Investing Update: 2 Stocks Saying No Recession

What I'm buying, selling & watching

Stocks again added to their gains for the year. The Dow was up 1.2% for the week and up 2.2% YTD. S&P 500 up 0.8% for the week and up 7.8% YTD. So far the big gainer for the year, the Nasdaq was up 0.3% for the week and up 15.8% YTD.

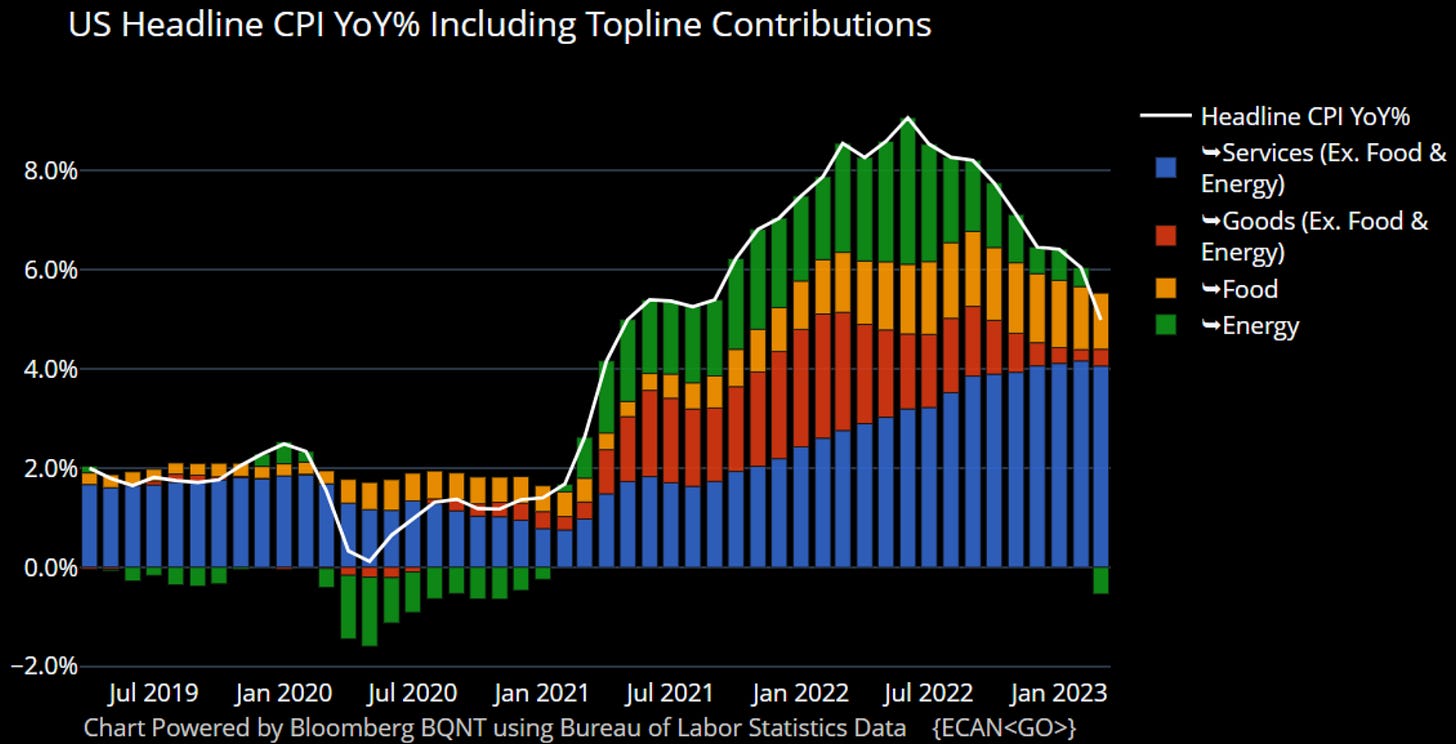

Yet we keep hearing the talking heads and pundits keep saying the market has it wrong. Maybe they’re wrong. The Fed may be done with rate hikes. The banking crisis and further contagion fears are subsiding. Banks started to kick off earnings Friday and results have looked very good. Then what I think may be the biggest story is that inflation continues to drop.

June 2022 9.06%

September 2022 8.20%

December 2022 6.45%

March 2023 4.98%

Do you sense a trend?

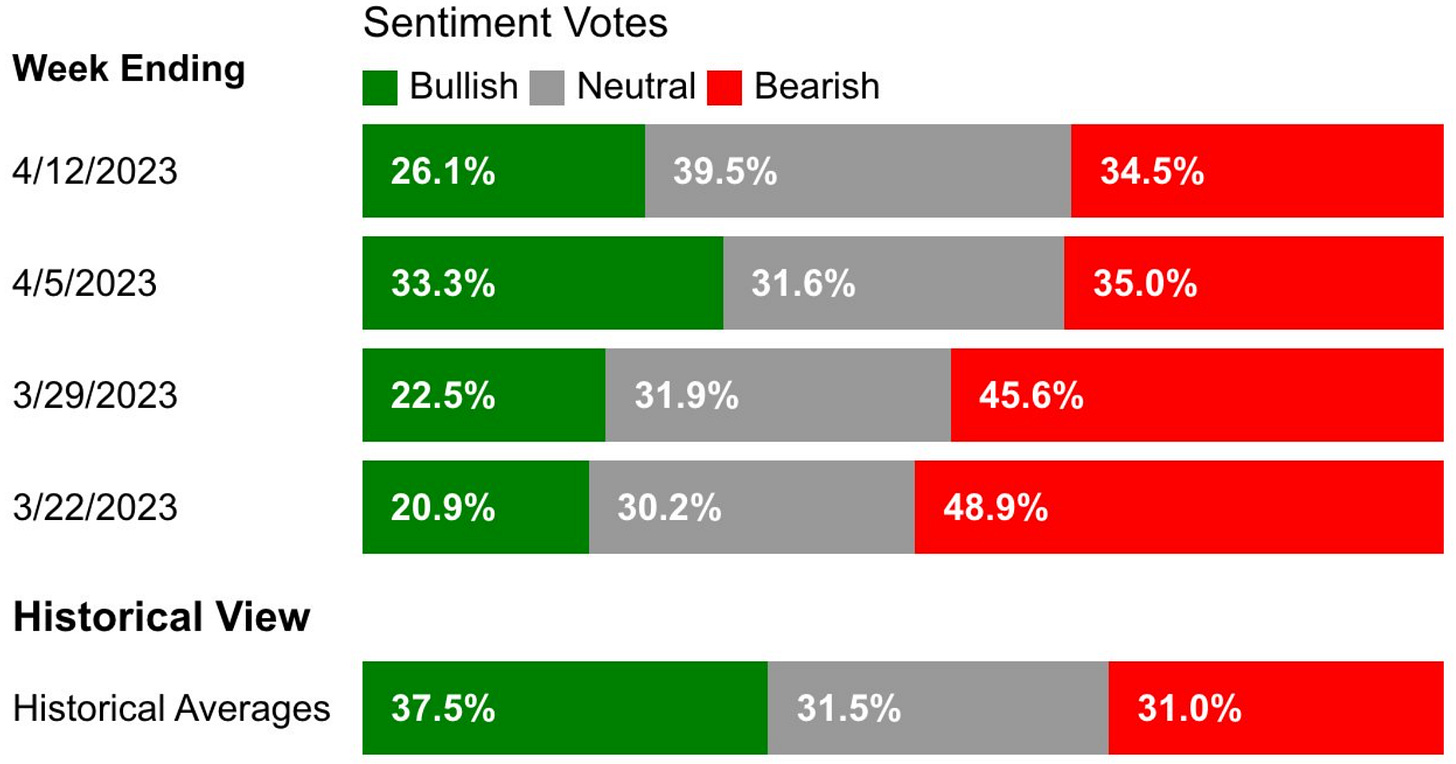

Bullish Sentiment Falls

Weekly sentiment shifted from starting to get more bullish back to being very neutral and still with an emphasis on bearish. Neutral which is essentially unsure has really spiked to almost 40%. The bullish side sits at 26.1% down from 33.3% and it continues to be way below the historical average of 37.5%.

Bears are doubling down further. Hedge funds are now sitting with their largest net short position in the S&P 500 since 2011.

Volatility Hits 52-Week Low

This week saw the VIX (Volatility Index) reach a new 52-week low on Thursday. For all the risks and worries that are out there this is saying that the volatility expectations over the next 30 days are extremely low.

Not everything is great but things seems to be going rather well. There are risks just like there always is. But things definently aren’t as bad as some have been painting the picture to be. The VIX is painting us a different picture.

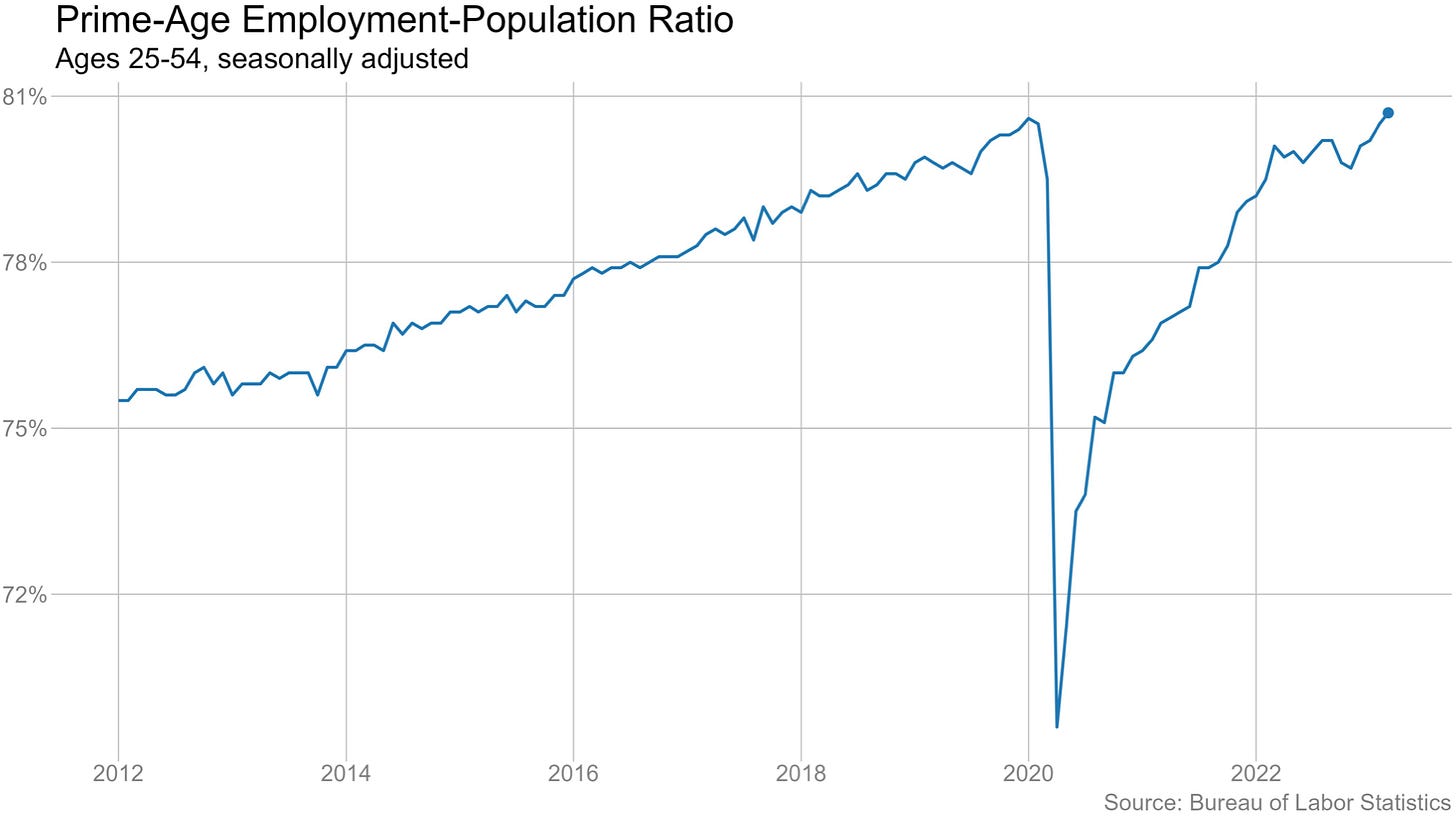

Workers Have Returned

The nobody wants to work theory just got debunked this week. We now have the prime-age employment-population ratio which is for ages 25-54 hit 80.7%. That’s the highest rate dating back to May 2001.

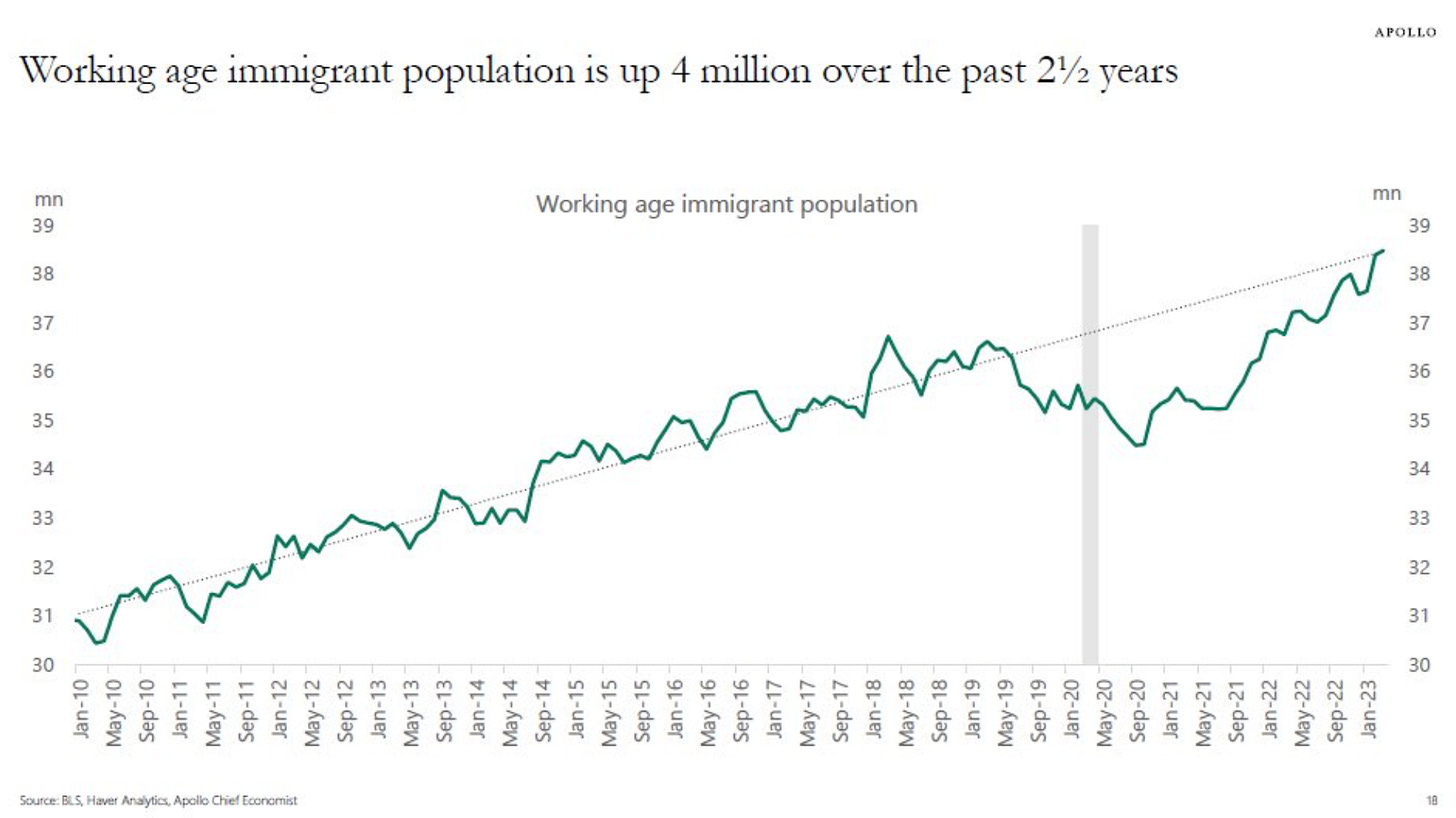

I wrote on immigration and titled it Nobody Is Talking About Immigration in my February post, Investing Update: A New Bull Market? This is important as it helps the labor market, wage inflation as well as overall inflation. The working age immigration population is back to pre-pandemic trend.

2 Stocks Saying No Recession

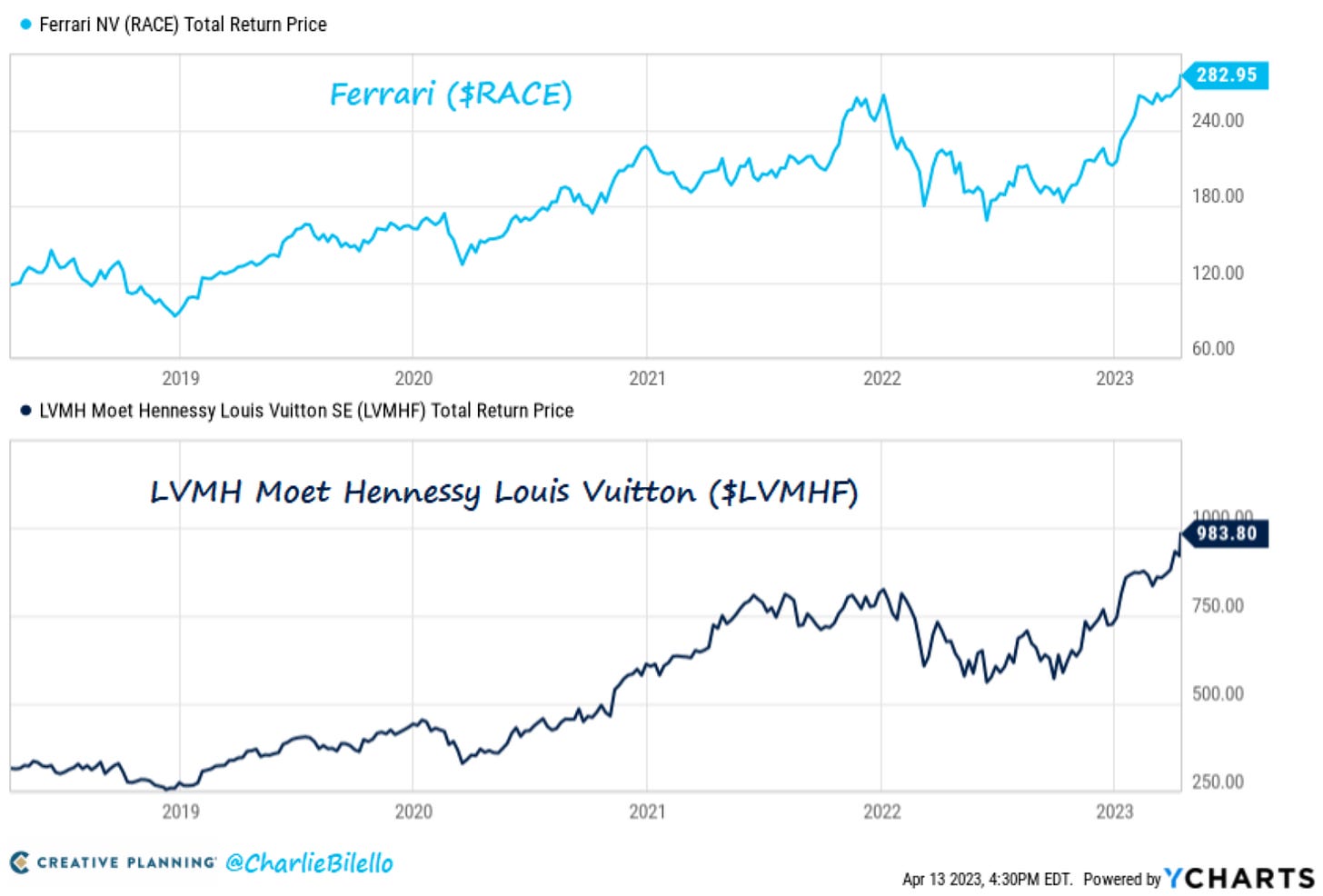

When you talk high-end luxury goods it starts with LVMH. Their brands include Louis Vuitton, Tiffany, Christian Dior, Dom Perignon, TAG Heuer and many others. The vehicles you think of when thinking high-end brand and luxury is Ferrari RACE 0.00%↑. Both of these stocks have now hit all-time highs this week. This type of performance from these two high-end luxury companies does not tell us we’re in a recession.

What I’m Watching

We’ve been stuck in this same trading range for quite an extended period of time. Most of the stocks that I’ve made buys in recently are still near those same levels. I do think that the overall market is enticing at levels still due to the overwhelming bearishness of investors.

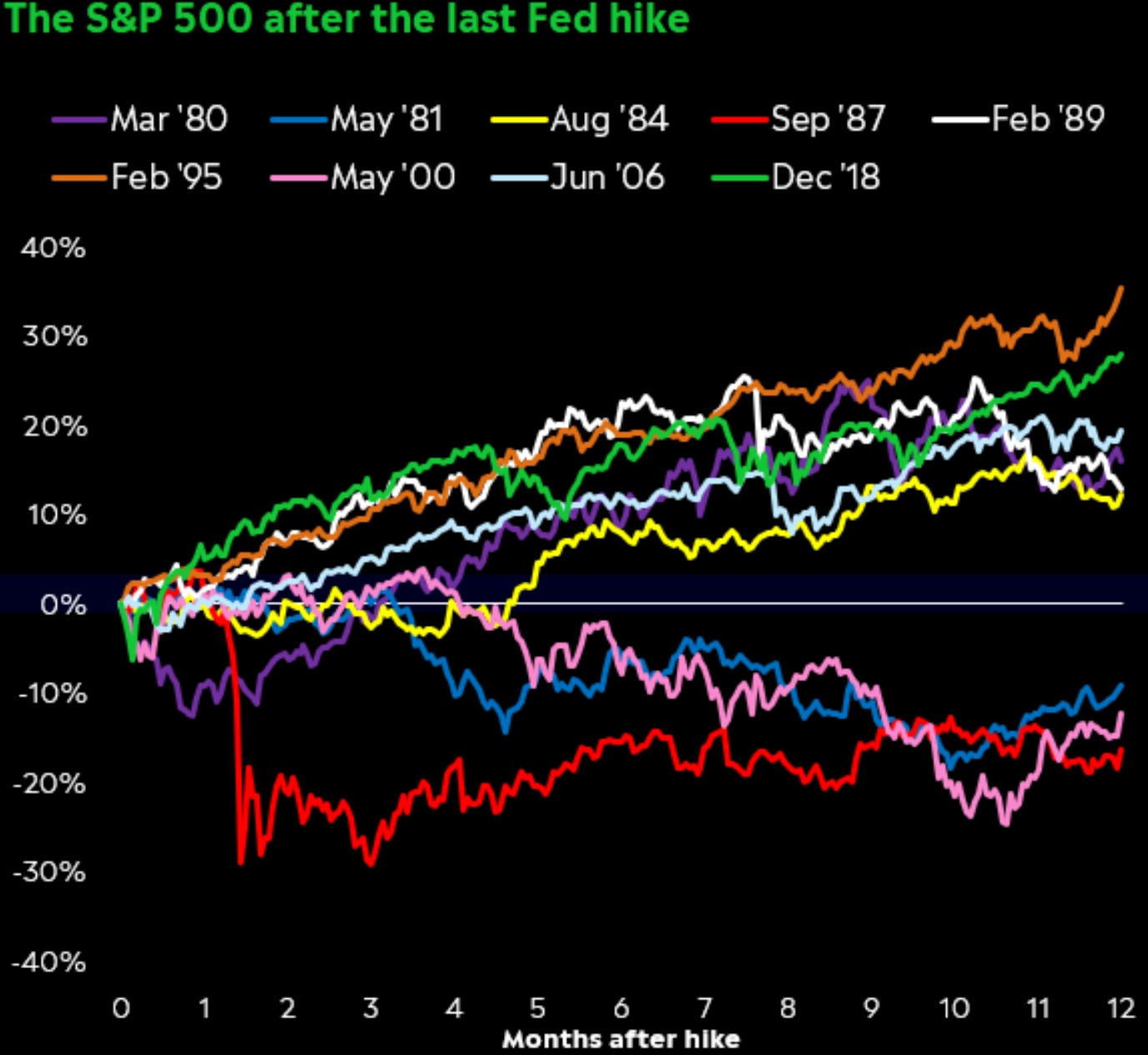

I’ve mentioned that I feel inflation has peaked. It has been nine straight months of lower numbers. I also feel that we’re done with the hiking of rates. I was curious after the last Fed’s last rate hike, what historically does the market do afterwards? Across came Callie Cox’s chart below the same day I started wondering this. Like she read my mind!

Outside of 1981, 1987 and 2000 the following years turned out to be quite bullish. To me this is another bullish sign and I’m actually feeling that my year-end prediction of 4,350 on the S&P 500 may be too low.

The Coffee Table ☕

Barry Ritholtz wrote CPI = 5% (Time to Stop Raising Rates). As I was reading this I found myself nodding in agreement. Barry is spot on and if you aren’t following Barry’s writing you should. He was the first person to start blogging on finance and is referred to as the “blogfather”. Plus he’s a great guy as he actually helped me out with my writing when I started Spilled Coffee.

I thoroughly enjoyed Sam Ro, CFA post What getting older has taught me about P/E ratios, which he wrote on his birthday. Sam’s birthday is just a few days before mine. Something about those April birthdays! Happy Birthday Sam! I enjoyed how he tied in his personal career growth with him getting older and how that ties into how companies will never stop the pursuit of earnings growth. One of his best reads this year.

Warren Buffet had just an awesome response to his eating habits this week in his interview with CNBC this week. "I've gotten to 92 with the habits of a 6-year-old. So far it's working. I found everything I like to eat by the time I was 6. Why should I fool around with all of these other foods? If somebody told me I would live an extra year if I ate nothing but broccoli and a few other things all my life instead of eating what I like to eat, I would say take the year off the end of my life. I'm happier when I'm eating hot fudge sundaes or drinking Coke or whatever it may be, hot dogs."

I was recently lucky enough to come upon two bottles of 10-Year Henry McKenna after they were just delivered to a local grocery store. I’ve been trying to get some of this for some time as it’s sold out online. Since it got awarded best bourbon at the San Francisco World Spirits Competition, it has been very hard to get. After having it I can see why. The bottle I opened is one of the better bourbons I’ve had and it’s in my top 5 favorite so far.

Thank you for reading! If you enjoyed Spilled Coffee, please subscribe.

Spilled Coffee grows through word of mouth. Please consider sharing this post with someone who might appreciate it.

Disclaimer: This is not investment advice. You should not treat any opinion expressed as a specific inducement to make a particular purchase, investment or follow a particular strategy, but only as an expression of an opinion. Do your own research.