2 Stocks That I've Never Sold

Why I've never sold any shares in these two names

When I think about selling stocks that have become big winners, I always go back to a quote from legendary investor Peter Lynch:

“Selling your winners and holding your losers is like cutting the flowers and watering the weeds.”

One of the hardest decisions in investing is knowing when to sell.

Many investors feel like they have to once a stock hits a certain return. They convince themselves it’s time to take profits. But selling just to sell doesn’t make much sense to me.

What if you simply don’t sell?

If you still believe in the company, in its leadership, and in your own conviction—why sell your winners at all?

After trying different ways of investing, I decided I wanted to use a high conviction strategy. What does that mean? A high conviction investing strategy is one that builds and maintains only a few investment positions. For me, I strive to own between 8 and 12 stocks or ETFs.

Here are four lessons that I’ve learned over the years that have helped me immensely in my high conviction strategy.

I don’t day trade. I may go weeks without making a move. I won’t sell or trim a position just to sell. I don’t sell unless a company’s story changes, or if I want to trim something for another opportunity I may like better. I overtraded in 2022 to try and recover my losses and that only made my performance worse that year.

Let your winners ride. If I believe a company goes higher, why sell? Don’t sell just to sell.

In 2008, during the GFC, I had bought Microsoft. Not long after it doubled, I sold my entire position. I had read that once you’re up nicely on a stock, you should sell and lock in your gains. It was a mistake and I should still own those shares. But I was 23 years old and still learning. It was a great lesson to learn while I was young.

So when I bought Apple in 2014, I applied what I had learned from the Microsoft mistake and didn’t sell it after it doubled, then doubled again. I still own it and have trimmed a little along the way but have mostly let Apple keep running to this day.

There are two other stocks I’ve bought but never sold a single share of. I’ll get to those in a bit.

Often doing nothing is the best decision. Somedays you have to just sit there and do nothing. Sit on your hands. If you have high conviction on something there will be many days where you’re tempted to sell by giving into the panic and hysteria. You have to block out the noise and maintain focused on the long-term.

Invest how you want. Everyone has a different time horizon and investing objective. There is no one sized fits all approach to investing. There is no perfect portfolio. This is what works for me. It may not work for everyone and that’s just fine. It’s how I want to invest.

Earlier this year I wrote about my investing philosophy. You can read that full post in My Investing Philosophy

This is my approach. It may not work for everyone, but it works great for me.

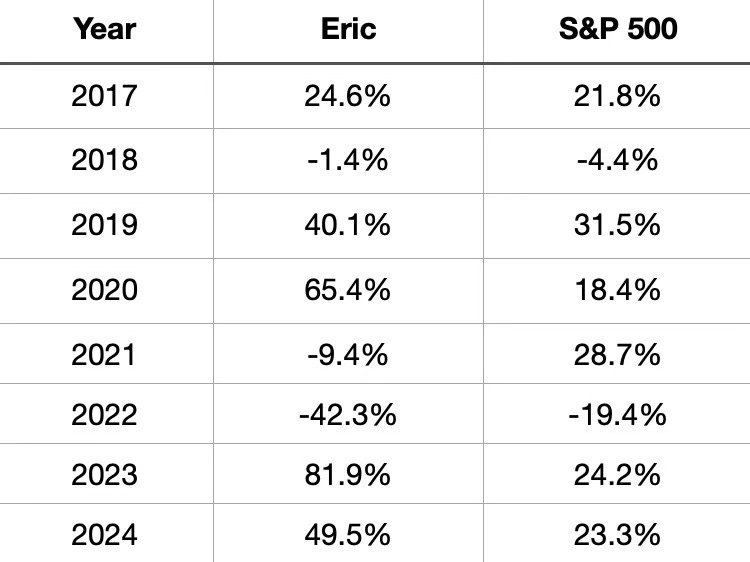

This investing approach has done well for me when I compare it against the S&P 500. My actively managed portfolio has outperformed the S&P 500 in 6 of the past 8 years.

I’m on pace to outperform the S&P 500 again in 2025, which would make it 7 out of the past 9 years.

There are stocks I’ve owned for many years. But only two that I’ve never sold a single share of.

In fact, I’d be more likely to add to my positions in these two names than to ever sell them.