Higher For Longer

The effects of higher interest rates

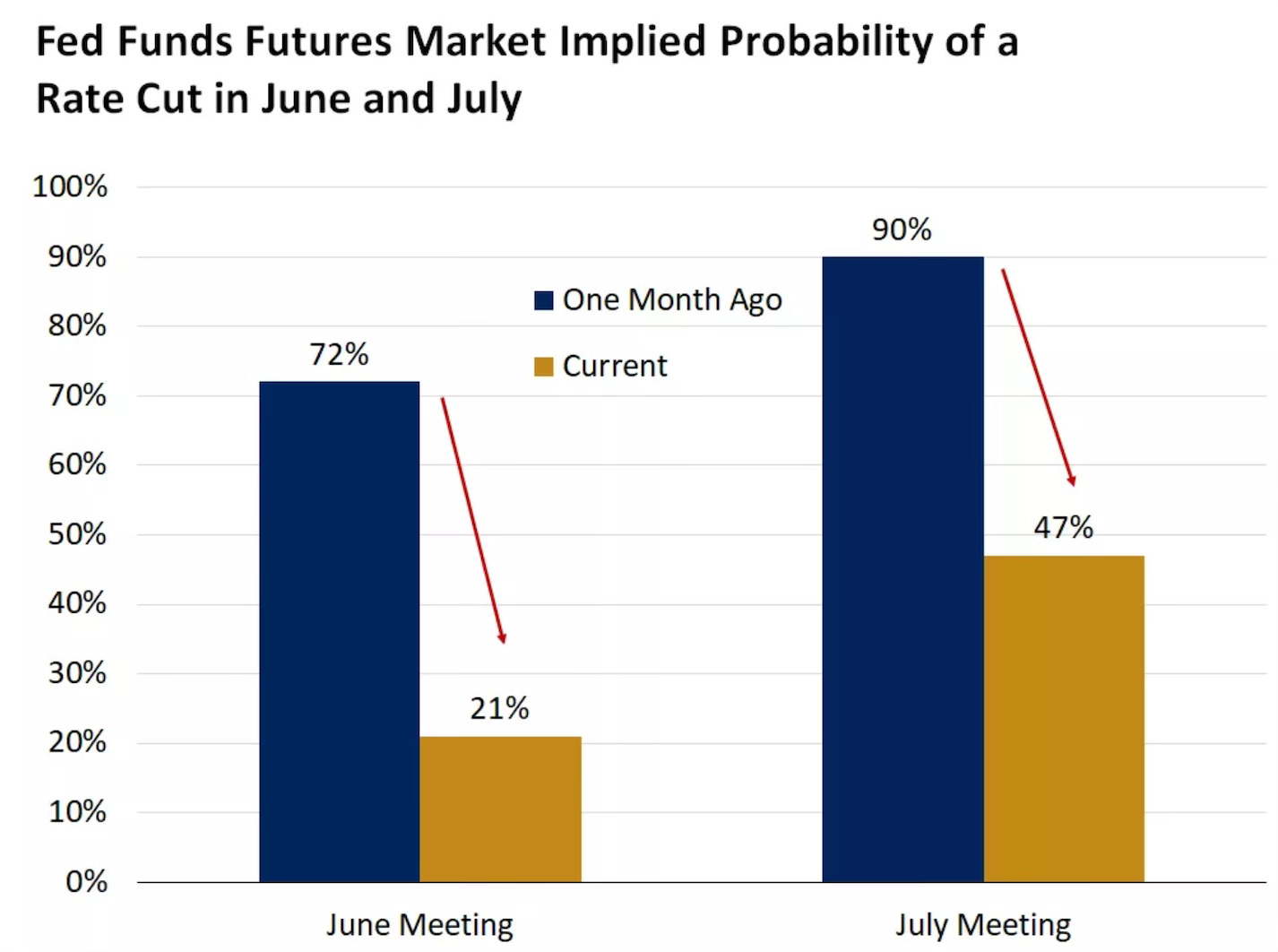

At the start of the year the expectations were that the Fed would be cutting interest rates by mid-year.

With inflation remaining sticky, those expectations have now shifted remarkably lower. The probability of a rate cut in June and July have tumbled.

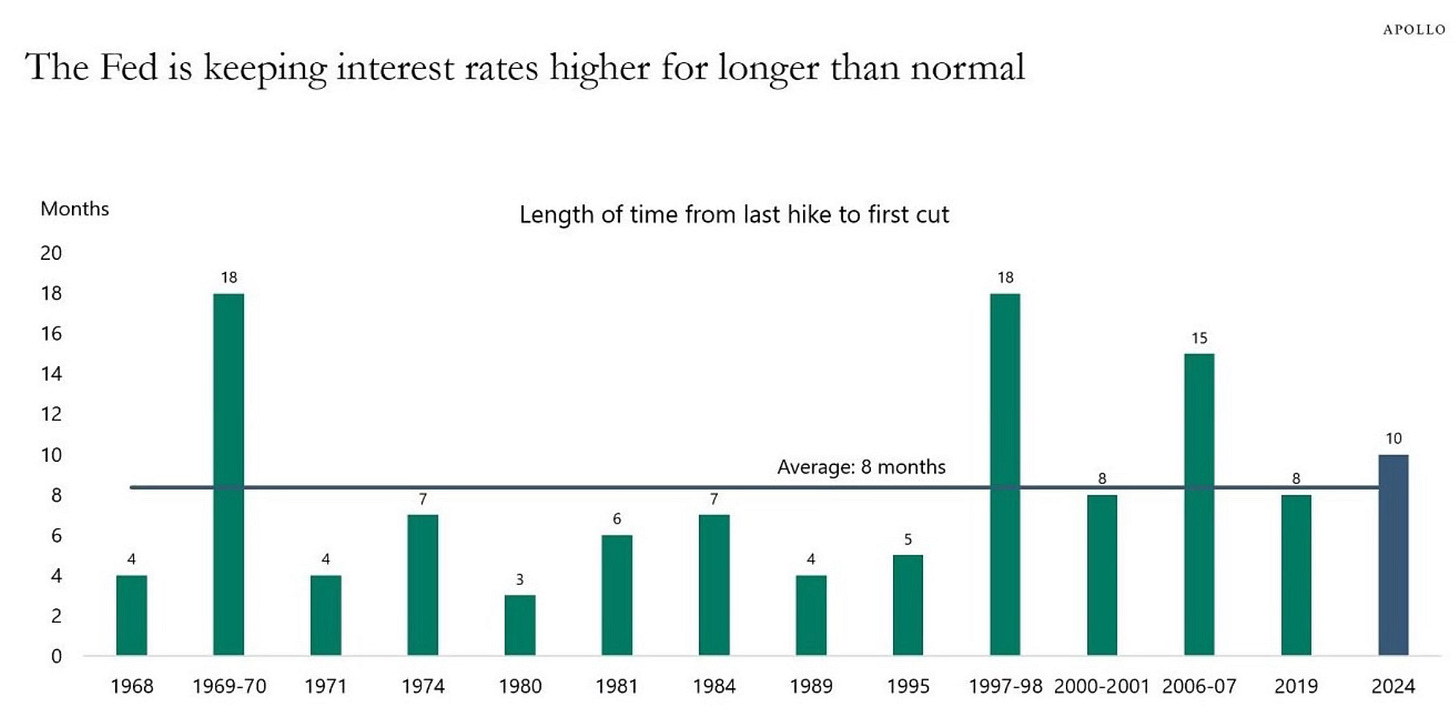

We now continue to hear the phrase, “higher for longer.” Rates have actually already been higher for longer than normal.

I wouldn’t be surprised that if we start to hear more about the possibility of rate hikes. I don’t think it’s out of the question that we see a rate hike before we see a rate cut. This all comes on the heels of an economy that’s just so strong.

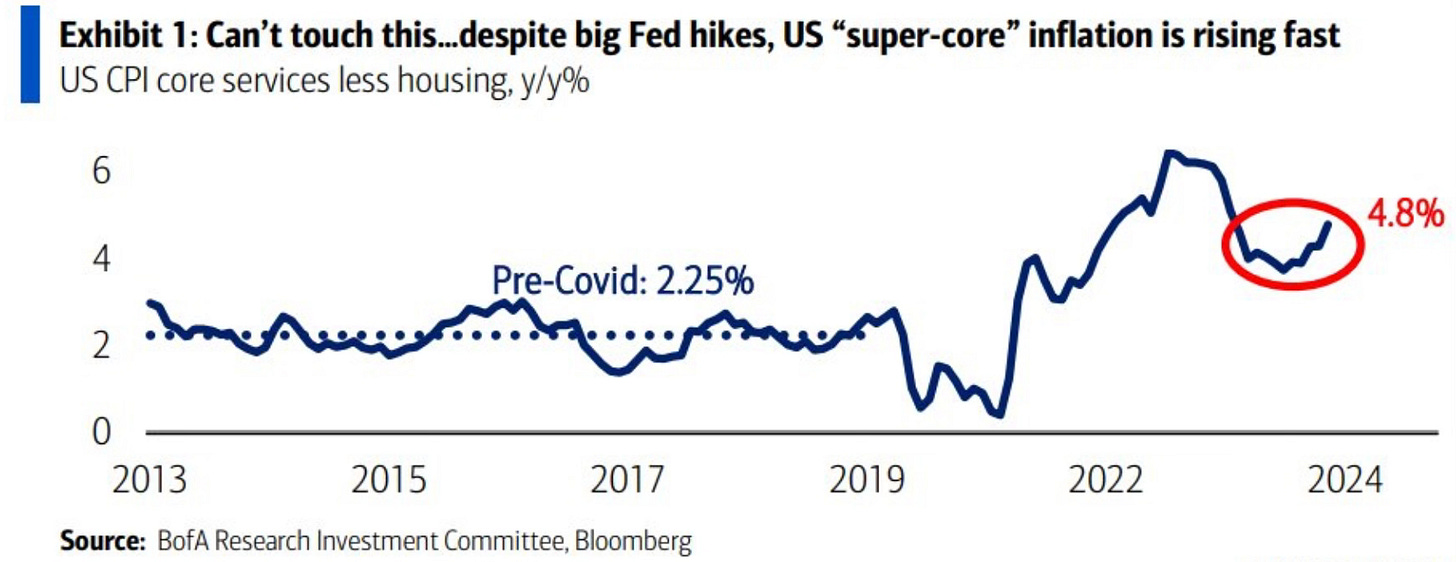

The real worry in my view is what’s going on with supercore inflation. Supercore calculates services prices without housing figured in. It’s what the Fed has said they’re focused on right now. It just climbed up to 4.8%, the highest in 11 months.

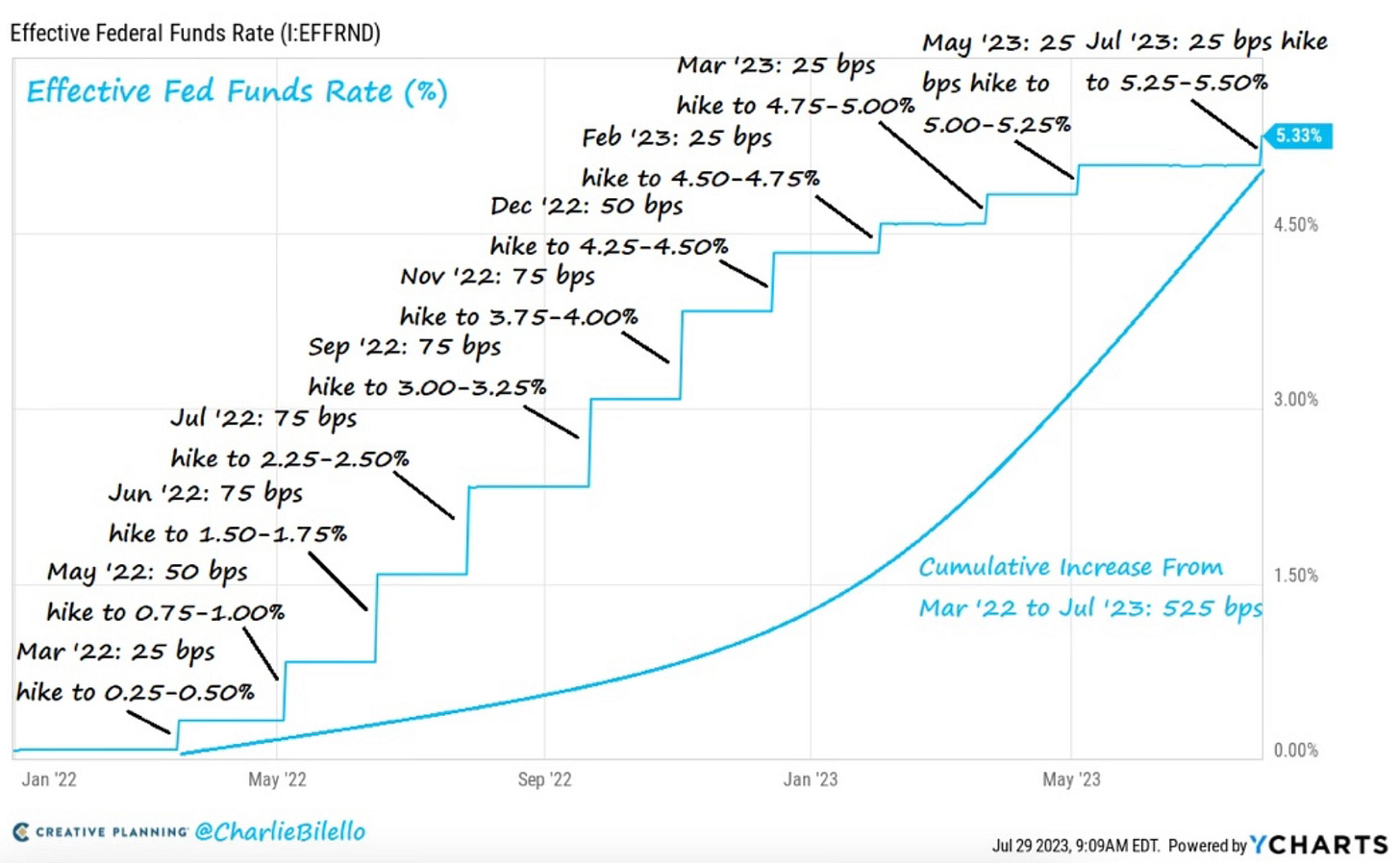

The Fed raised interest rates 11 times from March 2022 until their last rate move in July 2023.

This was supposed to cool the economy off and bring inflation down. The raising of rates should cool down the economy, stock market and housing. One could argue that all three have in fact gained strength.

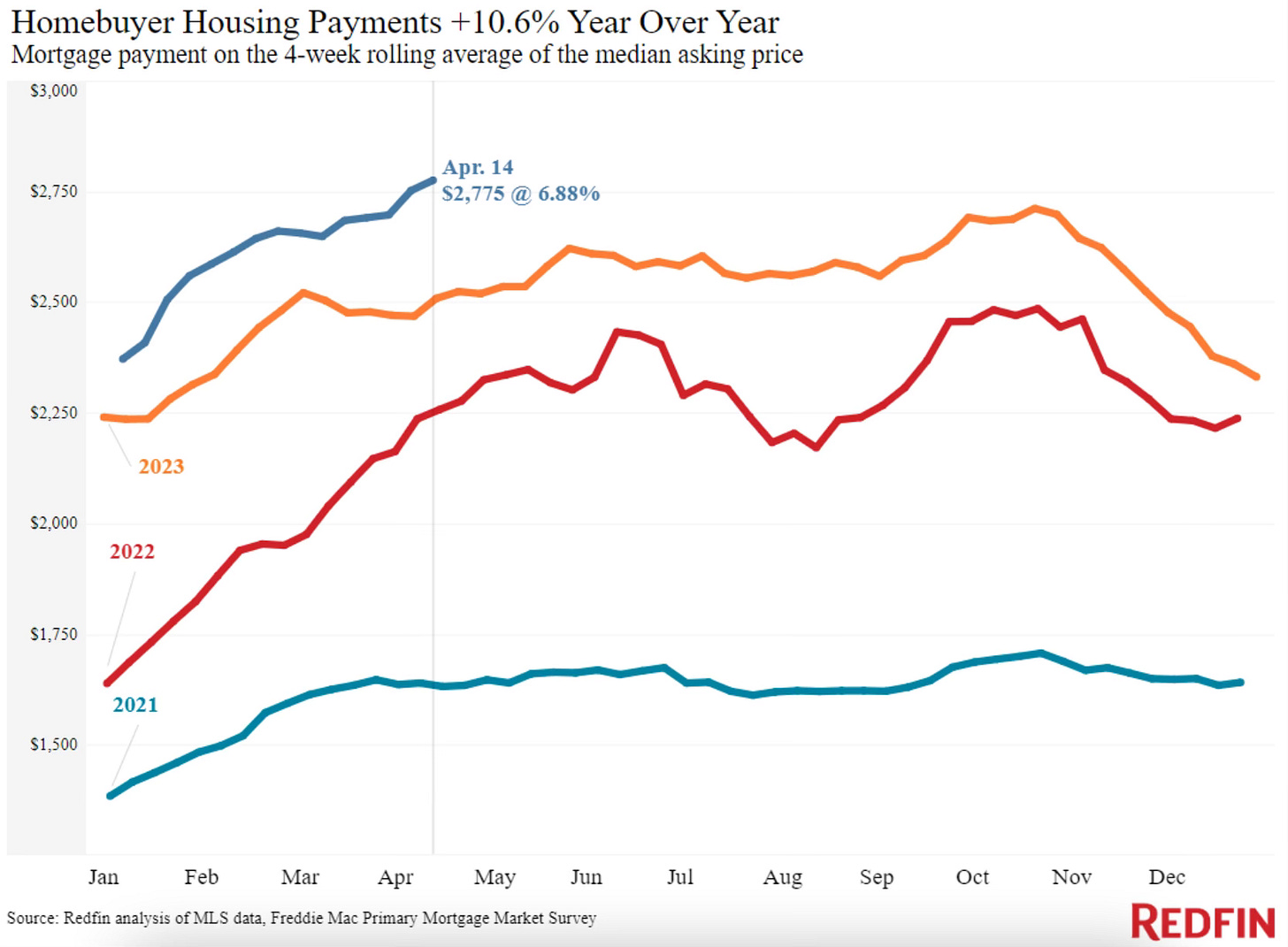

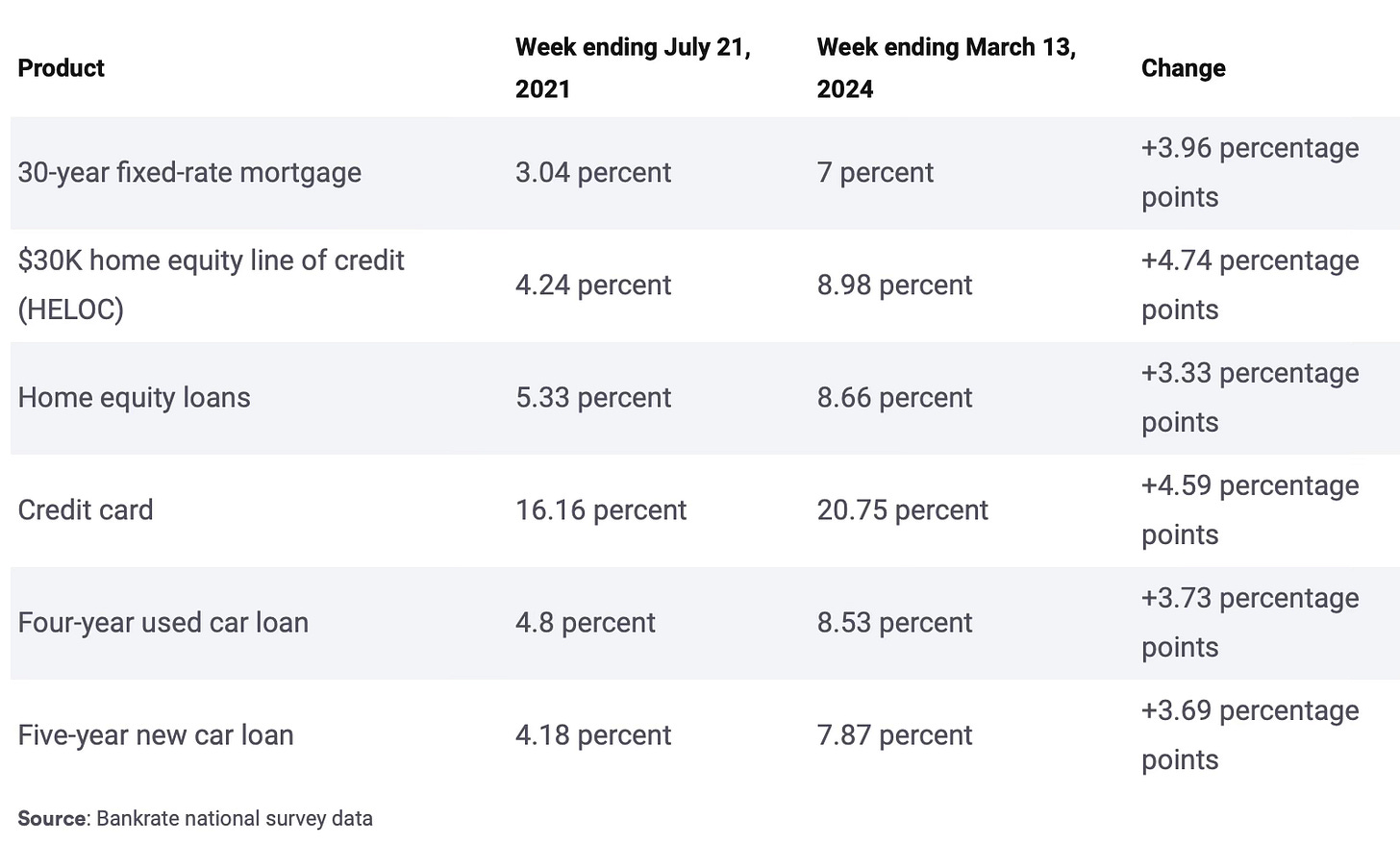

That was completely unexpected. Just look at what the raising of rates has done to the costs of borrowing money.

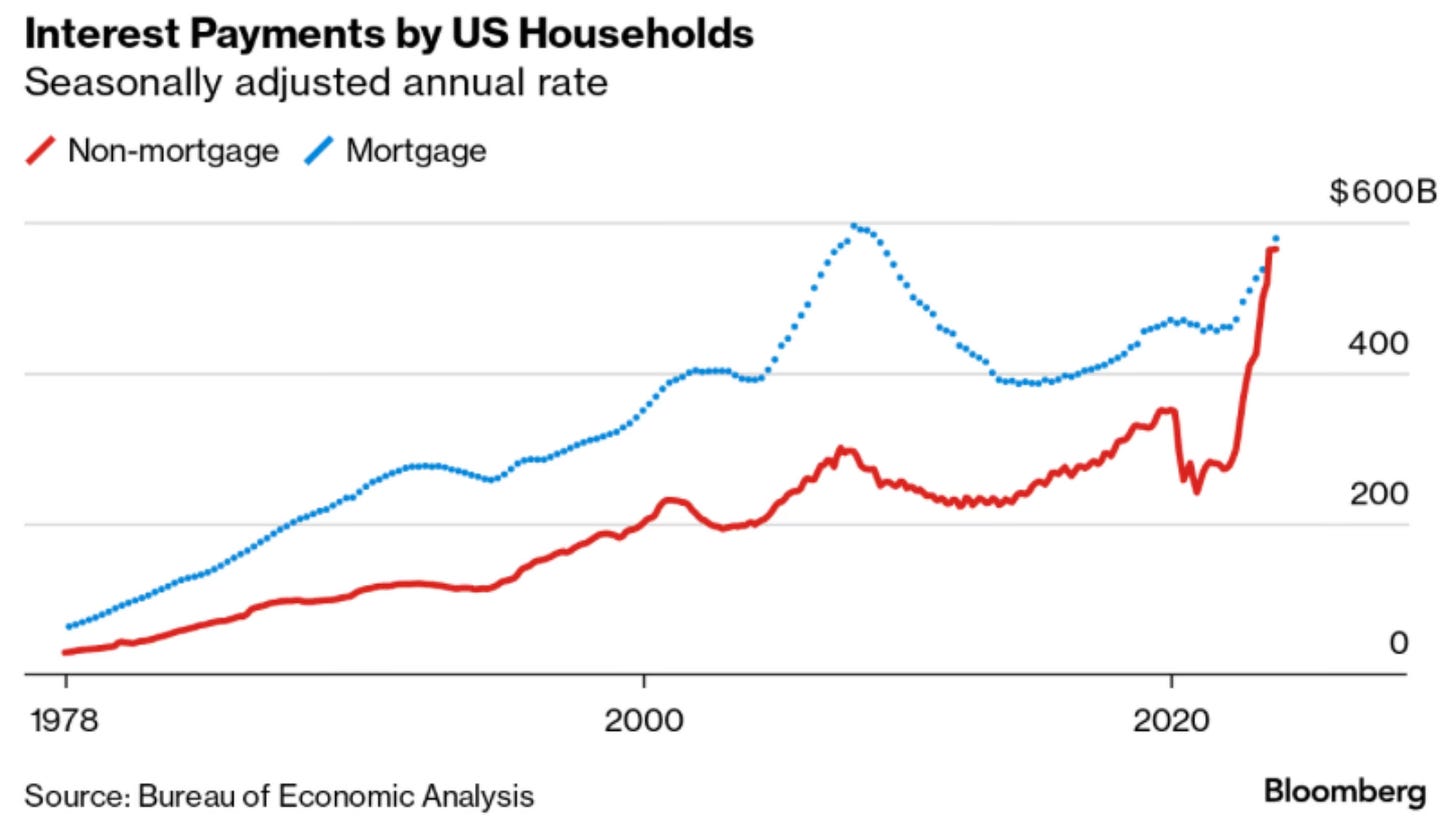

For the first time in history, US households are spending as much on interest payments for non-mortgage debts as they are for their mortgage debt.

This comes even as housing payments are at all-time highs.

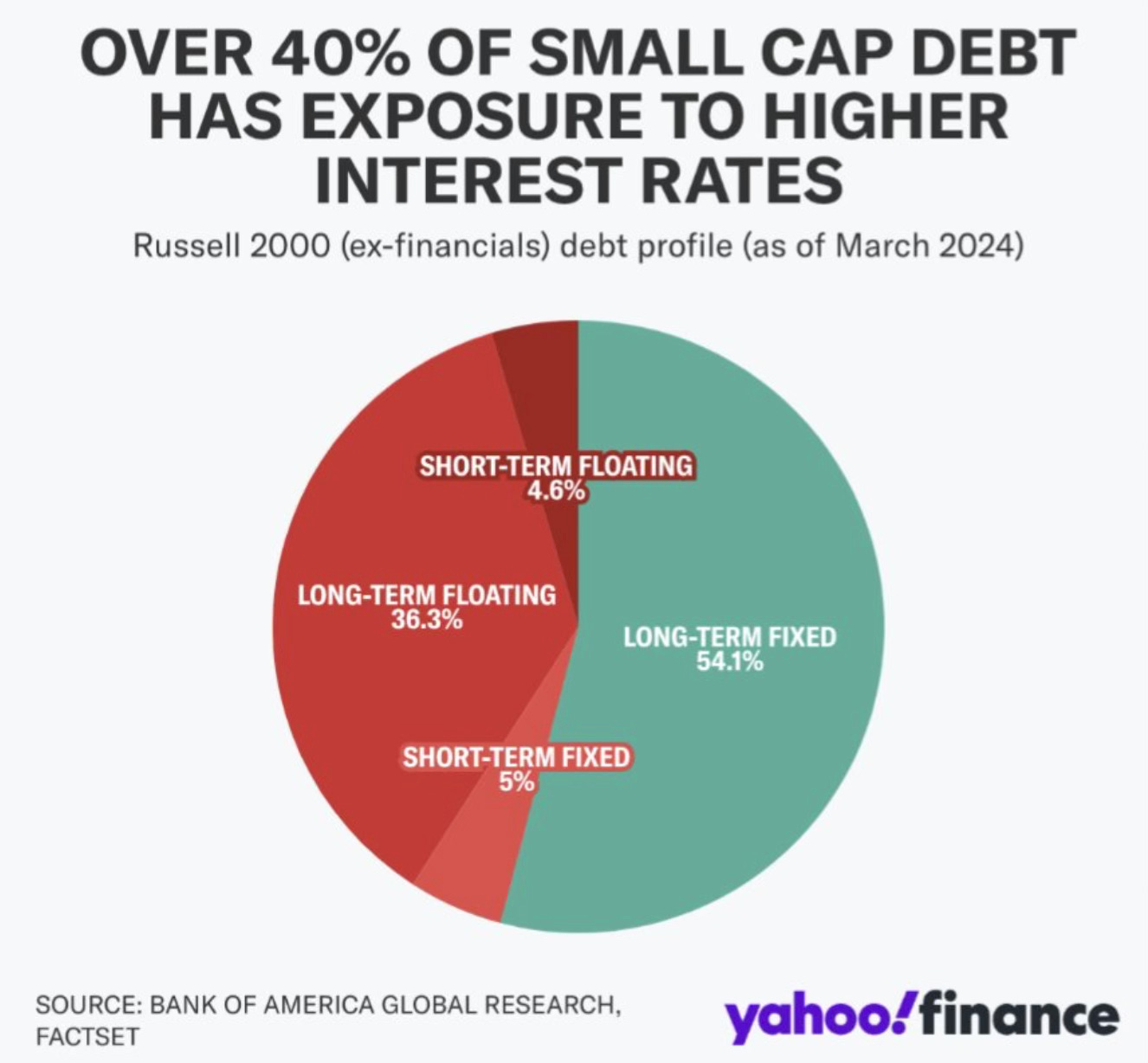

The raising of rates also really impacts the smaller companies. Over 40% of small cap company debt has exposure to higher interest rates.

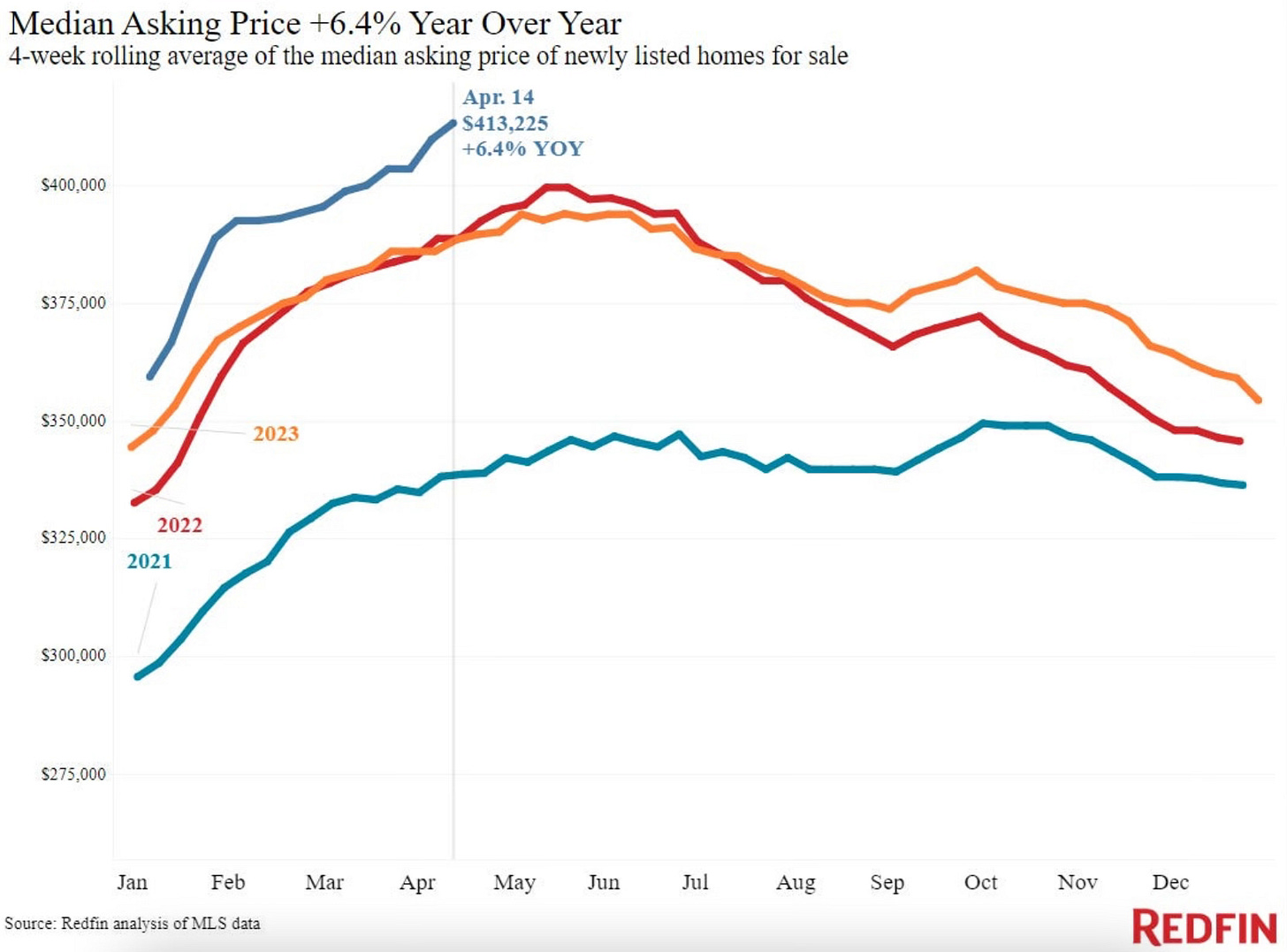

Judging by these charts you would think that things would have cooled off. Well you would have been wrong.

Yet here we are.

Home prices are at all-time highs.

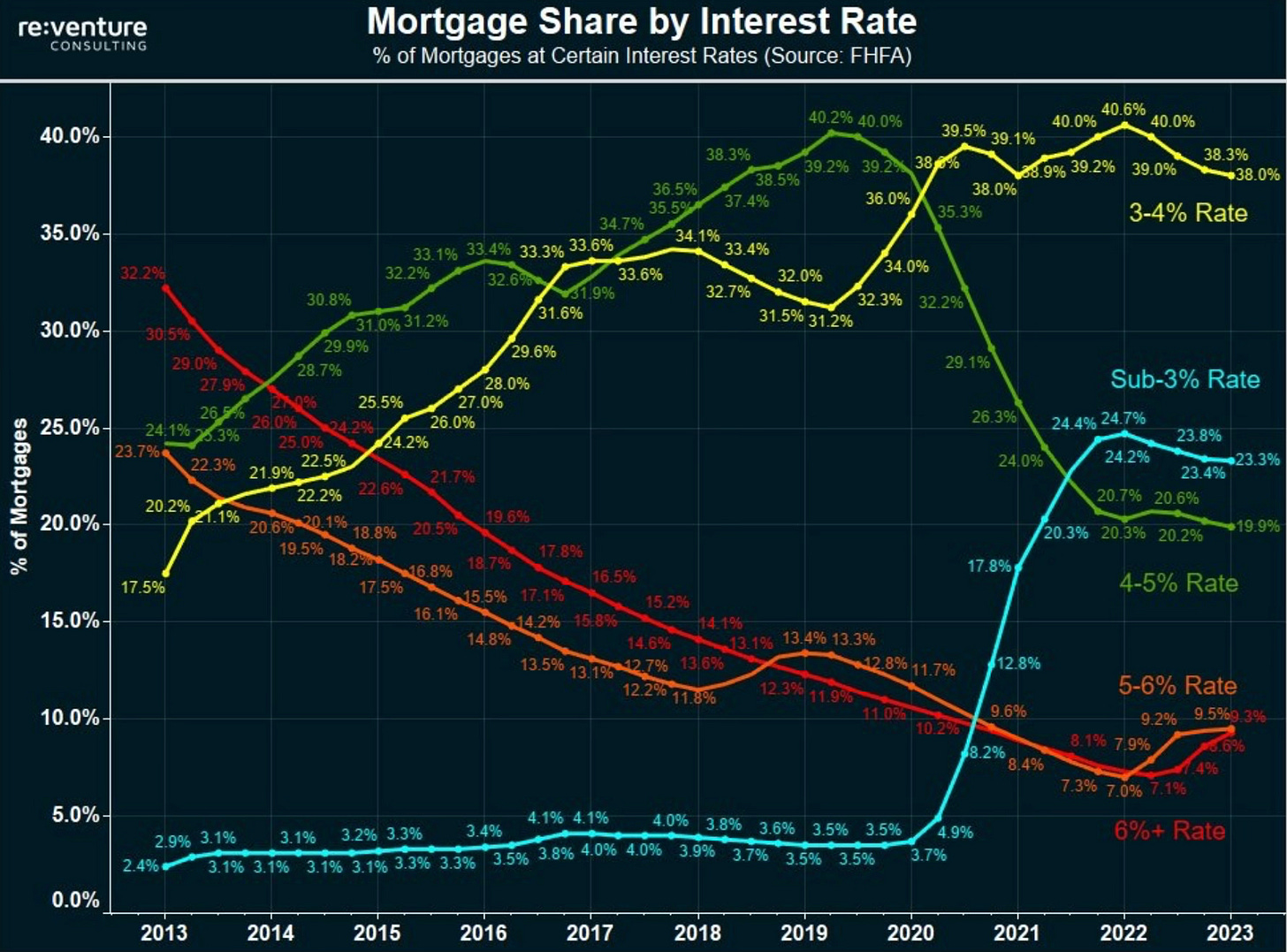

That’s due to the continued strong demand for homes but also with the make up of current mortgages held by US consumers.

96% of mortgage debt in the US is on a fixed rate. 38.5% of homeowners don’t even have a mortgage at all. Only 9% of all borrowers have an interest rate of over 6% and above. That’s where rates currently stand.

As people hold these low mortgage rates on their homes they have no incentive to sell and move. With the 30-year mortgage currently at 7.38% I wonder what we see first, 5% or 10% mortgage rates?

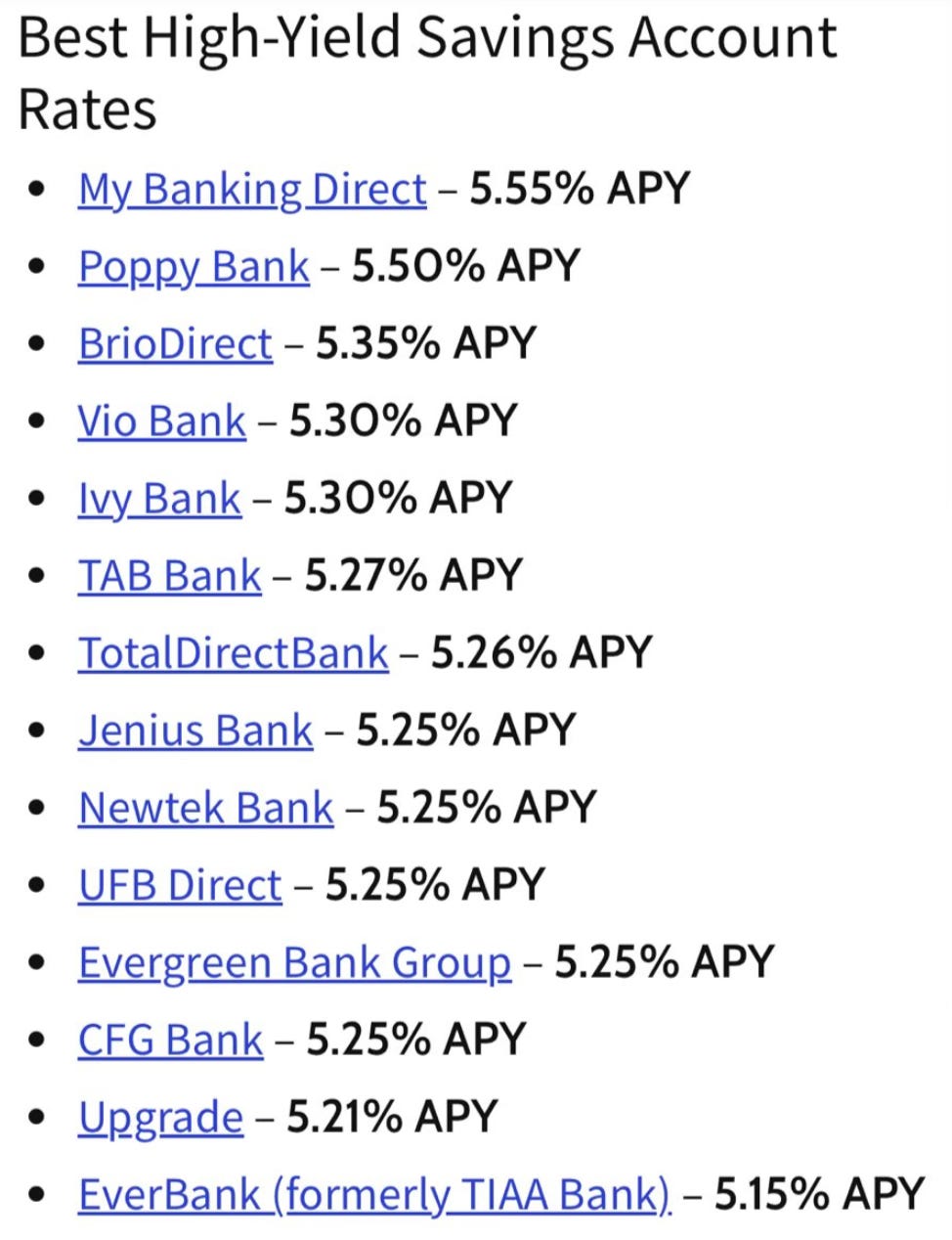

Consumers have their home prices at all-time highs with loads of equity in them. They can also get over 5% on cash in their savings accounts. When was the last time we saw that?

By rates remaining higher for longer, what’s the short term risk for the US consumer? The economy is hot and they’re employed, their home is worth more than ever, they can get 5% on their cash and stocks are at all-time highs.

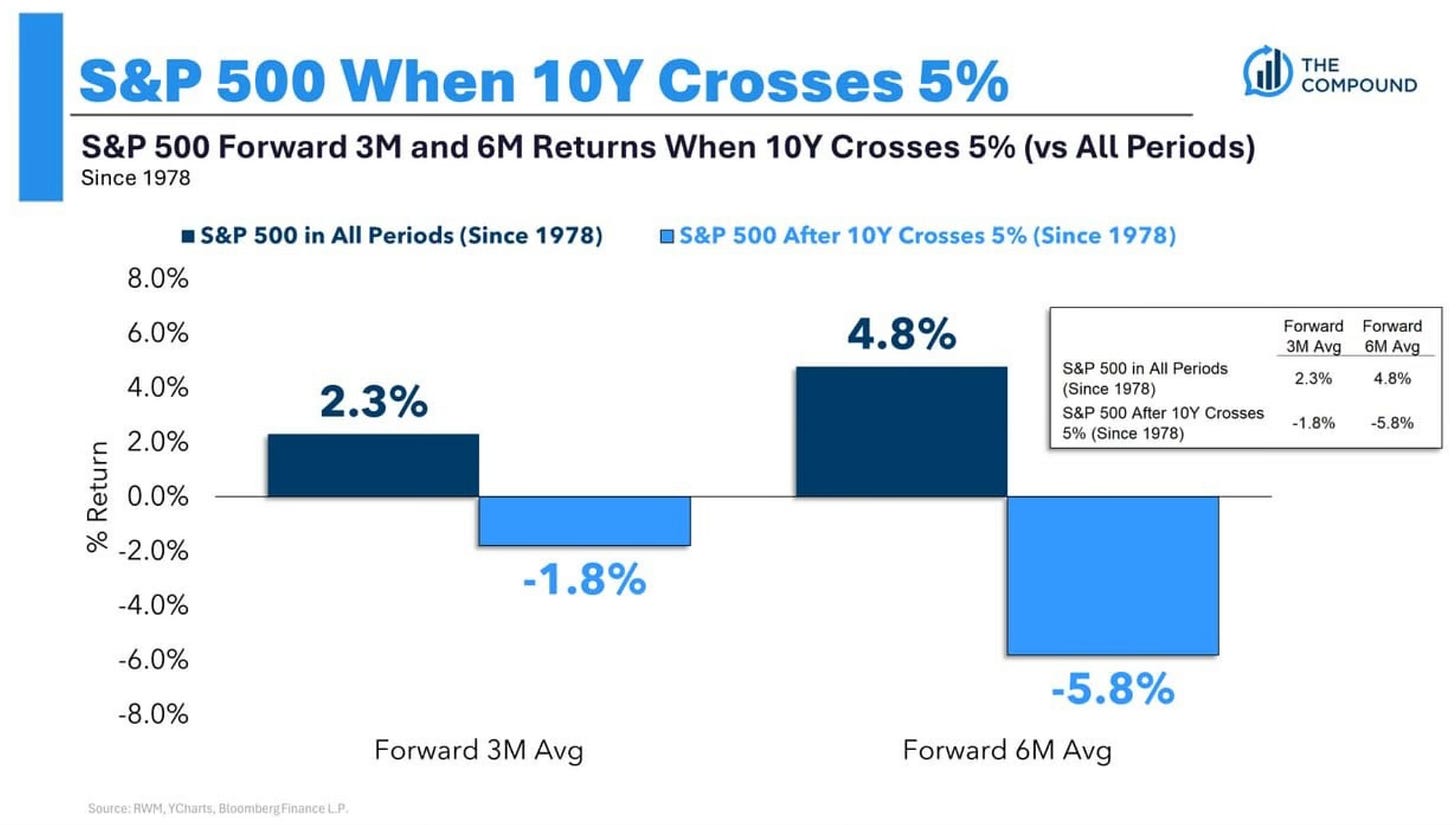

An area that could hit a speed bump is if rates continue higher is the stock market. 5% rates and the 10-year treasury don’t mesh very well.

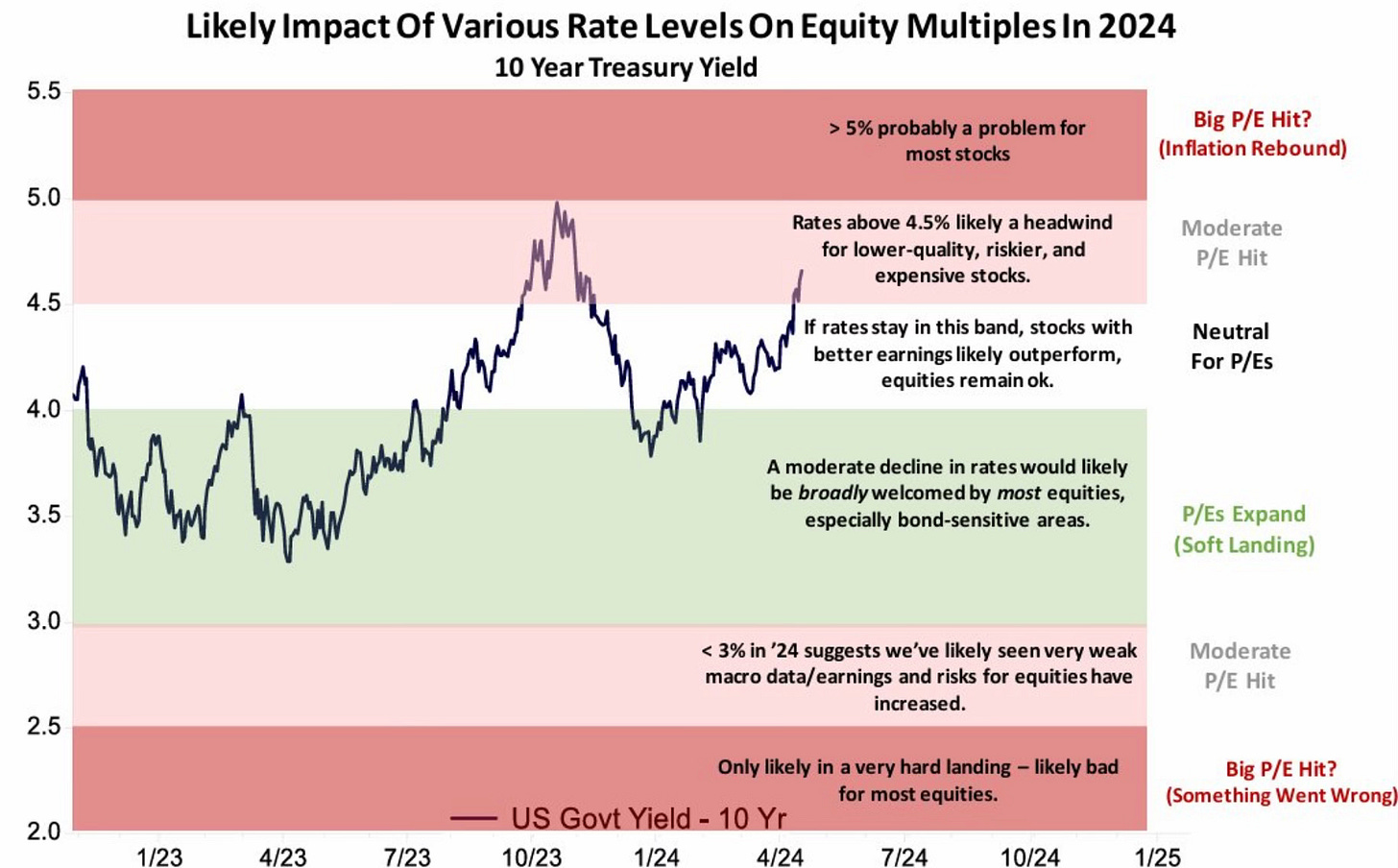

This was a great chart that was done last week that shows how much the stock market underperforms once the 10-year crosses 5%.

This is another chart from Piper Sandler that shows how treasury yields are likely to impact equity multiples. You can see that 5% and above raises concerns.

And rates on the 10-year sure seem to be heading towards 5%.

The biggest story over the coming months is going to center around inflation and where the Fed looks to take rates. It’s going to again dictate and be the most important factor in the direction of the economy, stock market and sentiment of the US consumer. The phrase “Don’t Fight the Fed” still stands true. Right now it proves just as important as ever.

The Coffee Table ☕

Kevin Kelly who wrote one of the most famous blog posts in history and one of my personal favorites, 1,000 True Fans just celebrated his 73rd birthday. For it he offered 101 bits of advice he wish he had known earlier in 101 Additional Advices. Such a great piece to read and it’s another of his posts that you bookmark and reread from time to time.

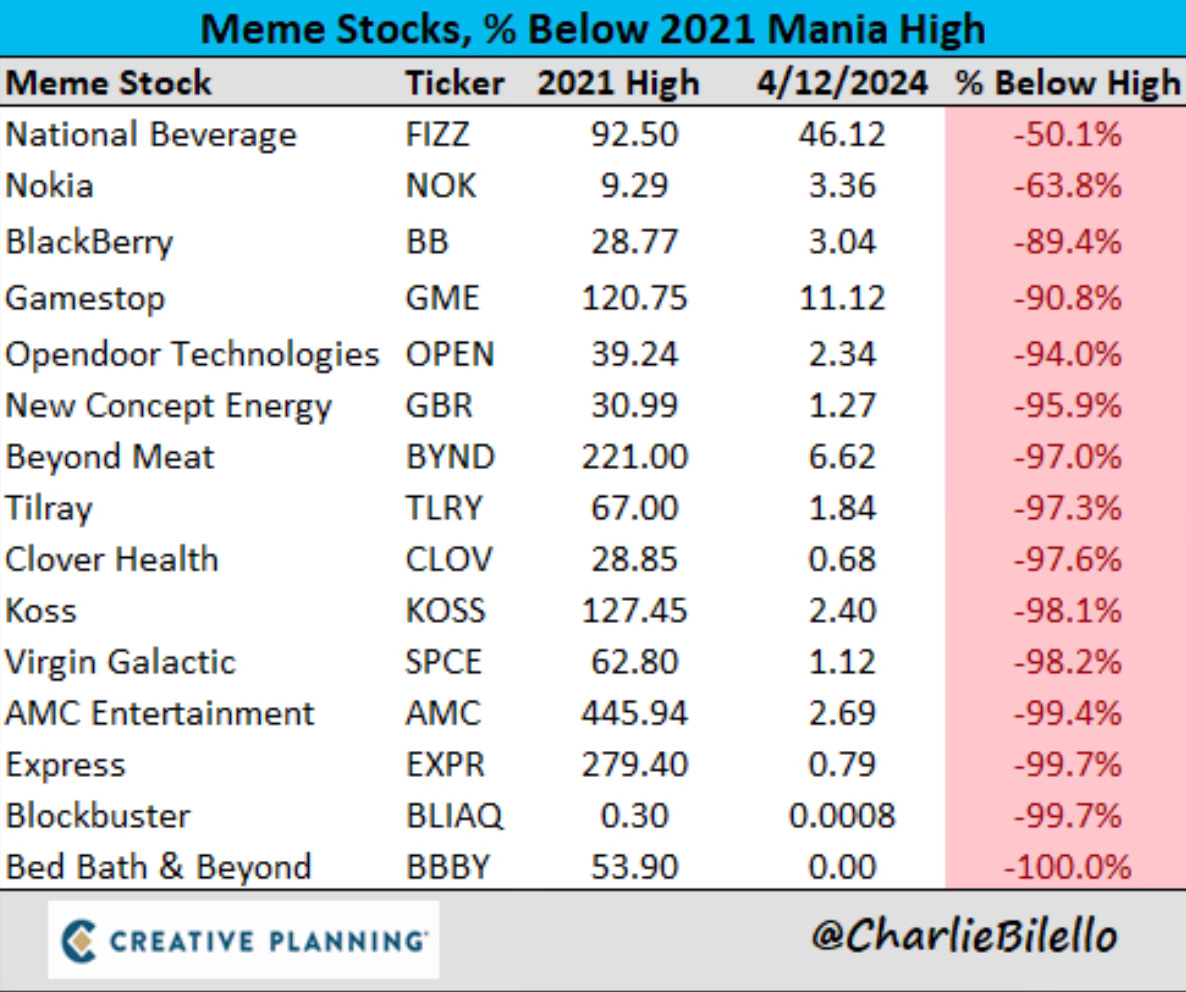

Remember the meme stock mania in 2021? Gamestop? AMC? Look at how high these stocks went in 2021 and where they are today.

Thank you for reading! If you enjoyed Spilled Coffee, please subscribe.

Spilled Coffee grows through word of mouth. Please consider sharing this post with someone who might appreciate it.

Order my book, Two-Way Street below.