Coming off of two strong years in 2020 and 2021, the market ended 2022 with one of the worst years on record.

DOW 33,153 -8.78%

S&P 500 3,840 -19.44%

Nasdaq 10,467 -33.10%

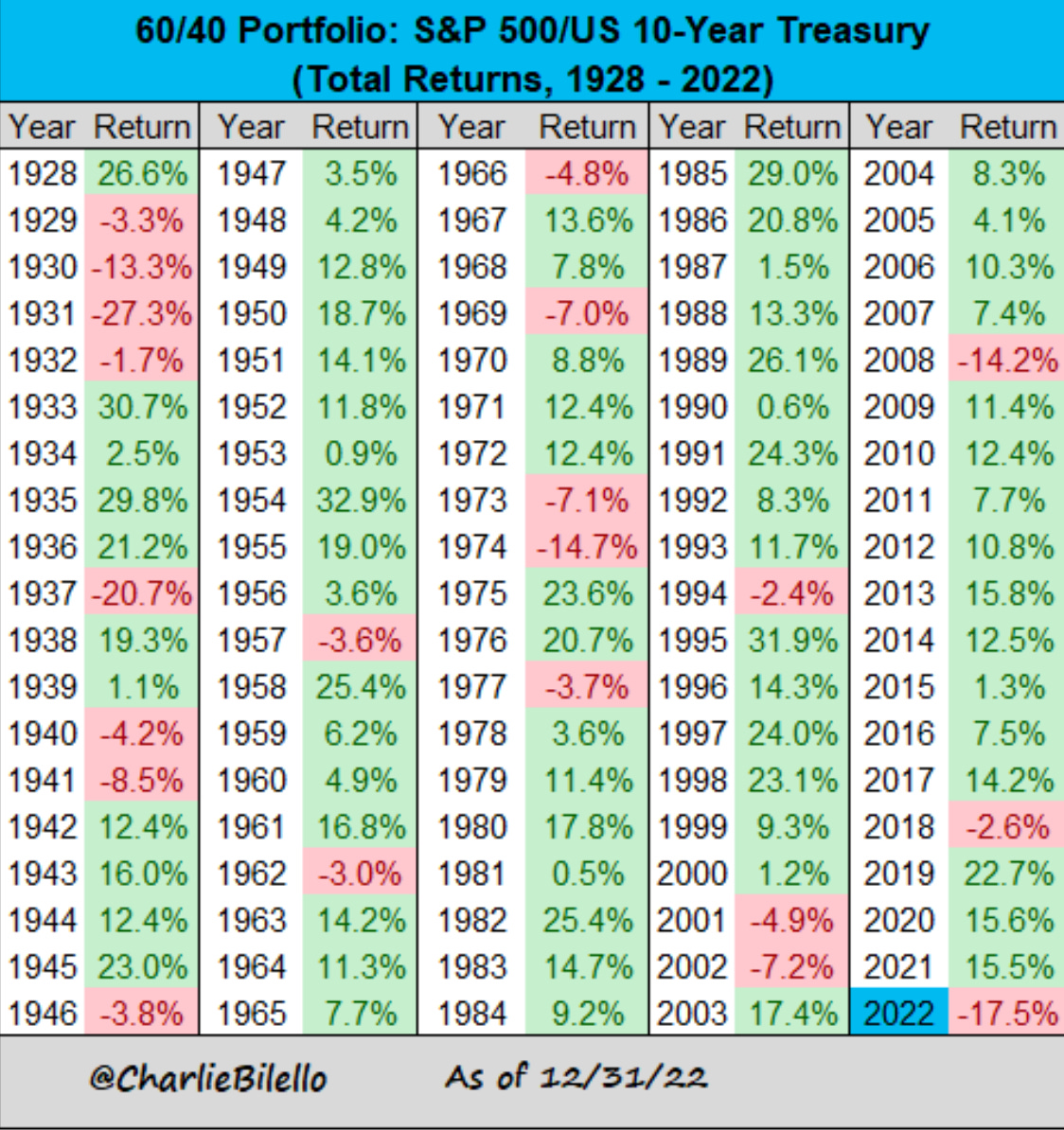

We saw the S&P 500 have its 7th worst return in history. The Nasdaq had a 13-year positive returns streak come to an end. It was the worst year in history for the 10-year treasury bond. The traditionally conservative 60/40 portfolio (60% stocks and 40% bonds) had the 3rd worst year in history.

Below are some easy to read charts which illustrate the history of the S&P 500, 10-year treasury and 60/40 portfolio on a total return basis.

Even the most popular mega-cap tech stocks got crushed in 2022.

Apple AAPL 0.00%↑ -26%

Microsoft MSFT 0.00%↑ -28%

Alphabet GOOGL 0.00%↑ -39%

Amazon AMZN 0.00%↑ -50%

Meta META 0.00%↑ -64%

Wall Street strategists didn’t see this coming either. Going into 2022 the consensus was for the S&P 500 to finish around 4,800. 2022 ended at 3,840.

These are some of the smartest people on Wall Street. But this shows two things. It shows just how hard it is to know what the stock market will do and the consensus by which everyone thinks is going to happen, isn’t always the right path to follow.

2023 Outlook

As we turn the page to 2023 we should look back to history for what happens when we come off of a down year. It tells us just how rare it is for back-to-back down years. As Tom Lee illustrates below, coming off 21 instances of annual declines, 18 of those following years the S&P 500 was higher. Down only three times the following year.

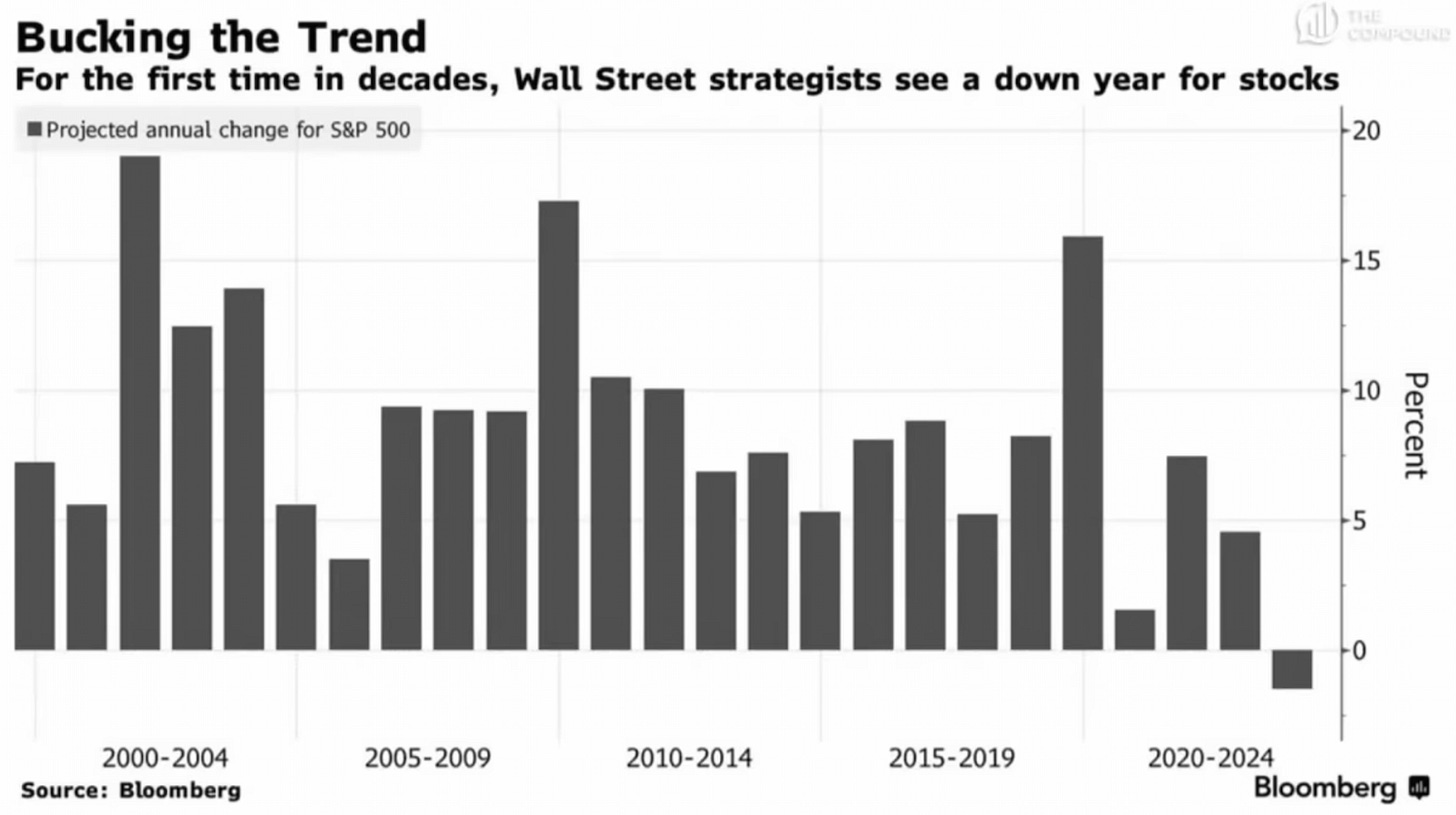

Wall Street strategists are predicting the first down year in decades. 1999 was the last time the consensus was a down year for stocks.

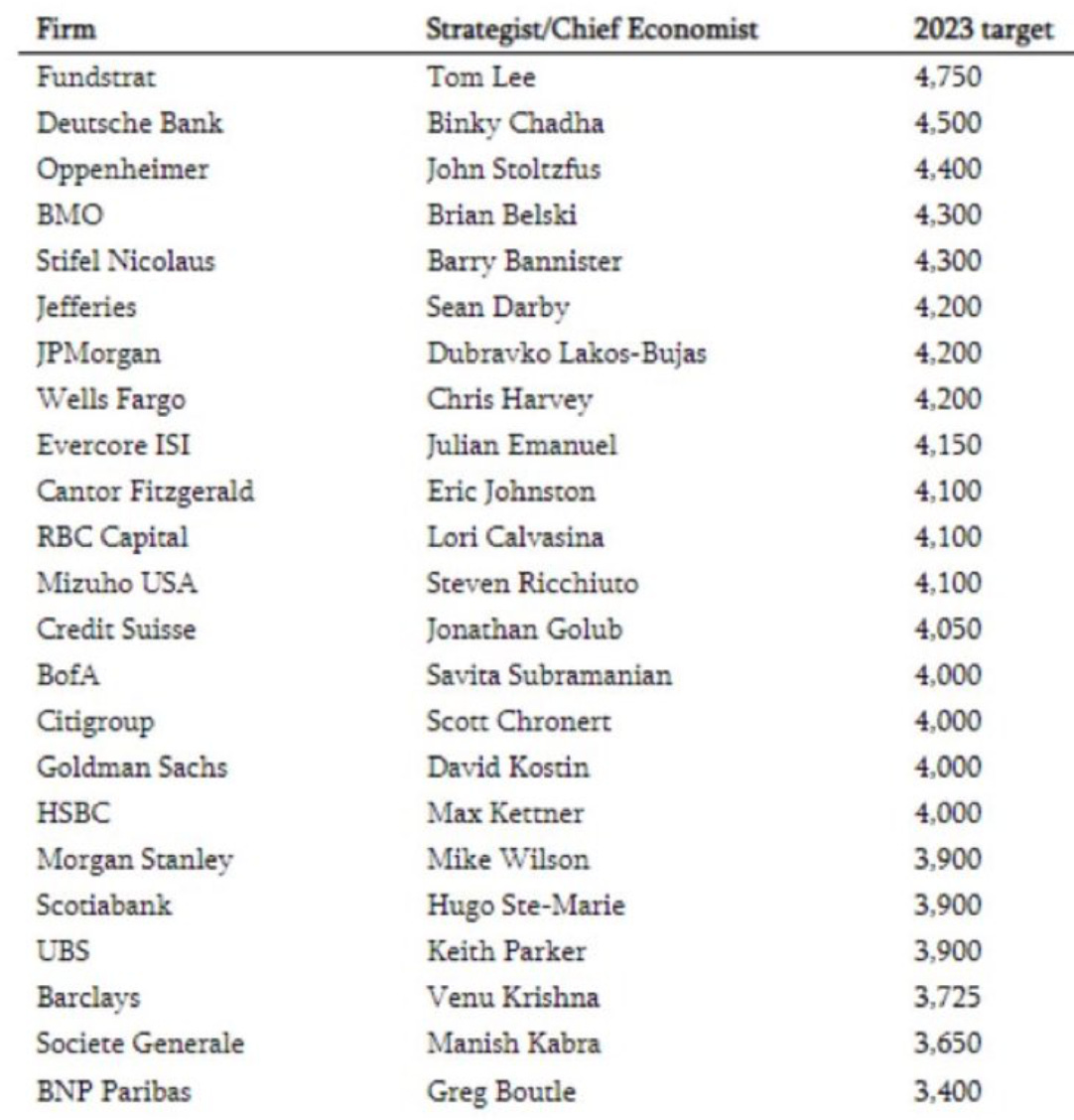

Here is where some Wall Street strategists predict the market will finish in 2023.

The consensus for where we end 2023 per Sam Ro's post on TKer.

The range of forecasts is pretty wide, and so different surveys are yielding different results. Bloomberg surveyed 17 strategists who had an average forecast of 4,009. Reuters’ poll of 41 strategists revealed a median forecast of 4,200.

My Outlook

Consensus on 2023 is bearish. We hear about the high likelihood of a recession now at 70% per a survey done of economists by Bloomberg. The Fed is playing hardball and raising rates. If this is consensus, then to what extent is all this negativity priced in? Does the market already have a shallow recession priced in? A deep recession priced in?

The recession word and the depth of it will be a debate moving forward as unemployment is still at only 3.5%, which takes us back to 1969. I also feel inflation as well as wage inflation has peaked.

Consumer sentiment still sits near all-time lows.

We haven’t seen equities this under owned relative to bonds dating back to March 2009.

Things are as bearish as I can remember for such a long stretch. Everyone I talk to seems to be bearish and negative about the stock market. Friends and family have told me they’re putting their money here and there instead of in the stock market.

The last time these conversations came up was 14 years ago. It was the same people at the same time of the year as I recall it well during the holidays in 2008. As we now know it turned out that the stock market had already bottomed in September of that year.

Consensus and seemingly everyone being on the same side of the boat looks good and sounds good until it isn’t. If you’re looking at investing in months sure you can be bearish and skittish to invest. But my investment horizon is many years out. If your horizon is measured in years, this is what you want if your putting money to work.

I’m expecting a tough start to the year. I think we retest the October lows of 3,577 on the S&P 500. I think it will hold and then things take off to have a positive above average return for 2023. I’m calling it a rock n’ roll rally. We’ll rock backwards and go down, but then that momentum fuels us to the upside as a new bull market begins. For a number as I know many of you’ll ask, I’ll say 4,350.

My bullish view and this side of the boat has a lot of empty seats. I’m fine with that. In my next investing update on 1/21, I’ll share what buys I’m going to be making to start the year.

The Coffee Table ☕

Kyla Scanlon who writes kyla's Newsletter had an excellent post on 2022 called 2022 was Really Weird. She reviewed everything from crypto to commodities to housing to venture capital to human behavior. It was an enjoyable read.

The Onveston Letter | Beating The Index had a piece called Dart-throwing monkeys vs. Cathie Wood. Who wins? I found it both entertaining and interesting.

Ben Carlson wrote two good pieces on the markets in 2022. They were Why Markets Were Down in 2022 and 2022 Was One of the Worst Years Ever For Markets

Thank you for reading! If you enjoyed Spilled Coffee, please subscribe and/or give a gift subscription for others.

Spilled Coffee grows through word of mouth. Please consider sharing this post with someone who might appreciate it.

Disclaimer: This is not investment advice. You should not treat any opinion expressed as a specific inducement to make a particular purchase, investment or follow a particular strategy, but only as an expression of an opinion. Do your own research.