Buying Stocks On Bad News

Learning from the past

Looking back and kicking yourself for missing out on failed investments is easy to do. Hindsight is 20/20. But what it does do is teach you. This is how you learn. It’s how I learn. It’s how everyone learns.

Then it’s applying what you learned to improve as an investor moving forward. Learning from your mistakes and how you’ll react if a similar circumstance or opportunity comes up in the future.

Right after the COVID crash in March of 2020, the oil selloff occurred in the fall of 2020. This happened during a period when the price of oil went negative for the first time in history. Due to ongoing COVID concerns there was no demand. People weren’t driving and the oil investments were reflecting as if people were never going to drive again and goods weren’t going to need to be transported. Oil related stocks tumbled with the price of oil.

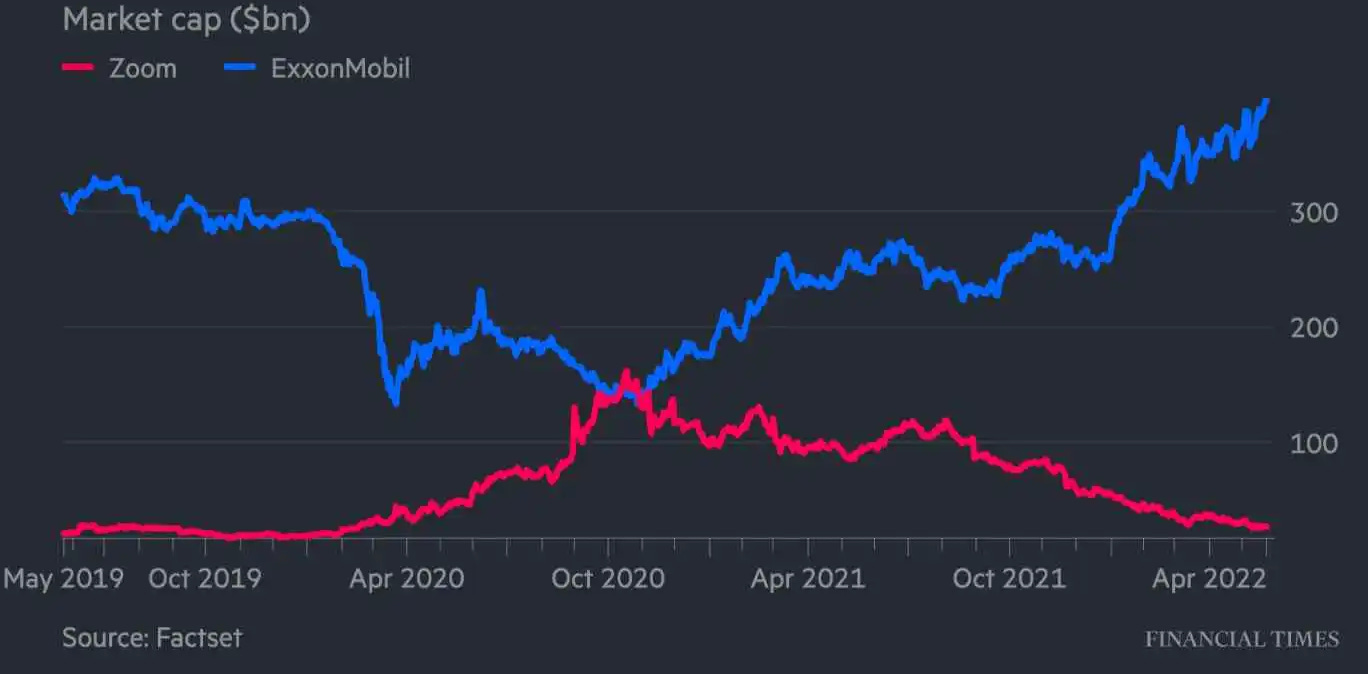

At the time Zoom was the hottest new company and stock. It become synonymous with COVID. Everyone was using it to communicate and the stock soared.

Zoom ZM 0.00%↑ briefly even surpassed ExxonMobil XON 0.00%↑ in market cap. Today Zoom’s market cap is down to $21 billion and ExxonMobil’s is $475 billion.

Had you bought ExxonMobil in October 2020 you would have an over 250% return.

The United States Oil Fund ETF USO 0.00%↑ and Chevron CVX 0.00%↑ have also delivered triple digit gains during this same period.

Looking back didn’t you, me and everyone else know that eventually the demand and price of oil would come back? Why the heck didn’t I invest while the news was the worst? It was a short-term downturn that I failed to capitalize on. How did I miss this? It almost seemed too easy. But I did learn from it.

Fast forward two years to October of 2022 and we were in the midst of another supply and demand story. This time it was related to semiconductors.

During COVID there was a semiconductor shortage due to overwhelming demand. Then came a slowdown in demand and companies had excess inventories. News headlines again made it seem like semis were never going to be needed. There was too much inventory and semi related stocks sold off. Even though they’re needed to operate most everything with any type of technology in it. They’re just as important as oil to the world

Having my oil mishap fresh in my mind and noticing the similarities I was going to try and capitalize this time.

I had already been buying shares in semiconductor manufacturing leader Nvidia NVDA 0.00%↑ on its way down. But I really felt things were near a bottom. The news and sentiment on semiconductors was overly negative. I decided to buy the VanEck Semiconductor ETF SMH 0.00%↑ at $167, which I detailed in my Investing Update: What’s Priced In? in October. It turned out the bottom was $166.97. I got lucky. Since semis have led the market higher and the SMH ETF has turned out to be a good investment up over 40% already.

Two other recent examples we can look to for peak negative and over sold short-term headlines is Disney DIS 0.00%↑ and Tesla TSLA 0.00%↑.

Disney fell to an 8-year low to end the year due to political headwinds, a weaker than expected Avatar opening and CEO Bob Chapek being replaced by previous CEO Bob Iger. The stock finished 2022 down 45%. It seemed like nothing could go right and the iconic Disney brand wasn’t going to be the same.

Since those levels Disney has gone up almost 22%.

Tesla which I do own, also went through a similar story with Elon Musk’s purchase of Twitter at the end of the year. It finished 2022 down nearly 70%. It was down to a two-year low dating back to August of 2020. You would have thought by the news headlines that Tesla wasn’t going to sell anymore vehicles and that Elon Musk was no longer the same visionary leader.

Since those levels Tesla has gone up 60%.

These types of opportunities will continue to come up with some of the best run highest quality companies in the world. Headlines cause stocks to sometimes get oversold. The challenge is to block out short-term noise with an eye on the long-term. Looking years out and not days or weeks. When the news is darkest and it feels like there isn’t anyone left to sell the stock, it’s a time to buy. Fear compounds on fear. A short-term overreaction can create a long-term opportunity.

I continue to learn. Some of my investments turn out and others don’t. No matter how long you’ve been an investor you’re always learning. Here are a few questions that I now look to and ask myself when opportunities like above arise.

Is the news going to have a short-term or long-term effect? Will this just have a temporary impact, as in weeks or months?

Does this change the company’s story and alter the long-term outlook? Does this make you lose confidence in the management team or the valuation for the long-term, as in years out?

Is this an entire industry or company specific issue? Such as an industry demand story like oil and semiconductors were.

The Coffee Table ☕

Joachim Klement who writes Klement on Investing did a piece detailing how to look at investment returns and the difference between geometric and arithmetic returns. An interesting and informative post. The most important equation or why Bitcoin has to average 30% return a year to break even with the S&P 500

Jack Raines had an excellent post called 11 Things That 0% Interest Rates Caused. In such a short time so much reversed course and he did a nice job detailing each of the euphorias. A few of these I had already forgotten about.

Thomas Kopelman wrote a good post on as a rule of thumb, how much car or house can you afford. How Much House/Car Can I Afford? I love the final sentence as it sums thinks up perfectly, “Use your money in a way that you value, that is key.”

Thank you for reading! If you enjoyed Spilled Coffee, please subscribe and/or give a gift subscription for others.

Spilled Coffee grows through word of mouth. Please consider sharing this post with someone who might appreciate it.