Investing Update: A Sector Flashing Caution

What I'm buying, selling & watching

The stock market saw a wild ending to the week.

Midday Friday, President Trump threatened China with major tariff hikes — sending the market to its worst day since April. A quick reminder that, yes, the stock market still cares about tariffs.

The S&P 500 and Dow both had their worst week since August. It was the worst week for the Nasdaq since May.

424 of the 500 S&P stocks declined on Friday, the most since July. The index fell back to levels last seen on September 11, wiping out a month’s worth of gains in a single day.

The Nasdaq had the worst day of the major indicies on Friday, down 3.56%.

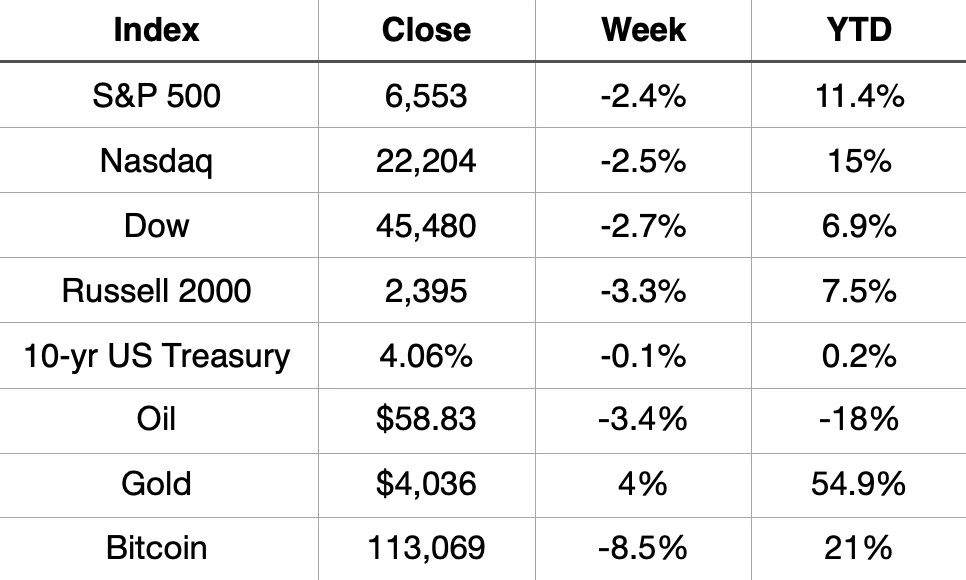

Market Recap

Weekly Heat Map Of Stocks

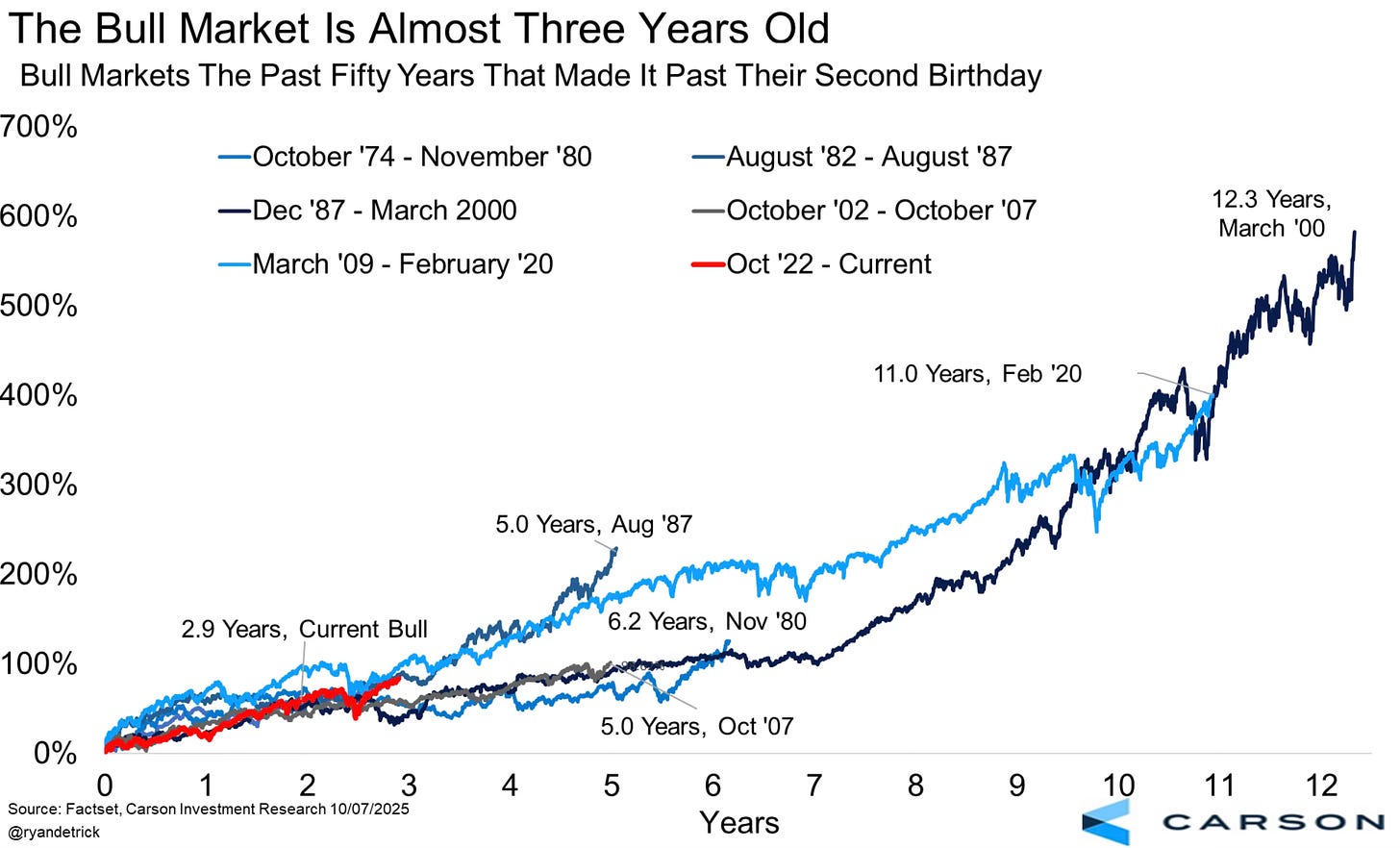

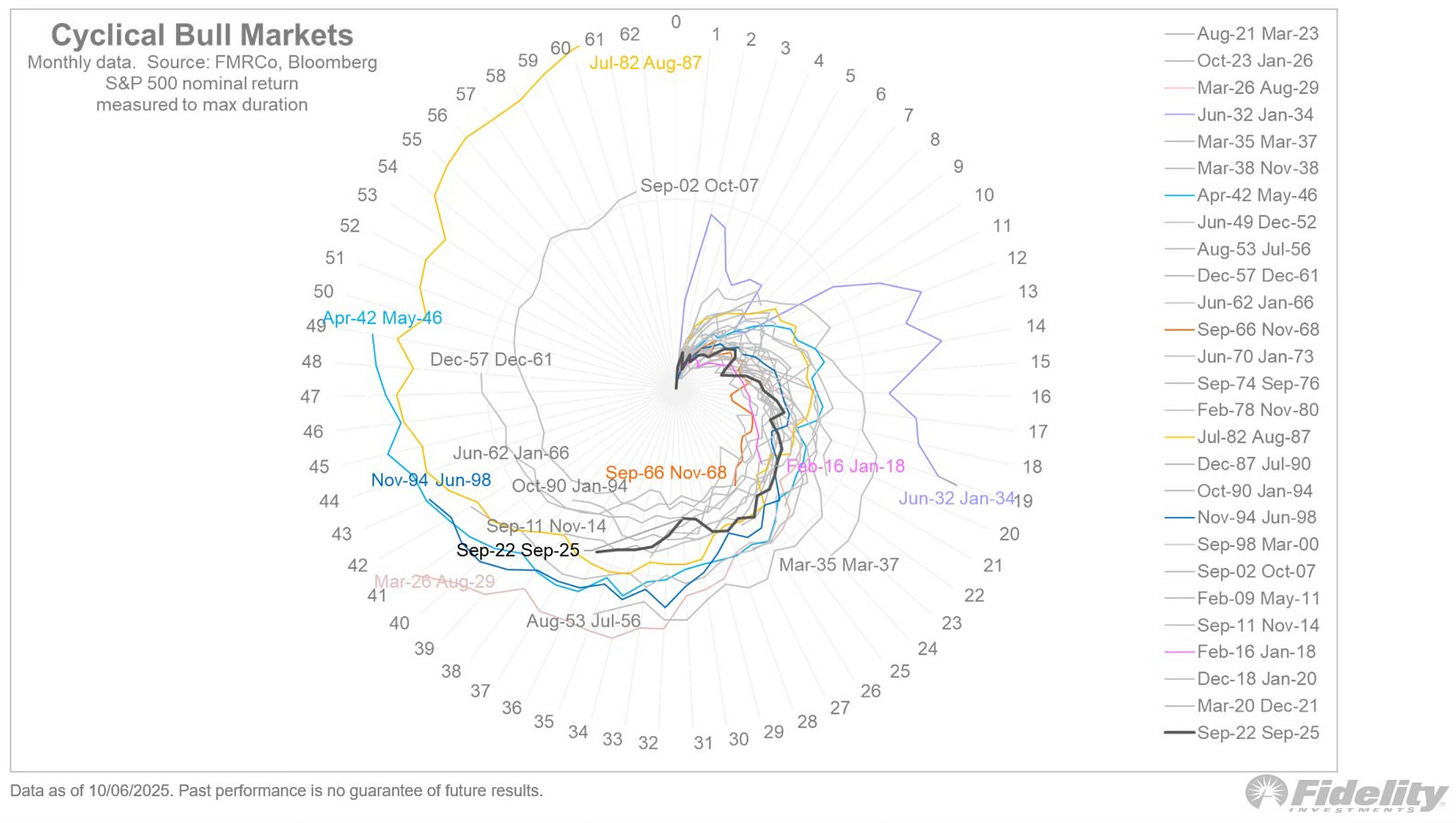

This wild drop occurred just two days before the 3rd birthday of this bull market.

Regardless what happened Friday, it’s good to remember that the last five bull markets kept going longer than three years. The shortest was five years and the average was eight years.

This bull market is still good for an almost 95% return.

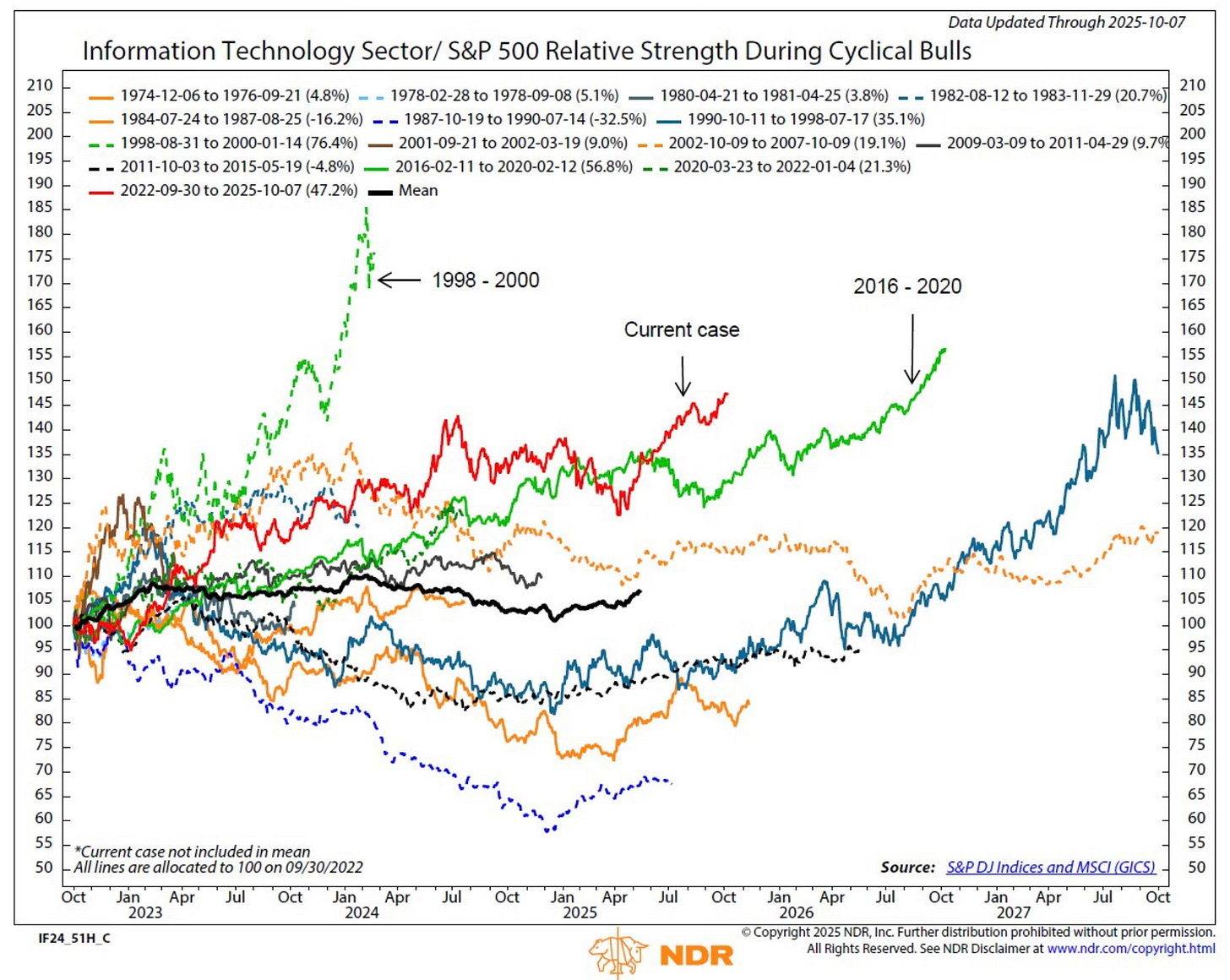

Rob Anderson makes a good point on how this technology cycle performance looks a lot like the 2016 to 2020 bull market and not like the 1998 to 2000 bull market that everyone keeps referring to.

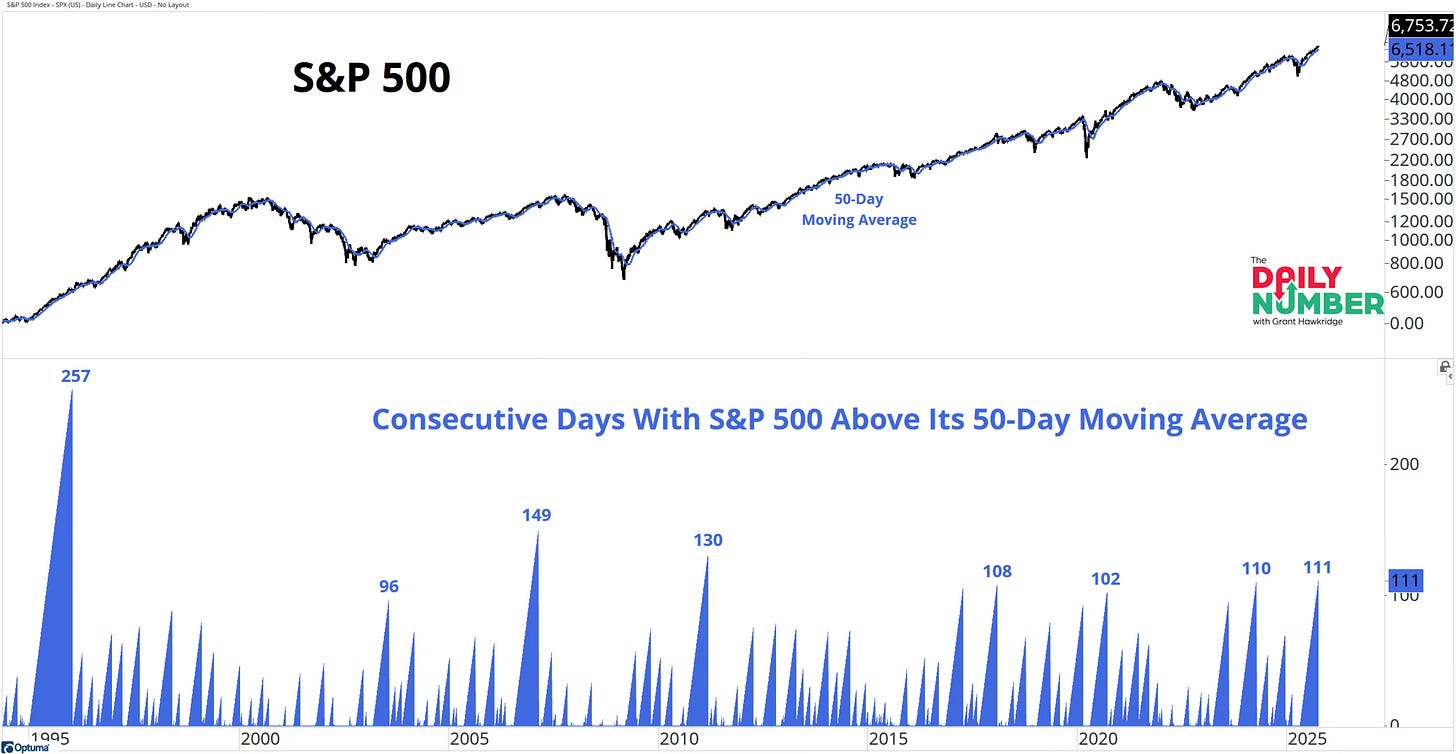

The S&P 500 has been above the 50-day for 113 straight sessions. That’s the longest streak since 2011.

That will be put to the test this coming week. After Friday’s selloff, the 50-day is being threatened.

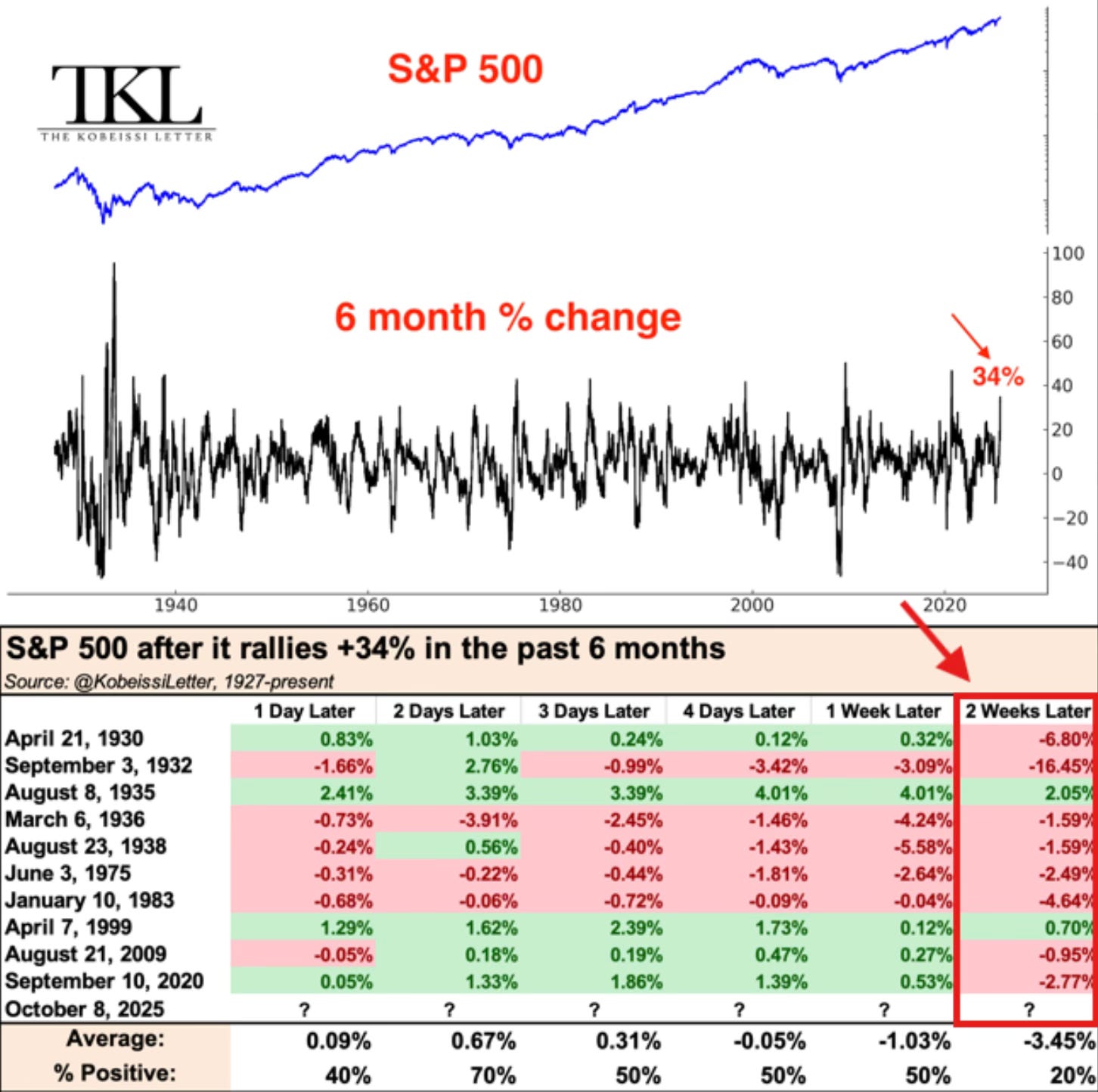

But are we due for a pullback?

The S&P 500 is now up +34% in 6 months, a move only seen 10 previous times since 1930. In 8 of the 10 previous occurrences, the S&P 500 ended lower 2-weeks later, with an average decline of -3.5%.

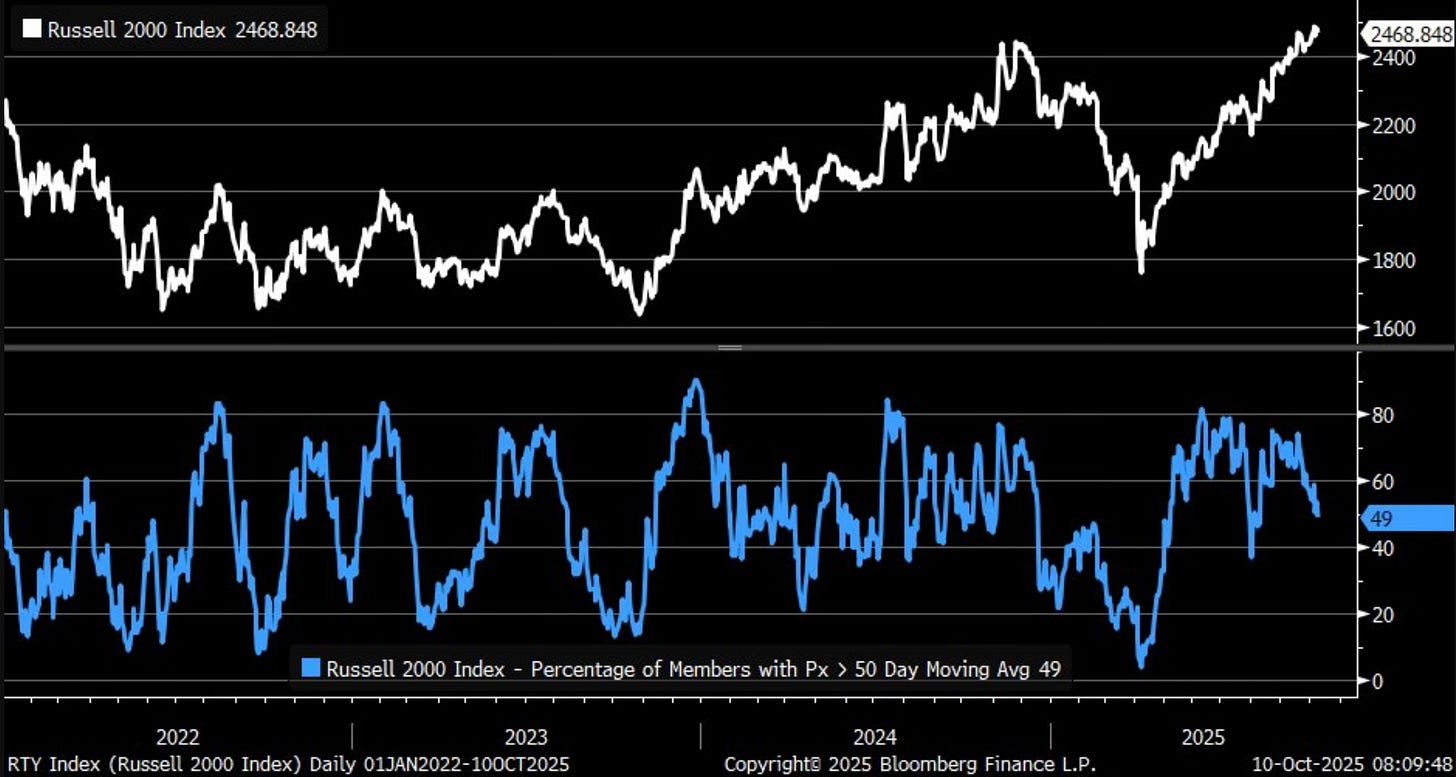

The Russell 2000 is now also under pressure. The percentage of members above their 50-day has now flipped below 50%.

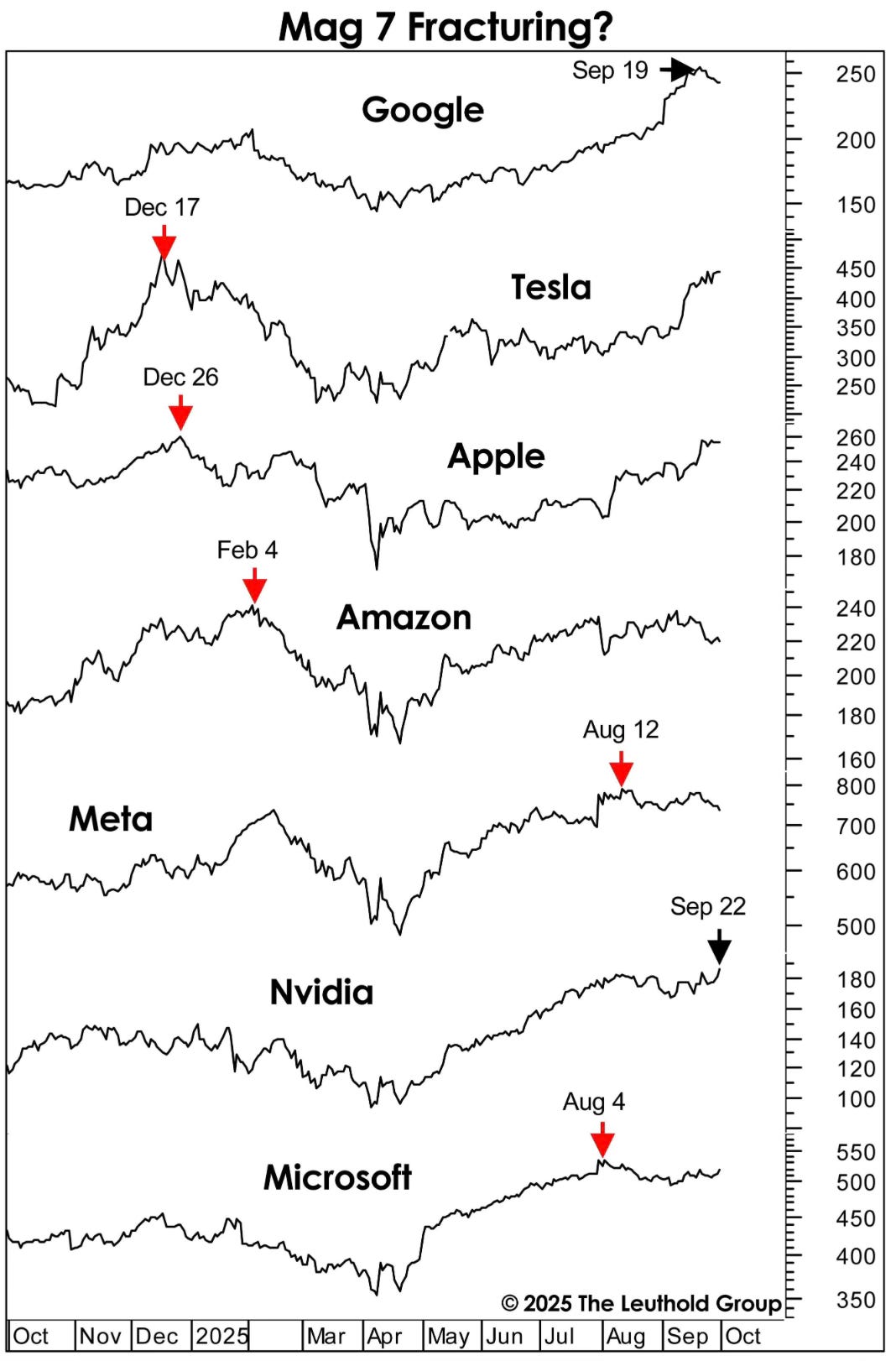

Maybe the biggest concern to me is what we’re seeing with the Mag 7. Only two of them (Nvidia and Google) have made a new 52-week high over the last month.

If they’re weakening and aren’t able to regain their footing, that will spell trouble for the bulls.

Now if you fall in the camp with retail investors. You may view this pullback Friday as a buyable dip.

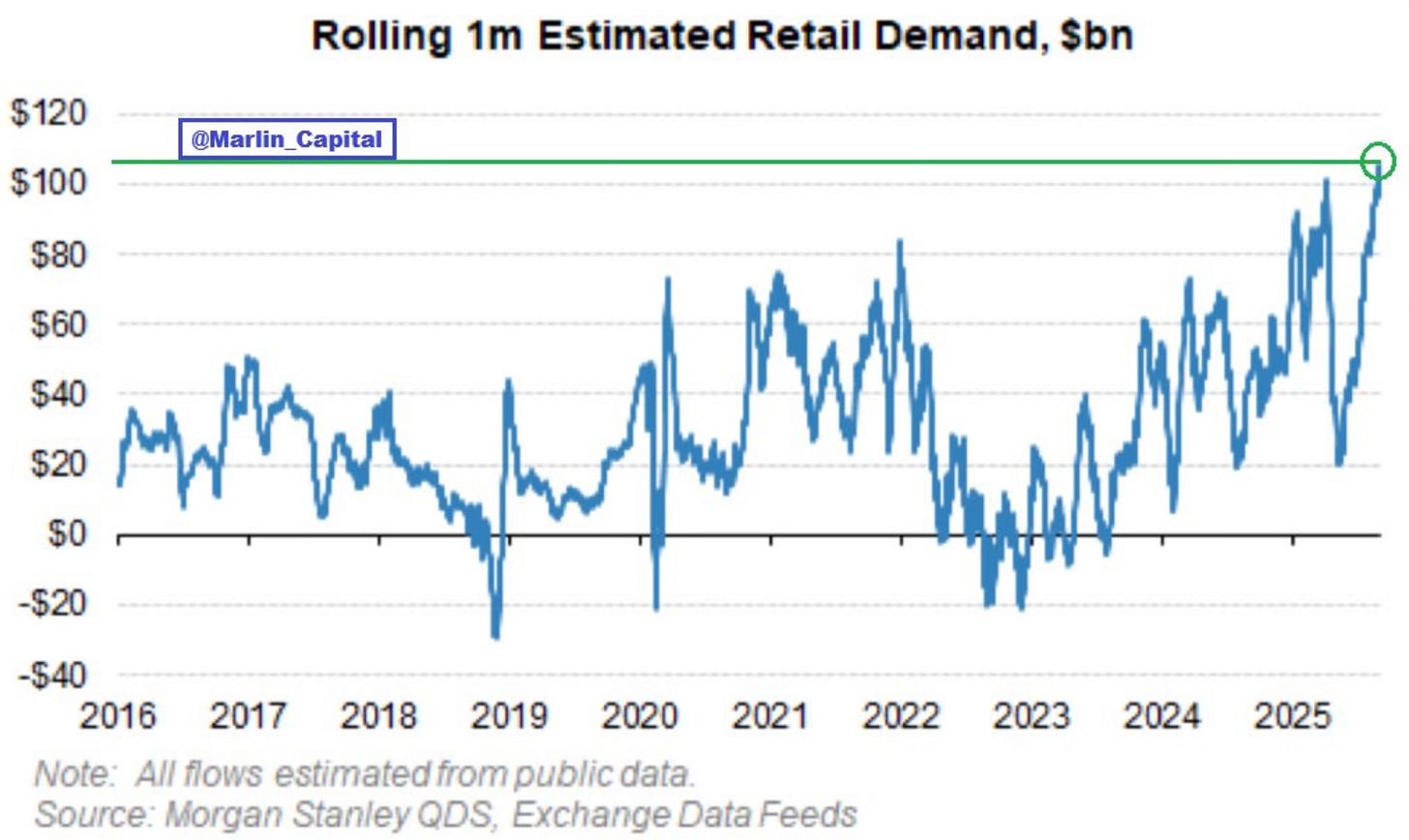

Retail investors just had the largest buying on record. It was the biggest one month of buying ever.

A tariff tiff isn’t enough to flip this level of bullishness from retail investors into sudden pessimism.

If you’re in the buy-the-dip camp, don’t overthink it, this is your pullback.

With earnings season on deck, it looks like a textbook setup. If you believe this bull market is still in its early stages, this is the kind of moment you circle. Never let a good pullback go to waste.

Individual Stock Intel

After Friday’s selloff, it’s time to watch for certain stocks approaching pullback levels — spots where we’d look to add to positions or start new ones.