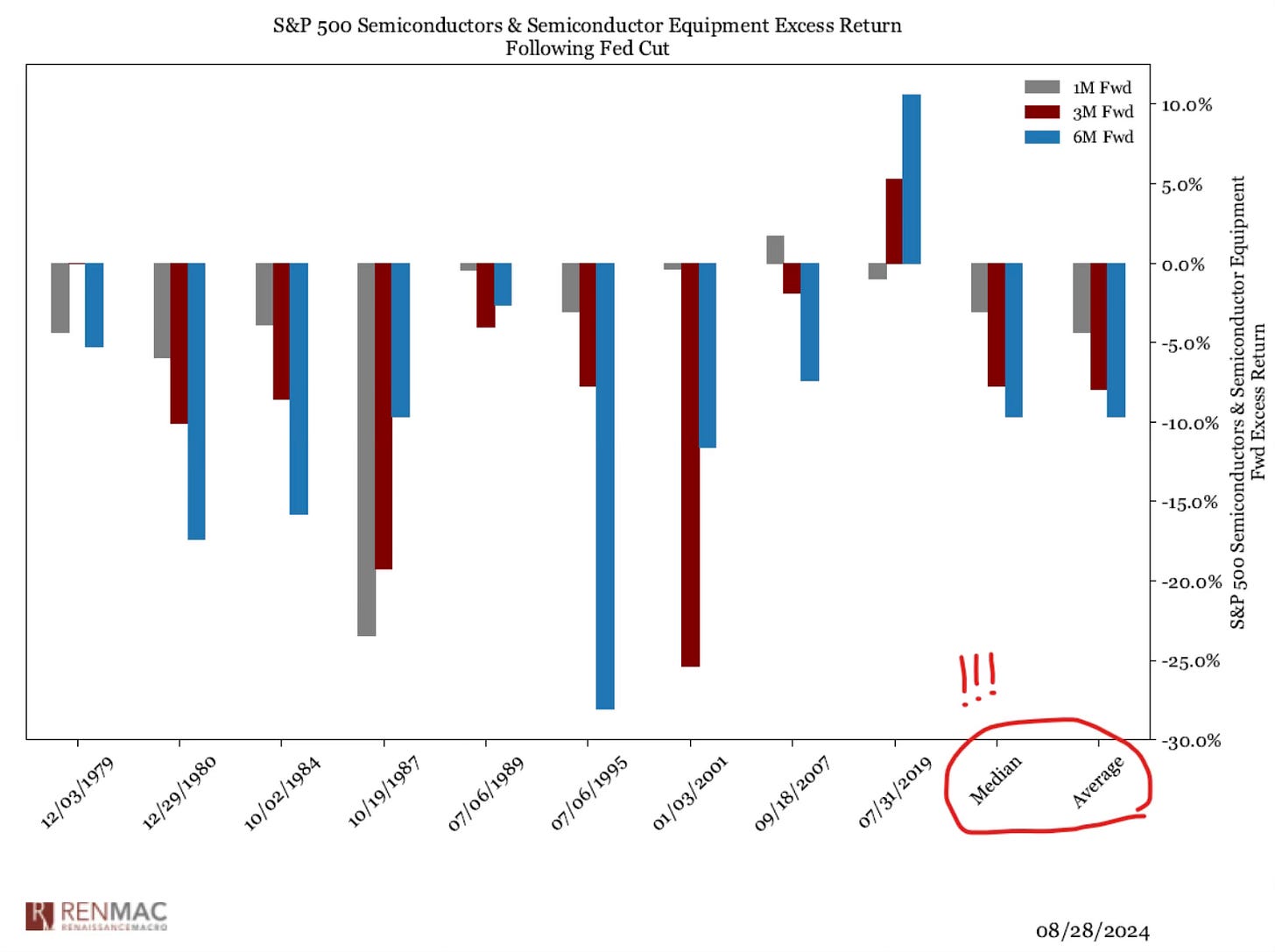

One area of the market that hasn’t fared so well after rate cuts has been the semiconductors. Other than in 2019, semiconductors have not had a good run over the 1, 3 and 6 months following rate cuts.

Is Nvidia Underowned?

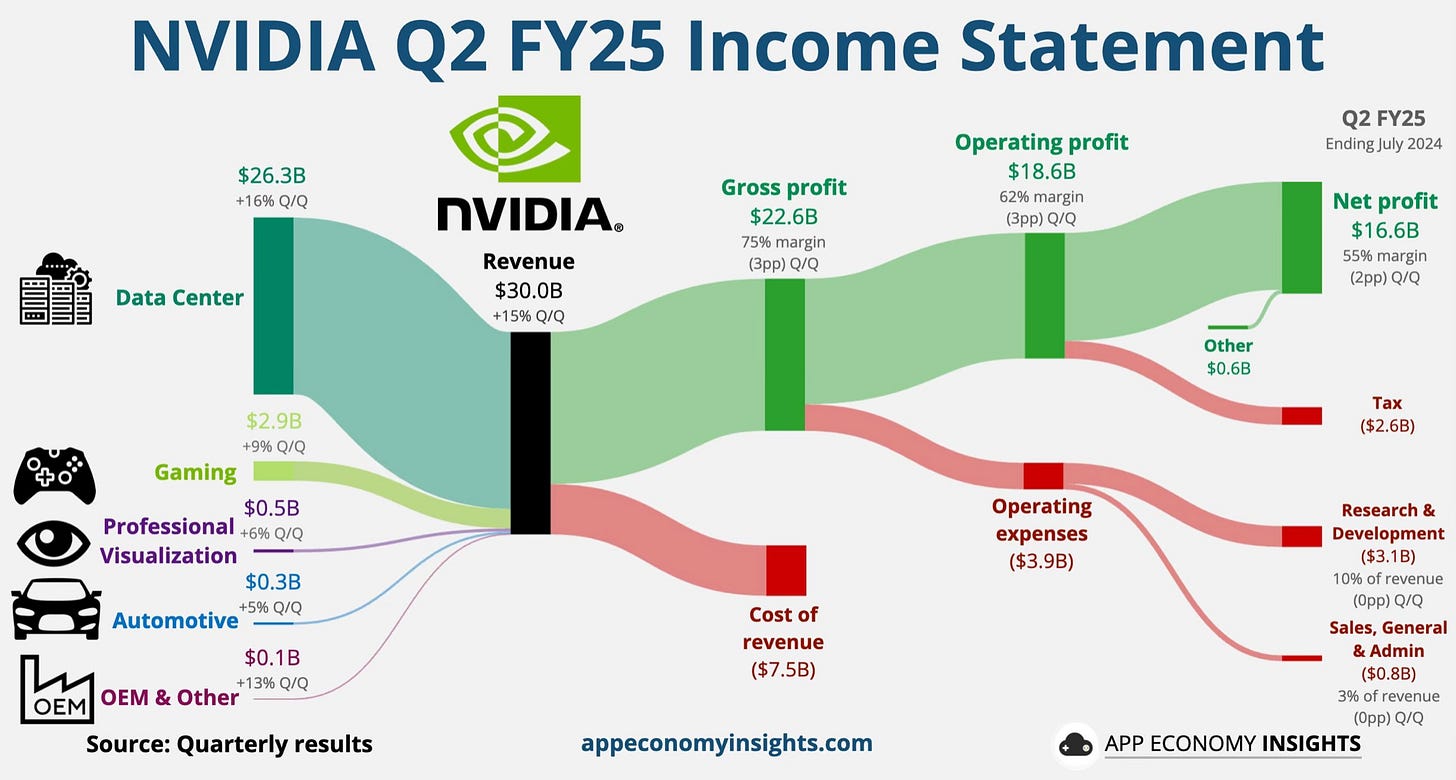

All the attention this week was on Nvidia’s earnings after the bell on Wednesday. After earnings it did finishThursday down 6%. The market was flat that day. I think many don’t understand how stellar of a year Nvidia has already had in 2024. It has more than doubled.

I thought this was a solid earnings report. The numbers still remain very bullish in my view. Margins are still at 75%. Nothing in this changed my outlook on this stock. As the AI buildout continues and it gets to the next steps, this is still where you want to be invested in this AI revolution.

I will be watching the iPhone 16 event upcoming. This is how the AI story is going to play out. The use cases will come to light and this will prove more bullish and serve as a show me moment in what AI is really doing.

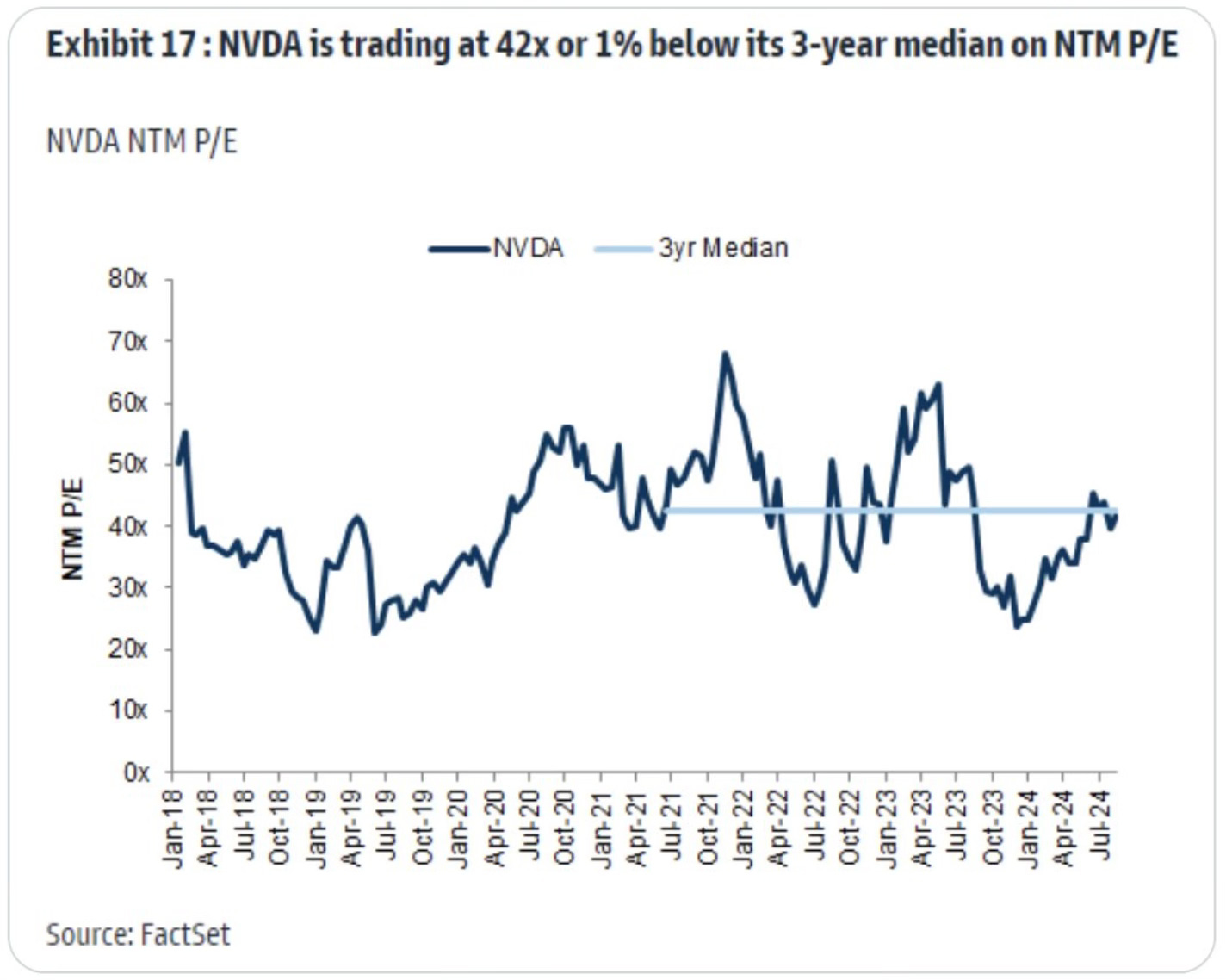

This will show what Nvidia chips are producing while the next leg of growth ramps up soon with the highly anticipated Blackwell GPU. It’s still a one of a kind growth company at a very reasonable valuation in my view.

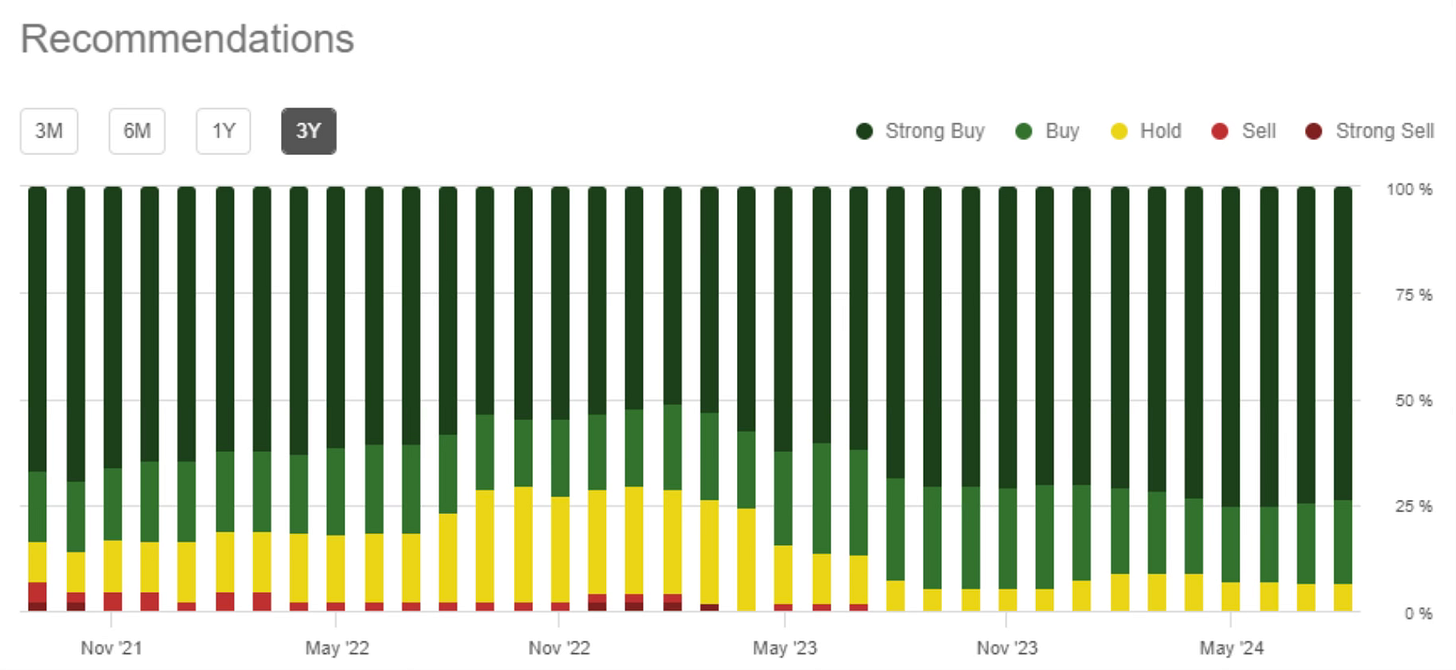

Wall Street’s view is still extremely bullish with 44 strong buys, 12 buys, 4 hold and 0 sell. I don’t think this is a stock anyone wants to mess with being short.

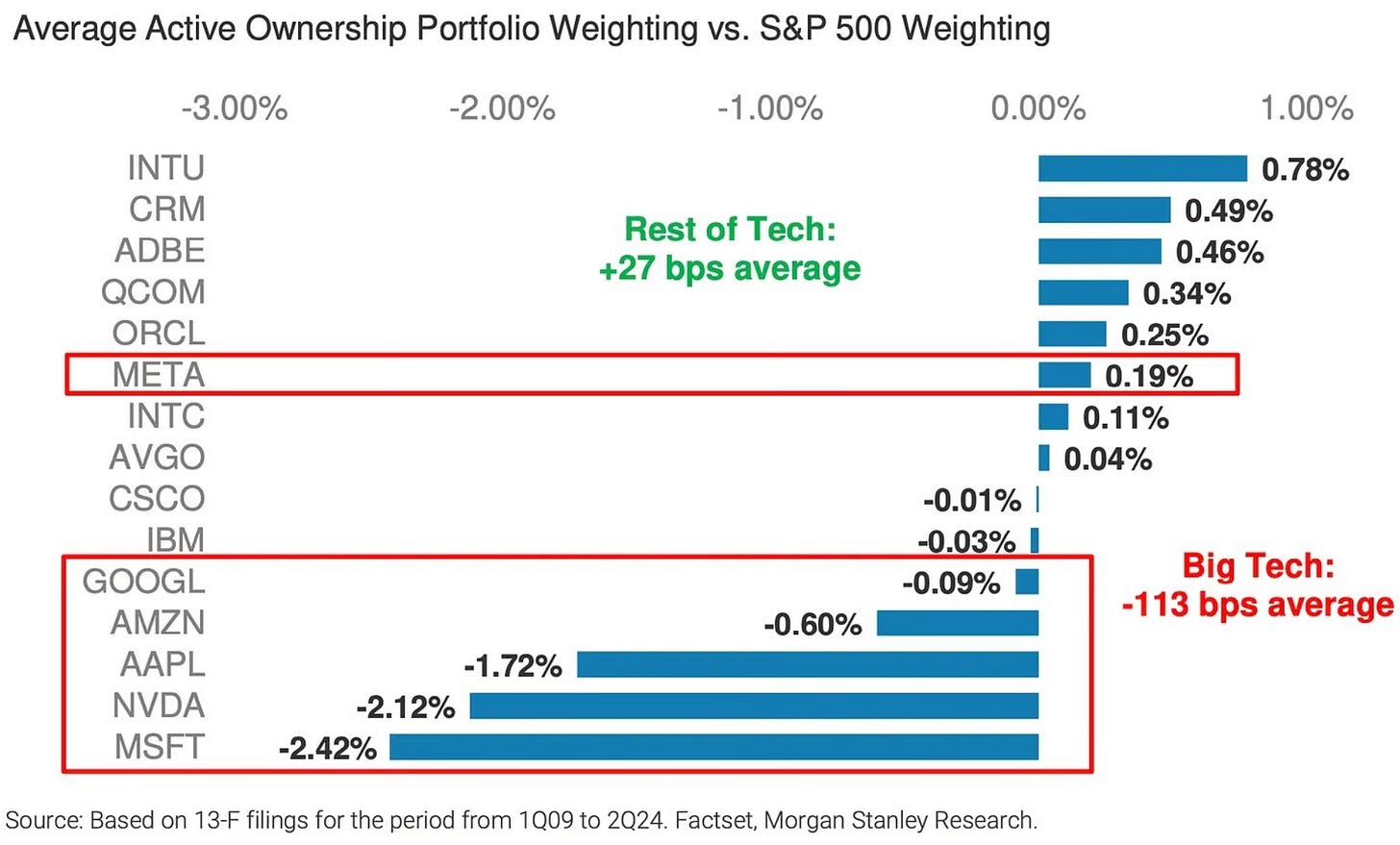

Nvidia is actually one of the most under owned stocks in the market. I’ve assumed this by what I was seeing but couldn’t really get any hard data to back it up. A number of the Mag 7 stocks are actually under owned vs the S&P 500 per Morgan Stanley where they said the following.

"Of the large cap stocks we evaluate, MSFT, NVDA, AAPL, AMZN, and GOOGL are currently the most under owned in actively managed portfolios vs. the S&P 500”

I remain just as bullish on Nvidia as I have been the past few years. I’ve wrote about my position in this name a number of times and why I have yet to sell a share. (My Nvidia Plan Moving Forward & The Nvidia Surge)

On Wednesday I will show just how big of a position Nvidia has grown to in my portfolio.

Upcoming Earnings

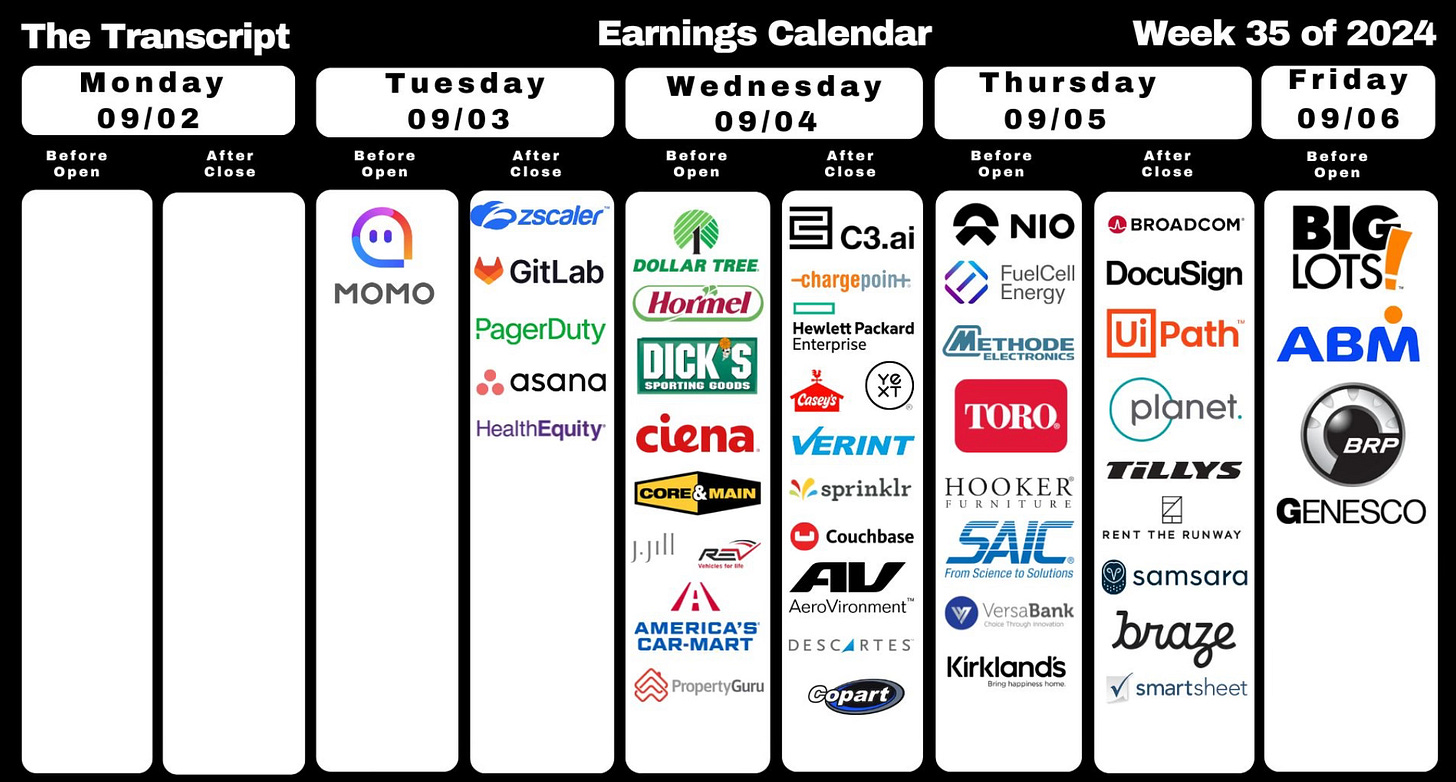

Earnings are coming to an end with only 6 S&P 500 companies reporting this week. I plan to have my eye on Dick’s Sporting Goods, Zscaler and Broadcom.

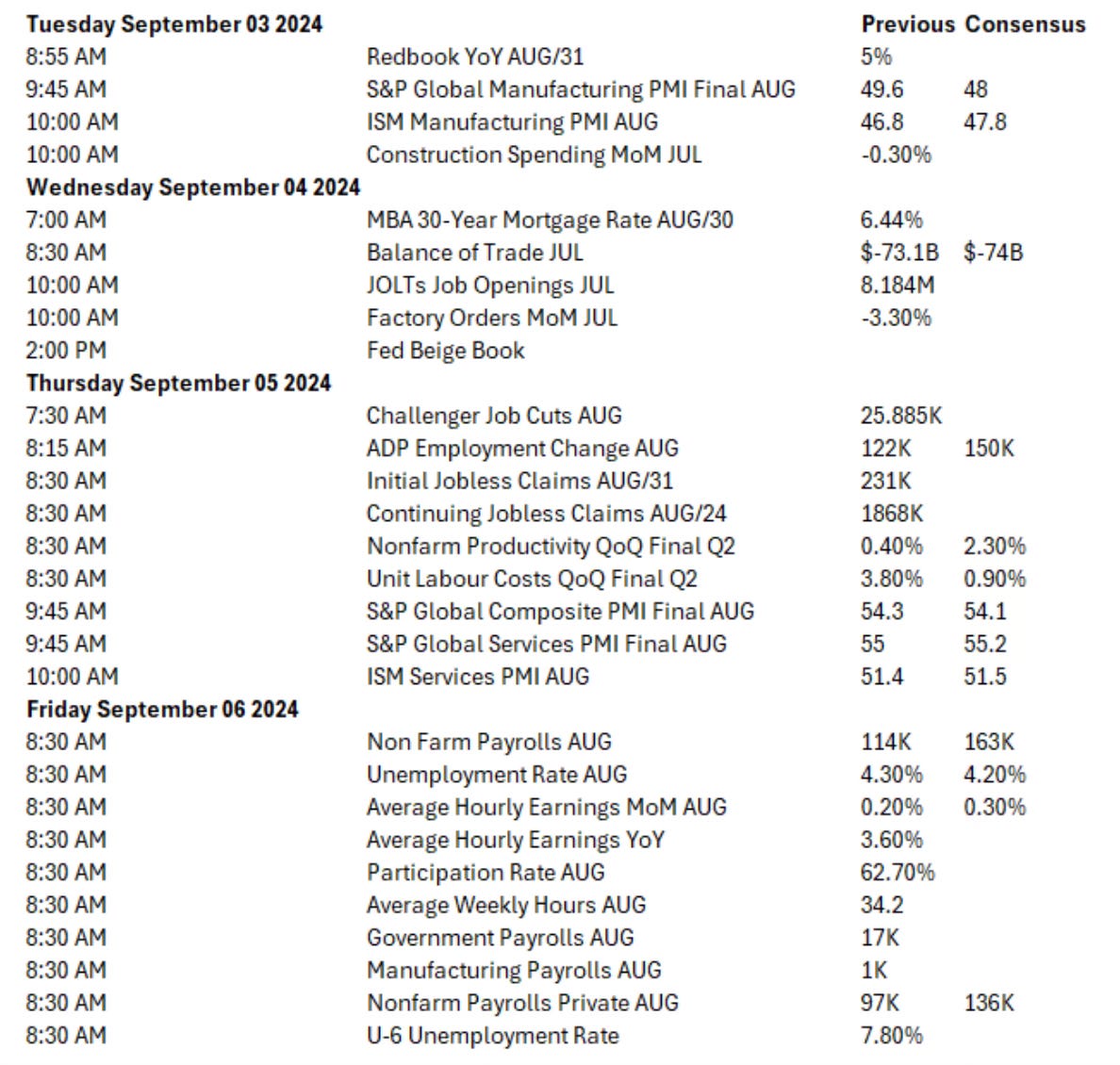

Data In The Next Week

The Coffee Table ☕

Are you a fan of dividends and dividend paying stocks? This was a very interesting post from Adam Grossman at HumbleDollar on why you likely don’t need to focus on dividend paying stocks. Yielding No Advantage

There was a good piece in the WSJ by Veronica Dagher, The New Etiquette of Negotiating With Your Real-Estate Agent. This was a timely and informative post with the new changes to real estate agent commissions. If you’re working with or may soon be working with a real estate agent this is an important read.

Morgan Housel wrote another banger of a post called, A Few Little Ideas And Short Stories. I loved the whole thing, but the last sentence is what will stick with you. “No one will remember you in 100 years, and it’s helpful to remember that when making big life decisions.”

This is a worrisome chart that was shared by Barry Ritholz. In fact, it’s quite sad. Kids are obsessing over video games and social media, while adults are obsessing over the news cycle, politics and social media. Isn’t it all a distraction?

Source: Barry Ritholtz

Thank you for reading! If you enjoyed Spilled Coffee, please subscribe.

Spilled Coffee grows through word of mouth. Please consider sharing this post with someone who might appreciate it.