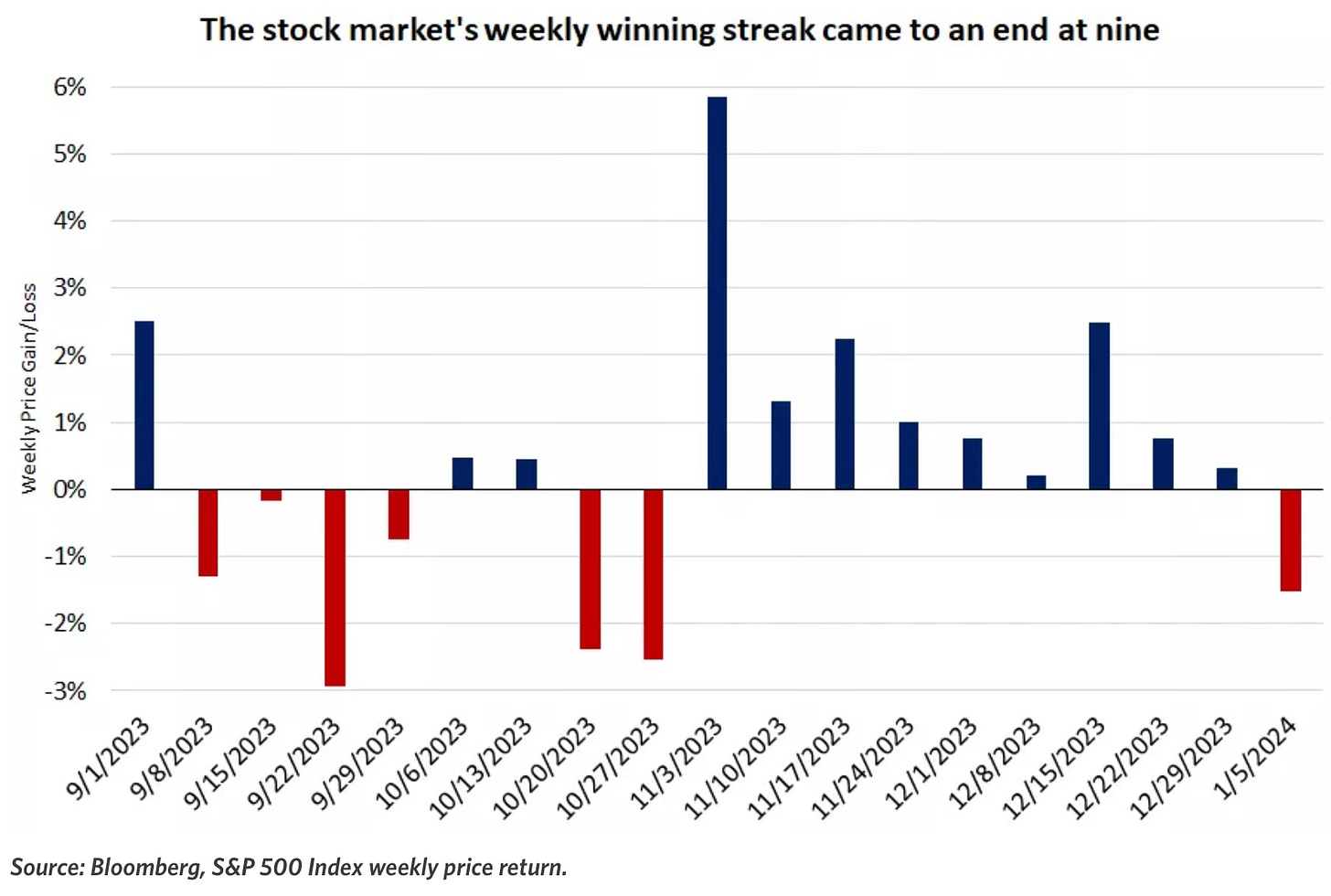

Last week saw the stock market’s nine straight positive weeks come to an end.

This week the stock market bounced back to finish positive. That now makes 10 of the past 11 weeks that the S&P 500 has been positive and it now sits just shy of a new all-time high.

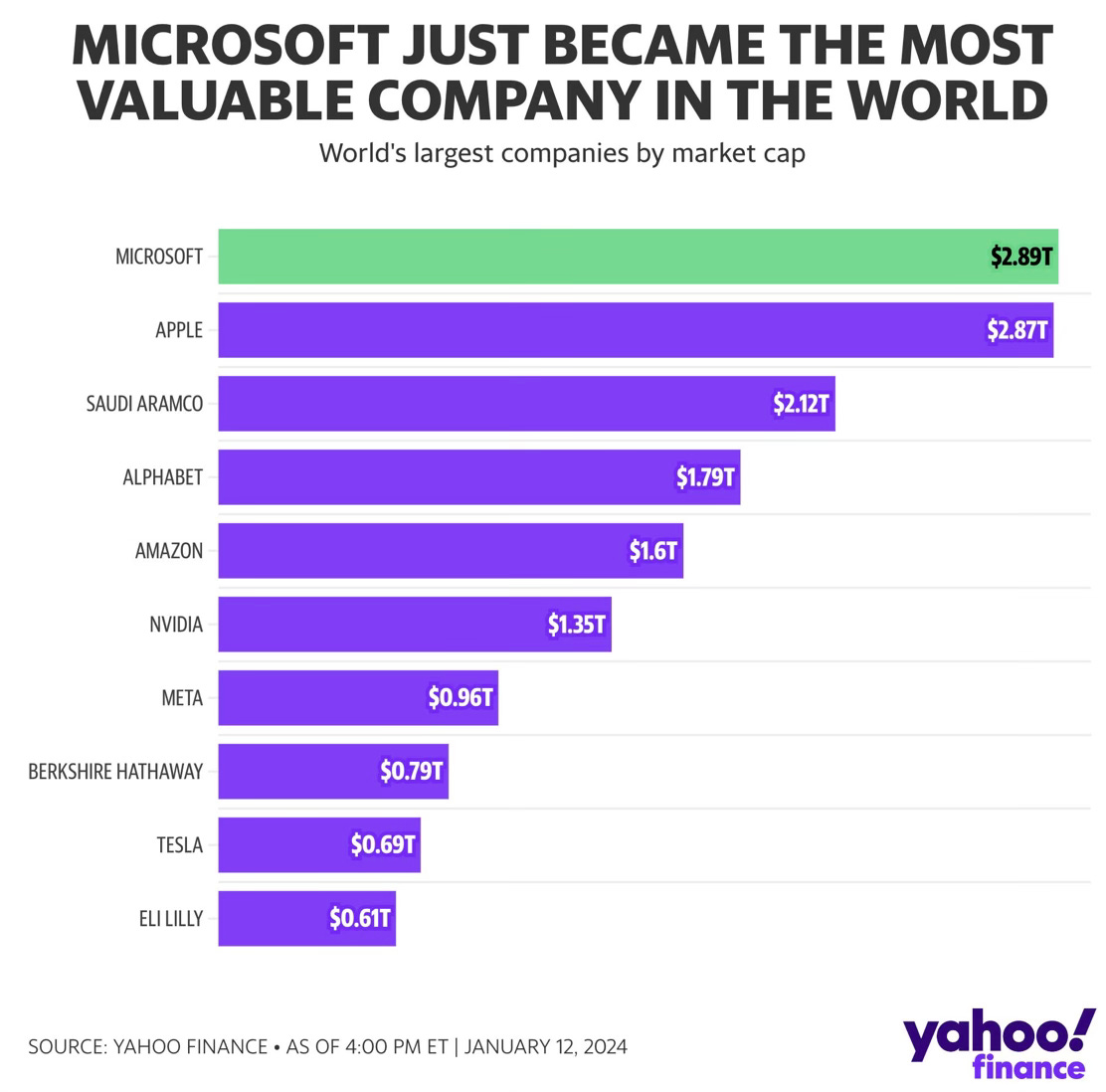

This week also saw a new leader in the race for the most valuable company in the world. Microsoft surpassed Apple for the top spot.

The Magnificent 7 also finish the week at a new all-time high.

The Mag 7 just continues to lead this market higher. With their leadership and the widening market participation from the other 493 stocks has this bull market operating on all cylinders. Until the Mag 7 stocks start to falter, there is little reason to worry that the overall market will falter.

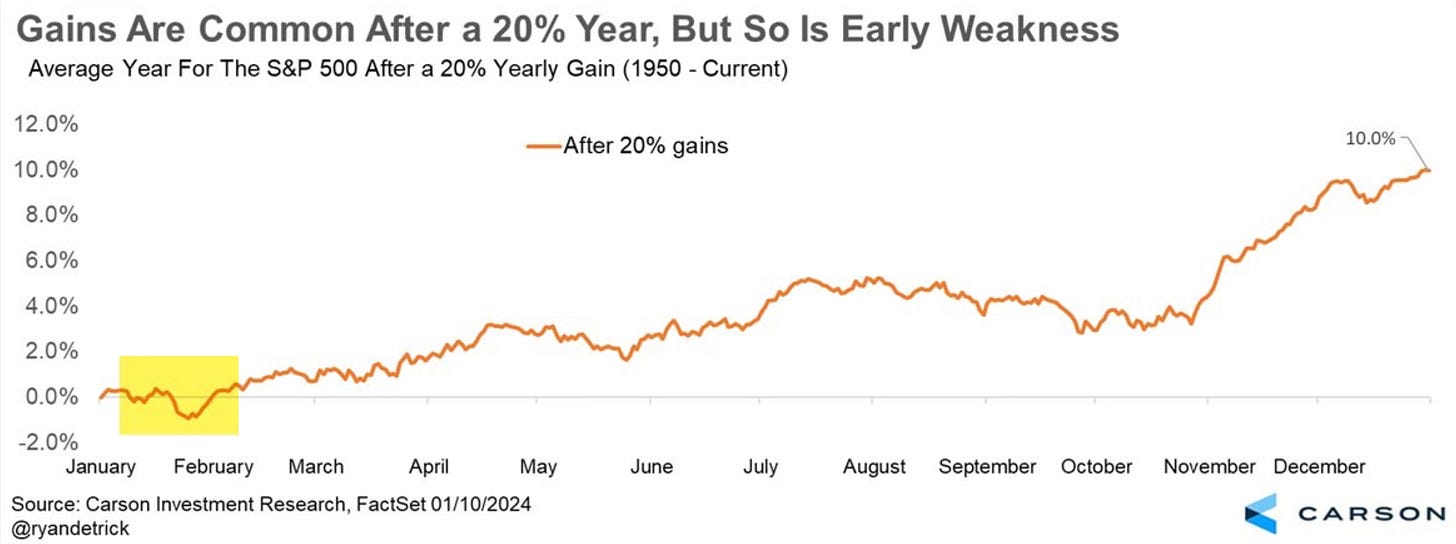

A Slow Start Is Expected

Slow starts to a year after 20% gains like we saw in 2023 are common. But as Ryan Detrick points out below, the slow start usually ends up turning into a rally the rest of the year.

Usually solid gains when all is said and done (higher 80% of time and up 10.0% on avg), but early in the year it is normal for some weakness.

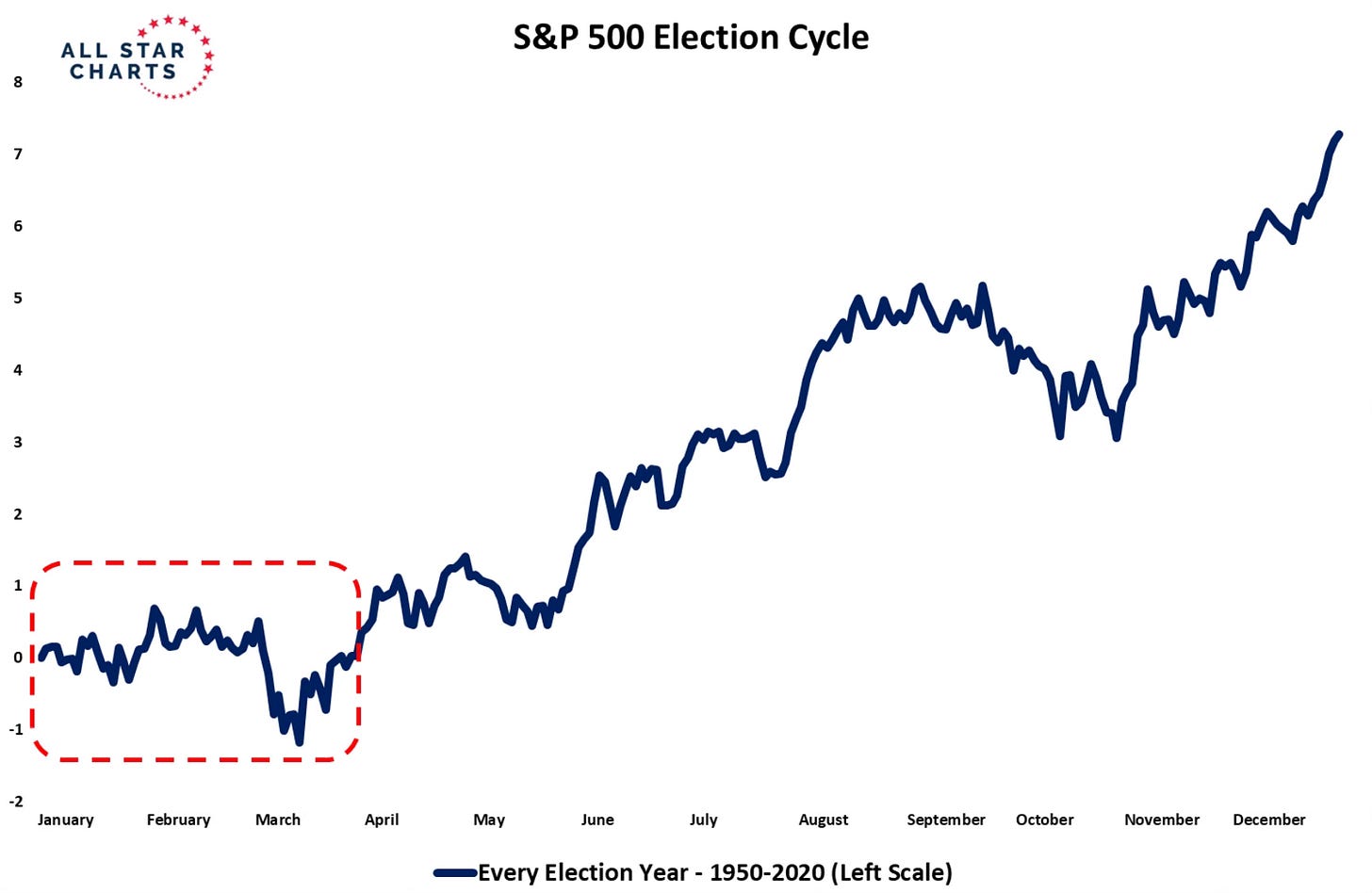

This same slow start holds true in election years, which we’re in now. It takes a few months but then we typically see a rally for the rest of the year. This chart from Grant Hawkridge shows what every election year from 1950 to 2020 has done throughout the year.

This could be taken as a good signal to buy on any weakness or pullbacks early in 2024 as history shows us in these two instances that outperformance likely comes the rest of the year.

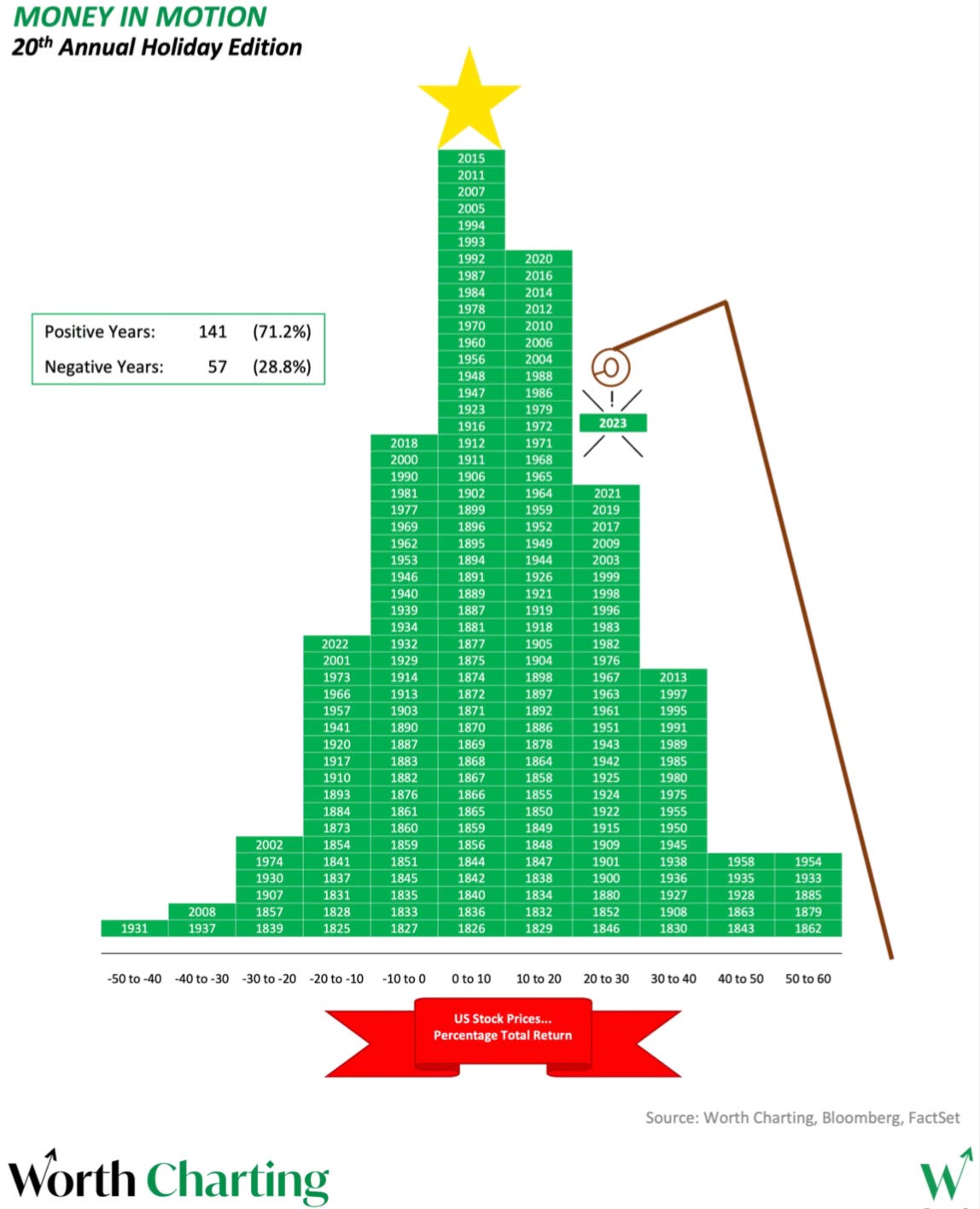

Stock Market Christmas Tree

I love this annual Christmas tree visual from Worth Charting which shows the historic stock market returns. Out of 198 years of stock market returns, there have been 141 positive years (71.2%) and 57 negative years (28.8%).

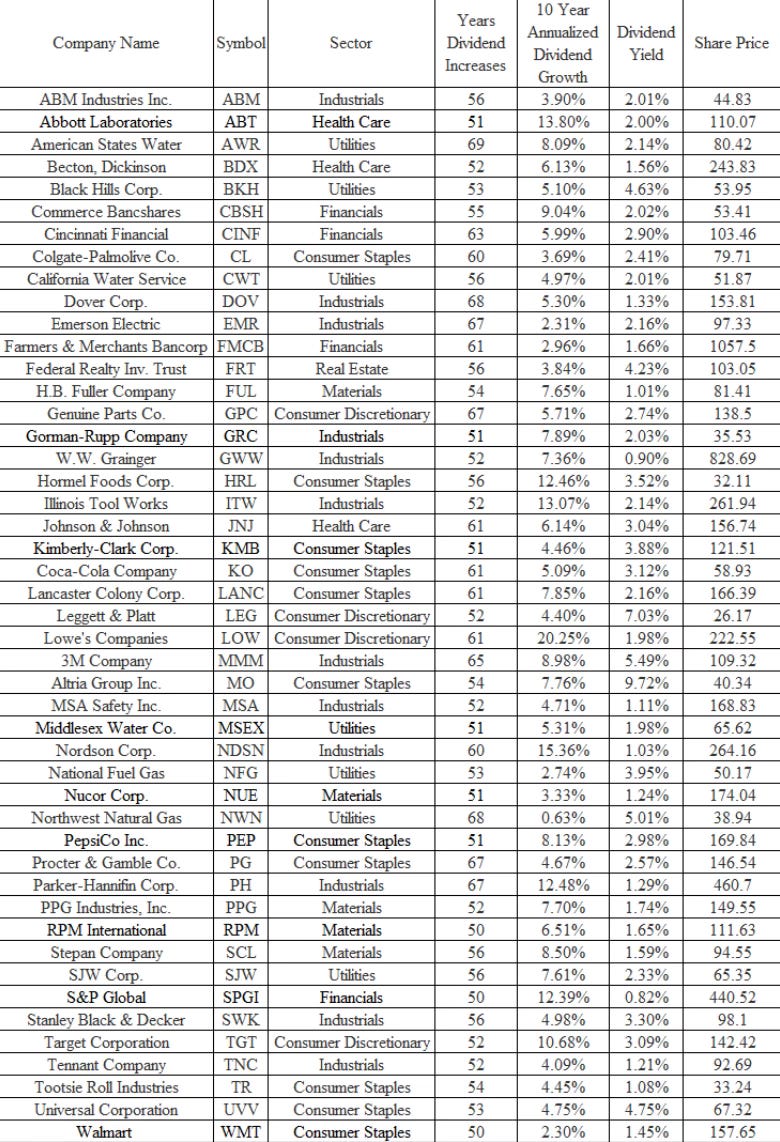

Dividend Kings For 2024

I always find this annual dividend kings list fascinating from Dividend Growth Investor. A dividend king is a company that has raised their dividend each year for at least the past 50 years. In 2024 that list is made up of 47 companies.

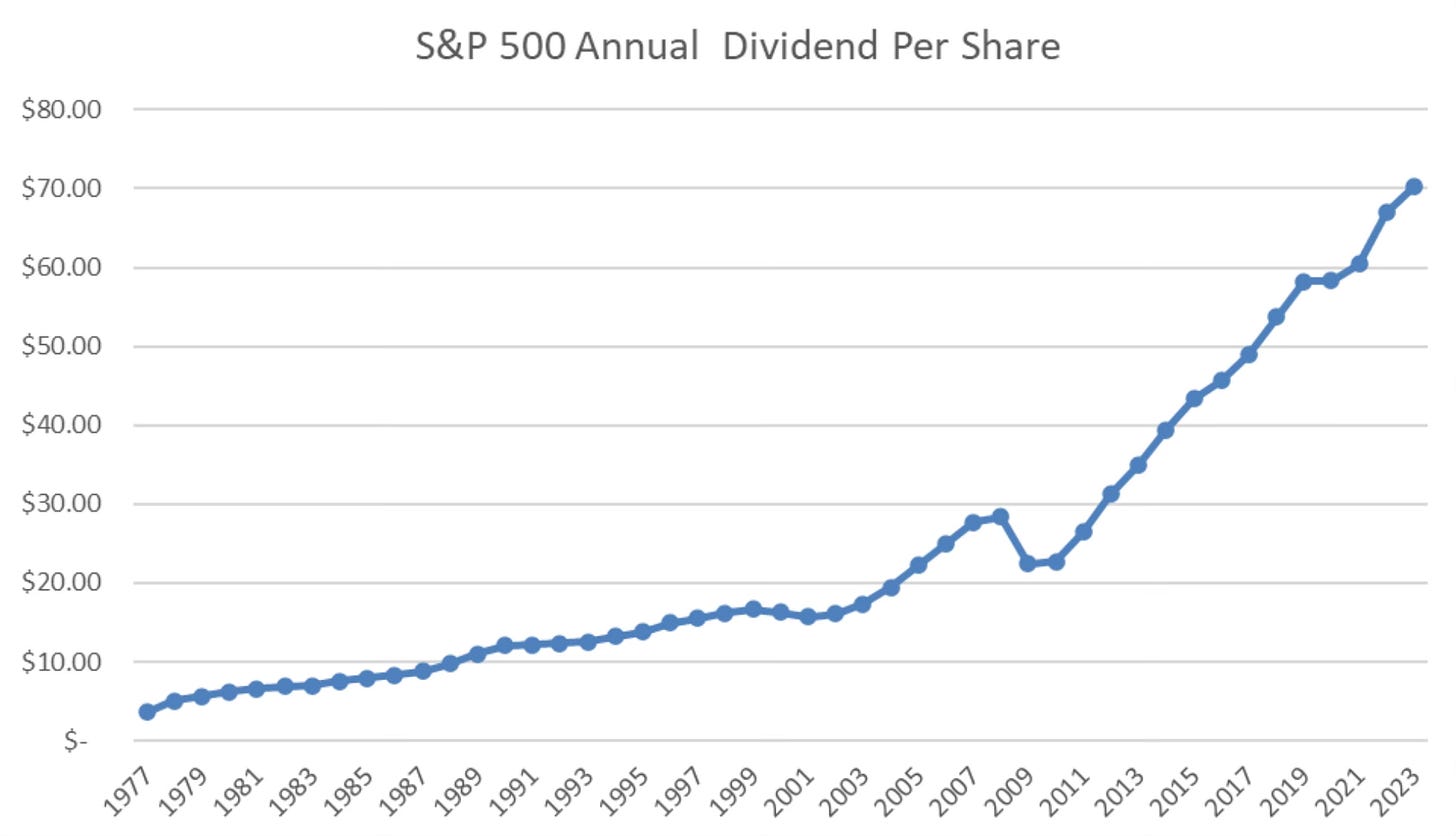

This chart about dividends also came across as interesting to me. In 2023 the S&P 500 paid a record $70.25 dividend. This now marks 14 straight years that the S&P 500 has had a dividend increase.

3 Stocks For 2024

It will be hard to do better than my 3 stock picks from 2023. Investing Update: 3 Stocks For 2023.

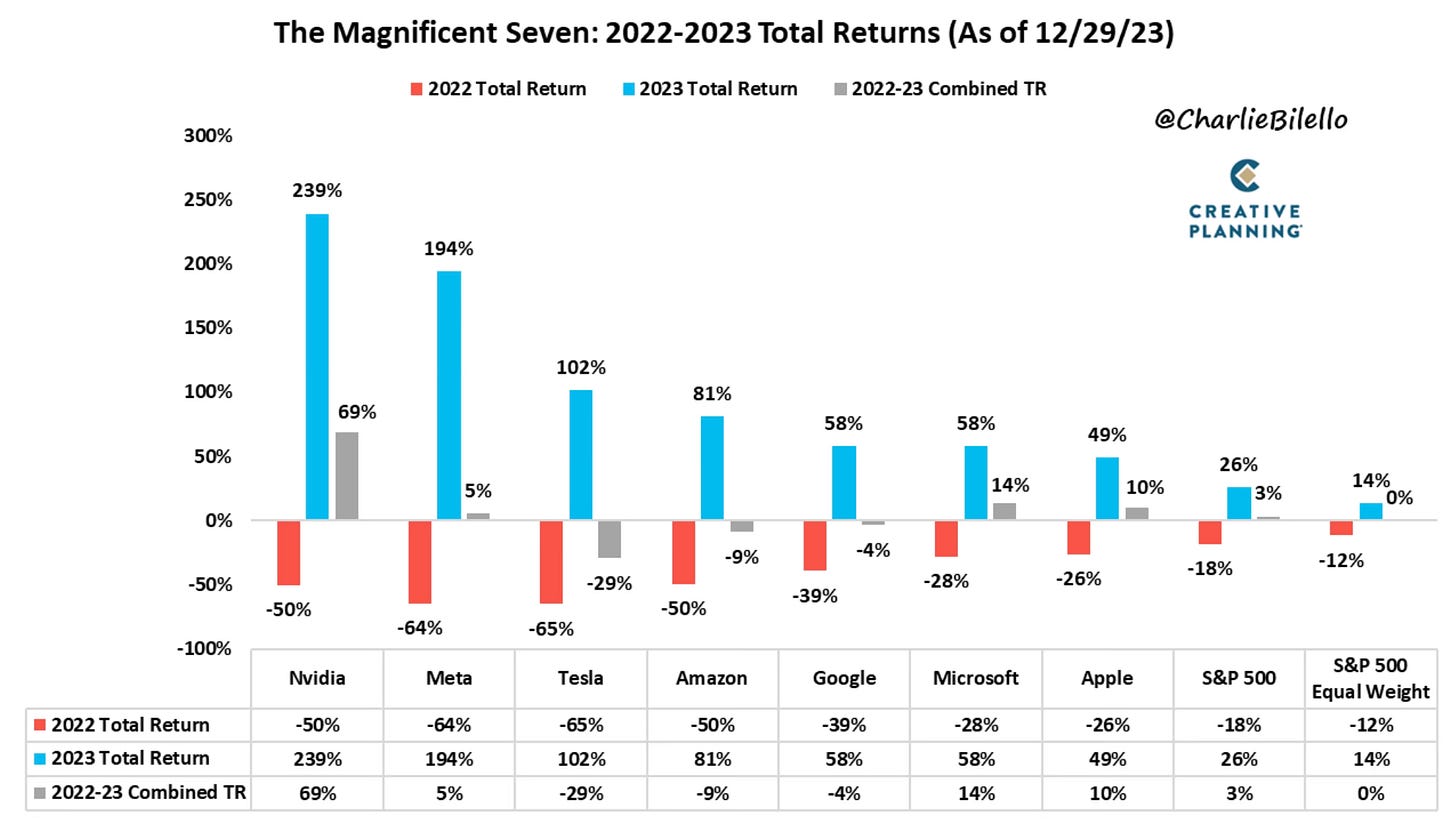

Nvidia: +238.87% (#1 performing stock in the S&P 500 in 2023)

Amazon: +80.88%

Deere: -6.74%

But here we go for 2024. I do own all three of these stocks personally and will continue to add to these names as I feel opportunity presents itself.

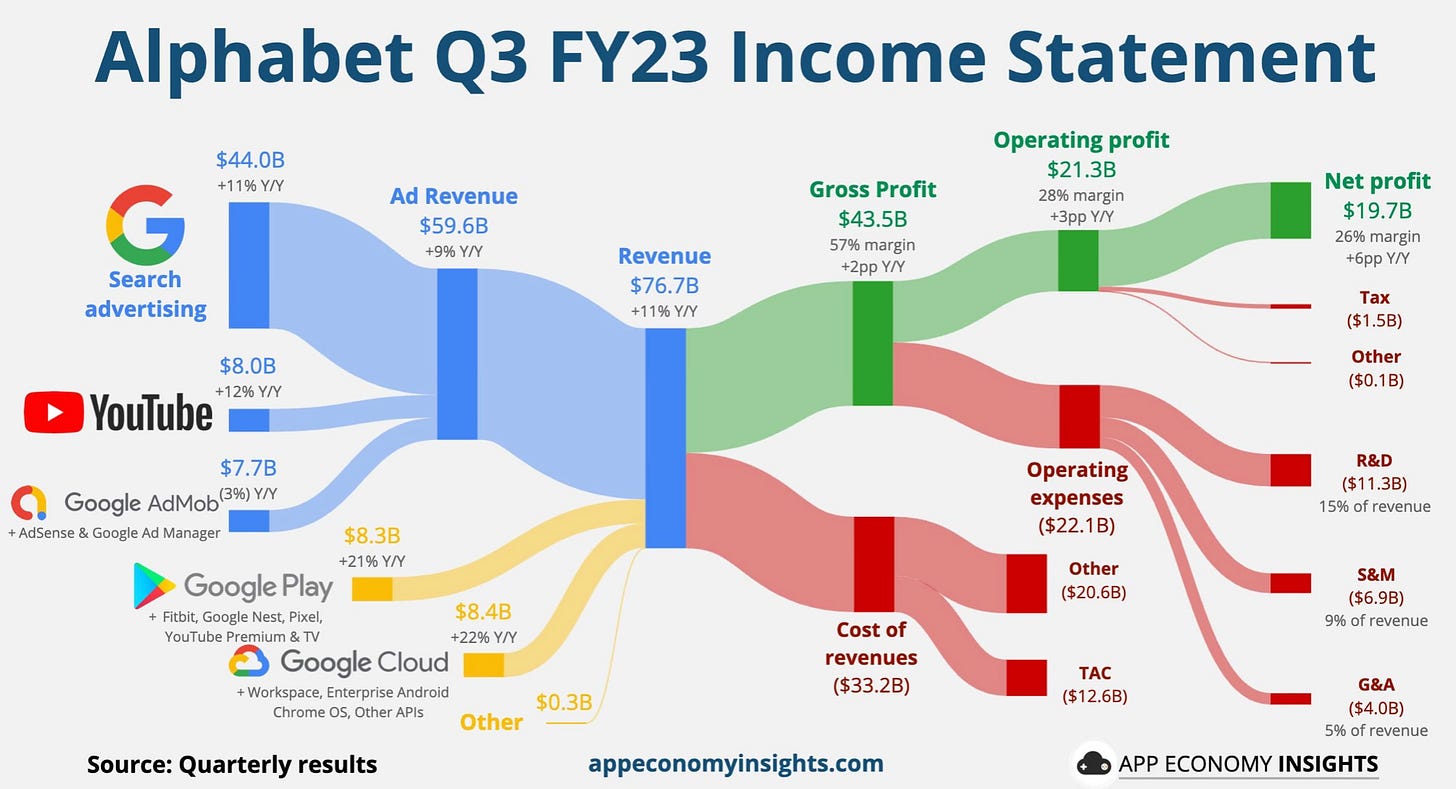

Alphabet

My first stock pick is Alphabet. This is still in my view one of the most undervalued large-cap stocks. As the AI revolution continues to play out, Alphabet is going to be right at the forefront of this new technology and offers tremendous long-term upside.

Alphabet has lagged the other Magnificent 7 stocks and it’s still not back to its high in 2021. The two-year return is actually still negative.

From a valuation standpoint, Alphabet is still the cheapest of the Mag 7 stocks by quite a bit and I think it’s significantly undervalued. It’s expected to grow as fast as Microsoft and three times as quickly as Apple. Yet it still trades at a discount to both!

Price-to-Earnings Ratio (P/E) of the Mag 7 stocks.

Amazon 80.95

Nvidia 72.27

Tesla 70.84

Microsoft 37.68

Meta 33.08

Apple 30.38

Alphabet 27.38

This then leads me to the overlooked area of Alphabet which is the YouTube story.

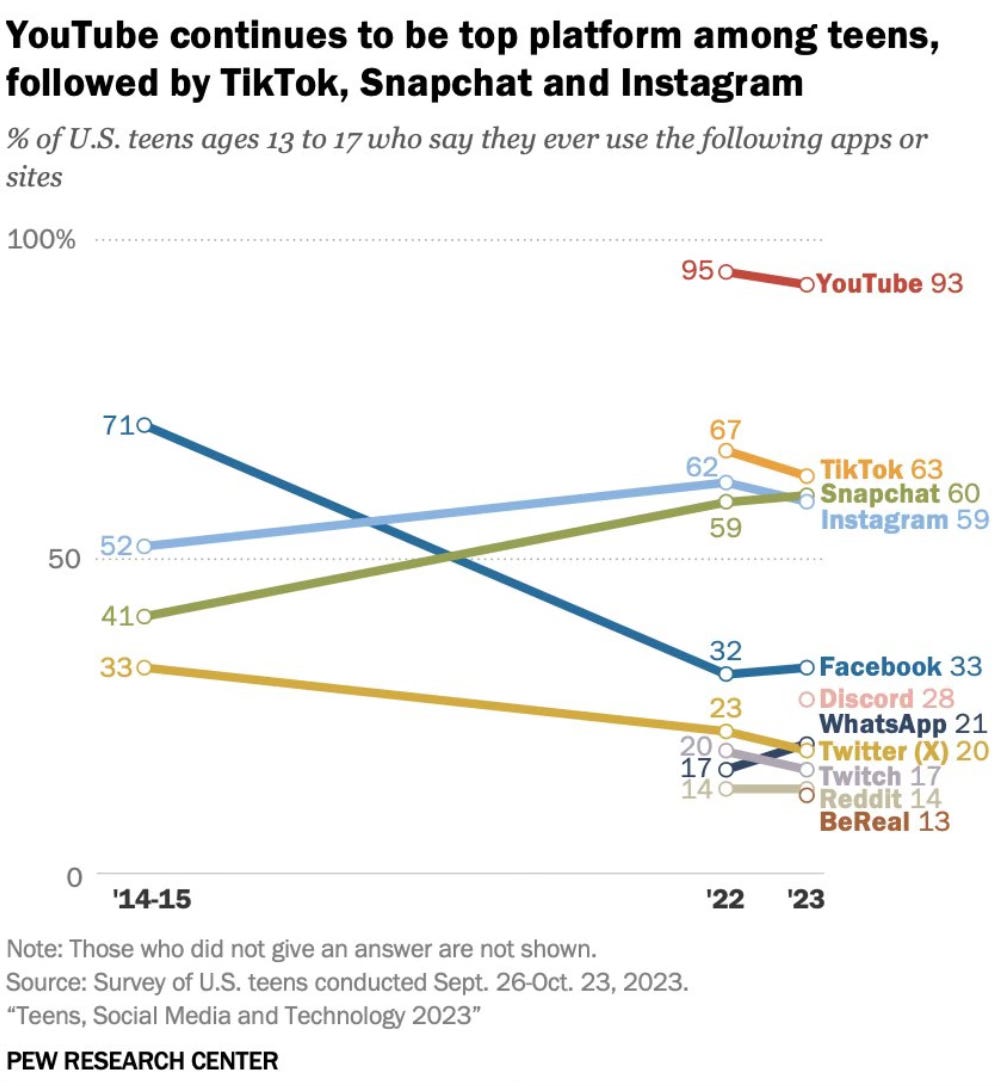

Last month Pew Research released the following survey on the top platforms among teens. I didn’t have any idea that YouTube was this popular and had such a dramatic reach. 93% of US teens ages 13 to 17 use the YouTube app. The next closest TikTok and Snapchat are not even close.

YouTube also beats Netflix in both time spent watching and ad revenue dollars. Netflix has a market cap of $215 billon. I’m starting to really wonder what YouTube alone is worth.

Below is what I’ve written in my previous Investing Updates when I’ve recently purchased shares in Alphabet.

$135: 12/9/2023- Investing Update: Fuel To Move Market Higher

$83.93: 11/12/2022- Investing Update: I Went On a Buying Spree

$95: 10/29/2022- Investing Update: Investor Cash Levels Rise

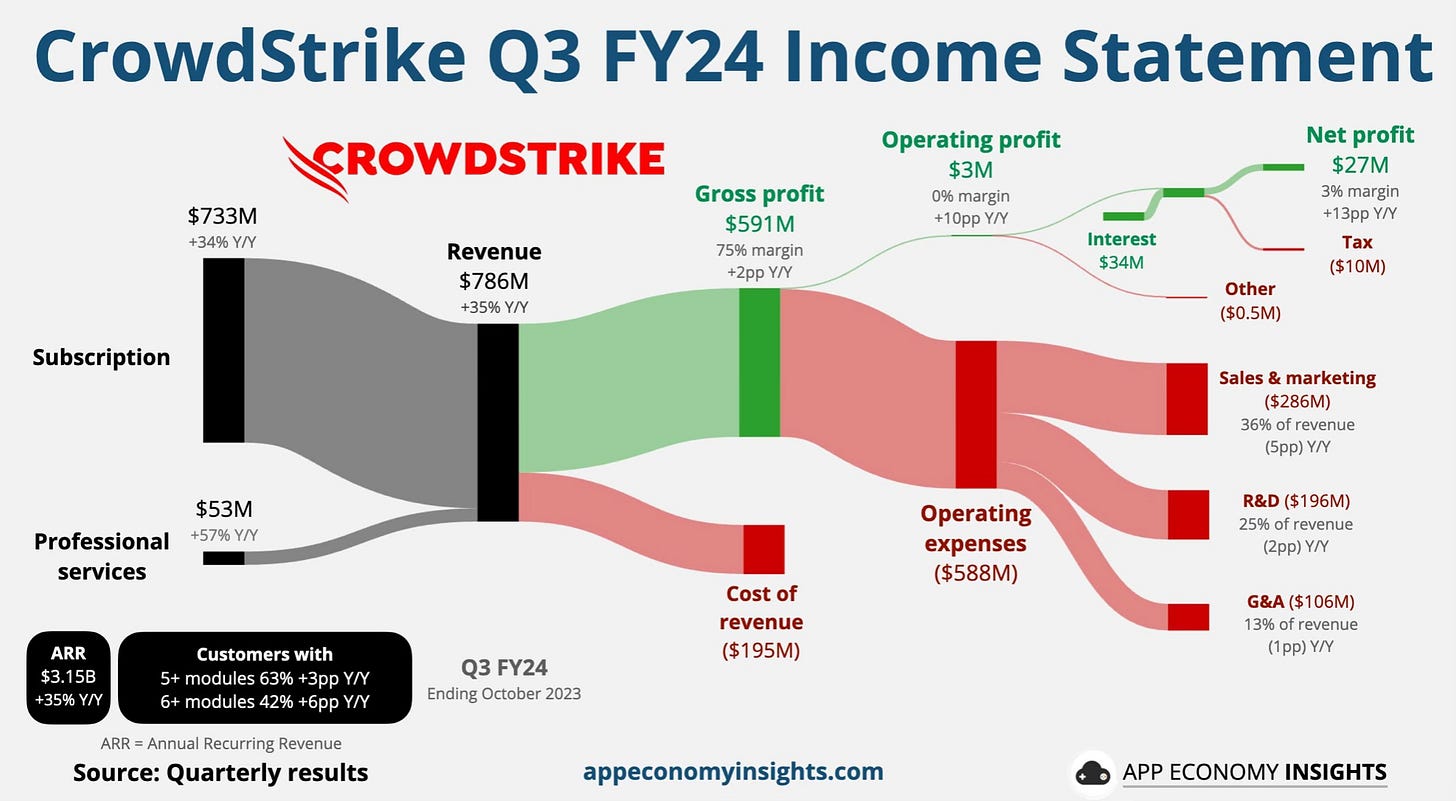

CrowdStrike

My next pick is CrowdStrike. Readers of Spilled Coffee know that this has been my favorite growth stock since I started my position in 2020 at $125 a share. Now at $283 a share, I still feel there is still major upside. Even after a 142.9% rise in 2023.

I believe that in 2024, cyber security will be the best sub-sector of technology. Data and customer information protection is becoming a top priority for companies. That leads to big gains for the company that I think is best in class, CrowdStrike.

In the never-ending world of data breaches and cyber attacks on companies and even individuals, it’s hard to find sectors and companies with a bigger available TAM (Total Addressable Market) or pricing power opportunity in the years ahead.

Below is what I’ve written in my previous Investing Updates when I’ve recently purchased shares in CrowdStrike.

$144: 6/24/2023- Investing Update: Bull Market or Bear Rally?

$122: 4/29/2023- Investing Update: Insider Buying Returns

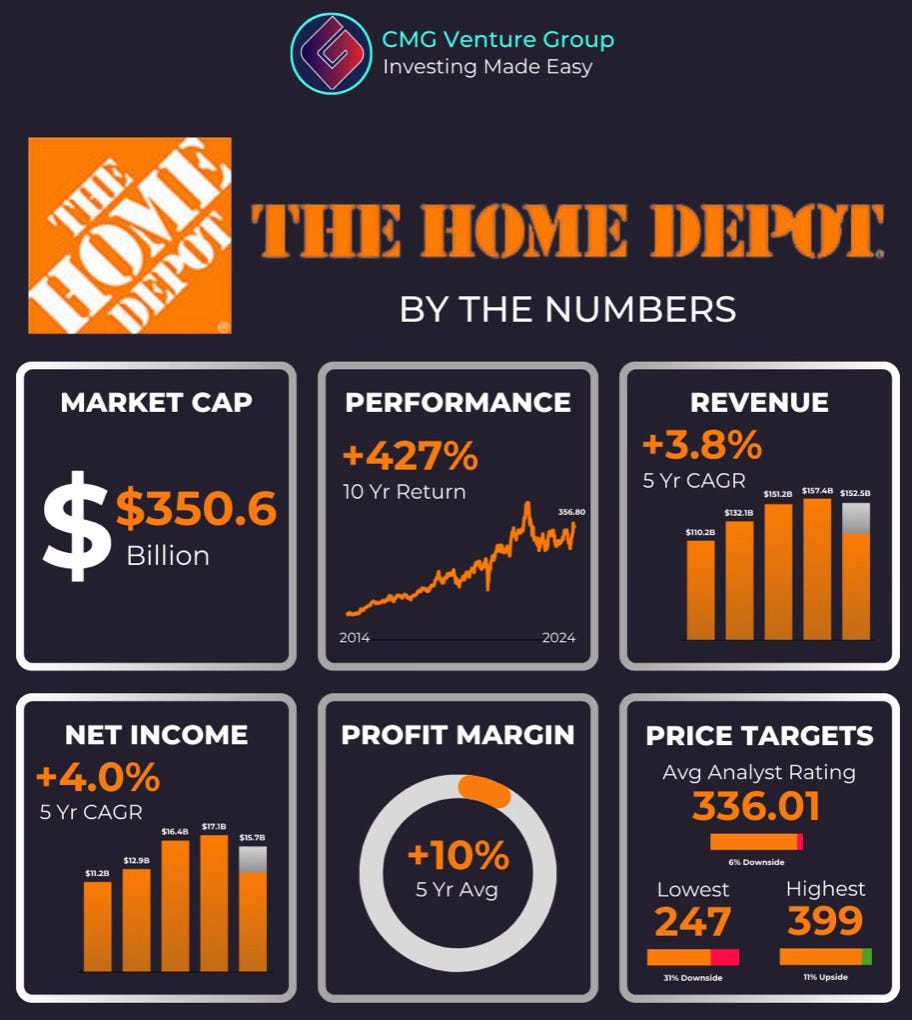

Home Depot

My final picks is a bit of contrarian idea in Home Depot.

Over the past two years the stock is negative 9%. We’ve just seen home builders hit new all-time highs, yet Home Depot has lagged the construction and housing theme. I think that changes in 2024.

I think the housing theme returns in 2024 behind lowering mortgage rates, increased housing demand and further renovations and construction spend. I expect Home Depot to break out to new all-time highs in 2024.

Below is what I’ve written in my previous Investing Updates when I’ve recently purchased shares in Home Depot.

$291 share: 10/7/2023- Investing Update: Is It Time To Buy?

$285 share: 5/13/2023- Investing Update: Buy in May and Stay?

The Coffee Table ☕

Edwin Dorsey at

compiled a list of the best free and paid resources for investors in Our 2023 Hedge Fund Analyst Christmas List. This is a long, detailed and excellent breakdown of various sites and people who are worth following. I’ve discovered some good new follows.I really enjoyed Barry Ritholtz’s post, Are You Bullish or Bearish in 2024? He looked at 2024 from both sides. Reasons to be bullish and also reasons to be bearish. A good outlook to 2024 from where things currently stand.

I picked up a bottle of the newly released Kentucky Owl’s Maighstir Edition. They partnered with a scotch whiskey master blender to come up with this year’s limited edition bourbon. I came away tasting dark fruit, cinnamon and vanilla. It finished sweet and spicy with some cherry and almonds to me. It’s a very good bourbon but it doesn’t quite match their limited edition from last year, which was the Kentucky Owl Takumi Edition.

Thank you for reading! If you enjoyed Spilled Coffee, please subscribe.

Spilled Coffee grows through word of mouth. Please consider sharing this post with someone who might appreciate it.

Order my book, Two-Way Street below.