Investing Update: 2025 Recap & 2026 Outlook

What I'm buying, selling & watching

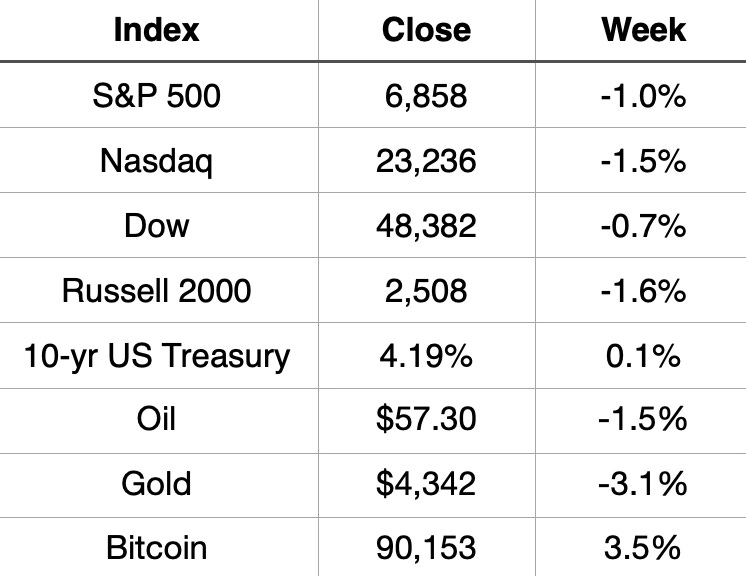

The holiday shortened week ended with the S&P 500 finally posting an up day on Friday, snapping a four‑day losing streak. The Nasdaq, meanwhile, fell for the fifth consecutive session. This marks the second straight year that the annual Santa Claus rally failed to appear for investors. Now all eyes turn to 2026.

Market Recap

Weekly Heat Map Of Stocks

2025 Recap

The S&P 500 finished 2025 up 16.4%, marking its third consecutive year of gains. The Nasdaq climbed more than 20% for the third straight year, while the Dow rose 13%, also finishing above 10% for the third year in a row.

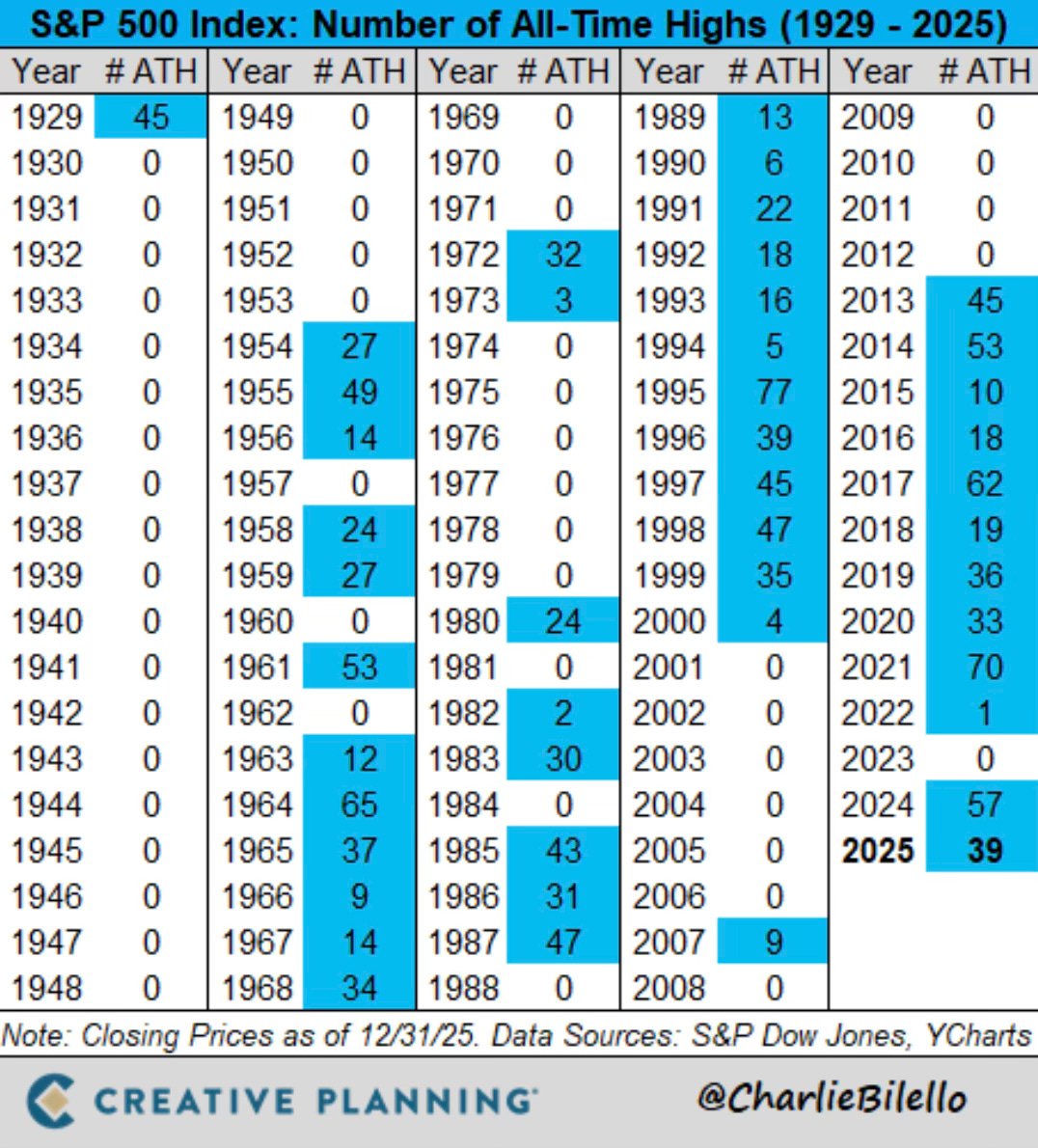

In 2024, the S&P 500 set 57 new all-time highs. 2025 continued the trend, adding 39 more new all-time highs.

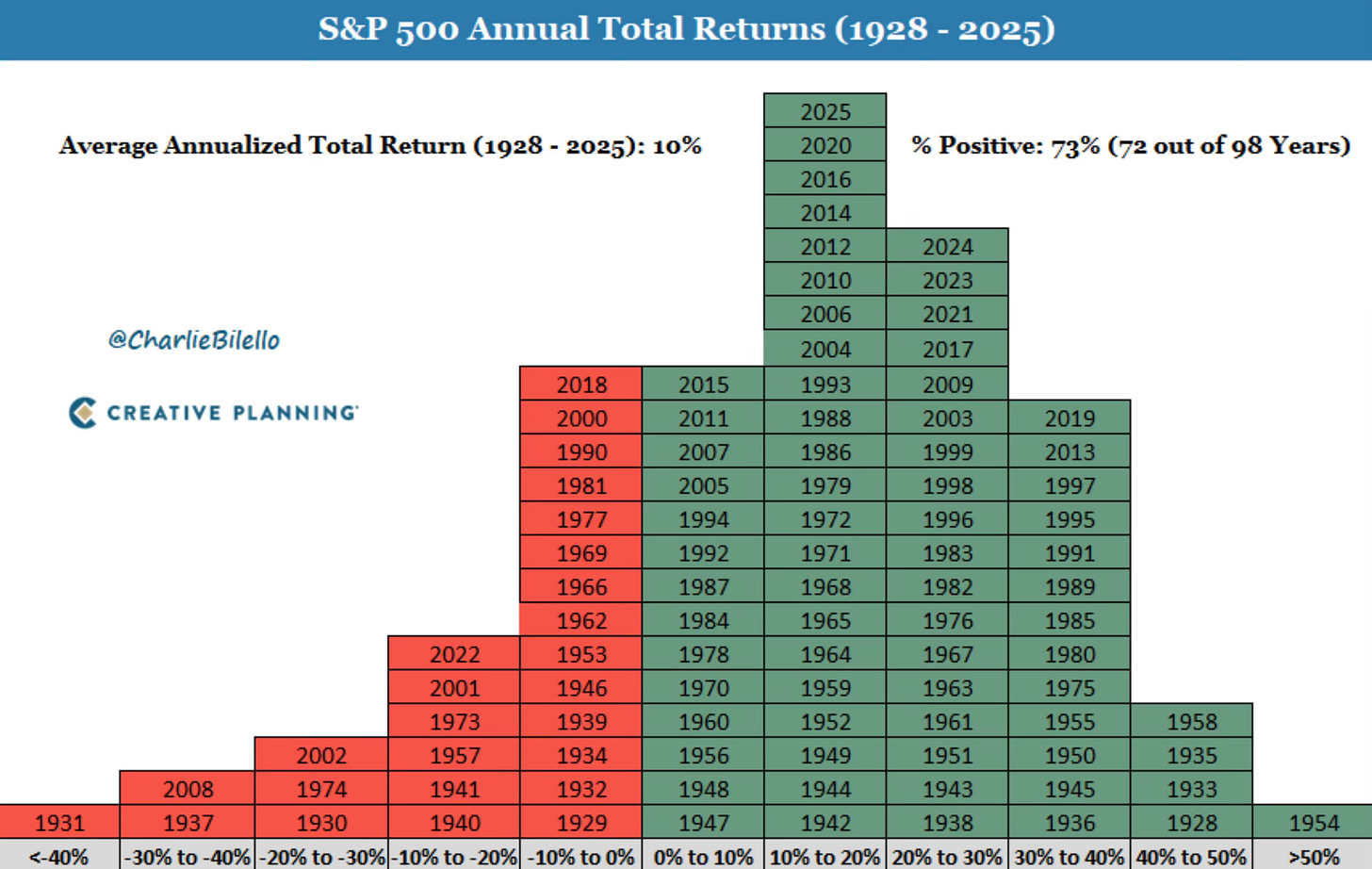

The pyramid of returns adds another to the 10-20% category. Out of the last 98 years, the S&P 500 has been positive in 72 of those years. That means it has had a positive year 73% of the time.

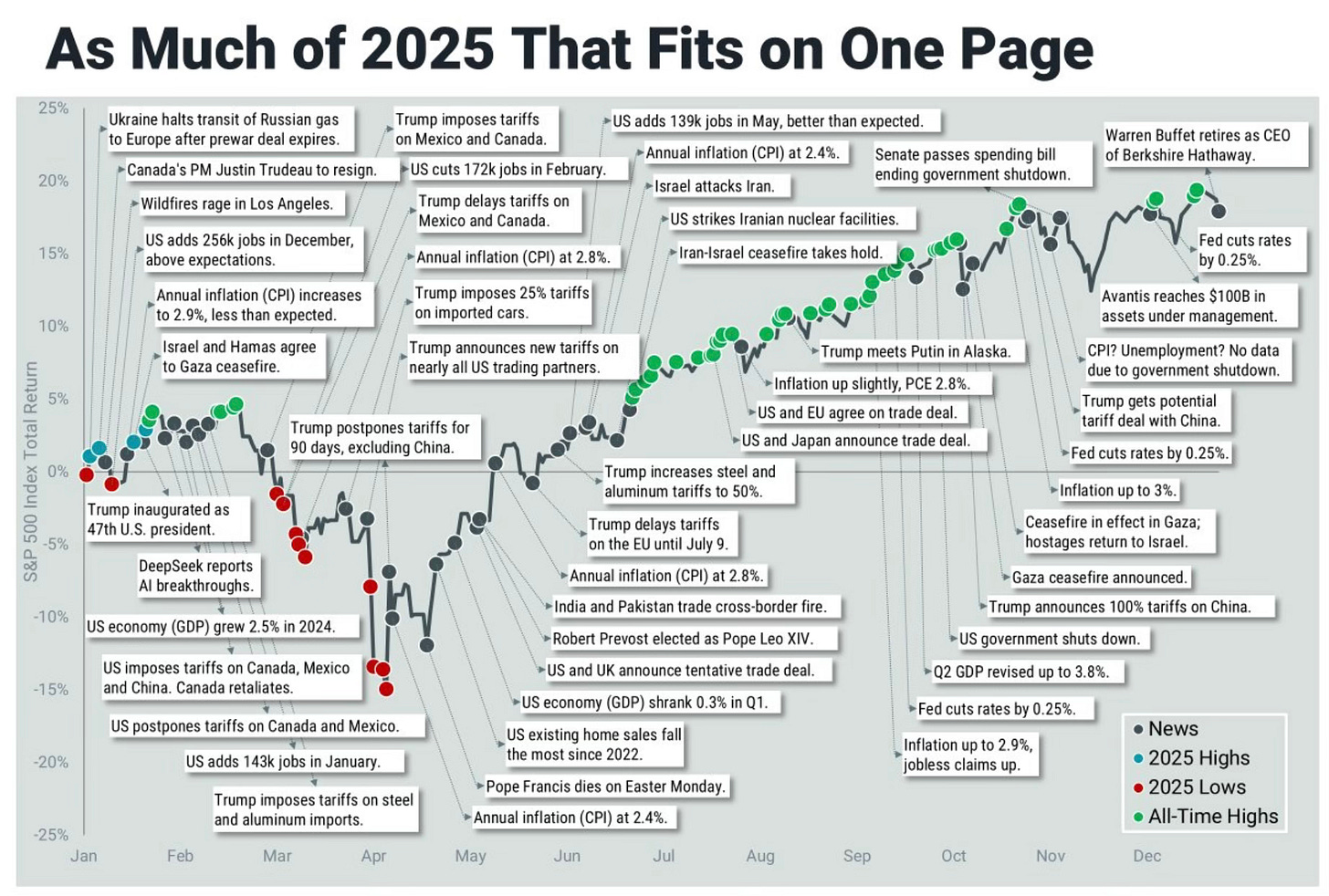

Do you recall all that happened in 2025?

This visual lays out, in chronological order, the key events of the year. As always, a lot happened. At the moment, each event feels significant, moving the market up or down. Yet year after year, the stock market proves its resilience and keeps moving forward. Despite what the fear mongers might say, that direction has historically been higher more than 70% of the time.

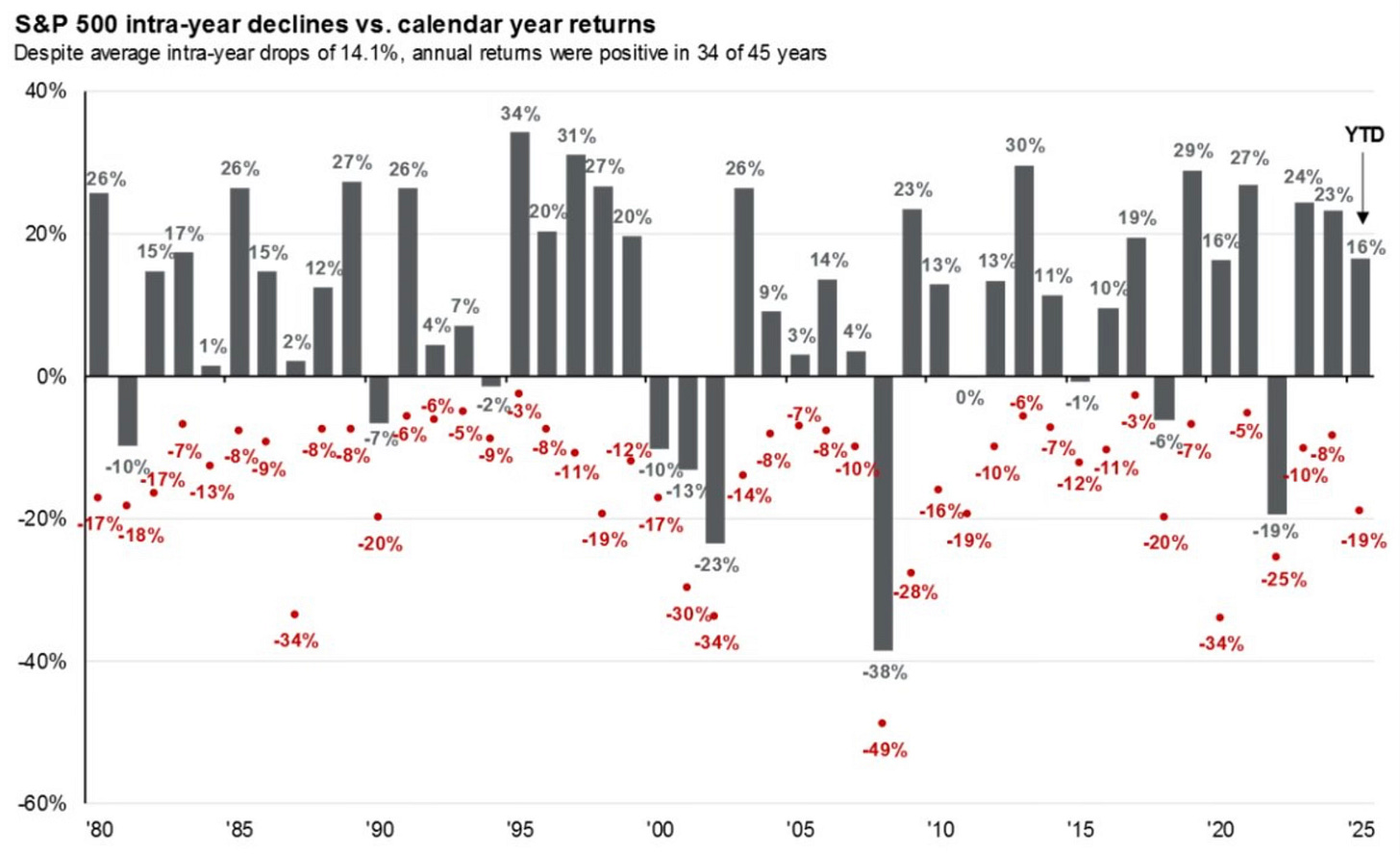

Like each year, that path isn’t just a straight line up. There are always drawdowns. In 2025, that largest drawdown was 19%.

Here are how the Dow components finished out the year. 23 of the 30 stocks finished up on the year. Caterpillar and Goldman Sachs led the way, both returning over 50%. On the other end, Salesforce and UnitedHealth had years to forget. For the second straight year, Nike is in the bottom three. Is the iconic company ever going to bounce and reclaim its past glory? Or is its best years in the past?

Here is the heat map showing how each stock in the S&P 500 performed in 2025.

The best performing stocks in the S&P 500 in 2025 were led by Sandisk and Western Digital. Palantir, the top performer in 2024, finished 9th in 2025.

Then here are the worst performing stocks in the S&P 500. I will usually look this list over for interesting buys in the coming year, but at first glance, nothing jumps out at me.

I think most will be caught by surprise when you tell them that only two Mag 7 stocks outperformed the S&P 500. Only Google and Nvidia beat it in 2025.

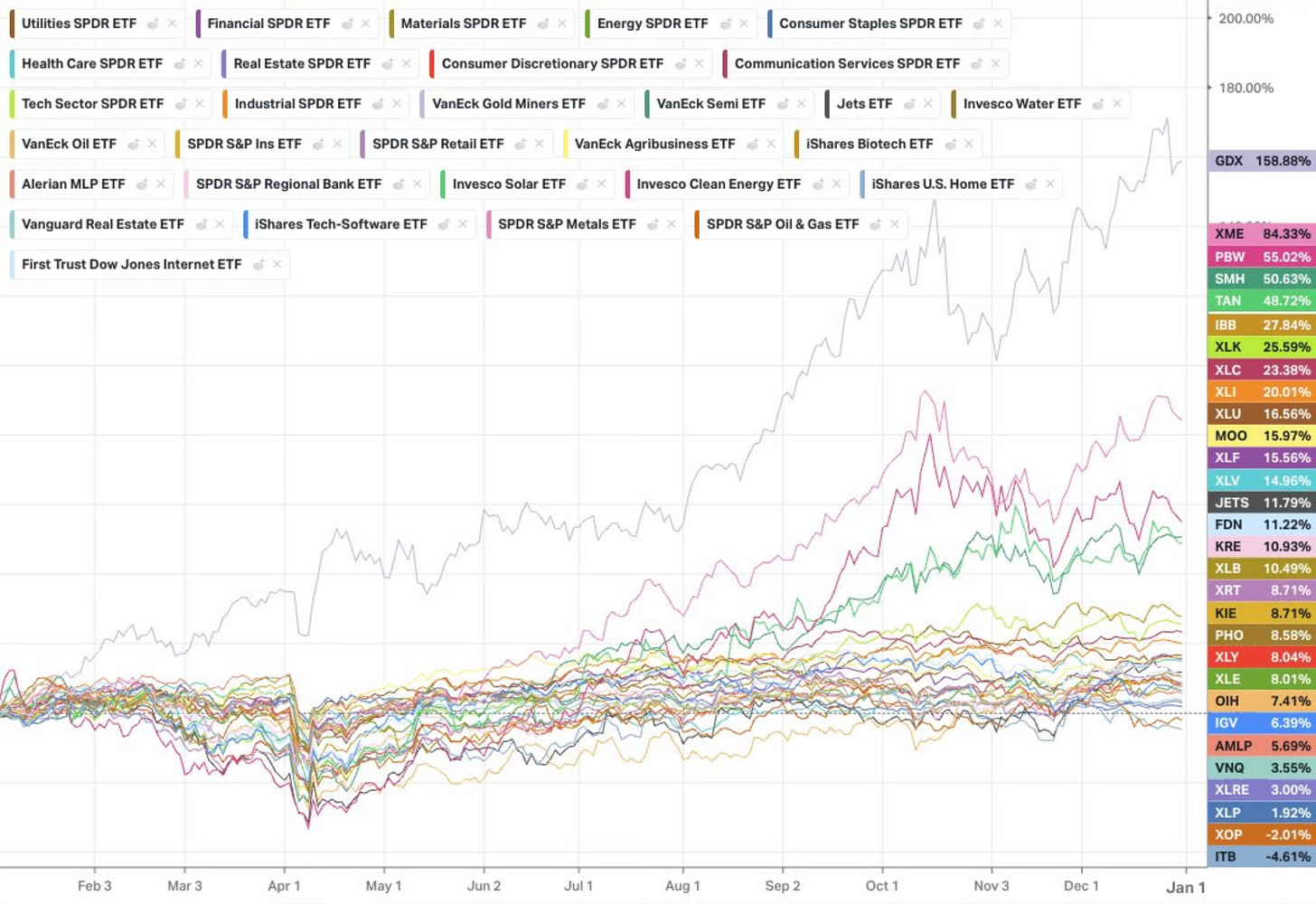

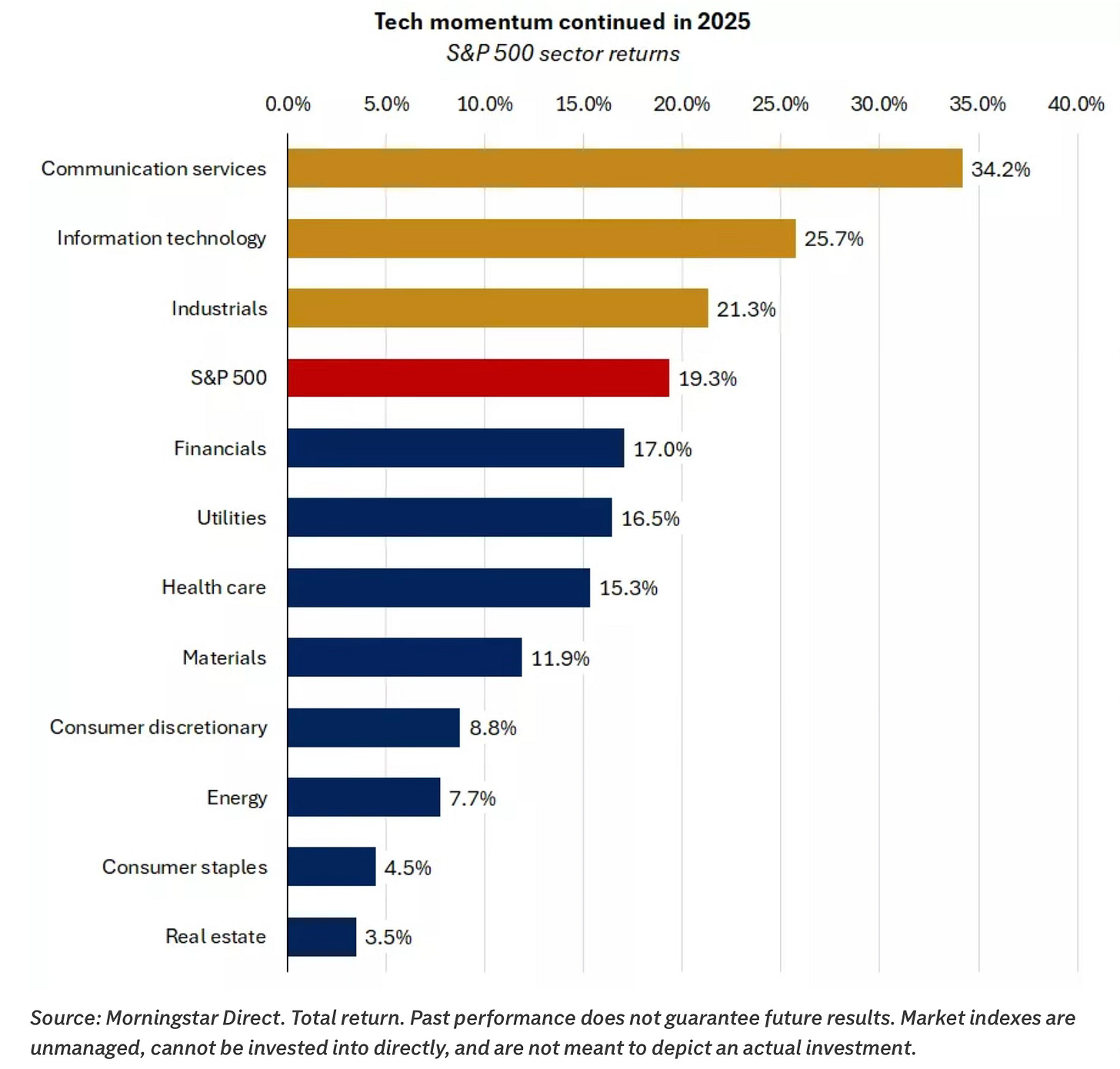

From a sector standpoint, only 3 of the 11 sectors outperformed the S&P 500 in 2025, though all sectors finished the year in positive territory. Communication Services once again led the way, while Materials lagged, just as they did in 2024.

I like this chart that shows how major assets performed throughout the year. It shows how volatility came and went throughout 2025. Winners were gold miners, metals, clean energy and semis.

Here is a look at how commodities fared in 2025. Silver had a dominate 2025. We will see if that carries over into 2026.

Then there is my favorite chart of asset class returns looking back to 2011 through 2025.

My 2025 Call of S&P 6,900

The S&P 500 finished 2025 at 6,846. I predicted on January 4, 2025 that the S&P 500 would finish 2025 at 6,900 in my Investing Update: 2024 Recap & 2025 Outlook.

Here is what I said.

I don’t think we see a repeat of a third year in a row of over 20% in 2025. I’m expecting much more volatility and bigger drawdowns this year which will provide buying opportunities. I’m expecting a 10-15% correction in 2025.

I think a lot of that volatility will come when the 10-year hits 5%. That will cause a growth scare and spook the market.

Even with that I’m still expecting the S&P 500 to celebrate S&P 7,000 in 2025, but the year finishes just below that mark at 6,900.

I reiterated my belief that we finished the year at 6,900 in September in my Investing Update: S&P 6,900 By Year-End? In it, I said the following.

I’m still sticking by that number. Even with expecting a pullback over the coming weeks, I still believe we finish at 6,900. Like I said, this upcoming pullback will be a buying opportunity which will then lead to a rally into year-end.

My prediction ended up less than 1% from where it finished the year. I’m not sure if I will ever get that close to the exact number ever again. It turned out to be one of my best years ever in predicting what the overall stock market will do.

Where do I see 2026 finishing? We will get to that in a bit.

My Performance In 2025

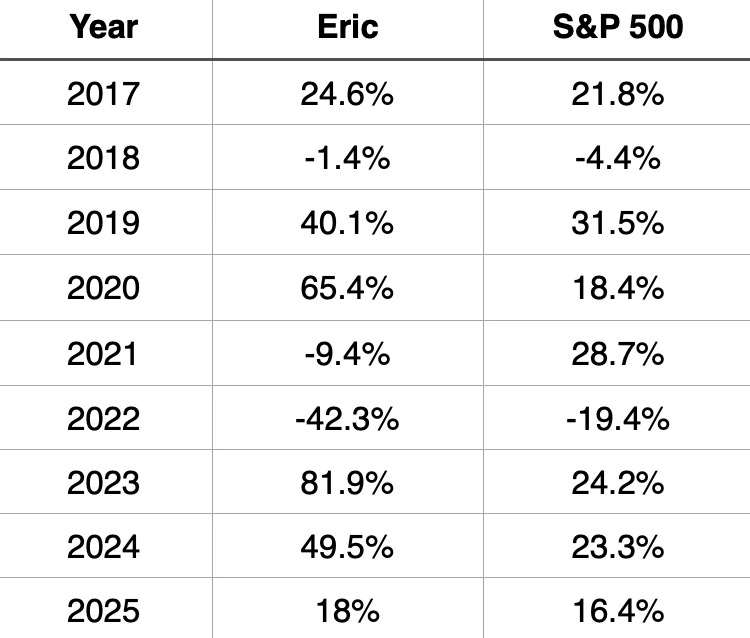

I wanted to look at where my actively managed portfolio and my 3 stock picks for 2025 finished up versus the major indices.

My Portfolio (Actively Managed): +18%

Dow: +13%

S&P 500: +16.4%

Nasdaq: +20.4%

Although my 2025 performance didn’t match 2023’s 81.9% or 2024’s 49.5%, I’m still very satisfied with how the year turned out.

I’m proud to say this will mark the 3rd consecutive year, and the 7th time in the past 9 years that I’ve outperformed the S&P 500.

I include this chart to remind myself of just how difficult it is to outperform the S&P 500 consistently.

Only 22% of actively managed large-cap funds have outperformed the S&P 500 this year, the lowest proportion since 2016 and well below the average of 40%.

Now let’s take a look at the stocks that currently make up my portfolio, as well as my 2026 outlook.