Drawdowns Will Happen

It’s not a matter of if—but when, how deep, and how you respond.

As I write this, the S&P 500 just hit another new all-time high. It’s the 11th new all-time high of 2025.

The S&P 500 hasn’t had a down day of more than 1% in over a month.

Low volatility and record highs? What’s not to love?

It makes you forget about the drawdowns and risks that come with investing.

Markets don’t go up in a straight line. They never have, and they never will. If you’re in the game long enough, you will experience moments where your portfolio dips 10%, 20%, even 50% or more. These are called drawdowns, and they’re an inevitable part of the journey.

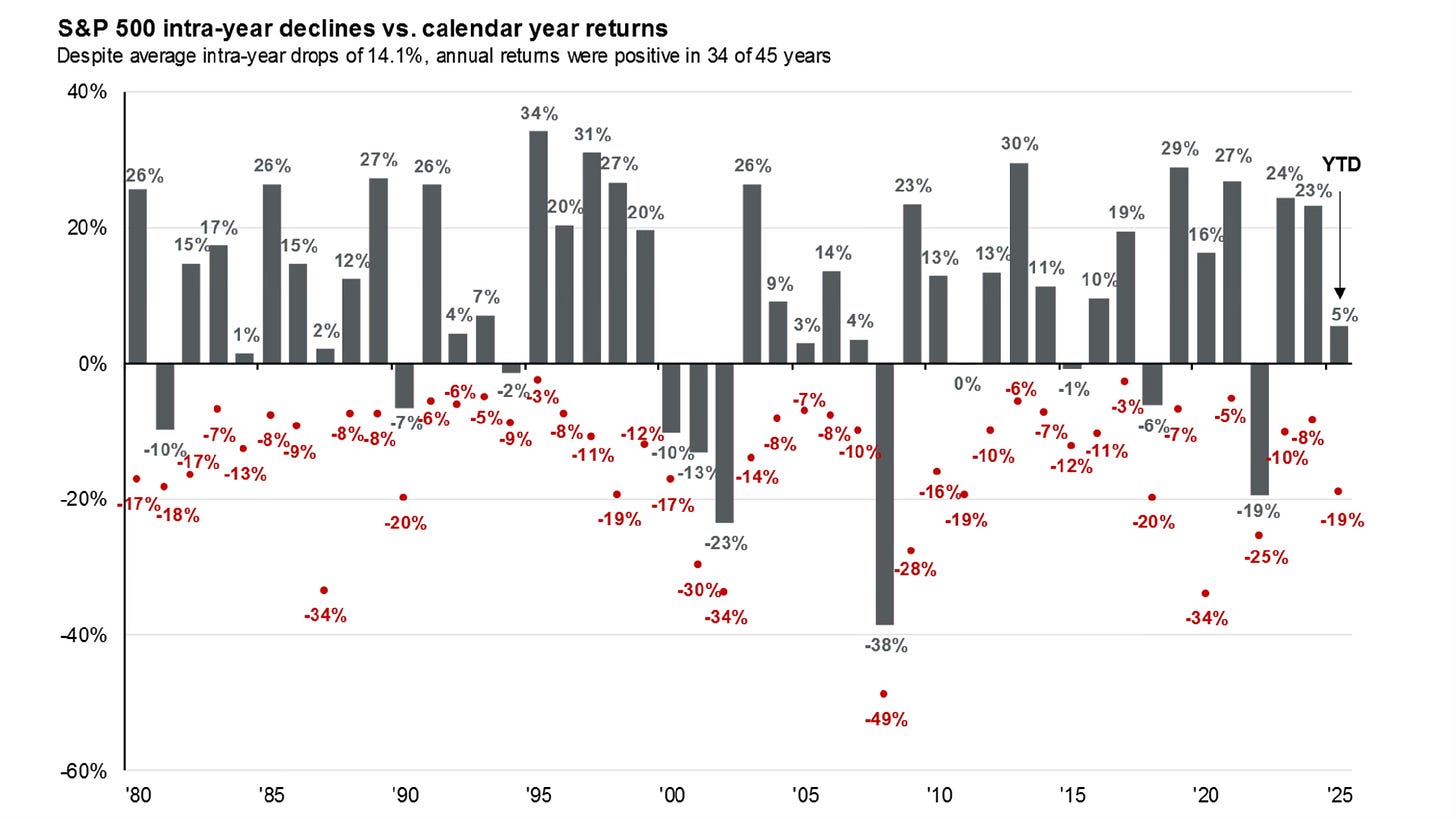

Just take a look at what the S&P 500 has done each year. Every year there is a drawdown at some point. It’s just a matter of when, how deep and how you respond to it.

Going back to 1980, the average intra-year drop for the S&P 500 is 14.1%. Yet, the annual returns were positive in 34 of those 45 years.

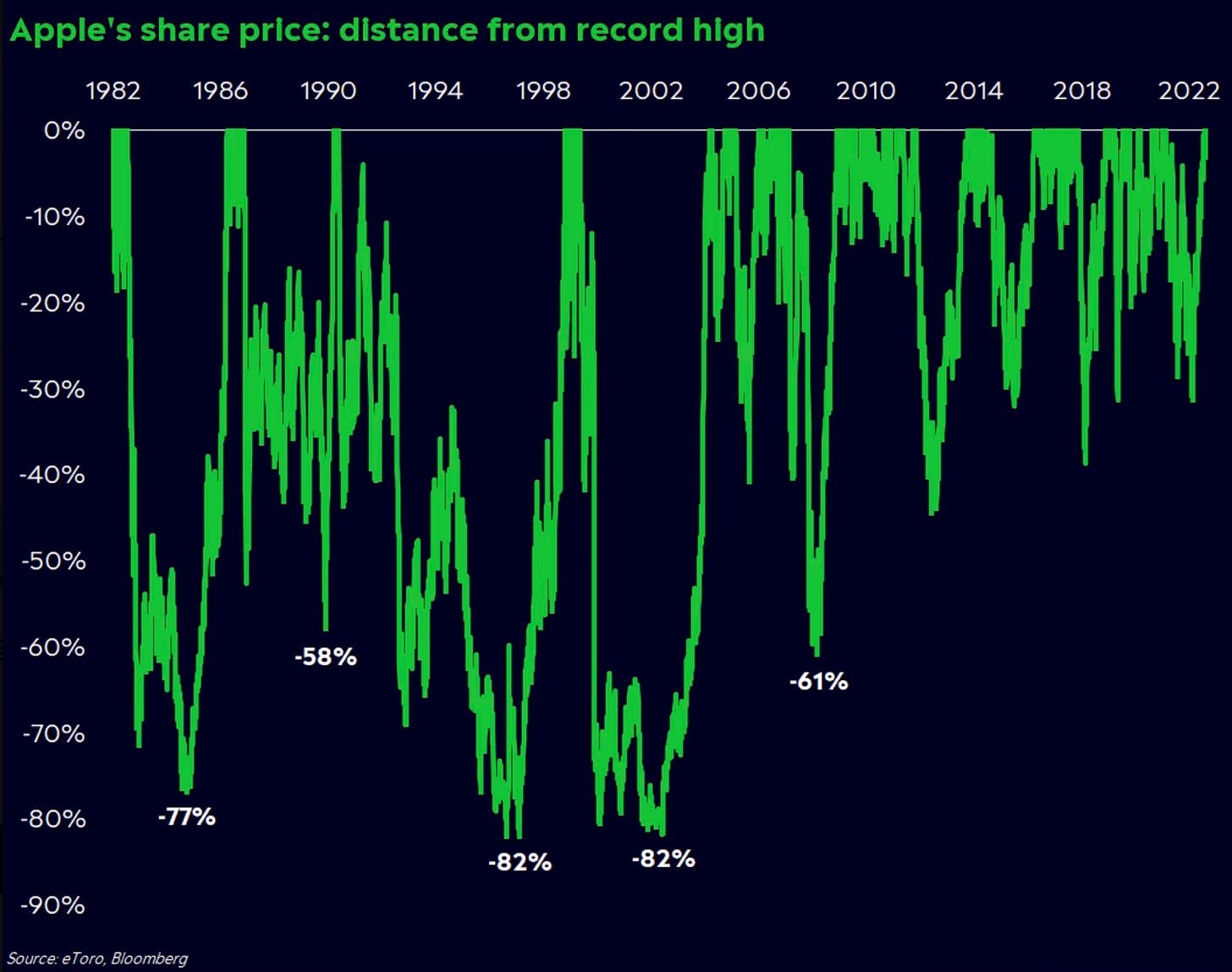

Take a look at two of the biggest winning stocks of all-time, Apple and Nvidia.

To experience all the gains that Apple has since coming public, you would have had to withstand.

15 drawdowns of 20% or more

5 drawdowns of 50% or more

2 drawdowns of over 80%

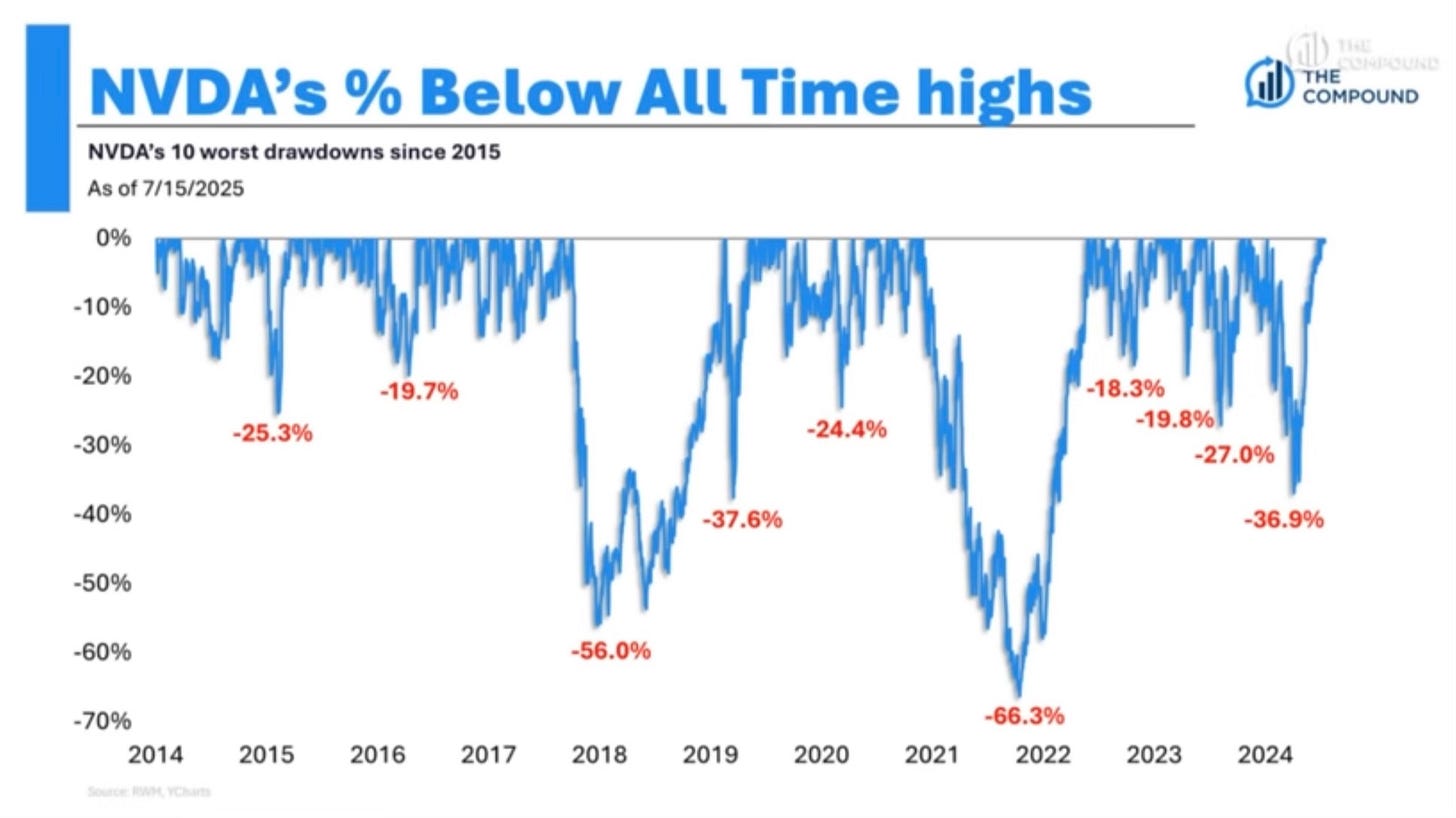

Nvidia is a similar story.

Just since 2018 it has experienced a drawdown of over 66% and 56%. Then another 37% and 36%.

Investing sounds so easy doesn't it? It does until you look at what investors have to endure to experience those gains.

When you look at a long-term chart, it’s a smooth looking road in hindsight. But living through a drawdown feels very different. It tests your patience, your conviction, and your discipline. You start questioning everything: your strategy, your timing, even yourself.

What matters is what you do when drawdowns do happen.

Your job as an investor is to be prepared for it. Here are a few ways you can be.

Having cash or dry powder.

Knowing your time horizon.

Allocating based on your risk tolerance—not your risk appetite in good times.

Reminding yourself that volatility is the price of admission for long-term returns.

Drawdowns are inevitable. You can’t diversify away from them. You can’t time your way around them. You can’t outsmart them with charts or AI or clever hedges forever. At some point, volatility knocks on every investor’s door. It’s not a question of if a drawdown will come. It’s a matter of when and how you’ll respond when it does.

The Coffee Table ☕

This was an informative piece in Kitces. It talked about the balance about how every customer touchpoint doesn’t have to be personalized. It makes you think about the client touches you make. Finding The ‘Right’ Balance Of Personalization And (Time) Cost Of Client Touchpoints To Boost ROI

I liked a post that was sent to me by a reader in the Washington Post, 7 simple ways to be a bit happier each day. This was an interesting post about 7 science-based ways to add joy to your life. Tune into gratitude, doing something kind, celebrate another’s joy and tune into what matters were ones that stuck out to me the most. Even a few minutes of snacking a day can have a big impact. A good thing to read to align your life perspective a bit.

The attention has turned away from the price of eggs to the soaring cost of beef. The U.S. beef prices have continued to soar.

Thank you for reading! If you enjoyed Spilled Coffee, please subscribe.

Spilled Coffee grows through word of mouth. Please consider sharing this post with someone who might appreciate it.