April’s CPI inflation number came in at 8.3%. That is down a tick from March’s CPI of 8.5%. Will 8.5% in March mark the peak of inflation?

Calming inflation is vital for cooling off so many segments of the economy. Let’s take a look under the hood to see where numbers are at.

Here are some YoY (Year-over-Year) increases on specific items from the April 2022 CPI Report.

Airfare +33%

Eggs +23%

Hotels +23%

Bacon +18%

Chicken +15%

Milk +15%

Furniture +15%

Coffee +14%

Beef +14%

Fish +13%

I think we can all understand why when we go out to eat at a restaurant, the prices are almost double what they used to be. To understand why our grocery bills are almost double, these numbers are all you have to look at.

65% of the 95 components that go into calculating CPI are up 6% or more YoY.

To see how each state is faring with inflation, here is a US Inflation map.

You knew this had to have an affect on the US consumer at some point. The prices continuing to rise in literally everything, would eventually start to show up in data.

The University of Michigan Consumer Sentiment Index fell to 59.1 in May. That is lowest level since August of 2011. Last month it was at 65.2, a drop of 9.4% in one month. May of 2021 consumer sentiment was 82.9. YoY change of -28.9%.

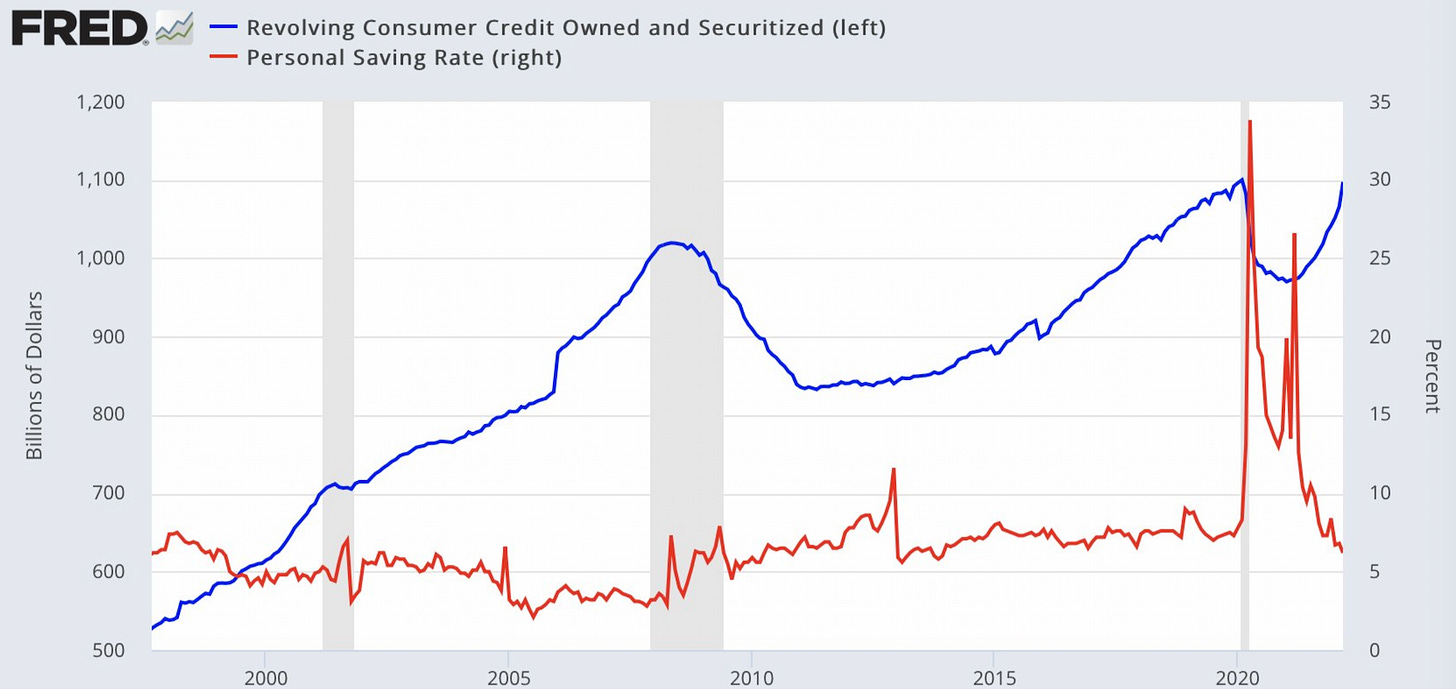

On April 8, I wrote a post entitled Personal Savings Has Fallen Off a Cliff. In it I highlighted that the US consumer savings rate had tumbled. All the stimulus money from the pandemic had all been spent.

As this chart illustrates, we’re seeing consumer savings continuing to tumble lower and the buying on credit going upward. The wider that gap gets, the more unlikely it can continue. It’s not economically sustainable. Bad for both the country and for individual consumers. Approaching record credit card debt, with a dwindling savings, while seeing inflation levels not seen in 40 years, isn’t a very good mixture.

But the spending has just continued to chug along. Consumers have shifted from spending their savings and resorted back to buying on credit. The consumer sentiment index above indicates Americans are not happy about rising prices, but they still continue to spend. This was proven by April’s retail sales data, which continued to grow with an increase of 0.9%. Consumer spending is important as it’s 70% of the economic activity.

You can understand why so many are talking about a recession. These levels aren’t sustainable long term. A recession is two consecutive quarters of declining GDP. But in a recession you also experience a decrease in employment. Right now that is the complete opposite. There are not enough workers to fill all the available jobs.

Will we get a smooth landing? Or will we experience a crash landing? Your guess is as good as mine, or any economist’s guess. Opinions, viewpoints and predictions are all over the board. I have my popcorn ready as I’m really curious how this turns out in the months ahead. I hope you have yours ready as well.

Thank you for reading! If you enjoyed Spilled Coffee, please subscribe and/or give a gift subscription for others.

Spilled Coffee grows through word of mouth. Please consider sharing this post with someone who might appreciate it.