Investing Update: 3 Stocks For Year-End

What I'm buying, selling & watching

An up and down week in the stock market saw the Dow and S&P 500 finish the week in positive territory, while the Nasdaq slipped into the red.

Investors showed more caution toward high-flying tech and AI linked names. Concerns over stretched valuations and shifting flows put the most pressure on the Nasdaq.

Market Recap

Weekly Heat Map Of Stocks

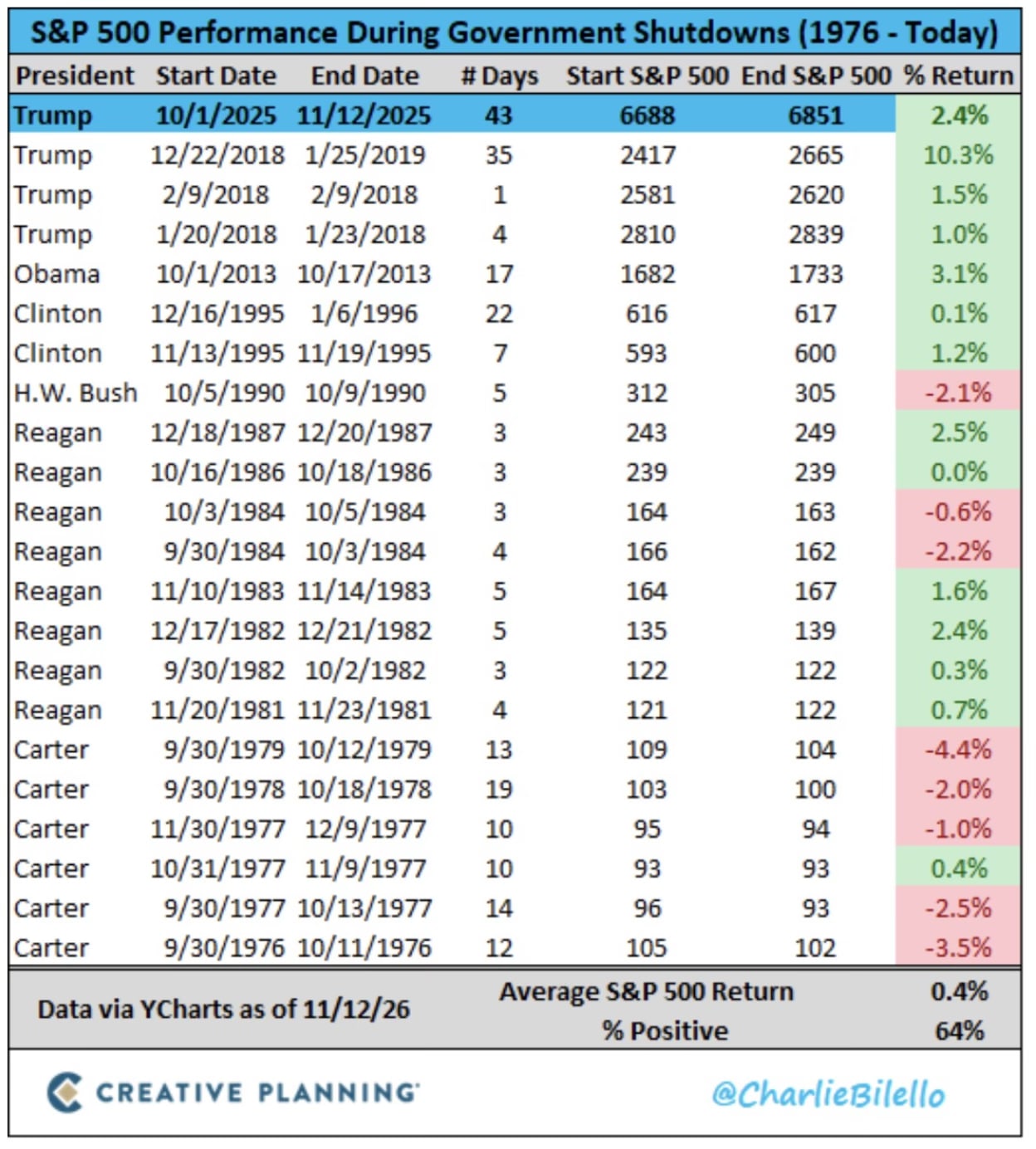

This week did see the government shutdown come to an end. It lasted 43 days, from October 10 to November 12. During that time the S&P 500 rose 2.4%.

Remember this the next time they try to scare you about a government shutdown affecting the stock market. Over the last seven shutdowns, the S&P 500 finished positive each time.

Best Performing S&P 500 Stocks YTD

Worst Performing S&P 500 Stocks YTD

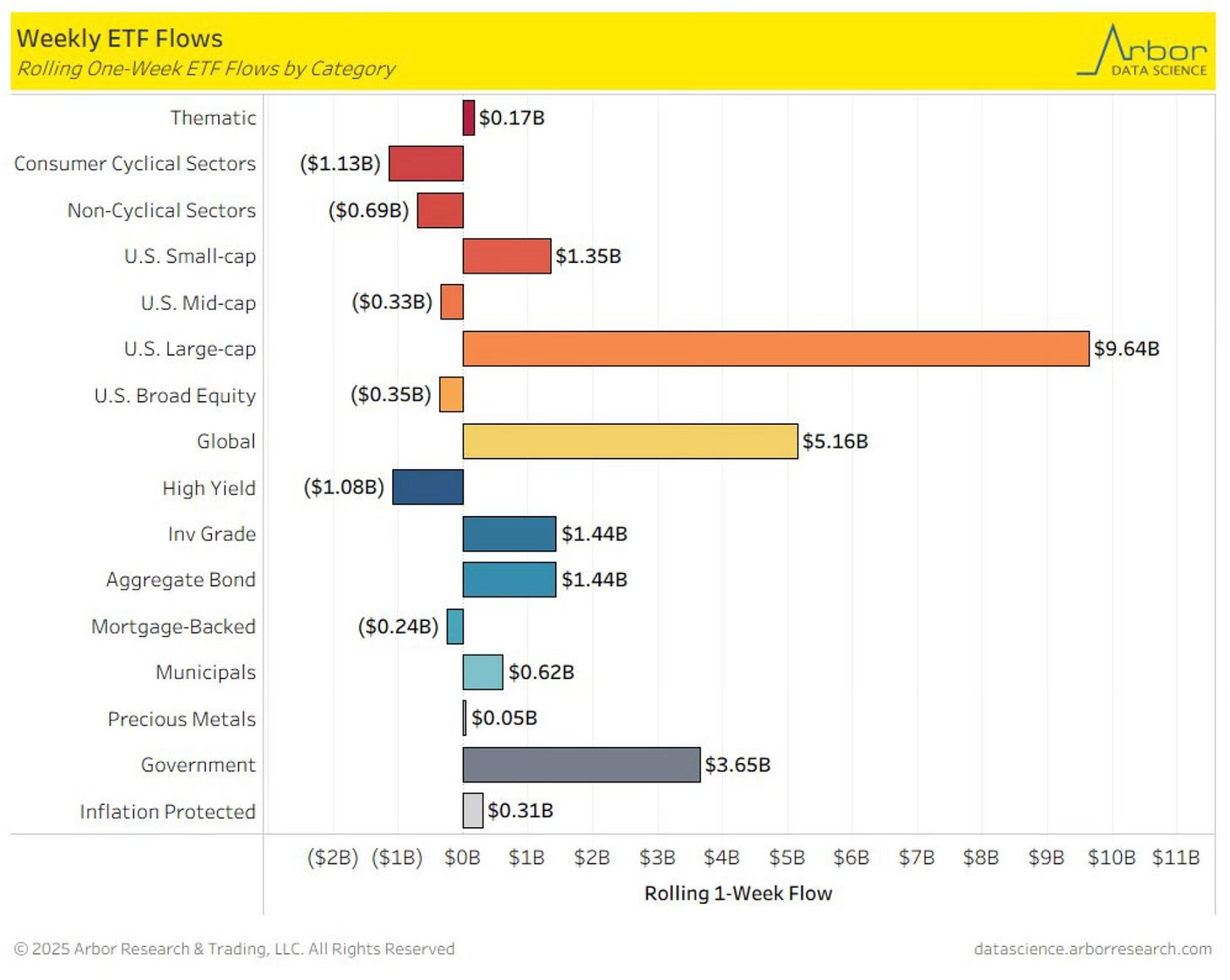

What ETF Flows Show

We continue to see U.S. large caps attract the most inflows.

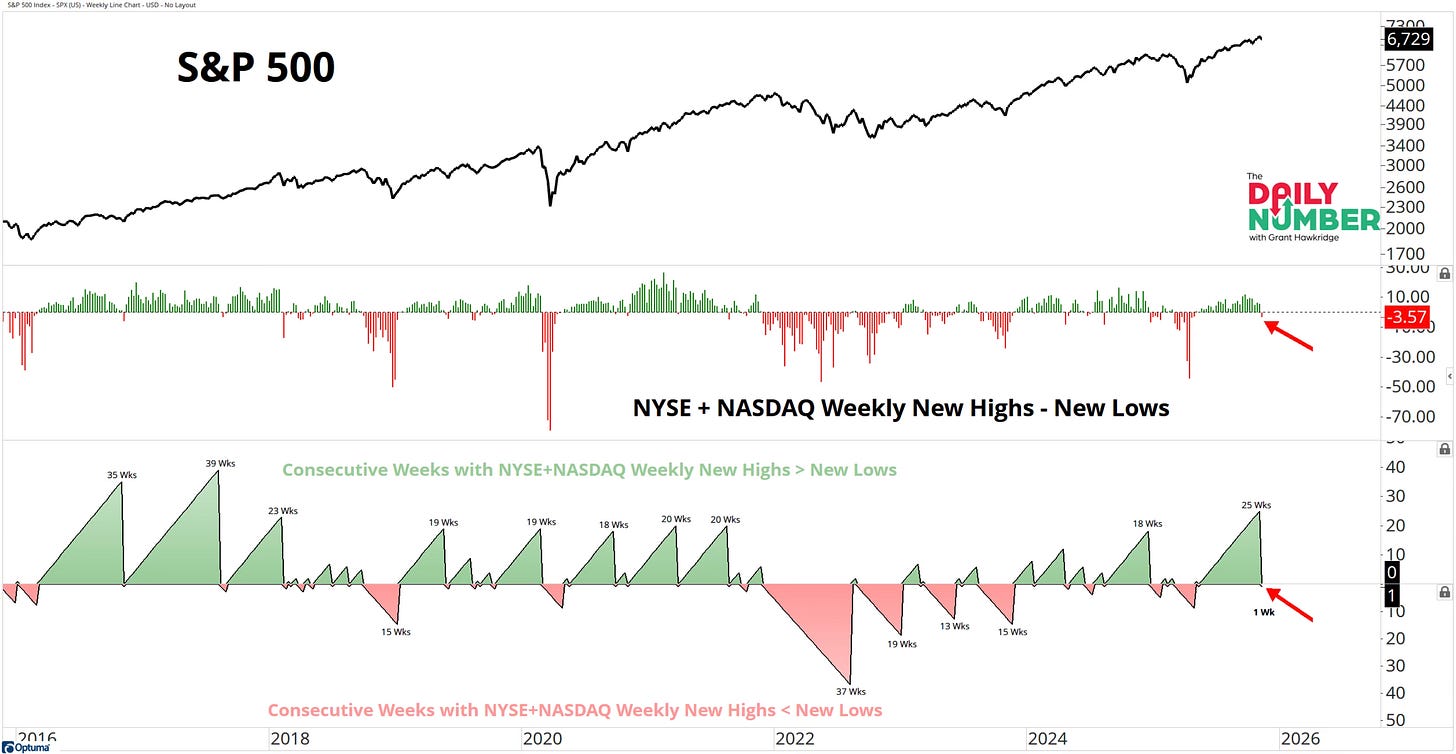

We’re starting to see breadth finally blink. For the first time in 25 weeks, the number of new lows outnumbered the new highs across both the NYSE and Nasdaq.

I do have concerns over the percentage of the S&P 500 tech stocks that are above their 50-day. It’s the lowest since April.

It has now been two months since we last saw a cycle high for the percentage of NYSE stocks above the 200-day.

60% or above is a healthy level during a bull market and we’ve now seen stabilization just below that now at 55%. It has been above 60% since August.

This feels like a bull market on shaky ground, but the pullback has been modest. The S&P 500 is still less than 2 percent from its all time high.

Nvidia reports earnings on Wednesday. Expectations are for results that are in line with forecasts and strong overall, which should ease some of the anxiety around the AI build out. A solid report would likely steady the market and push Nvidia back above 200. I expect it to run up and then take out the $212.19 high. If that happens, the broader market should follow and the S&P 500 will also move on to new all time highs.