Investing Update: 3 Stocks For 2026

What I'm buying, selling & watching

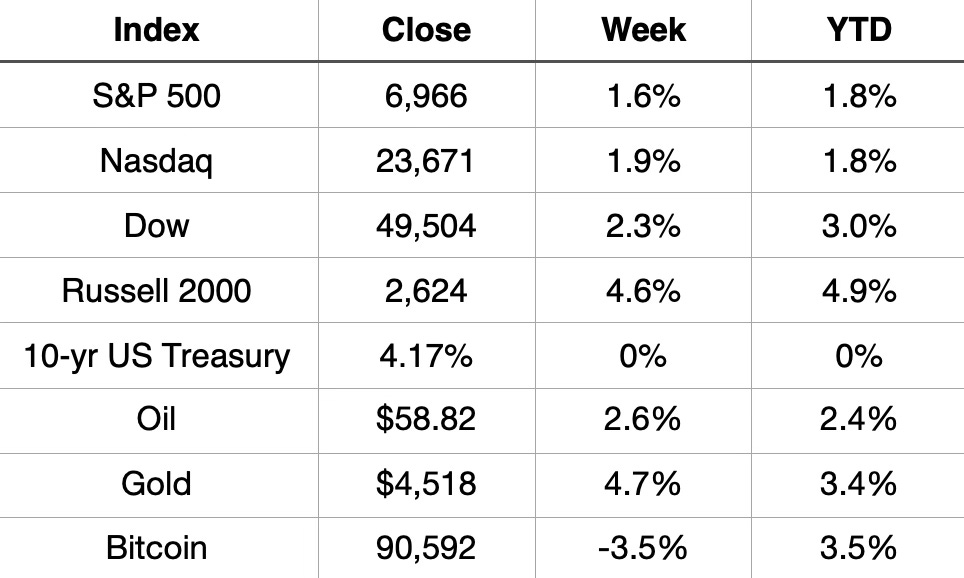

The Dow and S&P 500 closed Friday at new all-time highs, capping a week where every major index finished higher. It has been a historic start to 2026, with the S&P 500 already logging two record breaking sessions in its first full week.

Year-to-Date Performance:

Russell 2000: +4.9%

Dow Jones: +3.0%

S&P 500: +1.8%

Nasdaq: +1.8%

The broad market strength suggests the everything rally of late 2025 is carrying over with full force into the new year.

Market Recap

Weekly Heat Map Of Stocks

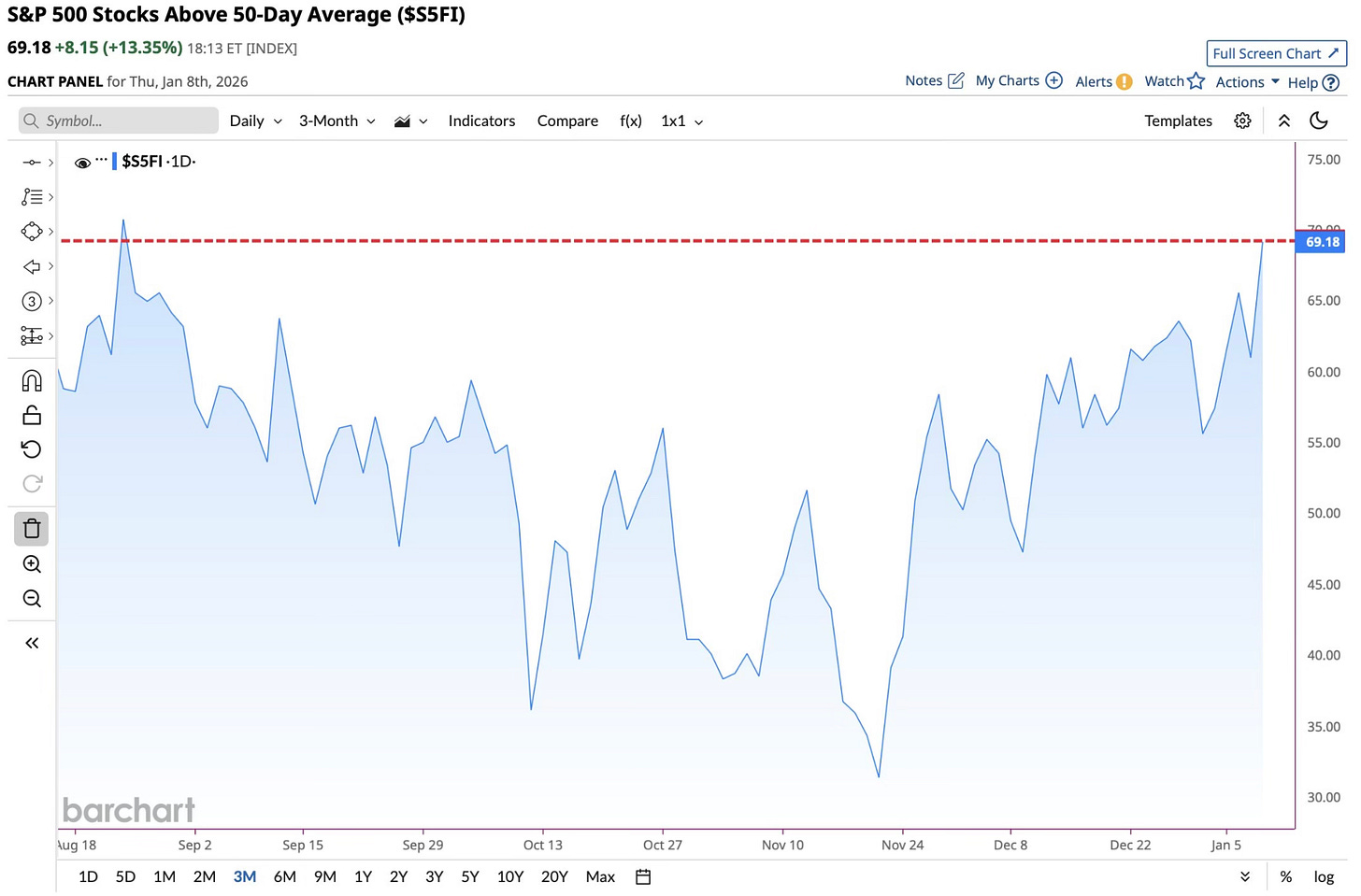

The everything rally should indicate that risk appetite is still strong. Grant Hawkridge shows in his risk Risk-On Risk-Off indicator exactly that. In fact, it looks to be strengthening. His indicator is at the highest level since November 2024.

69% of S&P 500 stocks are now trading above their 50-day moving average. That’s the most since August.

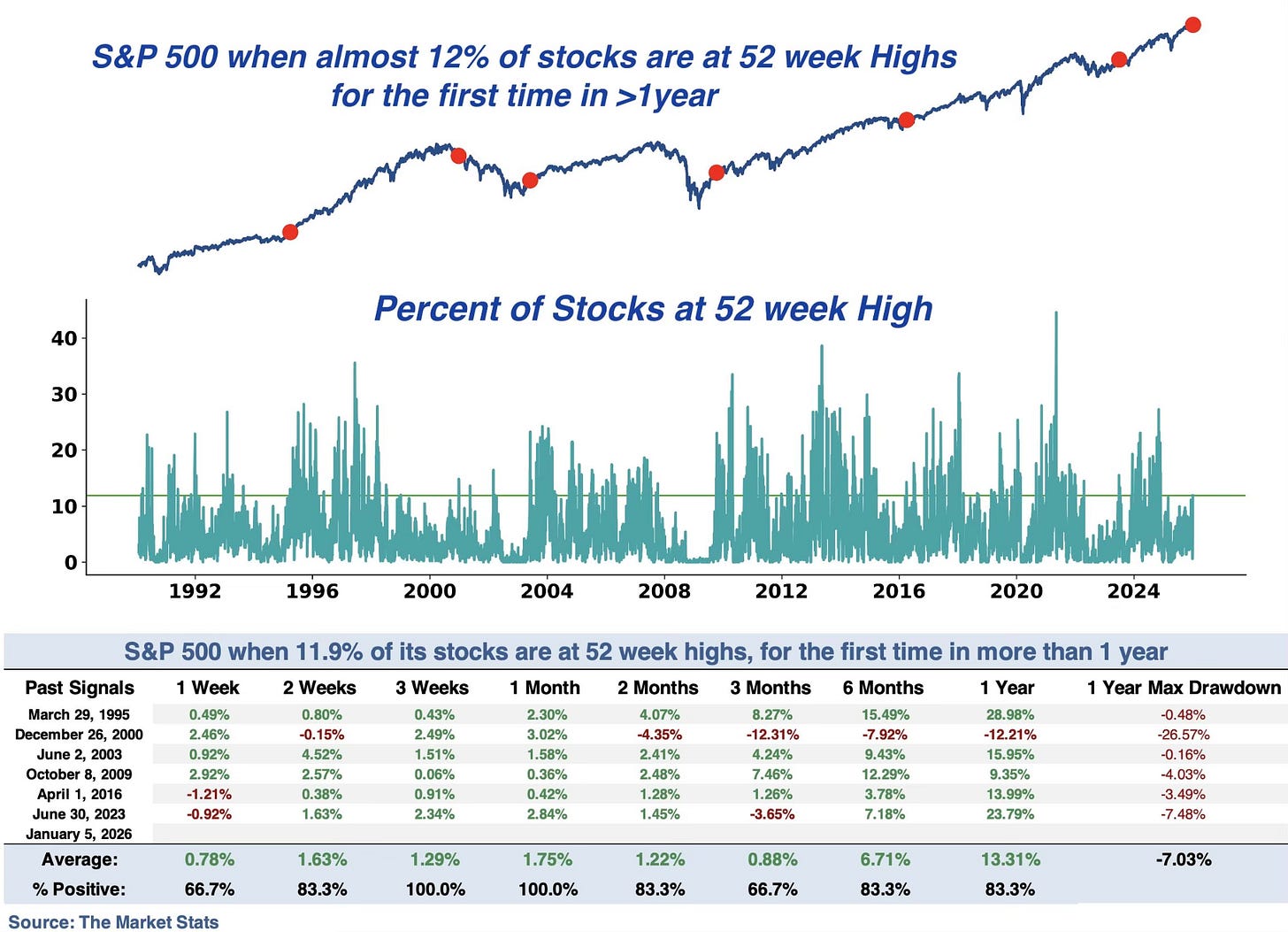

The S&P 500 just had the most new 52-week highs since November 2024. That means about 12% of S&P 500 stocks are at 52-week highs.

When this has happened in the past, you can imagine what the outcome is 3 months, 6 months and 1 year later. A lot of green!

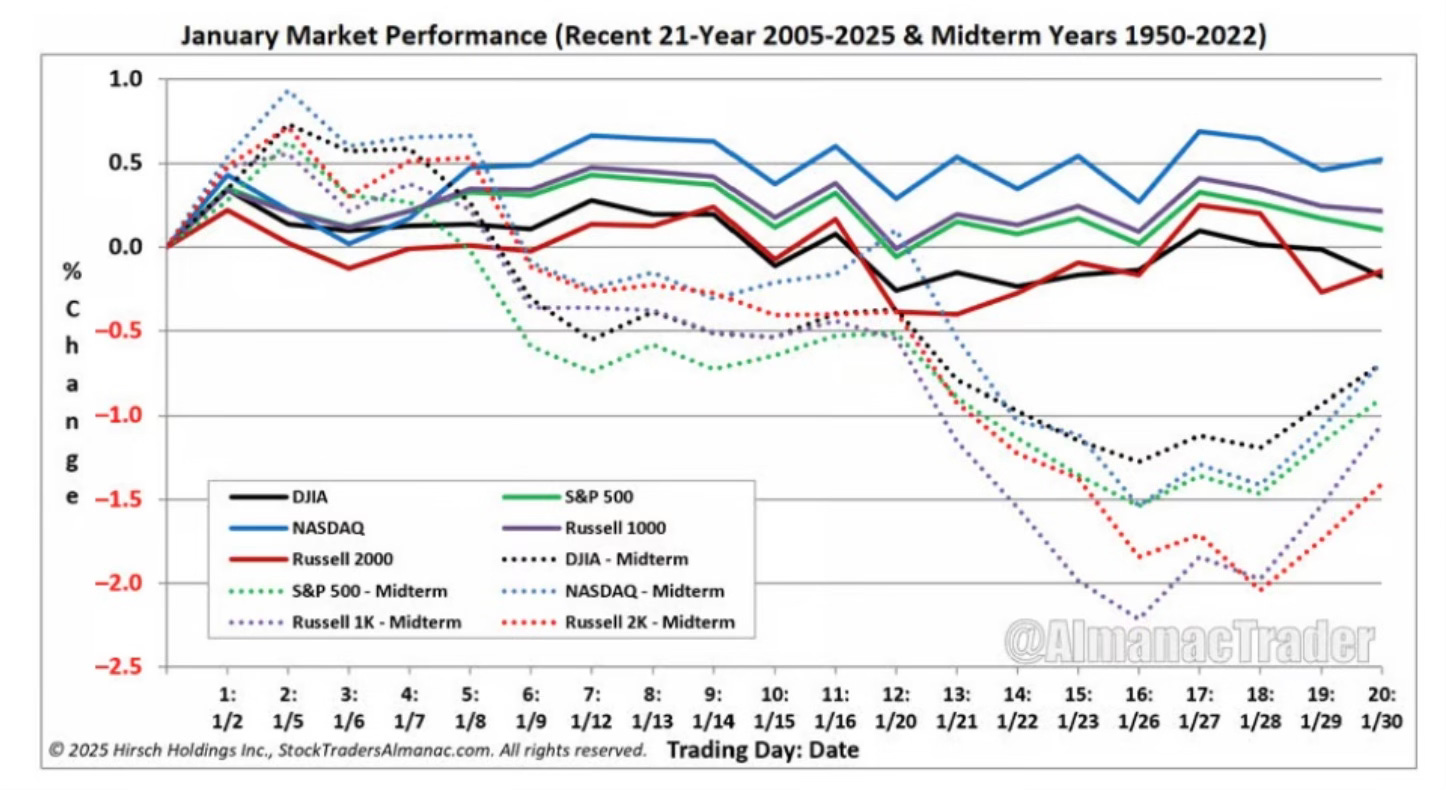

It’s also worth keeping in mind that January has historically started strong but tends to weaken as the month goes on. This has been especially true in midterm years like the one we’re in.

Charts That Matter

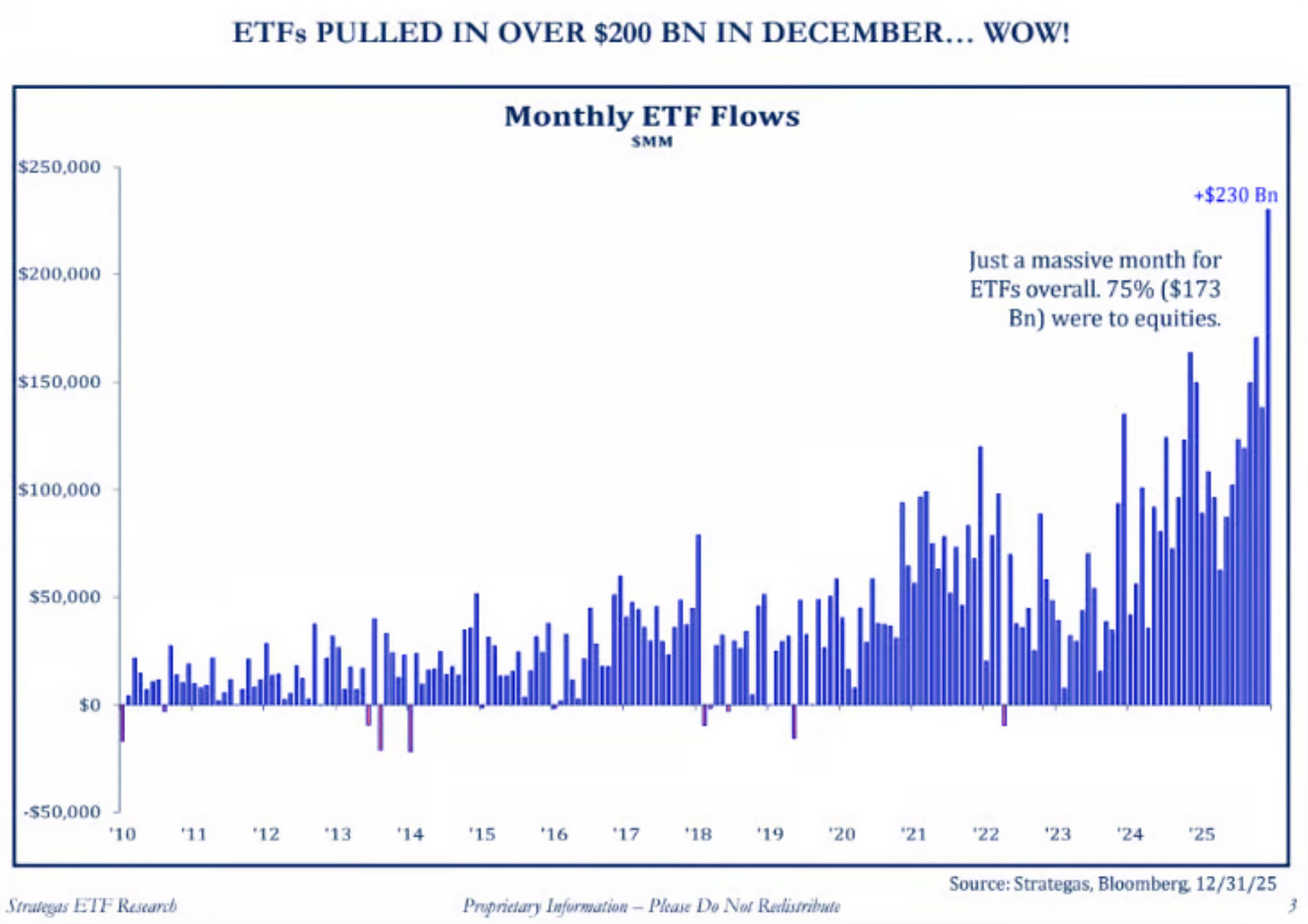

Take a look at ETF flows in December. It was a record month for inflows, with $173B of the $230B total going into equities. It’s hard to be bearish when you see numbers like that.

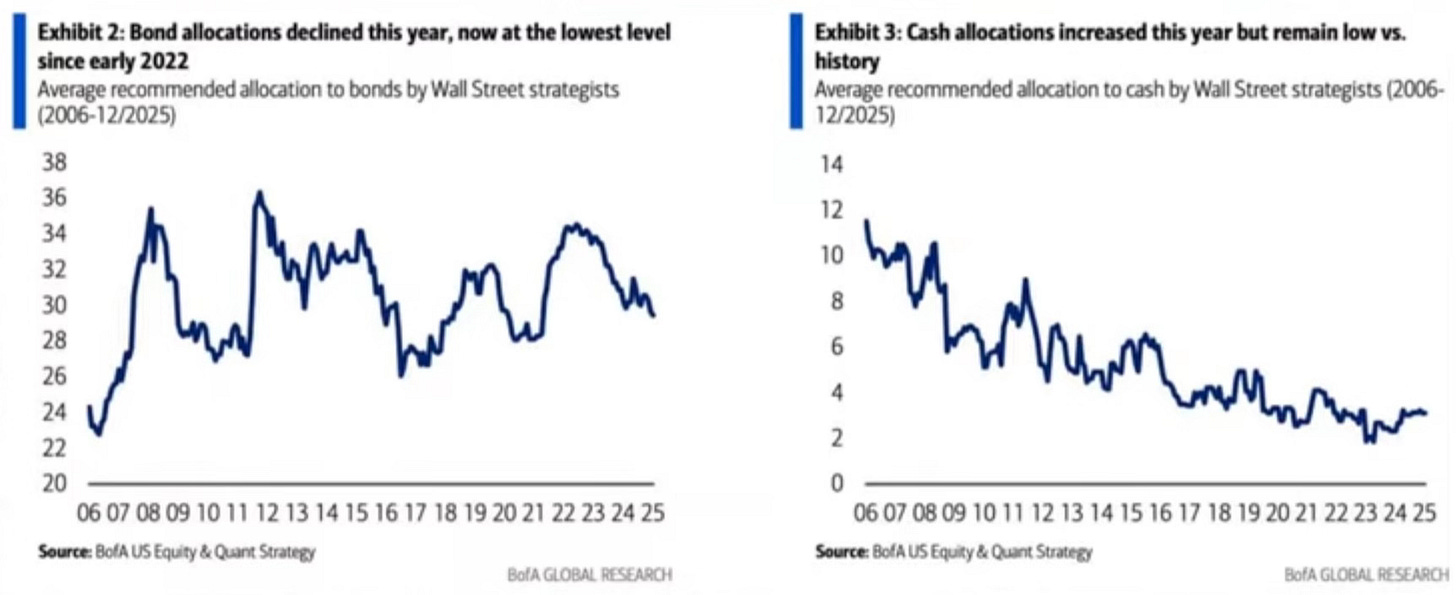

As equities continue to rally, allocations to bonds and cash keep sliding.

Bond allocations are at their lowest level since early 2022. Cash allocations have ticked up slightly but remain historically low. With stocks doing what they’ve been doing, it’s hard to blame investors.

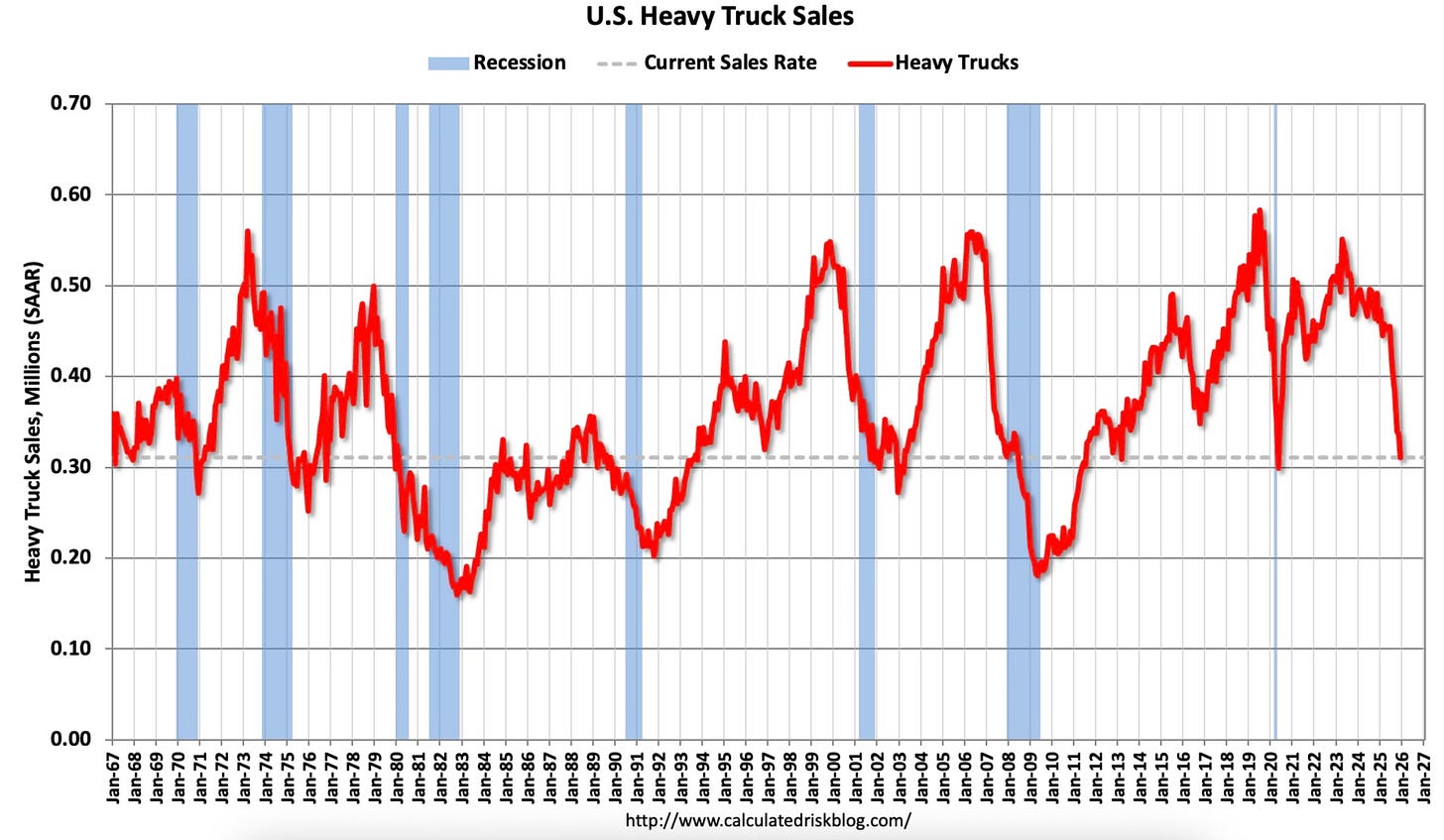

If there’s one chart that keeps catching my eye, it’s this one, and it’s the same chart I highlighted last quarter.

Heavy truck sales, which tend to roll over ahead of recessions, continue to decline. These levels are clearly noteworthy. There aren’t many charts or data points that concern me right now, but this is one I continue to watch closely.

If you missed my 2026 Outlook last week, you can view it here: Investing Update: 2025 Recap & 2026 Outlook. I will get to my 3 Stocks For 2026 in just a bit.