Investing Update: 3 Stocks For Year-End

What I'm buying, selling & watching

The S&P 500 finished the week up just over 1%. The Nasdaq was up just over 2%. That takes the S&P 500 back up to 15% YTD and Nasdaq 31.8% YTD.

This week saw a streak break of 8 straight green days for the S&P 500. That’s the longest streak of 2023. On Friday the Nasdaq had its best day since May and Microsoft closed at a new all-time high. Over the past two weeks the S&P 500 is up over 7%.

On October 28th I wrote the following in Investing Update: Why The 200-Day Moving Average Matters.

The old adage that nothing good happens below the 200-day moving average does hold true. But this is also an accumulation point where investors have to continue stepping in to buy. We’re at a historical seasonality standpoint where history tells us the market has an upside from here but you’re also afraid of catching the proverbial falling knife.

It turns out the 200-day level is where investors stepped in and bought. The stock market has bounced right off those levels.

Now does history continue to repeat itself for the rest of November and through December to year-end?

Going back to 1980 the returns for November and December has been positive over 80% of the time. Only 8 of the past 42 years saw negative returns.

The average return has been 3.5%. History tell us that there is a very high likelihood that the market will continue to rally from here into year-end.

Stocks Love Mondays

Last week Ryan Detrick and I were discussing how crazy it is that Mondays seem to only be green days in 2023.

He put together such a perfect chart showing the S&P 500 annualized returns in 2023 based on the day of the week. You see how big of an outlier Mondays are. What surprised me is how strong Fridays have also been.

A Sign of What’s to Come?

Two charts came about this week that don’t paint the best picture for the road ahead for the economy.

The first which shows temporary help in the services category shows a downward trend in the nonfarm payrolls. From a macro view, a lot of investors and economists watch this closely because in the past this has been an early indicator of upcoming recessions.

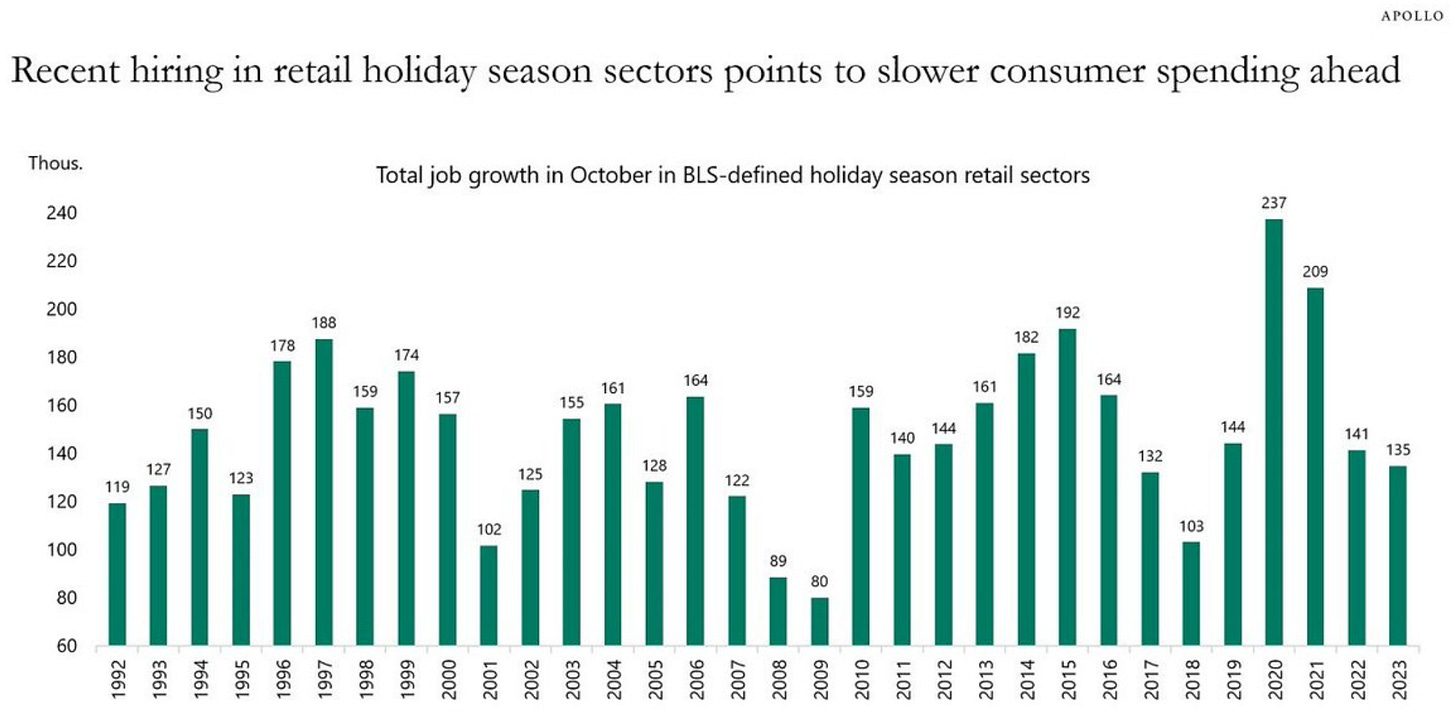

The other chart is retail hiring in anticipation of the holiday season. It’s the lowest number in five years and third lowest in the past 13 years. This signals that the retailers are expecting a weaker holiday season.

A Sector Opportunity?

I’m not a big fan of investing in banks. I’ve tried numerous times but I now view banks just like I do airline companies as uninvestable. You can trade around them but I have my reasons why I don’t view them as good long-term investments.

What can’t be avoided though is how good of a buy they look to be right now.

US Banks are at a 80-year low versus the S&P 500. When you talk about bottoming and there is nowhere for something to go other than up. That’s this chart and US banks.

This all-time low in banks mirrors what we recently saw with energy stocks. Energy stocks versus the S&P 500 were also just recently at all-time lows. With the nowhere to go but up, you can see what the result was. Banks just may see a similar bounce off the bottom.

Fuel For This Rally

There are some indicators which I’ve notice that signal there is reason to believe there is more fuel to boost this rally.

We just saw investor sentiment do a complete reversal. The AAII survey went from the highest bearish level of the year to all the way below average in one week. That’s a tremendous reversal.

This JP Morgan client survey, asked if clients are more likely to increase or decrease their equities exposure over the coming days/weeks. It currently shows that 67% plan to increase their exposure. That’s the highest reading in over a year.

Those are surveys and sentiment. So what about earnings. We know earnings are what drives stocks. They continue to impress. Now to the tune of the best in 7 quarters. This from Mike Zaccardi.

90% of aggregate earnings have been reported. Earnings came in 5.7% ahead of expectations at the start of the season, above the 3.7% pre-Covid average surprise, best in 7 quarters

Lastly it sure looks like investors have given up trying to short any of the Magnificent 7 stocks. The short interest in the Magnificent 7 stocks has now hit an all-time low. They’ve led the market higher and to see any type of significant selloff you would need to see these stocks breakdown. Clearly nobody is betting on that with these current short interest levels.

3 Stocks For Year-End

As I was talking about stocks with a few friends of mine, a unique question came up. With only 7 weeks left in the year, what stocks do you think will perform the best from now until the end of the year?

A total random thought I know. But if you’re looking to make a giant jump in your yearly returns to beat or outperform a goal or benchmark, what would you buy? Some wild stocks ideas were brought up. Many were in regards to holiday shopping and travel demand.

After our conversation, I thought about this further. Many of the names that have worked will likely continue to the end of the year. The Magnificent 7 will probably continue to climb higher. I wanted to come up with some different names that aren’t as well known or talked about. A few swing for the fence type names that have current momentum. Here are three I like.

Celsius Holdings I’ve had my eye on this name for a long time. I’ve learned about the energy drink business more after researching for my piece on Monster Beverage. Learning From the Top Stock of the Past 20 Years.

But what really peaked my interest in this stock recently is after it just reported earnings and indicate that it was now outselling Monster on Amazon. They have a 21.4% share versus Monster at 18.6%. This is getting very intriguing with a market cap still at only $13 billion.

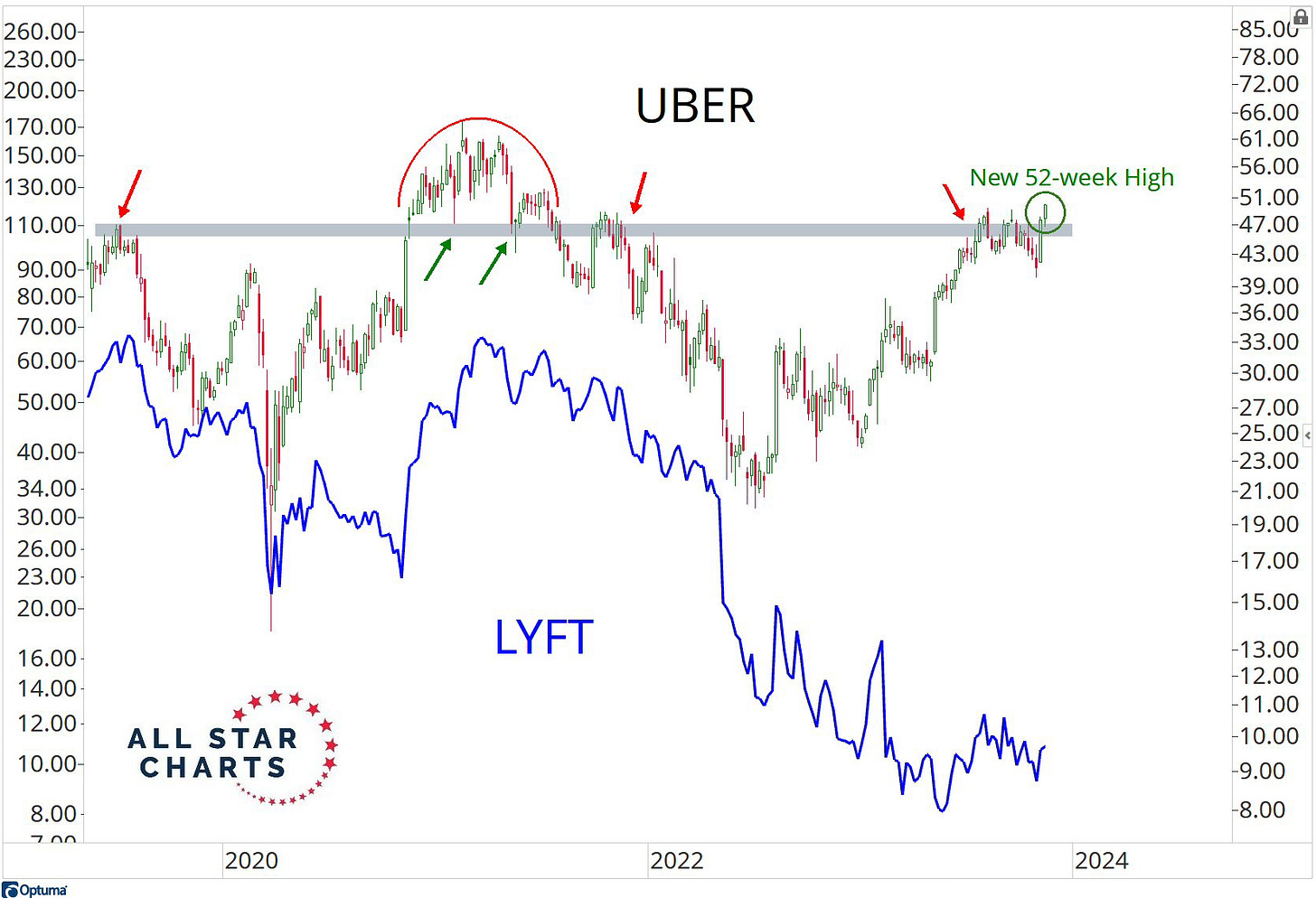

Uber Readers of Spilled Coffee have heard my love for both Uber the company and stock. It reached an important level after it reported earnings this week. The stock climbed above the $50 a share threshold and hit a new 52-week high. It has momentum and with the holidays and travel season coming, who do you think stands to benefit? It’s a loved product that is now seeing its stock also get some love.

I had also said that I didn’t feel Uber had competition anymore from Lyft. You can decide that for yourself.

CrowdStrike My favorite high growth stock is CrowdStrike. It’s in a clear uptrend and with the continued rash of cybersecurity ransom attacks and threats to companies, I can’t own enough of this stock. The security breaches and cyber fights won’t stop for companies. To combat them is where CrowdStrike comes in and they do this around the world. In just the past three months it’s up almost 35%. What a beautiful chart!

I currently own shares in Uber and CrowdStrike.

Moves I’ve Made

S&P 500 Index This week I added to my S&P 500 index position.

As we near the end of the year, I always take a look at my stock positions and do an updated investment thesis on every security that I own. I want to make 100% sure each one fits into my plans for 2024 and beyond. I will be doing this over the coming weeks and will share any updated I make.

The Coffee Table ☕

When you talk charts and what the charts show, you need to listen to what J.C. Parets is saying. He had a good post called New Lows Peaked a While Ago. He shows how new stock lows in the S&P 500 peaked in early October. Sometime we have to look at individual stock behavior and not just the overall indexes.

I liked Barry Ritholtz’s post Where is This Rally Going? It’s a very simplistic yet informative post on where things are at right now. He looks at some current market narratives and provides a no-nonsense view on what they mean and the affect they may have.

Ben Carlson had an informative post with some good charts called Seeing Both Sides of the U.S. Economy. It gives you a better overall understanding and visual of what is going on with U.S. economy both from the good and not so good side.

I picked up a bottle of Heaven Hill 7 Year Bourbon Bottled-In-Bond. I’ve seen it available from time to time but after a friend had recommended it, I decided to grab one. To the nose I smelled vanilla, oak and a tad of butterscotch. To taste I got some vanilla, cinnamon and a graham cracker with light spice to finish. It was very good. It’s a notch below Henry McKenna 10 Year but has a similar profile to that.

Thank you for reading! If you enjoyed Spilled Coffee, please subscribe.

Spilled Coffee grows through word of mouth. Please consider sharing this post with someone who might appreciate it.

Order my book, Two-Way Street below.