Housing Worries Are Building

7% mortgage rates are causing a problem

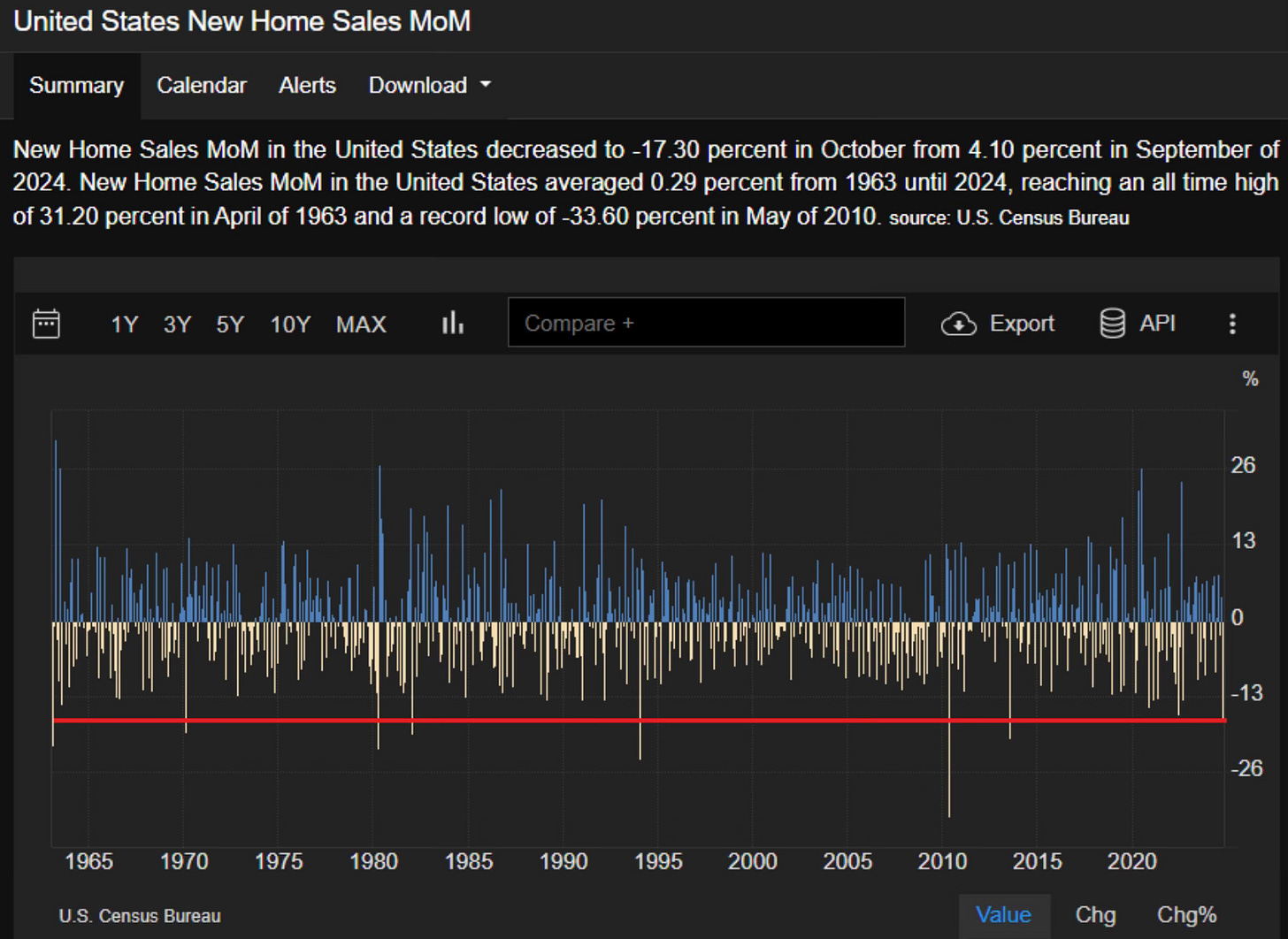

The proof that 7% mortgage rates are causing issues in the housing sector were evident in the U.S. New Homes Sales report that came out Tuesday.

New homes sales dropped by 17.3% in October. It’s the biggest drop since 2013 and 8th worst going back to 1960.

The 610,000 new home sales was the lowest since November 2022.

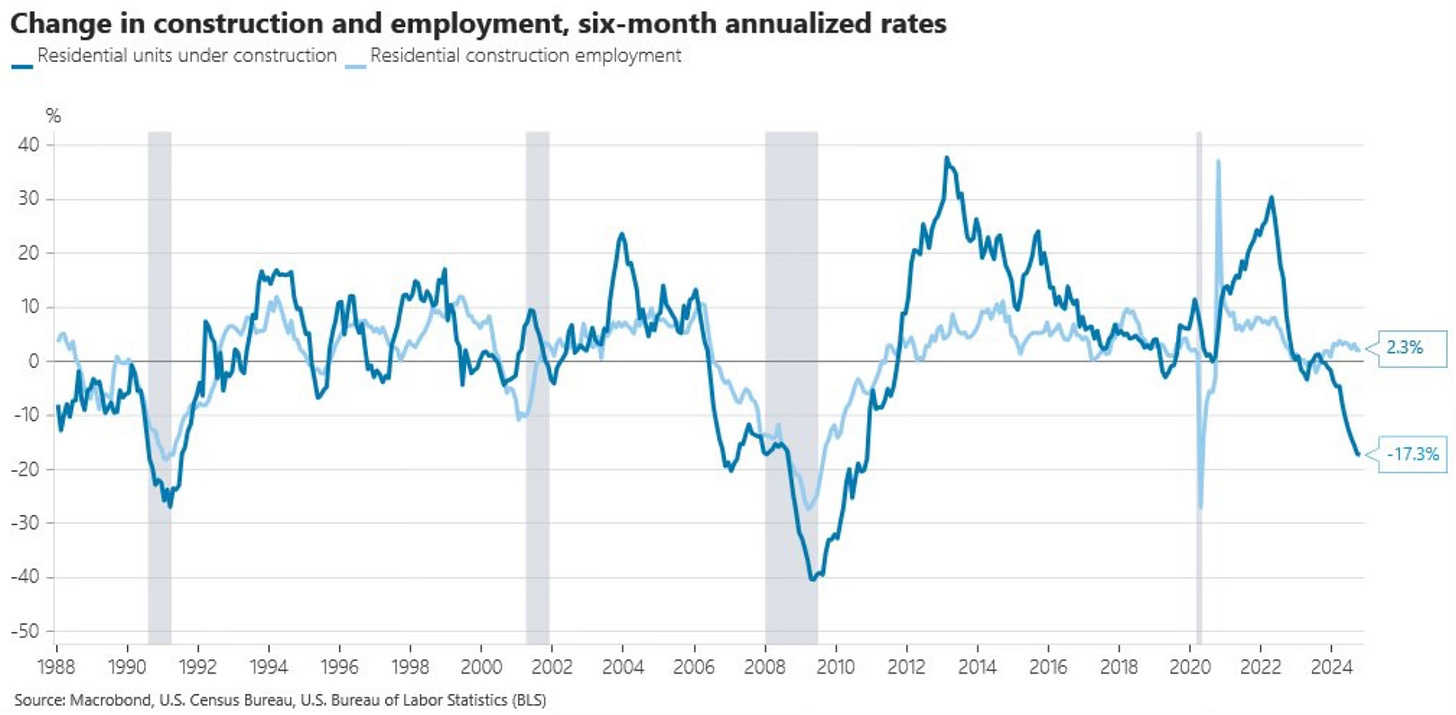

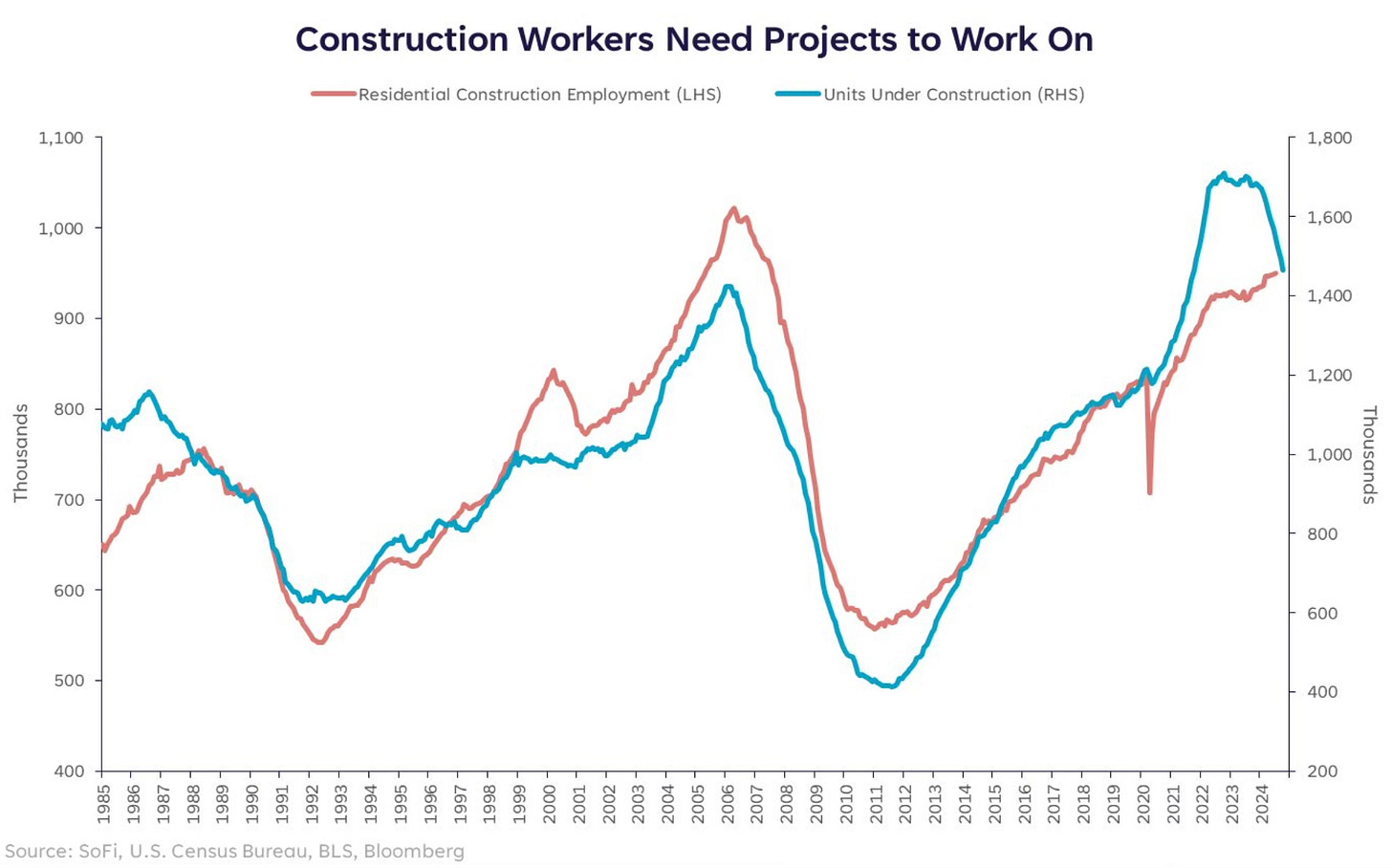

I’ve talked about the importance of residential construction jobs. In October, I wrote the following in Why Are Mortgage Rates Rising?

The one worry that this points to is residential construction jobs. This has been a data point that I have wrote about many times. It’s something I watch very closely as it’s tightly connected to recessions.

I wrote in depth about the correlation that the data shows in the charts in that piece. You can read that note here.

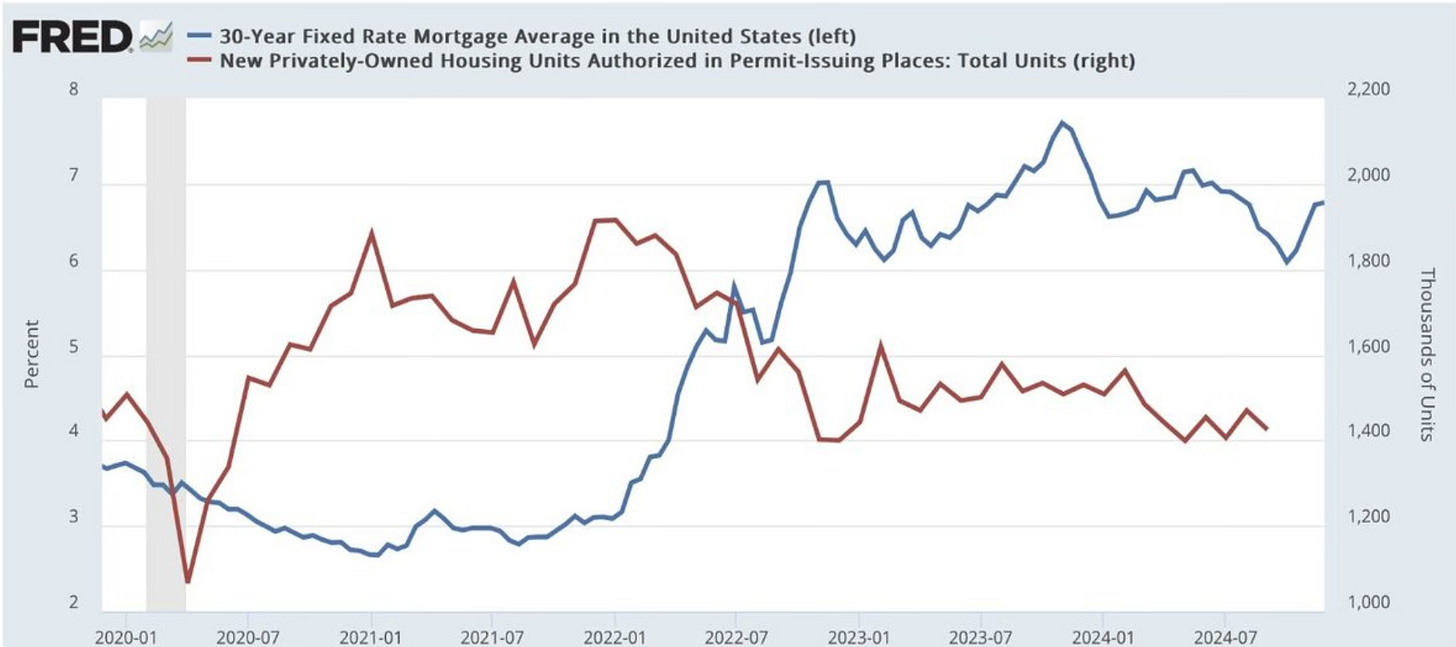

As the mortgage rates have risen, you can see what permits have done.

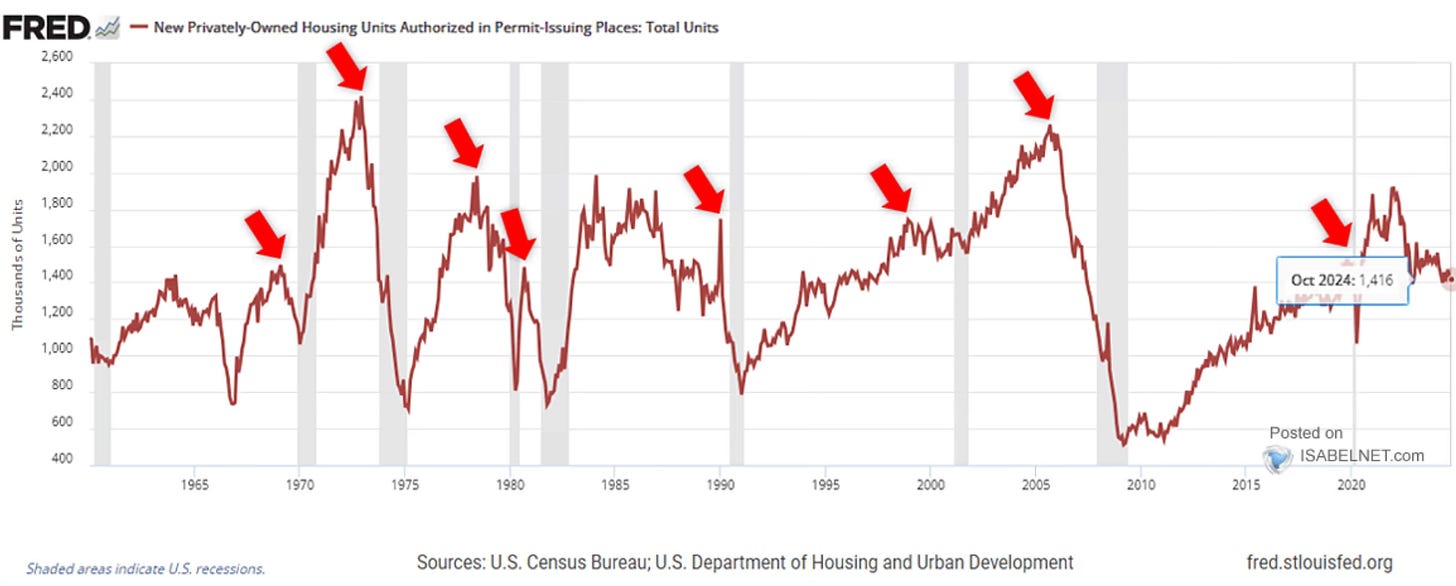

Permits actually fell 1.416 million in October. Permits tend to peak then decline before recessions.

Where are housing starts?

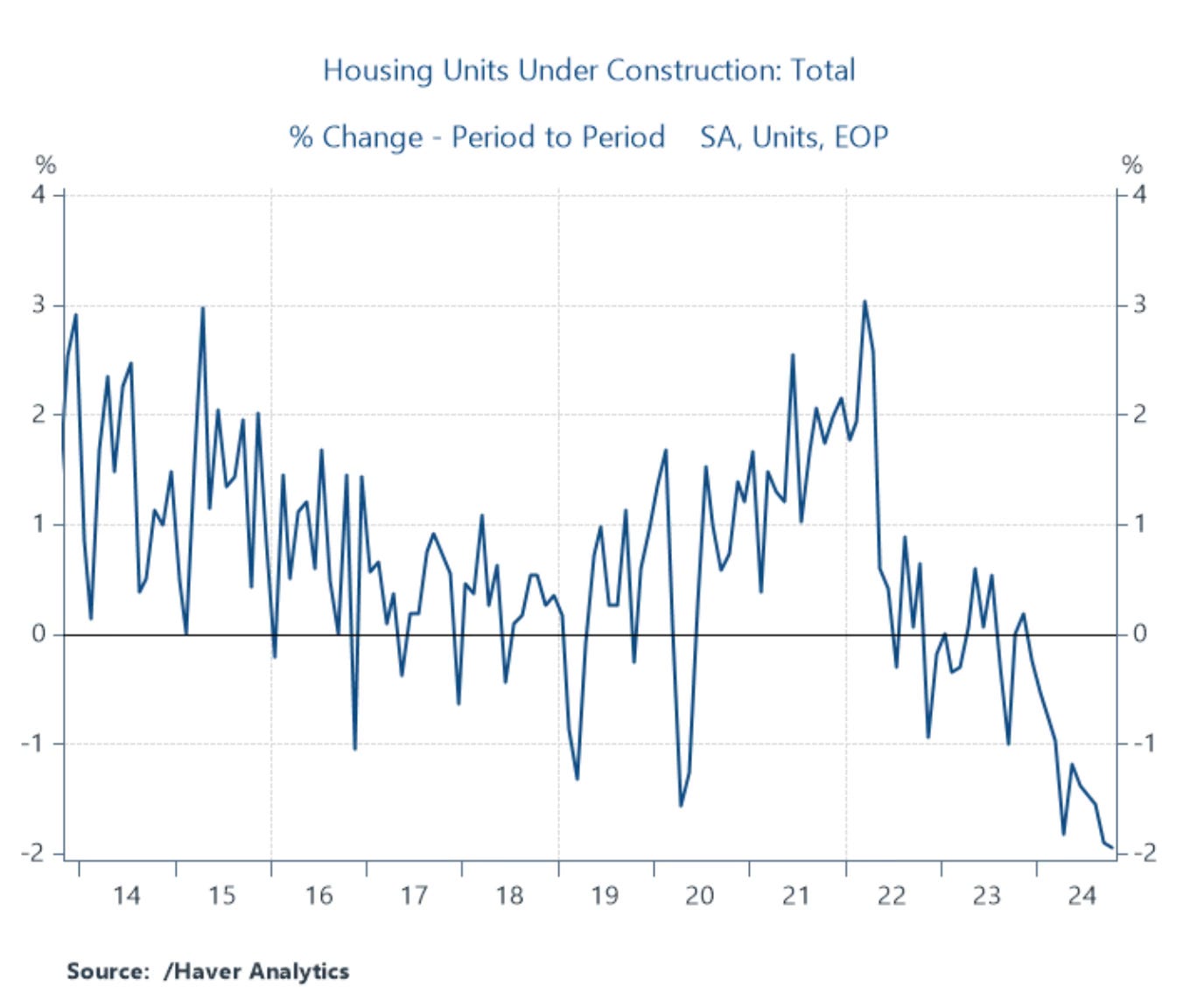

What about housing units under construction?

Completions are up while starts are down. If housing starts continue to be below completions, that doesn’t equal homes under construction growth. The decline is going to continue.

The big question as we enter 2025 is what transpires next. If rates don’t come down, how does new construction rise?

Remember that residential construction employment leads the broader economy.

You can guess where construction employment is headed if this continues. Just look at history.

There is the risk that this spreads among the housing sector. This was an important piece of information from Lance Lambert.

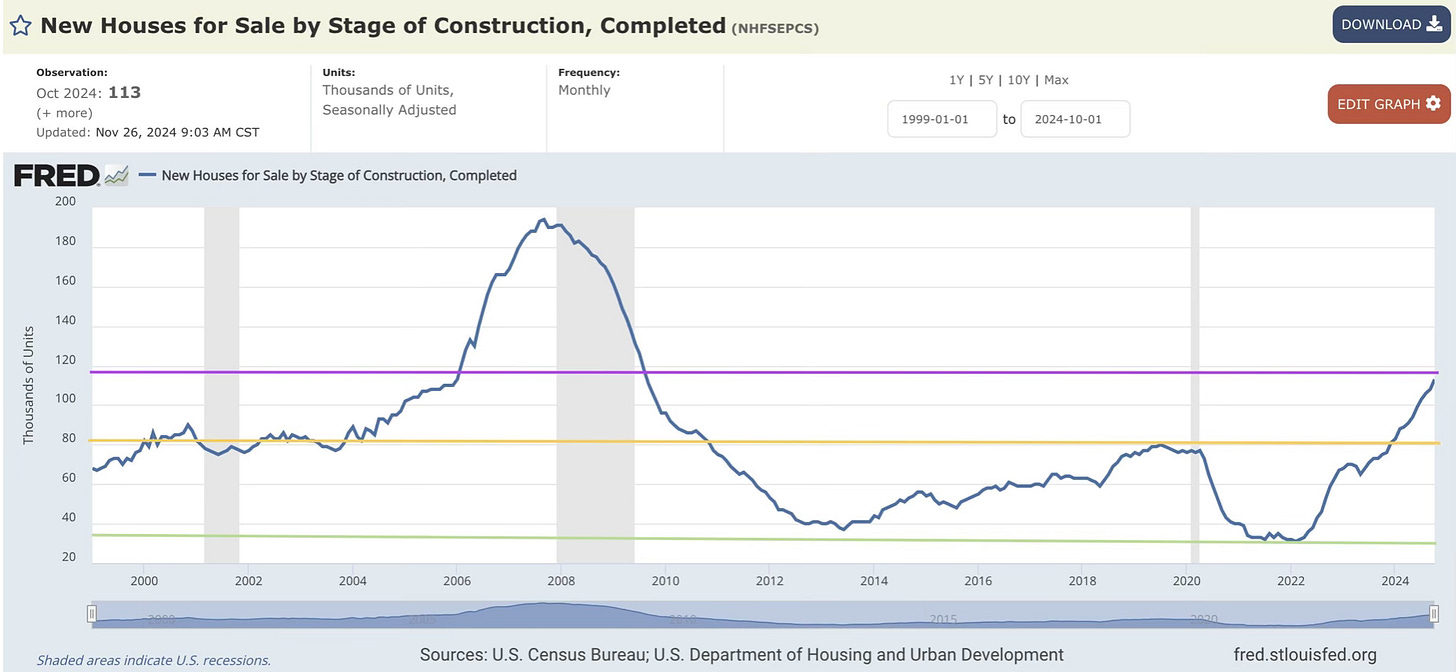

The total number of completed new homes that remain unsold is at its highest level since September 2009

It’s never good when new homes are sitting completed and for sale. Maybe it shouldn’t come as that big of a surprise when we look at where mortgage demand is at.

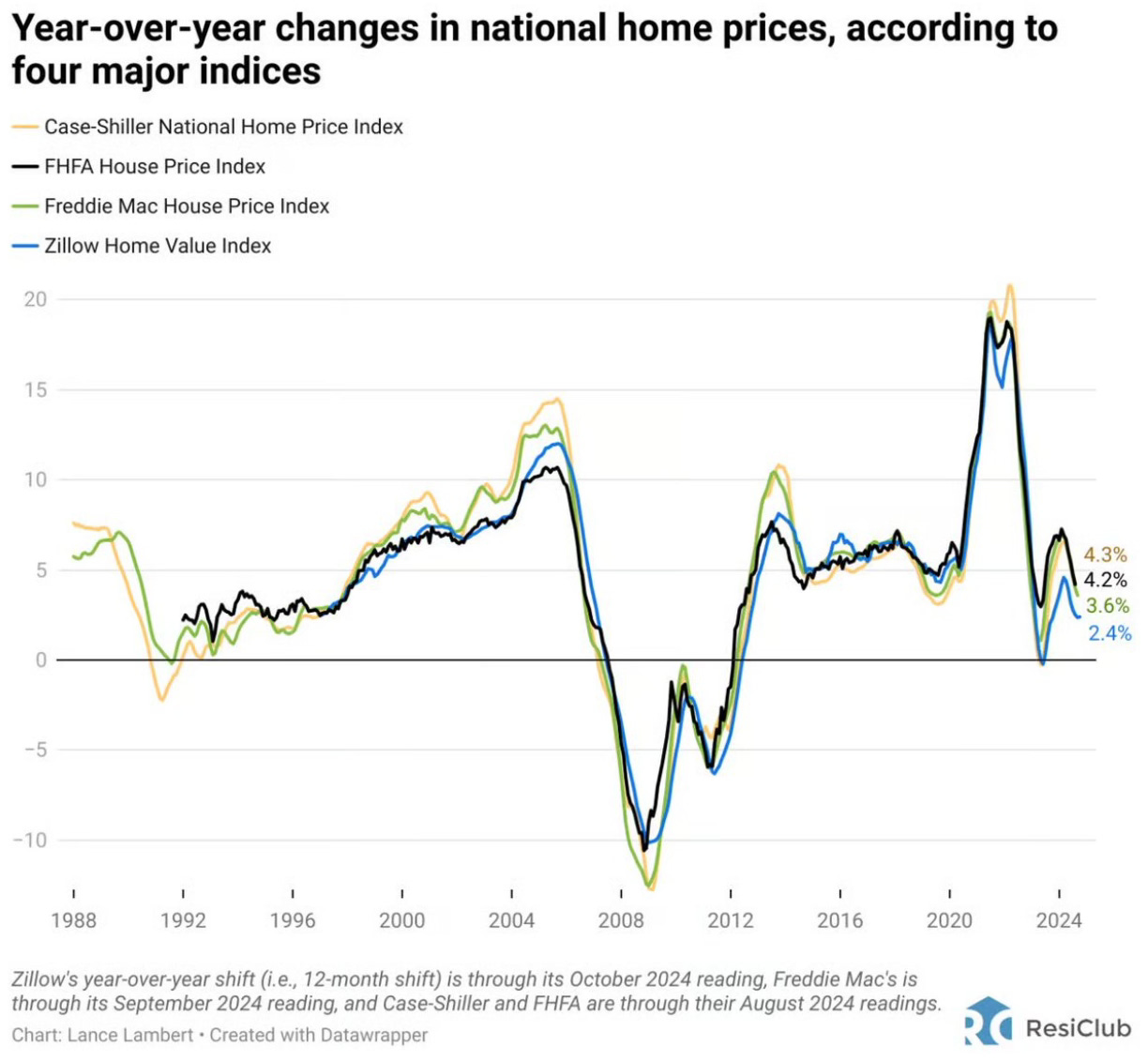

Could this eventually lead back to home prices? Does that have to come down next? It looks like that has also started happening.

As mortgage rates rose, there was a lot of asking if housing and the economy could handle a sustained period of 7% or higher mortgage rates. That answer is starting to become a resounding no.

It has caused a housing problem. The longer these conditions continue, the higher the odds that it causes a bigger issue.

If you haven’t been paying attention to the data around housing, it might be time that you start.

The Coffee Table ☕

Jonathan Clements who is fighting cancer, wrote a very memorable piece called Advice for the Kids. There is so much good in here on money, finance and life that I have read it twice. I will probably read it again. Such great advice.

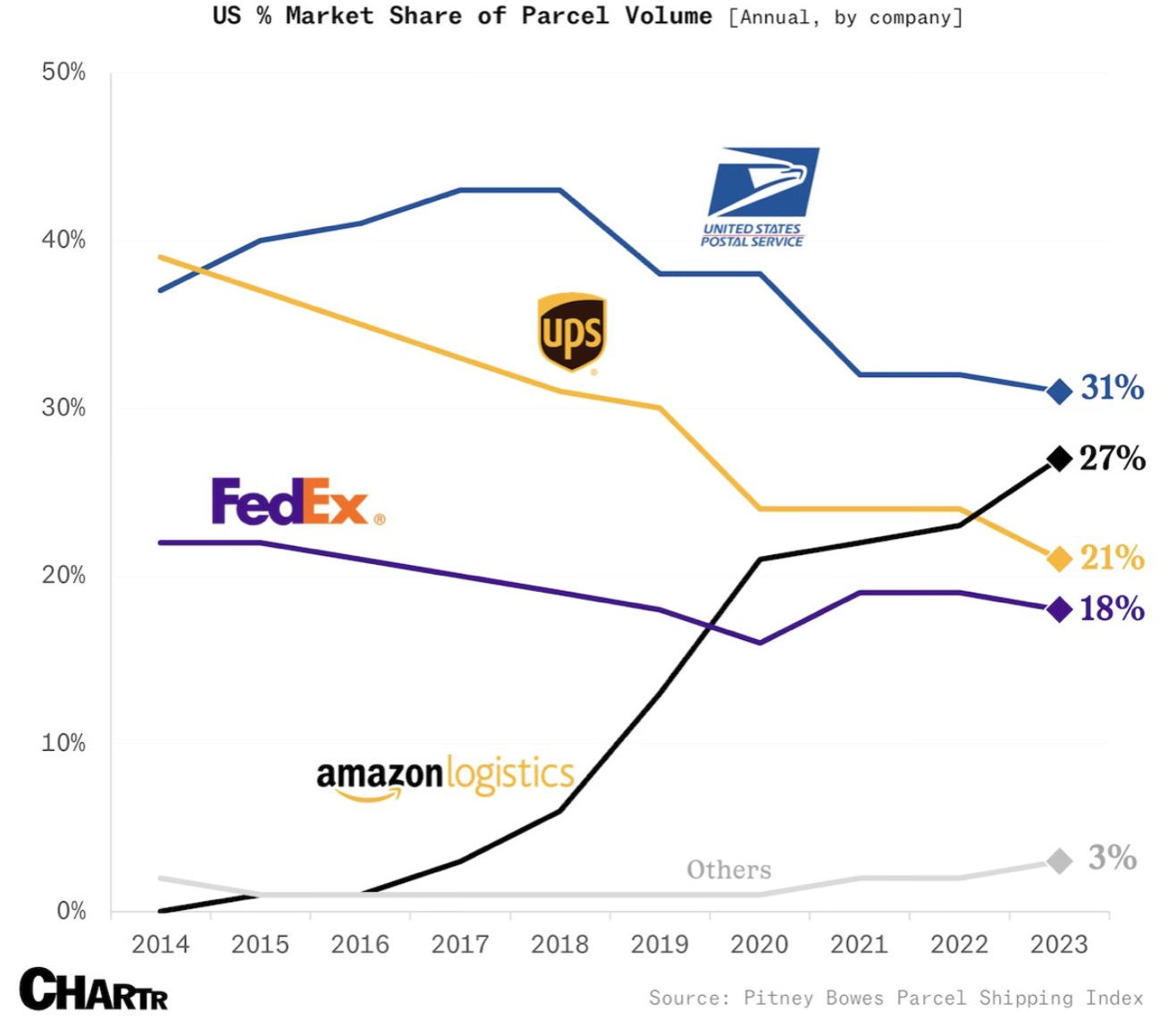

Here is a visual that shows just who will be delivering all the packages this holiday season. Take a look at what Amazon has done.

Thank you for reading! If you enjoyed Spilled Coffee, please subscribe.

Spilled Coffee grows through word of mouth. Please consider sharing this post with someone who might appreciate it.