Are Small Caps Investable?

A look into if small caps are a trap or a steal

Small-caps have been the awkward kid in the investing classroom lately. They sit quietly in the back, waiting to be called on, while the big names in the S&P 500 hog all the attention (and the gains).

The S&P 500, Nasdaq, Bitcoin and gold are all at all-time highs. Meme stocks have even made a comeback.

That brings us to small-caps — stuck on the outside of this party, looking in.

Small-caps have actually been on the outside looking in for years, which raises the question: Are they still investable?

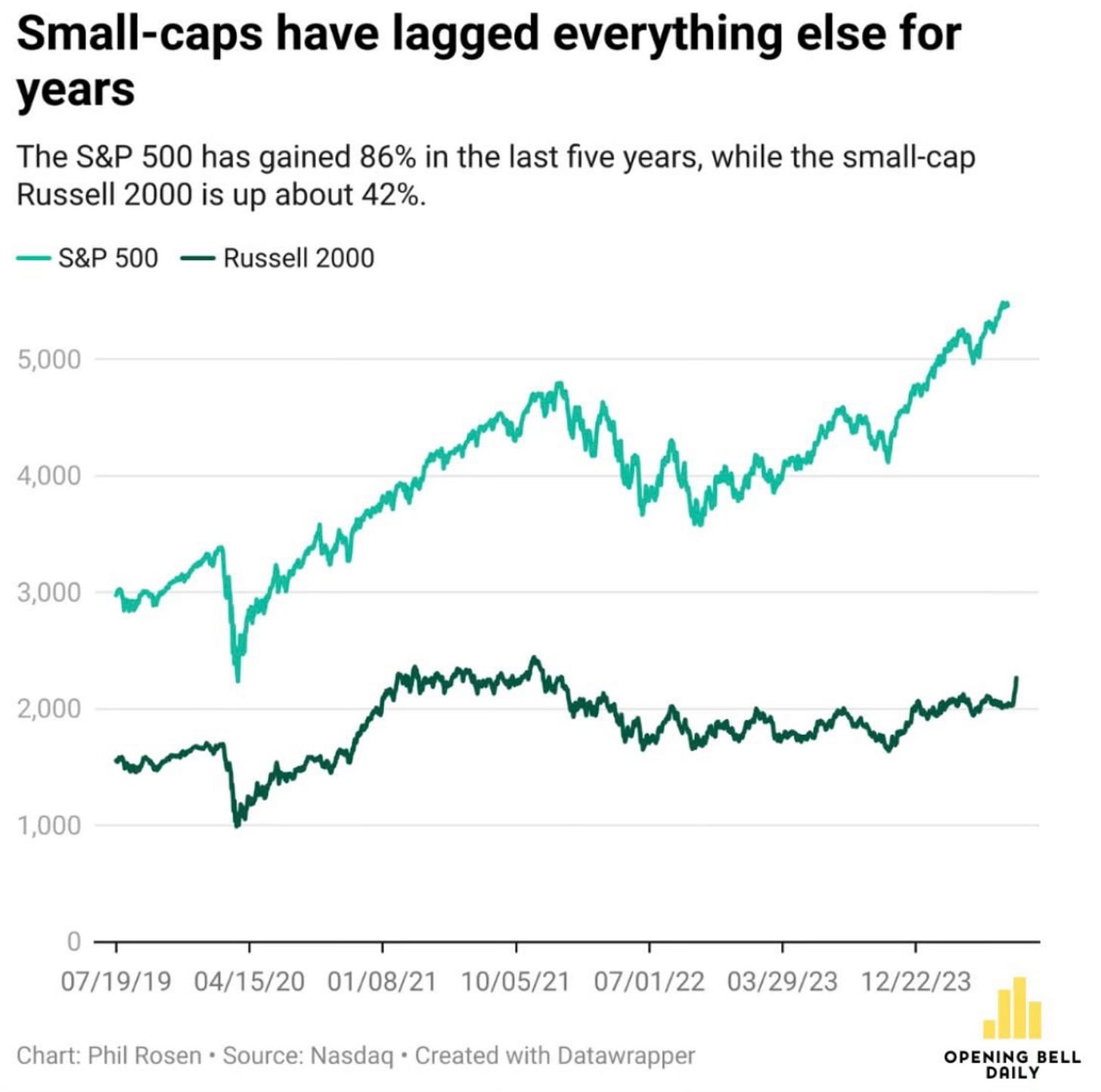

First, let’s look at how badly they’ve underperformed the S&P 500.

This is a great chart and note from Jim Paulsen.

It’s been a tough bull market for small company stocks. As shown in chart 1, the current decade started out okay. After a short but sharp pandemic bear market in 2020, small cap stocks significantly outpaced the tech-fueled S&P 500 index during the post-pandemic bull market ending in December 2021. That was the last time small cap stocks led over their larger cap brethren.

Looking at it from the view of another chart.

You can see the drastic underperformance of small-caps.

The truth is, the underperformance of the Russell 2000 to the S&P 500 goes back even further than these two charts show. Here is a comparison between the Russell 2000 and the S&P 500 from YTD, 5 year and 10 year performance.

YTD

S&P 500 +9.84%

Russell 2000 +2.56%

5 Years

S&P 500 +91.11%

Russell 2000 +45.28%

10 Years

S&P 500 +208.18%

Russell 2000 +88.24%

I know, not a pretty picture at all. Now let’s look to see if now is the time to invest in small-caps or if they’re just uninvestable. Are they currently a trap or a steal?