Everyone’s Selling Software. Should You Be Buying?

The sector is at its most oversold level since 2018. Here’s the bull and bear case.

The software sector just experienced something I’ve never seen before: a complete business model repricing in real-time. We’re not talking about a few bad earnings reports. We’re talking about companies beating estimates and getting obliterated anyway.

The Carnage

Software stocks just endured their worst week since 2008. The numbers are staggering:

IGV (iShares Software ETF) down 24% to start 2026

Salesforce down 29% YTD

Oracle down 60% from September highs

Palantir down 36% from November highs

Microsoft lost $400 billion in market cap on an earnings beat

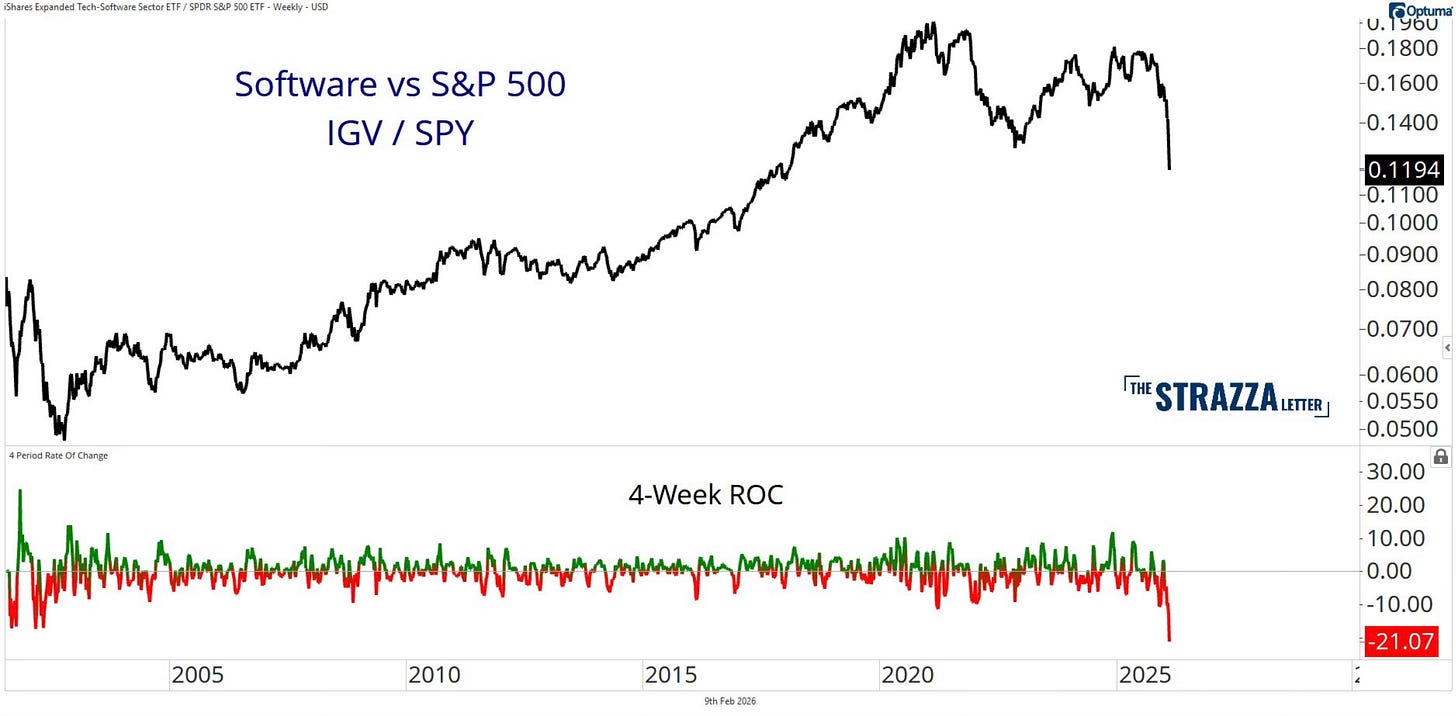

The sector is now at its most oversold level since 2018. 73% of software stocks are classified as oversold. That’s the highest level on record. Six years of relative gains versus the S&P 500 have been wiped out.

Software vs. S&P 500: The 4-week rate of change says it all.

The entire sector is getting crushed. It’s not just a few names or this isn't selective selling. Look at the bottom 20 names: All down 20-40%+.

The Catalyst